This has been a wild day of trading in the gold and silver markets.

KING WORLD NEWS NOTE: Soundcloud was having technical difficulties but KWN was finally able to release Michael Oliver’s historic audio interview (link below)! For now…

Now it’s gold’s turn

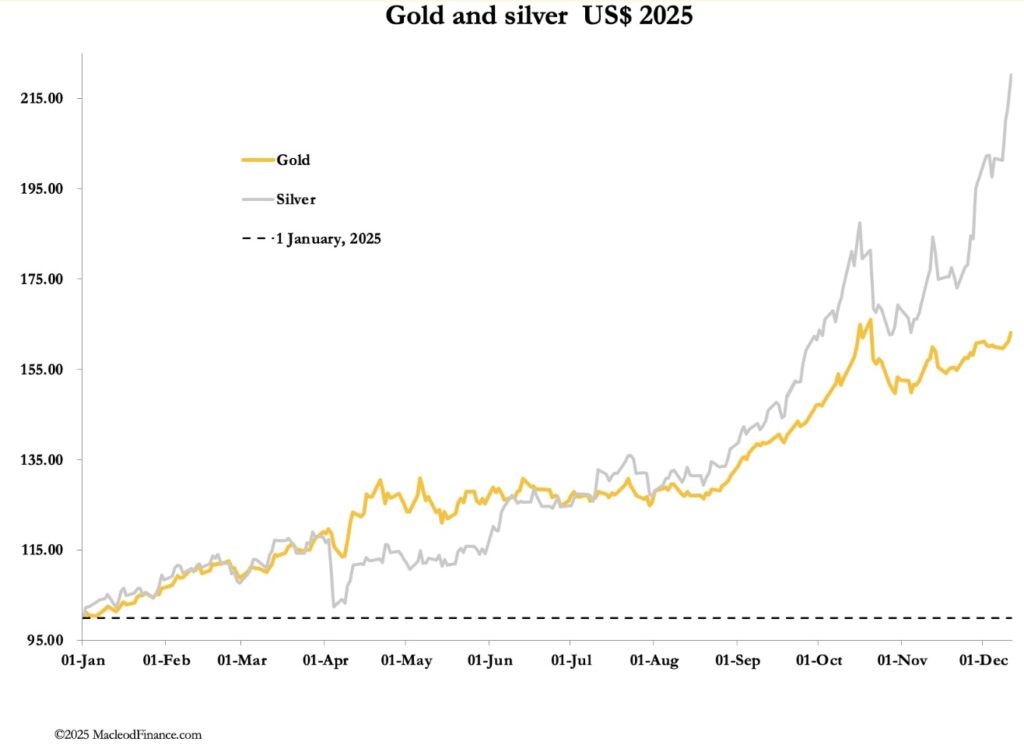

December 12 (King World News) – Alasdair Macleod: Wednesday’s FOMC statement confirmed that money-printing resumes, set to undermine the dollar in 2026. Estimates of future inflation will increase and gold and silver rise further.

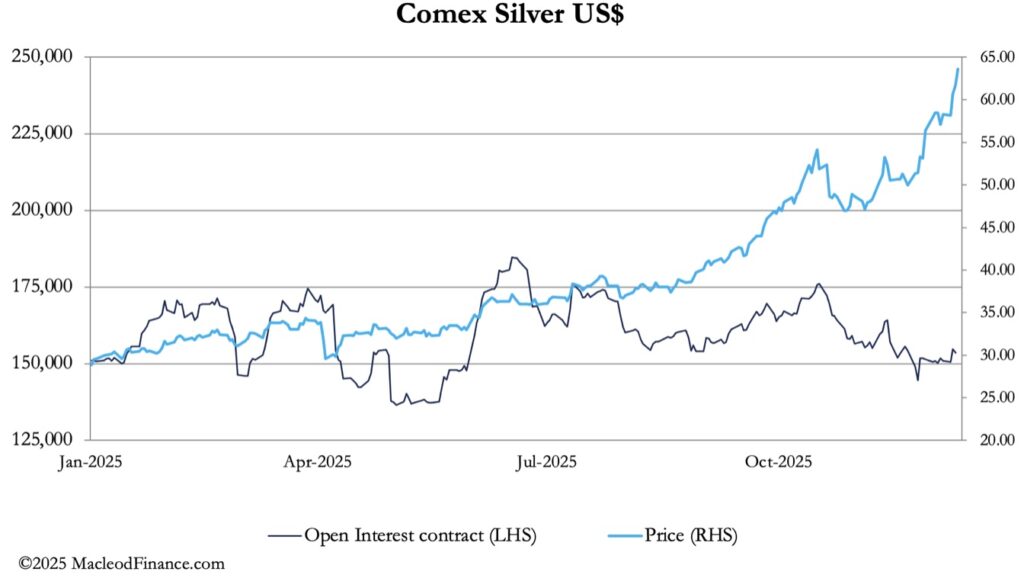

The star of the show this week was silver, as the chart below illustrates. The message being sent to derivative markets should alarm them: there just isn’t any physical liquidity to support the mountain of silver delivery obligations.

Both gold and silver have had a good week, with gold beginning to stir. In European morning trade, gold at $4318 is up $220. But silver’s rise was spectacular. At $64.10 this morning, it is up $5.90 with a seemingly unstoppable momentum driving it even higher.

We make no apology for repeating an important chart, showing how despite a soaring price investors in the form of futures speculators remain firmly on the sidelines:

Note how open interest has declined since silver’s peak on 20 October. Moderate speculative demand had taken open interest up to 175,000, when the bulls rightly expected a reaction, which took the price down from $54.40 to $45.60. They continued to sell until silver made a big move into new high ground on 28 November. They are now out of the market, which is being driven purely by liquidity shortages, resulting in elevated lease rates again in London.

