Today one of the greats in the business exposed why the price of silver will surge above $100 in 27 months!

Silver Price Set To Surge Above $100

October 9 (King World News) – Stephen Leeb: “Silver is often referred to as gold’s ‘sister’ metal. And if they were real sisters, you could imagine that silver might well resent the greater attention invariably lavished on its lustrous sibling.

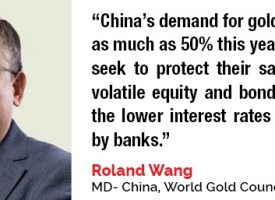

I’ve been making the case as strenuously as I can that gold is on the threshold of a great bull market that will transcend anything seen in the past, and I’ve urged all investors to make sure they have a big stake in it. But here I want to give silver its due as well, for I have long believed that as gold rises, silver – which for many investors might be the more affordable metal to acquire – will be enjoying a big bull move of its own…

BONUS INTERVIEW:

To listen to billionaire Eric Sprott discuss his prediction for skyrocketing silver

as well as his top silver pick CLICK HERE OR BELOW:

Stephen Leeb continues: “The factors accounting for silver’s surge, though, will diverge from those propelling gold. Gold’s rise will reflect its role as a monetary metal that will underpin international trade, starting in the East, and help ration increasingly scarce commodities. Silver, too, is a monetary metal and will always follow gold to some extent, but that is only one major reason for its forthcoming brilliant rise. Equally significant, if not more, will be sharply growing demand for silver because of its critical industrial uses, which will be burgeoning in coming years.

Of course, if silver supply was sufficiently abundant, demand could grow sharply and it wouldn’t matter at all in terms of silver’s price. But that isn’t the case. In fact, going back many decades, demand for silver has somewhat exceeded supply for much of the time. When Warren Buffett was accumulating silver in the 1980s, it was purely on the basis of demand outstripping supply.

Silver Supply In Deficit For 10 Consecutive Years

According to research into precious metals conducted by Thompson Reuters’s GFMS team, 2016 was the 10th consecutive year in which demand for silver exceeded supply. Demand for silver has two broad parts. Industrial demand has accounted for more than 55 percent of total supply. Nonindustrial demand – including investment inventories needed to back ETFs and the exchanges where silver is traded; coins and bars; silverware; and jewelry – accounts for over 45 percent or more of supply (the fact that the total of the two parts can top 100 percent of supply is in sync with supply lagging demand).

You might ask why, if demand has consistently been greater than supply, silver prices have not already been in a powerful bull market. The answer is that a good portion of monetary demand has gone into what GFMS refers to as above ground stocks, which mostly include coins and bars, but not either exchange or ETF inventories. This is silver has been available to be shifted around so as to satisfy some of the industrial demand. In other words, the accumulation of silver for nonindustrial purposes – monetary uses plus jewelry – has found its way into aboveground stores that can help lessen the pressure on supply.

Of these aboveground stores, the most important are what are termed custodian vaults, which contain by far the largest as well as the most easily diverted stores of aboveground silver. An estimated 1.5 billion ounces of silver are contained in custodian vaults, with 1 billion of those ounces, roughly one year of current worldwide supply, is in custodian vaults in China.

By contrast, as of the end of 2016, according to Thompson Reuters’ GFMS group, only around 650 million ounces of silver were held by ETFs, and just 250 million ounces were held by exchanges like the Shanghai Gold Exchange (where silvers futures are traded along with gold futures). Somewhat curiously, the GFMS also has devoted a fair amount of attention to determining the relatively minuscule amount of silver held in government coffers, estimating it comes to around 90 million ounces. It has done this while paying far less attention to considering the import of the far heftier holdings in custodian vaults, whose nearly 1.6 billion ounces represent some 60 percent of all aboveground inventories.

Ross Beaty, China & The Coming Silver Shortages

Ross Beaty, China & The Coming Silver Shortages

But if contributions of silver from existing custodian vaults have been enough to avert supply disruptions to industry, that will change as industrial demand for silver intensifies, and it certainly will. Silver, for instance, is critical to solar energy and particularly in photovoltaics. Recently KWN published a piece that quoted Ross Beaty, Chairman of Pan American Silver, as saying that some 100 million ounces of silver will be used in photovoltaic cells in 2017 – roughly 10 percent of silver demand. I have been arguing for years that solar demand for silver would be enough to create shortages, but now realize that solar is just one part of what will be explosive industrial demand for the metal.

Silver has a number of very special properties including an unmatched ability to conduct both heat and electricity. These properties make silver an essential component not only in solar but of virtually anything to do with information technology (IT). After several years in the relative doldrums, information technology has been ramping up. And a major chunk of this new-found growth is coming from – you guessed it – China. The Middle Kingdom has been making a big push to reorient its economy to emphasize new information industries, which are currently growing twice as fast as China’s overall economy, which is growing close to 7 percent a year.

Industries that China will be promoting that will require silver include AI (artificial intelligence), blockchains – which could be integral to China’s introduction of a new gold-linked reserve currency – the auto industry (both electric vehicles and internal combustion engines use silver), and the Internet of Things, which will be used to link the massive megacities China is creating. Some of these megacities will house 50 million or more people and will be linked by a wide array of circuits, and while any one of these circuits may contain just a small amount of silver, their huge numbers will add up to a massive source of demand.

The point is that even the likely one billion ounces China currently holds in custodian vaults won’t last long when matched against silver’s growing uses in coming years – and remember, China isn’t a short-term thinker, it plans for the long haul, 20 years out or longer. And with industrial demand for silver in the next 10 to 15 years likely to be much larger than total demand today and much greater than production, which if it hasn’t already peaked is close to peaking, China almost surely will decide to add to its custodial aboveground reserves.

Silver To Surge Above $100 In 27 Months!

Silver To Surge Above $100 In 27 Months!

This means that China, which has been stockpiling oil and rare earths and other resources it sees as critical to maintaining control over its economy, is likely to decide – possibly at its forthcoming big government get-together the week after next, to further add to overall demand for silver by stockpiling even more silver. That will be an additional source of demand that when added to the surging industrial demand and continued strong monetary demand will contribute over the near-term to much higher, possibly explosive silver prices.

The bottom line: Independently of anything that happens with gold, silver will be in a roaring bull market of its own. Silver owners will experience a pathway to riches in coming years. In the past, I’ve targeted silver as at least a $100 metal, and my best projection now is that by 2020, the $100 target will look very conservative.”

Speaking of silver…

Billionaire Eric Sprott has been busy aggressively buying shares of a silver mining company that he believes will be the #1 performing stock in the the coming silver bull market. Billionaire Sprott just reported adding nearly half a million shares to his already large holdings in this company in the most recent one week reporting period. It appears that Sprott wants to take his ownership of this company to a staggering 32%. You can learn which silver company billionaire Eric Sprott is aggressively buying shares in and where he believes the share price is headed by CLICKING HERE.

***KWN has now released the remarkable KWN audio interview with Egon von Greyerz and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: MAJOR ALERT: Greyerz Warns Swiss Bank Says It Will No Longer Hand Over Clients’ Physical Gold CLICK HERE.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.