This man just predicted silver will soar above $100 in a matter of months.

THE SILVER PAPER TRAP AND THE SHORT SQUEEZE: A PERFECT STORM

January 5 (King World News) – Email from King World News reader Gurjit L, Retired Pawnbroker: I may be retired now, but old habits die hard. After 30 years behind the pawn counter, you don’t just stop watching the charts—you just watch them with more perspective. I’ve seen silver go from a “boring” metal to a critical resource, and I can tell you that what’s happening this January 2026 is unlike anything I witnessed in my entire career. It’s been wild.

The world is currently waking up to a “Paper Trap,” and if you’re holding physical silver, you’re sitting on the only real exit.

The View from the Rocking Chair

Even in retirement, my phone still rings with old clients asking the same thing: “Gurjit, the news says silver is at $72, but the local shop won’t sell it to me for less than $95. What’s going on?”

What’s going on is that the “ticker price” has finally lost its tether to reality. On New Year’s Day, China effectively pulled the plug on the West’s silver supply by tightening export licenses. They aren’t just selling metal anymore; they’re hoarding it for their own AI and solar industries.

THE SILVER TRAP: The 47.6 Million Ounce “Great Drain”

The most dangerous part of this “trap” is the state of the vaults. In my shop, I knew I was in trouble if my inventory went out the door faster than I could restock. That is exactly what just happened to the COMEX.

- The Four-Day Shock: In the final four trading days of December 2025, institutional buyers stood for delivery of 47.6 million ounces of silver.

- The 60% Vanishing Act: This single week of demand claimed roughly 60% of the entire Registered inventory (the silver actually available for sale) that was in the vault at the start of the month.

- The Math: While the vault only has about 128 million ounces left, the “Paper-to-Physical” ratio has exploded to 378:1. If even a fraction of those paper owners ask for their metal, the vault hits zero.

THE BAILOUT: $74 Billion and the “Midnight Margin Smash”

On December 31, 2025, the Federal Reserve quietly injected a record $74.6 billion into the banking system through its “Standing Repo Facility.” But that wasn’t the only “emergency” move.

While everyone was partying, the COMEX pulled a move straight out of the 1980 Hunt Brothers playbook. They hiked margin requirements by nearly 50% in a single week.

- The $14 Collapse: This move forced over-leveraged traders to dump their positions instantly. It triggered a “flash crash” that wiped out $19 billion in market value in hours, slamming the price from $84 USD down to $70 USD.

- Why did they do it? The banks were trapped in massive short positions. By hiking margins at night, the exchange forced the price down so the “Big Boys” could cover their shorts at a discount.

THE INDEX HEADWIND: The $5 Billion Bloomberg Sell-Off

While the BRICS nations are building a floor, we have to watch the “mechanical” trap opening this week. Starting January 8 through January 14, 2026, the Bloomberg Commodity Index (BCOM) will undergo its annual rebalancing. Because silver performed so well in 2025, it now takes up too much room in the index—nearly 9% of the total. To follow their own rules for 2026, Bloomberg must “prune” that weight back down to a target of just under 4%.

Analysts at JPMorgan and TD Securities are warning that this will force passive funds to dump approximately $3.8 billion to $5 billion worth of silver futures (roughly 9% to 13% of the total open interest) onto the market in just five days. Don’t let the headlines fool you; if the paper price takes a “volatility dip” of 8–15% next week, it isn’t because people don’t want silver—it’s because the index computers are legally required to sell. For the patient investor, this “Index Smash” might be the last chance to see a $70-handle before the spring drain begins.

NEW DEMAND: The BRICS “Unit” and the Commodity Basket

The blueprint for the BRICS new trade instrument, “The Unit,” is now public: it will be backed by a basket of physical commodities.

- Silver as a Reserve: By including silver in their trade basket, BRICS is turning every silver bar into a “reserve currency.”

- The Result: This creates a floor for silver prices that Western “paper” smashes can’t keep down. If BRICS nations use silver to back their trade, they won’t care about the COMEX price—they only care about the ounces.

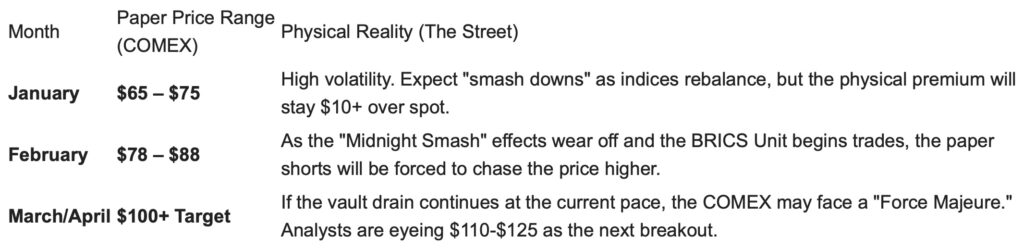

GURJIT’S GAZE: $100+ SILVER – Price Predictions for the Months Ahead

In my 30 years, I’ve learned that the “paper” price and the “physical” price often tell two different stories. Here is what I see for the first quarter of 2026:

The “Floor” is Set: Even the most conservative analysts now see $55-$65 as the absolute new floor. The days of $20 silver are in the history books.

My Final Take: Hold Your Ground

When I was in the shop, I always told my customers: “You don’t own it unless you can hold it.” We’ve moved into a two-tier market. On one side, you have the “Paper Boys” in New York using midnight margin hikes and $74 billion repo loans to stay afloat. On the other side, you have the real world—the BRICS nations and AI giants—who will pay almost any premium for real metal.

If you’re retired like me, security isn’t a number on a screen or a Fed repo loan—it’s the weight of the metal in your hand.

Stay Sharp: I’ll be watching the Daily Repo Usage and the COMEX Registered Stocks. If the Fed has to keep injecting billions while the vaults keep losing millions of ounces, the “Paper Trap” is about to snap shut.

Remember: this is not financial advice and you should always do your own research.

JUST RELEASED!

To listen to Alasdair Macleod discuss what to expect for gold, silver and the miners in 2026 CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

It’s Not Just Gold & Silver Skyrocketing, The Stock Market Is Going To Crash CLICK HERE.

Silver Sparkles & Gold Shined In 2025 But Look At What’s Ahead In 2026 CLICK HERE.

Silver, And What Stood Out To Me The Past Two Weeks CLICK HERE.

Here Is The Remarkable Big Picture Setup For Gold As We Head Into 2026 CLICK HERE.

CNBC Antics About The Silver Market CLICK HERE.

Turnaround Tuesday As Silver & Gold Soar, But Take A Look At This… CLICK HERE.

Black Monday For Gold, Silver & Platinum Markets. Here Is Where Things Stand CLICK HERE.

Costa – Here Is The Big Picture After Silver & Gold Prices Tumble CLICK HERE.

Tavi Costa – What A Week As Silver Explodes To The Upside! CLICK HERE.

Historic Silver Short Squeeze Sends Price Soaring Over 7% On Friday! CLICK HERE.

An Astonishing Christmas Prediction From Legend Richard Russell CLICK HERE.

EXPECT WAR: Early Days For Gold & Silver Bull, Especially The Miners CLICK HERE.

Hansen – This Is What Is Really Happening With Gold Market CLICK HERE.

$15,000 TARGET: Volatile Gold & Silver Trading But Look At What Is Coiled To Skyrocket CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.