Peter Boockvar says the price of silver needs to hit $200.

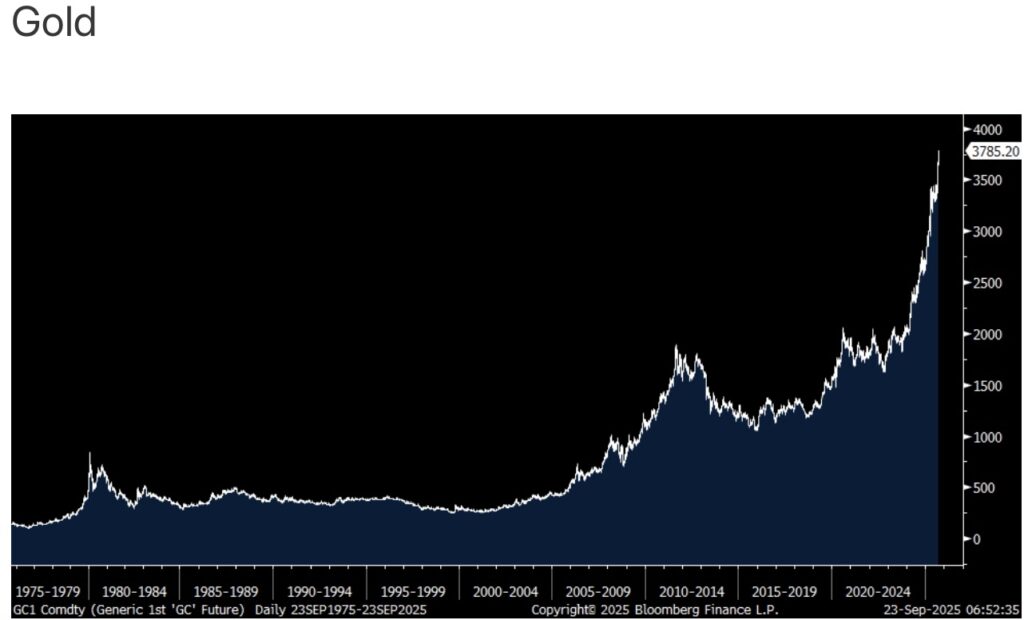

Here Is The Truth About Stock Market vs Gold

September 23 (King World News) – Peter Schiff: U.S. stocks are in a historic bear market that is far from over. Priced in gold (real money), the Dow Jones is down over 24% so far in 2025, 33% since the end of 2023, and 70% since 2000. The “bull” market is merely an illusion created by inflation. Gold exposes that illusion.

Inflation, Long Bond Yields, Gold, $200 Silver

Peter Boockvar: After having spoken in both a prepared speech and his Q&A last week after the FOMC meeting, Powell in his speech today is not saying anything new.

He again highlighted his challenge, “Near term risks to inflation are tilted to the upside and risks to employment to the downside, a challenging situation. Two-sided risks mean that there is no risk free path.”

For reference, after a tremendous bond rally that took the 2 yr yield to 3.54%, the 10 yr yield to 4.04% and the 30 yr yield to 4.65% at 1:59pm est last Wednesday, we now stand at 3.59%, 4.14% and 4.75% for each of those maturities. I remain bearish on long term sovereign duration around the world and you can’t just analyze US growth, inflation and Fed rate expectations as part of one’s analysis I believe on where rates will go.

Moving on to this continued rise in gold, which we remain long and bullish but acknowledging a correction could come at any moment.

I mentioned yesterday the stats where foreign investors in US assets are more and more hedging their dollar exposure. It is also reflective that non dollars are what they want and gold is the ultimate non dollar asset.

I want to highlight silver again as while we heard about gold reaching its 1980 inflation adjusted peak, silver would have to go to $200 in order to achieve that and is still below its nominal high of about $50. We remain bullish and long too of platinum.

Her Gold Price Predictions Have Been Deadly Accurate

Nomi Prins: “I think what’s happening in gold, and you’re right I did recommend all of those forecasted points on gold. We’ve hit them. I just put out a piece yesterday about the case for gold going into the final quarter of 2025 and moved my price prediction up to… CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.