This is why the price of silver is poised to skyrocket.

KING WORLD NEWS NOTE: Soundcloud was having technical difficulties but KWN was finally able to release Michael Oliver’s historic audio interview (link below)!

Gold Has Already Lead The Way

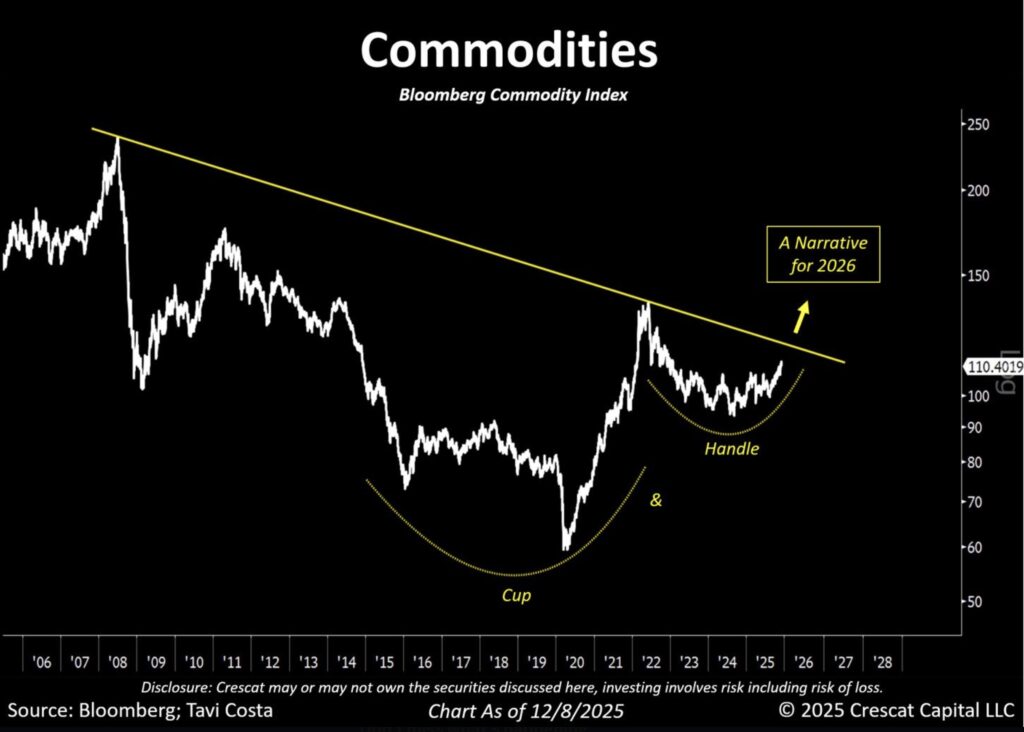

December 15 (King World News) – Otavio Costa: If you ask me, 2026 has the potential to mark a major inflection point for commodities.

Gold has already led the way, and what we’re seeing now appears to be the early stages of a much broader move across resource markets — one that could significantly benefit from what looks increasingly like an unavoidable, ultra-dovish Fed stance.

KING WORLD NEWS NOTE: Commodities Will Be The Big Story Of 2026

I’m especially excited about the potential for the gold-to-silver ratio to move meaningfully lower, copper to break out and enter a true price-discovery phase, and energy commodities to stage a comeback that may surprise many investors.

These are simply my own views — rooted in respect for history, a long-term conviction in hard assets, and the recognition that today’s structural imbalances outweigh any genuine ability to restrain inflationary forces.

Gold

Otavio Costa: Gold is approaching new highs again.

KING WORLD NEWS NOTE: Gold Price Close To All-Time High

The Fed is officially cornered, and an ultra-dovish stance has essentially become unavoidable at this point, in my opinion.

Powell openly acknowledged a weakening labor market, dismissed any possibility of rate hikes, moved ahead with another rate cut, and announced an expansion of the balance sheet — though we’re supposed to call it ‘not-QE’ to sound sophisticated given the structure of the purchases.

In my view, the rates market is overlooking how determined Trump is likely to be in reshaping the Fed next year and pushing for substantially lower rates — especially if unemployment rises sharply over the next 6–12 months, which I see as highly probable.

It’s also striking how confidently some commentators declare that inflation is headed lower, while inflation-sensitive assets are clearly signaling otherwise.

I would remain very open to the possibility that the US economy slips further into a stagflationary environment.

