The economy is now in a full-blown collapse. Take a look…

The Economy Is Collapsing

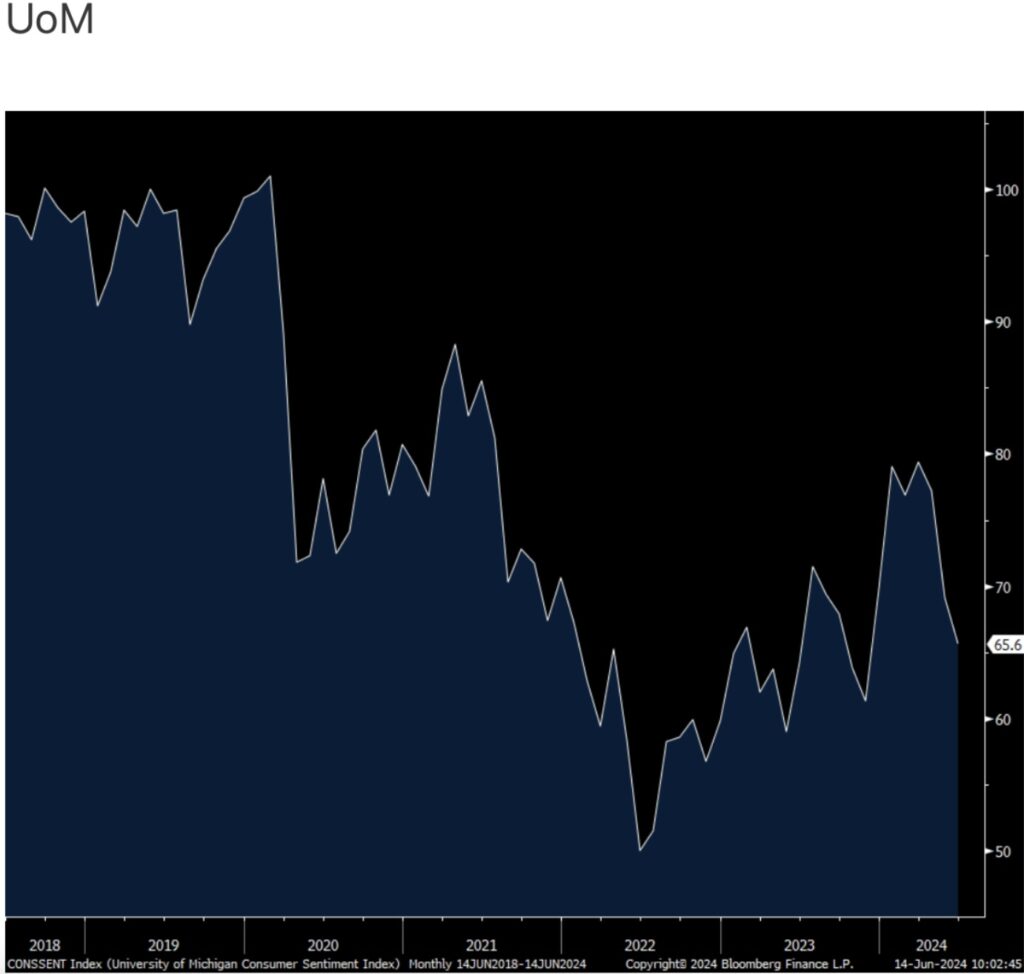

June 14 (King World News) – Peter Boockvar: The preliminary UoM June consumer confidence index unexpectedly fell to 65.6 from 69.1 and that is well below the estimate of 72. It’s now down almost 14 pts over the past 3 months.

Most of the decline came from the Current Conditions component which declined by 7.1 pts m/o/m while Expectations slid just 1.2 pts. One yr inflation expectations held at 3.3%, the highest since November and the 5-10 yr guess ticked up by one tenth to 3.1%.

Of particular note, those seeing ‘Higher Income’ fell 7 pts to the lowest since November 2013.

This Just Collapsed To Lowest Level Since 2013!

