Look at what is skyrocketing! Plus gold, miners and more.

Time For Emerging Markets?

September 8 (King World News) – Otavio Costa: What may seem like one of the most illogical moves to many looks highly compelling to me in today’s macro environment.

The goal isn’t to be contrarian for its own sake, but to pursue a thesis that is fundamentally strong and widely under-owned.

That, to me, defines EM today.

In addition to rising commodity prices, two key forces drive these economies: a weaker dollar and suppressed US yields.

Both seem likely ahead in my view, given the scale of the debt burden and the structural twin deficits we now face.

KING WORLD NEWS NOTE: Emerging Markets Are Coiled For Takeoff

Gold

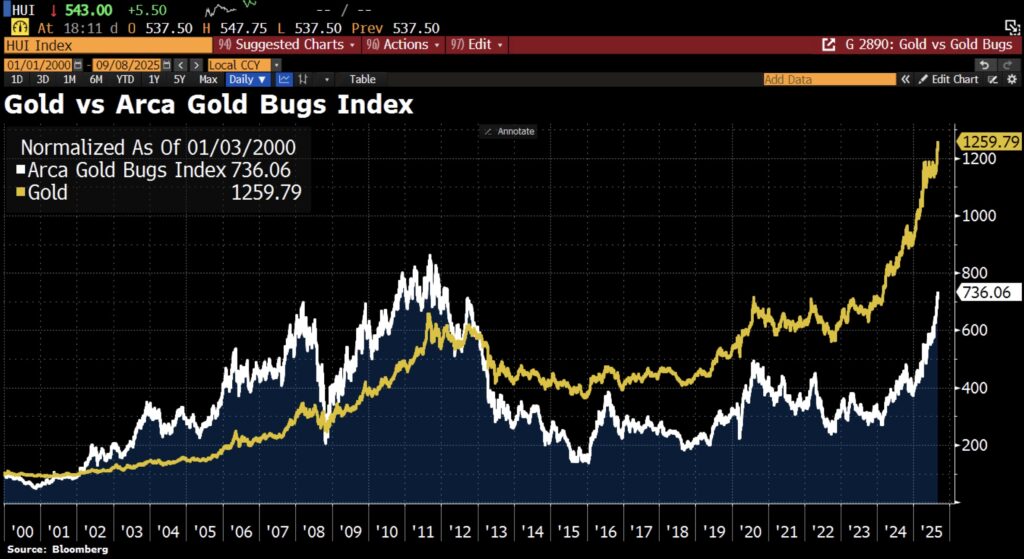

Holger Zschaepitz: Mind the Gap: Gold prices have climbed to new record highs, but gold mining stocks haven’t kept up. In fact, mining shares have been lagging well behind, a trend that has persisted since 2013.

KING WORLD NEWS NOTE: Gold Mining Stocks Set To Skyrocket As They Catch Up With The Price Of Gold

Get Out!

Peter Schiff: Ever since Alan Greenspan rescued the stock market after the 1987 crash, the Fed has made a series of increasingly bad monetary policy mistakes. But the mistake the Fed is about to make will likely be the worst yet. Get out of the U.S. dollar now, before it’s too late. Got gold?

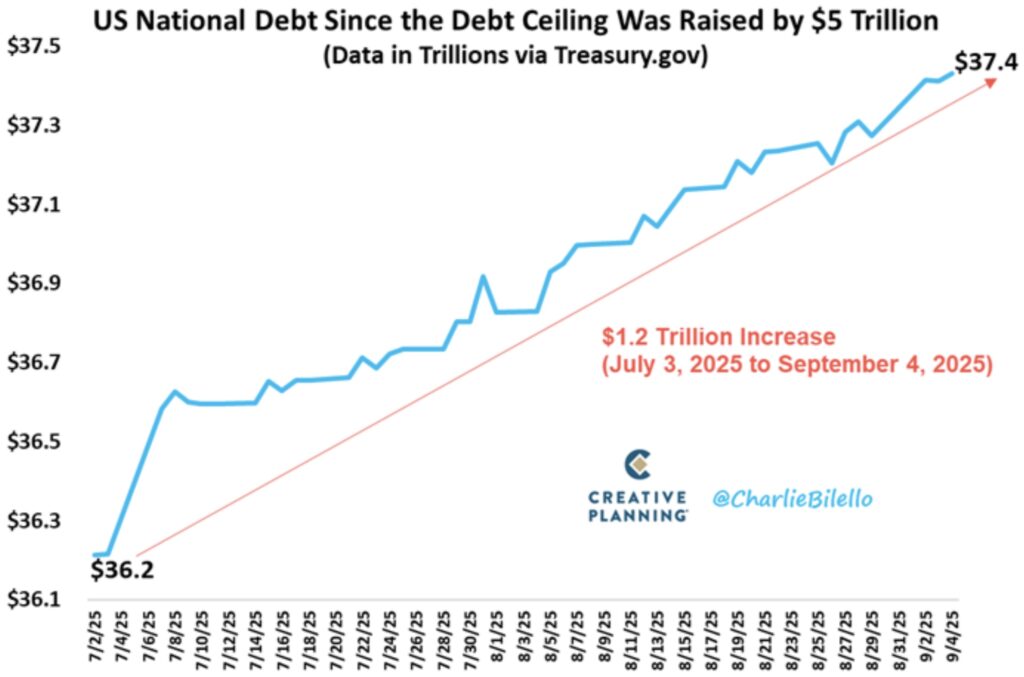

Skyrocketing US Debt!

Charlie Bilello: The US National Debt has increased by $1.2 trillion since the Debt Ceiling was raised just two months ago.

KING WORLD NEWS NOTE: US Debt Continues To Skyrocket

$10,000 Gold

To listen to Gerald Celente discuss his prediction for $10,000 gold CLICK HERE OR ON THE IMAGE BELOW.

Gold Blastoff!

To listen to Alasdair Macleod discuss $100,000 gold and the wild trading this week in gold, silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.