Western institutional investors are now beginning to pile into gold! Here is a look at many of the stunning developments taking place across the world.

Western Institutional Investors Beginning To Pile Into Gold

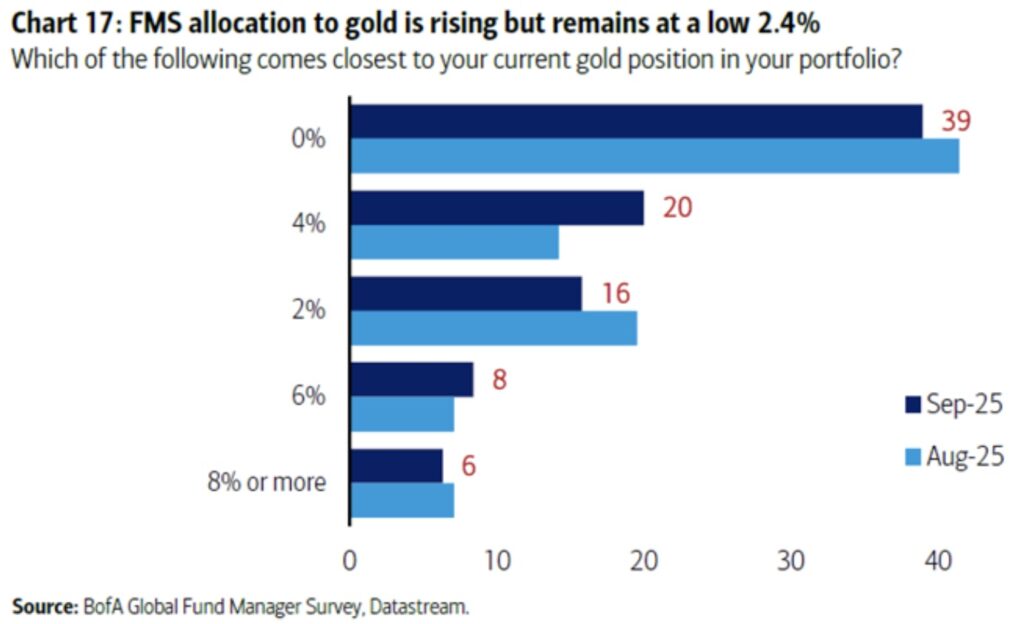

September 23 (King World News) – Fred Hickey: Another 6 tons into the GLD gold ETF today (+25 tons over past 2 business days). Brings the total GLD holdings to over 1,000 tons for the first time since August 4, 2022. Western institutional investors beginning to pile into gold. Despite gold’s huge outperformance this year, per recent BofA Global Fund Manager Survey, 39% still have close to a 0% allocation to gold. Another 16% with around 2%. The average is just 2.4%. Long ways away from Morgan Stanley CIO’s recently proposed 60%/20%/20% portfolio allocation strategy (60% stocks, 20% bonds & 20% gold). Still nothing happening with the GDX ETF. Remains stuck at 290,000 shares outstanding.

KING WORLD NEWS NOTE: 39% Of Institutional Investors Still Have Close To 0% Allocated To Gold!

Gold & Silver Surge

Peter Schiff: Gold rose another $40 this morning, hitting a new record high above $3,785. Silver jumped 25 cents to $44.25. Yet in an hour on CNBC, gold hasn’t been mentioned once. It’s the biggest financial story of 2025, yet the “leading financial network’s” top story is Jimmy Kimmel.

Gold Tells The Real Story

Peter Schiff: While the financial media celebrates new highs in the Dow, S&P 500, and NASDAQ, gold tells the real story. The Dow was barely positive, the S&P and NASDAQ gained less than 0.5%, but gold rose 1.7%. Priced in gold, the Dow is down 70% from its 2000 peak — a historic bear market!…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Great Stabilizer

