Today Eric Pomboy sent King World News an exclusive piece discussing how the long gold price suppression scheme is finally coming undone.

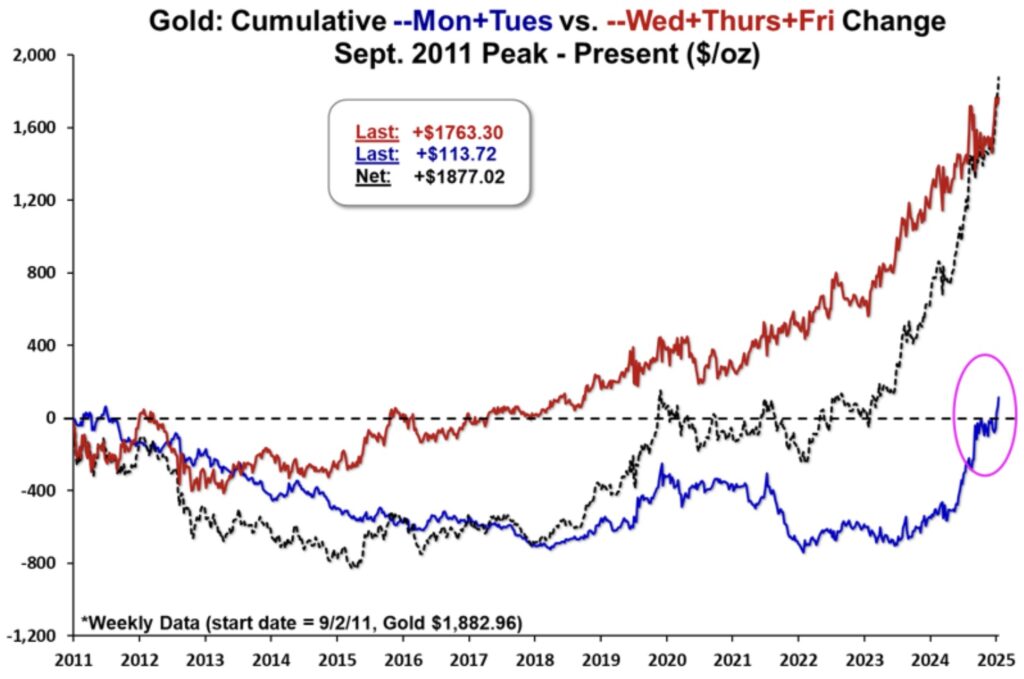

October 2 (King World News) – Eric Pomboy, President of Meridian Macro Research: In September 2011, Gold’s post-GFC rise hit a wall coinciding with the Fed’s implementation of Operation Twist. Since Gold’s 2011 peak, some notable trading patters have emerged. First, the bulk of downside pressure has been exerted during two time periods each day: 8-8:30am COMEX open and LBMA PM Fix which occupies the 10-10:30am slot. Additionally, the biggest downside days for Gold typically occurred on Mondays and Tuesdays. Together, this is evidence of what we would call a ‘carefully managed’ Gold price (see also: Gold suppression). As such, we decided to track Gold’s performance from 2011’s weekly high close of $1,883 for Mondays + Tuesdays vs. remainder of the week.

The result: cumulative Monday + Tuesday Gold performance since 2011 became increasingly negative as remainder of the week performance was hitting record highs. However, as the chart shows, Monday + Tuesday performance has come full circle and has just now broken out. Interestingly, it met firm resistance over the past few months (right at the 2011 level) and finally built up the momentum to break through.

In short: the years-long Gold suppression scheme looks to be coming undone which could translate to surprising moves right ahead as natural price discovery unfolds.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.