This Just Collapsed To Lowest Level Since Great Financial Crisis

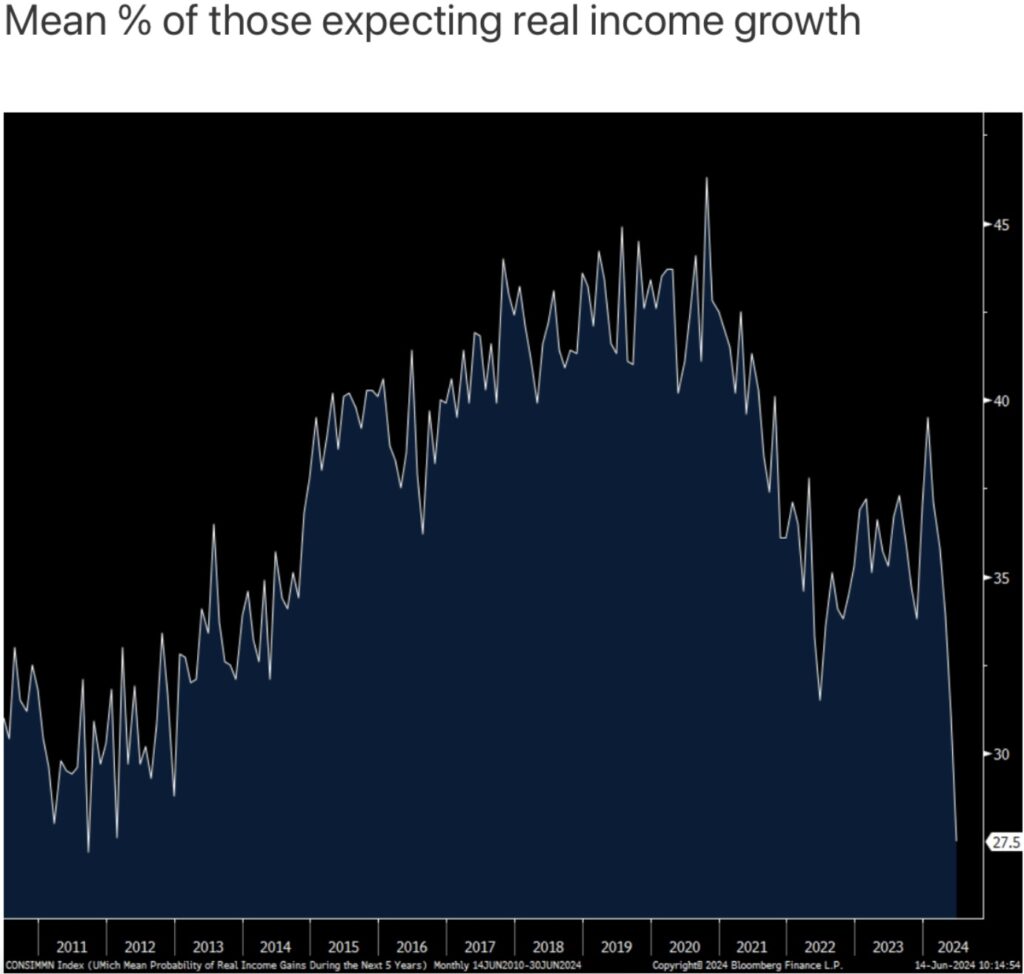

Combine this with still high inflation expectations, the mean % of those ‘expecting family income will beat inflation over next 5 yrs’ fell to just 27.5%, the worst read since 2011.

Percent Of Those Expecting Real Income Growth Collapses To Lowest Level Since 2011!

Spending intentions continue to deteriorate, both because of the cumulative rise in inflation and pared with the high cost of funding high ticket purchases. Plans to buy a car fell 15 pts in April, another 7 pts in May and 12 pts in June. At 51 that is the lowest since November 2022.