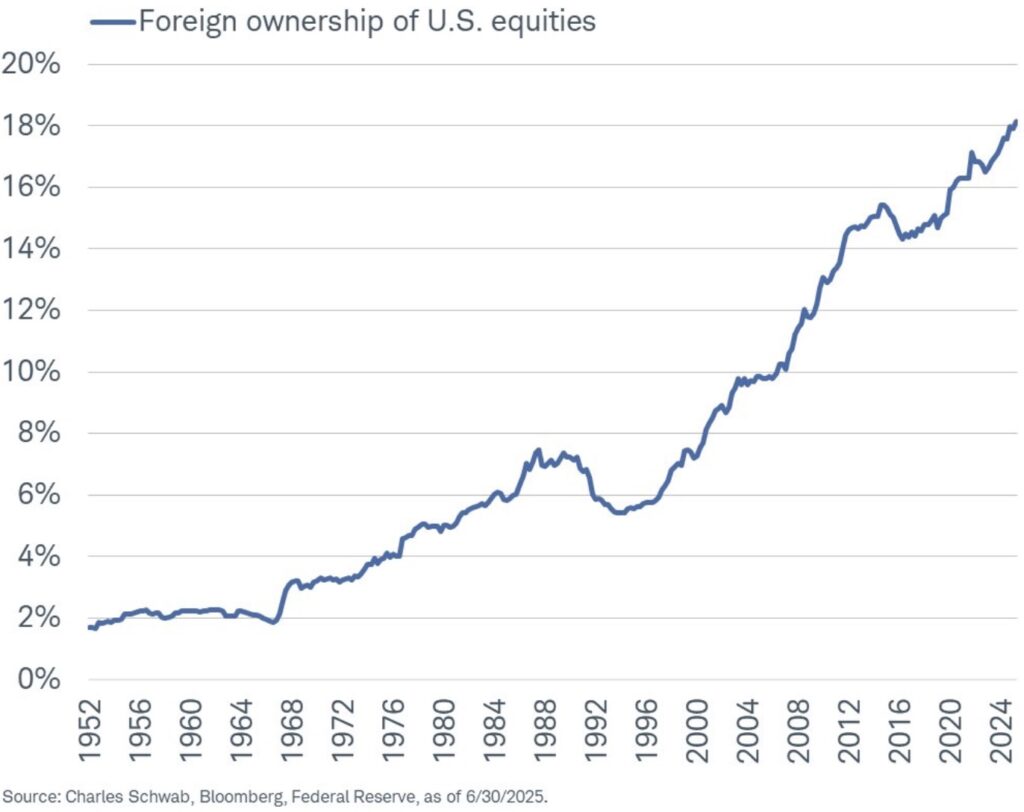

Liz Ann Sonders at Charles Schwab: Foreign ownership of U.S. equities has continued to climb this year, jumping slightly above 18% thru first half of year.

KING WORLD NEWS NOTE: Foreign US Dollar (SHORT) Hedging Has Soared, But So Has Foreign Money Flows Into The US Stock Market

This Won’t End Well

Tom McClellan: Here is another divergence to add to the long list of them piling up (and not yet mattering, so far). This one has mattered pretty well in the past.

KING WORLD NEWS NOTE: US Stock Market May Shock The Bullish Public By Crashing

Gold Miners Quietly Coming Alive

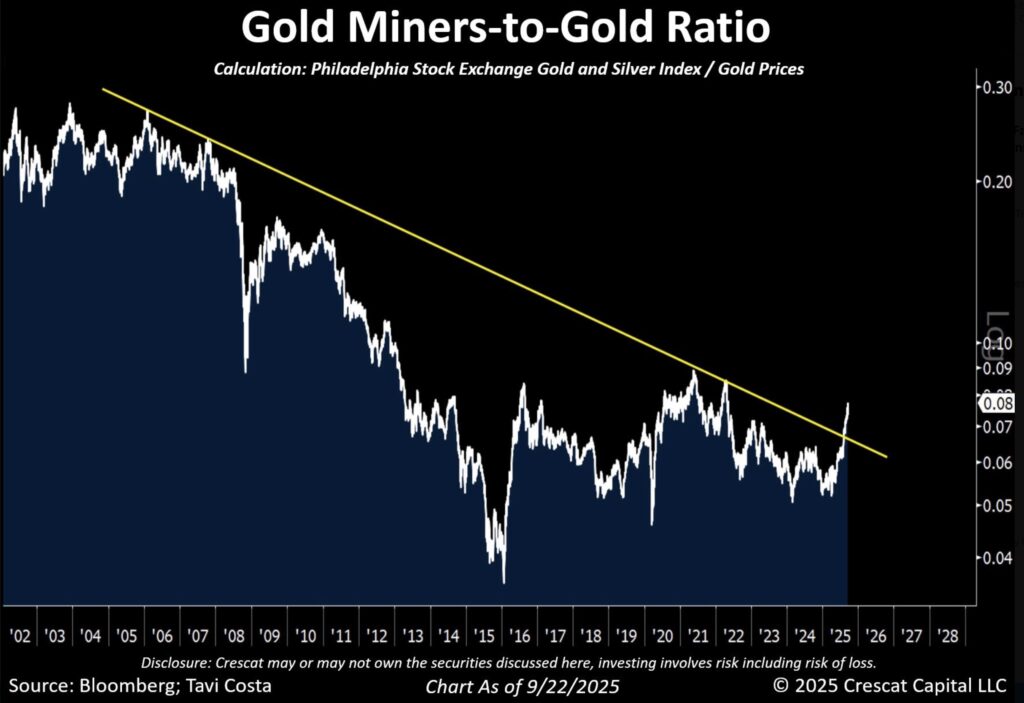

Otavio Costa: Major macro trends tend to be confirmed by decisive multi-year breakouts.