And with these massive macro distortions in play, my core view remains unchanged:

None of us own enough hard assets.

This Is Why The Price Of Silver Is Poised To Skyrocket

Otavio Costa: What’s been unfolding in silver these past few weeks is a defining shift for the entire metals and mining cycle, in my view.

This is the year silver stepped firmly into the leadership position it has historically taken during powerful, long-term bull markets.

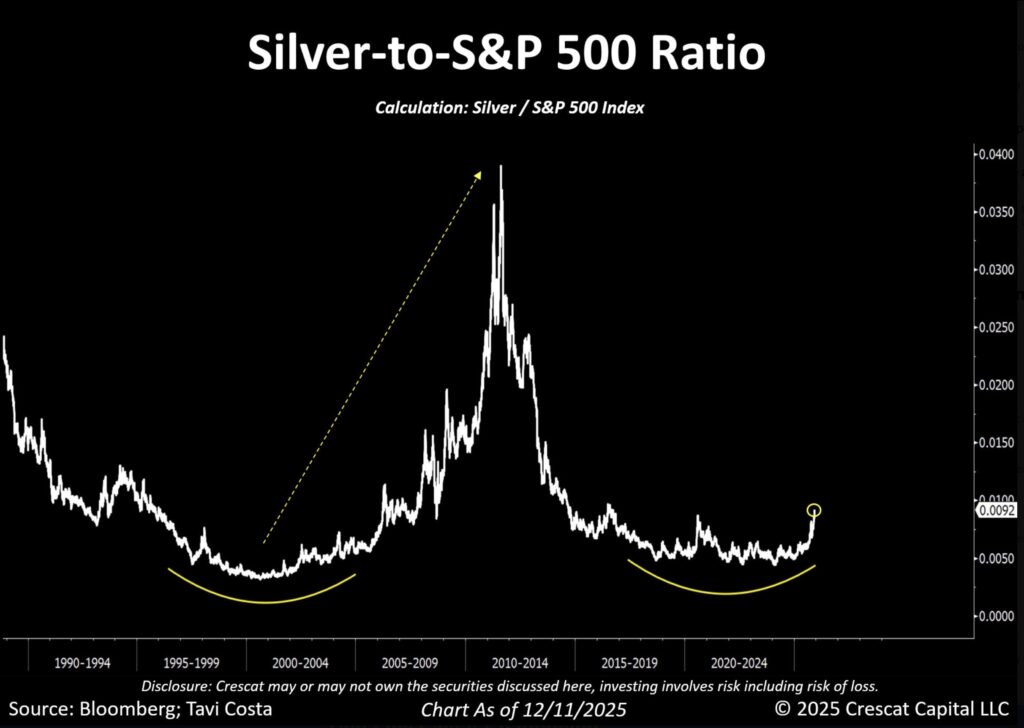

If you respect market history and acknowledge the inevitability of cycles, the silver-to-S&P 500 ratio isn’t just a useful chart — it’s a clear blueprint for the path ahead, in my opinion.

And while some are insisting the move looks overextended, I see the opposite.

KING WORLD NEWS NOTE: The Move In Silver Is Just Getting Started As Silver Is Coiled To Skyrocket vs S&P 500

I believe real wealth is built by riding the major trend with conviction, not by constantly second-guessing every bout of volatility.

From where I stand, we are entering what could be one of the most consequential and enduring phases the metals and mining sector has seen in the last 120 years.

Wondering Why Gold Has Risen So Much?

Peter Boockvar: Wondering still why gold has risen so much and continues to trade as well as it does? Front page of the Weekend FT, “EU freezes 210bn euros of Russian assets.” When these assets were first frozen in 2022, that freeze had to be renewed every six months by the 27 EU countries. What this does is now indefinitely freeze them. And, “The freezing paves the way for a loan to be raised against the assets to prop up Ukraine’s defense.”

The Russians immediately sued Euroclear in Belgium where the assets are being held but by owning gold that one can hold on its own territory is not subject to any confiscation. And that foreign government/central bank buying really began in earnest in 2022, as we know, when the Russian asset freeze first took place and has continued robustly since. This news over the weekend should perpetuate the trend as we look to 2026 and we remain positive and long, along with silver and platinum among the precious metals.

ALSO JUST RELEASED!

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

Historic Breakouts Will Send Gold & Silver Prices To Levels That Will Shock The World!

Michael Oliver discusses exactly what investors need to be doing with gold, silver, mining stocks and so much more and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.