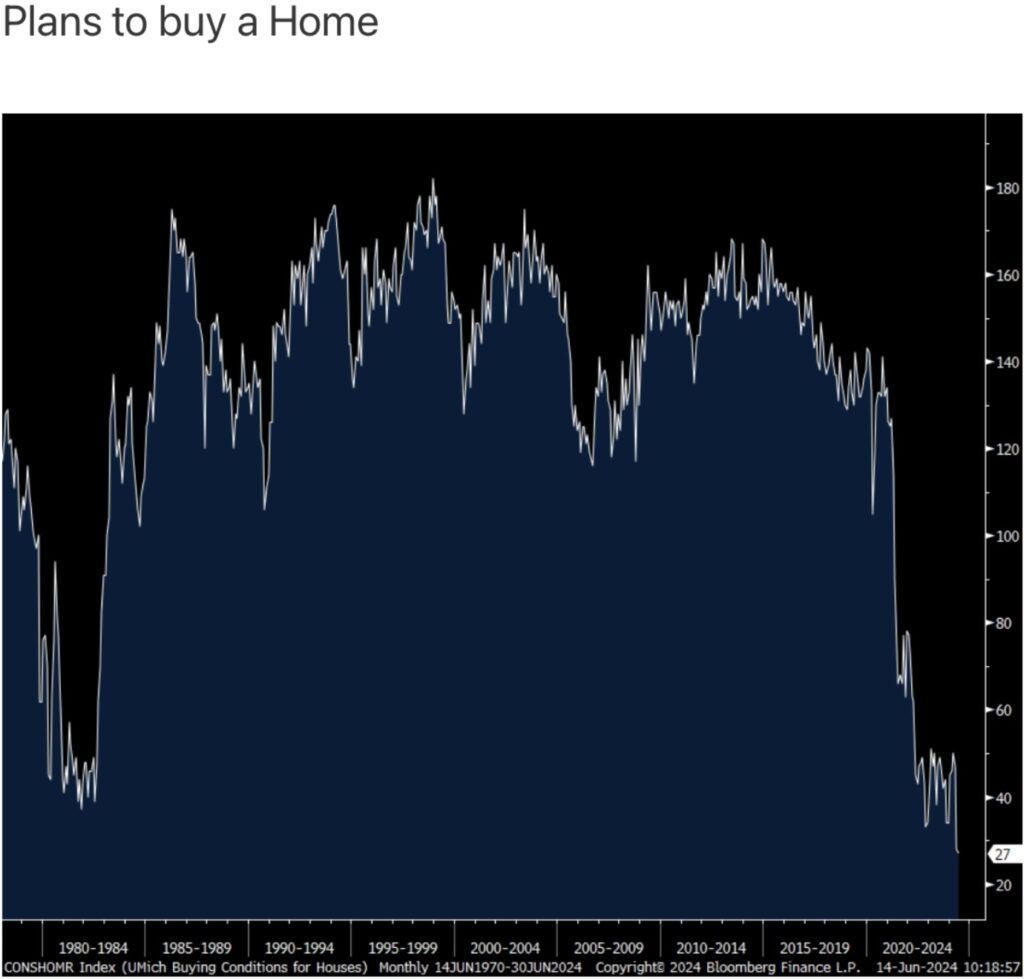

Plans To Not Buy A Home?

Plans to buy a home plummeted by 19 pts in May and fell 1 pt in June to 27, the lowest on record dating back to 1978.

ALL-TIME RECORD LOW

Plans To Buy A Home Plunges To Lowest Level In 46 Years!

We have to understand that a mortgage rate of around 7% today is not an apples to apples comparison to what rates were in the 1970’s because the home price to income ratio is dramatically higher today.

Another Collapse Reading

With respect to a major appliance, intentions to buy dropped 7 pts and by 28 pts in two months.

While we on Wall Street obsess about the inflation rate of change, many consumers could care less and are still struggling with the cumulative rise relative to their wage growth.

The bottom line is simply the inflation squeeze that lower and middle income consumers are feeling. From the UoM, “Although high price complaints have generally fallen since 2022 for higher-income consumers, these complaints have continued largely unabated during this period for those with lower incomes. While lower-income families have, as a group, seen notable wage gains in a strong labor market, their budgets remain tight amid continued high prices even as inflation has slowed. The views of middle-income consumers resemble those of their lower-income counterparts, a departure from historical patterns in which their mentions are squarely in between those of higher- and lower-income consumers.” Not quite what James Carville once 30 something years ago said but now it’s the cumulative rise in inflation, stupid.

Just Released!

Alasdair Macleod discusses collapsing Open Interest in the gold market as well as some other wild developments from around the world CLICK HERE OR ON THE IMAGE BELOW TO LISTEN.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.