The mining stocks-to-gold ratio appears to be doing just that.

Despite the recent strength:

We’re still more than 70% below the highs from 19 years ago.

This could mark the beginning of the institutional phase of the cycle — where patient capital starts positioning for long-duration exposure.

KING WORLD NEWS NOTE: Gold Mining Stocks Set To Skyrocket vs Gold

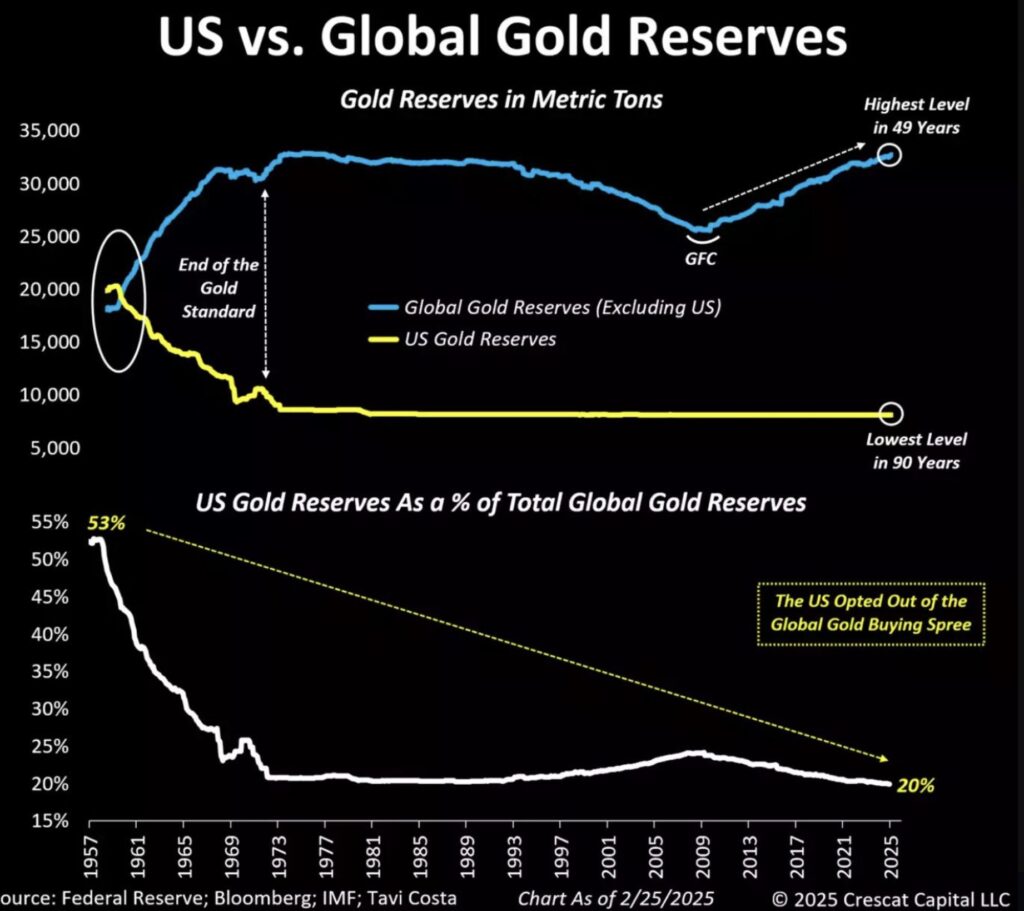

Will The Fed Join The Gold Buying Spree?

Otavio Costa: This is a defining question for the US in the years ahead:

How long can America afford to sit out the global rush for gold?

US gold reserves are now at 90-year lows, while the rest of the world has pushed their holdings to near 50-year highs.

At one point, America held over 50% of global gold reserves.

Today? Just 20%.

My view:

It’s only a matter of time before US policymakers are forced to rethink this stance.

KING WORLD NEWS NOTE: It Is Highly Unlikely The United States Has The 8,100 Tonnes Of Gold They Claim To Possess

Her Gold Price Predictions Have Been Deadly Accurate

Nomi Prins: “I think what’s happening in gold, and you’re right I did recommend all of those forecasted points on gold. We’ve hit them. I just put out a piece yesterday about the case for gold going into the final quarter of 2025 and moved my price prediction up to… CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.