Today the price of gold soared to a new all-time high near $2,500 post-Fed decision, but look at this…

July 31 (King World News) – Peter Boockvar: Again, the FOMC is leaving it to Jay Powell’s press conference in order to glean where the lean is on the timing of rate cuts as the statement had only modest changes, though still of note. The set up for that September cut was some tempering of the wording on the labor market. In June they said,

“Job gains have remained strong, and the unemployment rate has remained low.”

This was replaced with:

“Job gains have moderated, and the unemployment rate has moved up but remains low.”

Also, there was a very modest tweak to the inflation comments but also a set up for a cut. In June they said:

“there has been modest further progress toward the Committee’s 2% inflation objective.”

Today that line reads:

“there has been some further progress toward the Committee’s 2% inflation objective.”

Bottom Line

Bottom line, the Fed in the statement slightly sowed the seeds for a cut at the next meeting as they gather more evidence that substantiates one. Powell at his presser though will be able to give more tone and body language on whether that’s a lay up or not, which it likely is but something the market has already priced in…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Post-Fed Press Conference

Jay Powell sounds like he has verbal constipation with respect to a September rate cut. He so wants to say today ‘let’s do it’ but at the same time knows he doesn’t have to commit just yet before he gets more time and data until September 18th.

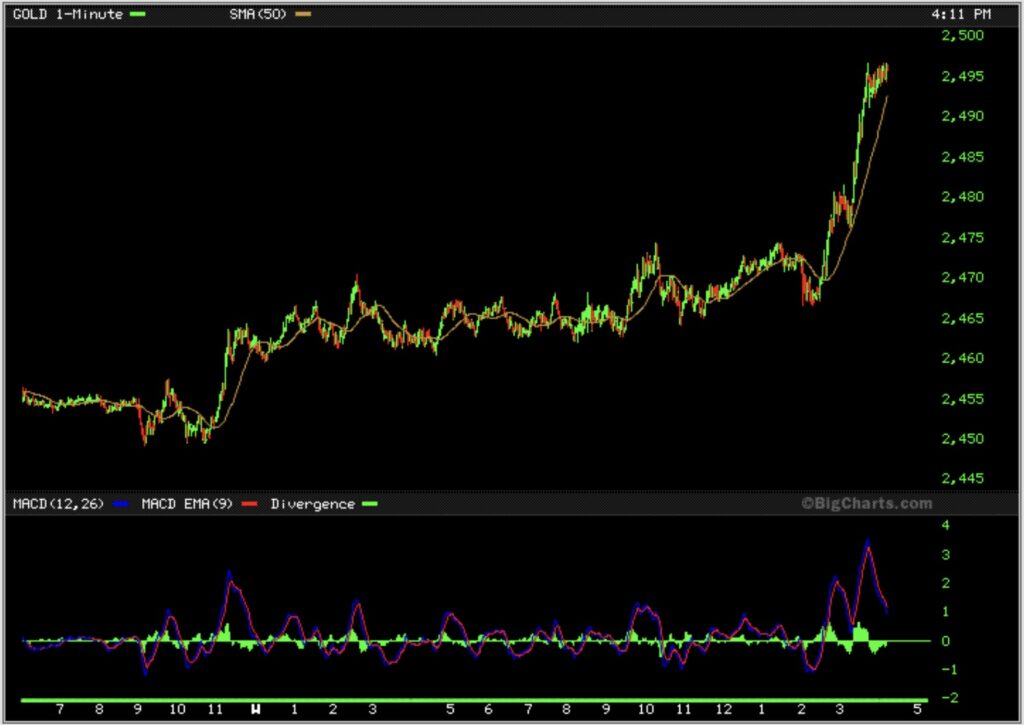

Gold Price Hits All-Time High!

King World News note: Immediately after the Fed decision the price of gold soared to an all-time high.

Gold Futures Hit All-Time High Immediately After Fed Decision, Near $2,500

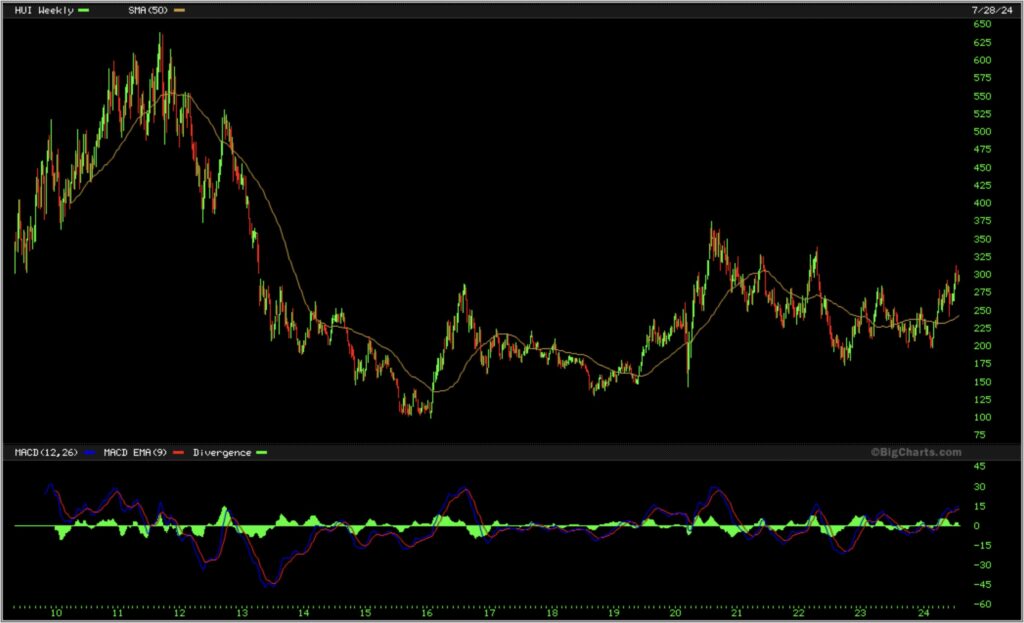

King World News note continues: Here is a 6-month chart showing the price of gold hitting all-time highs.

6-Month Chart Shows Gold Nearing $2,500 Level

King World News note continues: The HUI Gold Mining Index remains mired in fear. There is no money flowing into the sector yet but that will change. The metals manipulators and naked short sellers in Canada and the US have essentially destroyed the mining and exploration sector and made it “uninvestable.” This chart below is what a sector looks like when it has been torched and is considered “uninvestable.” Note the HUI is more than 50% below its previous high set in 2011, even though gold is now trading $480 higher!

HUI Gold Mining Index Remains Cratered: 50% Below Previous All-Time High. But HUI Gold Mining Index Will Eventually Shatter All-Time High!

For Those Of You Looking To Buy

King World News note: For those of you continuing to accumulate physical gold and silver through dollar cost averaging, remain disciplined and make your buys at the same time each month or quarter. For those of you accumulating your favorite high-quality mining and exploration stocks, the majors have already started what will be an epic run, the mid-tiers and juniors will follow. If you are already fully invested remain patient and enjoy the ride!

Released!

To listen to Alasdair Macleod discuss the volatile trading in the gold and silver markets click here or on the image below.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.