Where does this take silver, and what are the consequences for a financial system under increasing pressure?

Metals are different from stocks and bonds

While relatively rare in investment media, sharp liquidity driven moves in industrial metals are less so. This is because industrial consumers tend to act as a cohort, meaning that there is insufficient liquidity to absorb price shocks. With China suddenly tightening up on export licenses at a time when India is ramping up industrial demand, and other nations (notably the US) realising silver is a critical mineral to be hoarded, the effect of these developments on price should be obvious.

The lesson for investors inexperienced in industrial metal markets is that silver prices will continue to rise until the system breaks and/or the authorities intervene. With silver, we are not there yet, and it is difficult to see what the authorities can do other than declare force majeure in New York. The forward market being OTC in London, it is hard to see how this issue can be resolved other than counterparties reneging on contractual obligations by bankruptcy. But that would be a major financial crisis at the heart of the entire derivative industry. And a Bank of England/LBMA rescue would not resolve the silver shortage.

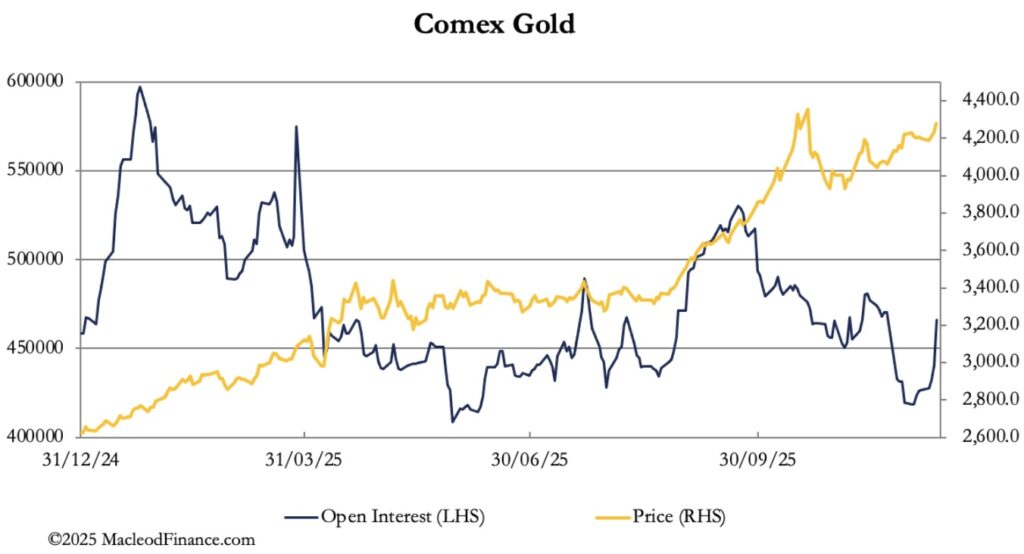

Meanwhile, gold started rising this week as the implications of the FOMC’s Wednesday statement sank in. The important part is the resumption of QE aimed at short-term treasury finance. Besides the message sent about liquidity issues in the banking system, the inflationary implications for 2026 will lead to higher estimates than the Fed’s bland assumption that it will remain under control, even above the 2% target.

On preliminary open interest numbers for yesterday, gold’s open interest on Comex jumped by 25,644 contracts. It is the clearest indication of investors starting to take a leveraged position for higher gold prices. This is reflected in the chart below:

Clearly, open interest on Comex can increase by a further 100,000 contracts before this indicator becomes overbought. Demand anything like that would drive gold significantly higher. And as our headline chart indicates it has significant catching up to do with silver.

It promises to become a vicious circle. Higher gold prices will generate the investment demand for silver which is so far lacking. If it breaks silver derivative markets, we could be witnessing the beginning of the end for other contracts. The fetters on commodity prices shackling them for the last 50 years will then be released, spreading the explosion in silver prices to other metals, other commodities, and even energy.

Historic Breakouts Will Send Gold & Silver Prices To Levels That Will Shock The World!

Michael Oliver discusses exactly what investors need to be doing with gold, silver, mining stocks and so much more and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Silver Surges Above $63 As More QE Sends Metals Prices Higher CLICK HERE.

ALSO JUST RELEASED: Fed Launches QE5 Sending Gold & Silver Higher And The Dollar Lower CLICK HERE.

ALSO JUST RELEASED: GOT GOLD? Buckle Up – Fiat Currency Destruction And Increased Inflation Heading Into 2026 CLICK HERE.

ALSO JUST RELEASED: Gold Coiled To Skyrocket vs Stock Market, But Look At Silver CLICK HERE.

ALSO JUST RELEASED: What Is Happening Behind The Scenes In The Gold Market Is Absolutely Wild CLICK HERE.

ALSO JUST RELEASED: Look At Who Just Said Silver Might Spike Above $500 CLICK HERE.

ALSO JUST RELEASED: Silver Lease Rates Explode In China As Gold Consolidation Continues CLICK HERE.

ALSO JUST RELEASED: Silver Short Squeeze Continues With Shortages Of Physical Metal Across The World CLICK HERE.

ALSO JUST RELEASED: Yes, Gold, Silver, Copper, But Take A Look At This Metal CLICK HERE.

ALSO JUST RELEASED: They Have Lost Control, Plus Another Gold & Silver Bull Catalyst CLICK HERE.

ALSO JUST RELEASED: Greyerz – This Man’s Predictions For The World Are Absolutely Terrifying CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.