Look at what is happening with gold, used cars and the US dollar.

There was a delay in KWN publishing due to travel. Thank you for your patience.

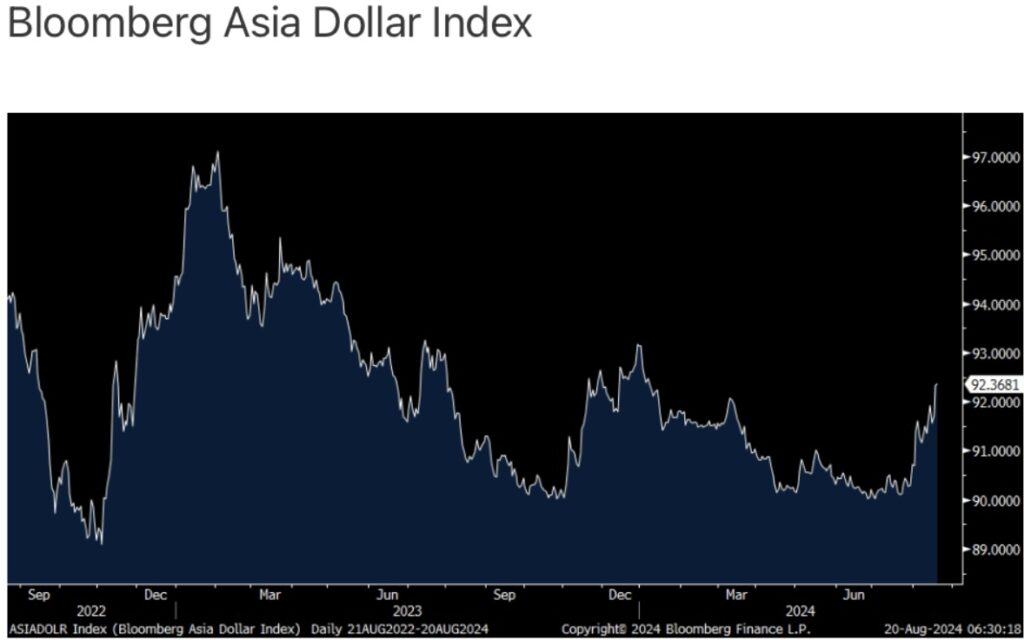

August 20 (King World News) – Peter Boockvar: Quietly it seems the US dollar continues to weaken and it is not just versus the euro and yen heavy DXY.

The Indonesian rupiah and the Thai baht are at the highest since early January. The Korean won is at the highest since March. The Singapore dollar is at the highest since January 2023. Some of the help to these currencies has been the yen rally but certainly some is the shrinking interest rate differentials.

Asian Currencies Strengthening vs US Dollar

The US dollar is also weakening dramatically against gold as gold is a currency.

Price Of Gold Hits Another All-Time High

We remain bullish and long, along with silver.

What’s amazing is that the western investor has completely missed the rally, broadly speaking, as measured by the 23 million ounces of gold taken out of all the gold ETFs over the past few years and that process started just as the Fed was hiking rates in March 2022 and in search of interest bearing bonds instead.

At some point, that western investor will be back and will kick start the next leg higher in gold.

The US dollar is still trading pretty well though against the commodity currencies such as the Canadian and Aussie dollars along with the Brazilian real but all are off their recent lows.

US Dollar Journey

Since the DXY lows in mid 2021, the dollar rally has really been just an interest rate differential play, nothing more. In June 2021, the dollar started a huge rally when Jay Powell at that Fed press conference said they are finally beginning to talk about tapering QE. The DXY topped in late September 2022 just as the Fed was ending its pace of 75 bps of rate increases. One has to wonder though at when that point is reached where the US dollar more reflects worries about US debts and deficits rather than just what the Fed will do. I don’t know the answer but am always on the look out.

Regardless of the factors, if the US dollar weakness persists, import prices will become a more important economic indicator to watch as the US economy still has a large trade deficit, totaling about $800b over the 12 months into June, with the three recent months each over $70b.

Sweden Cuts Rates

The Swedish Riksbank cut interest rates by 25 bps as expected to 3.5% and said they will likely cut again. They said “If the inflation outlook remains the same, the policy rate can be cut two or three more times this year, which is somewhat faster than the Executive Board assessed in June.” Even with the cut though, the Swedish krona too is rallying against the dollar, though has been weak of late.

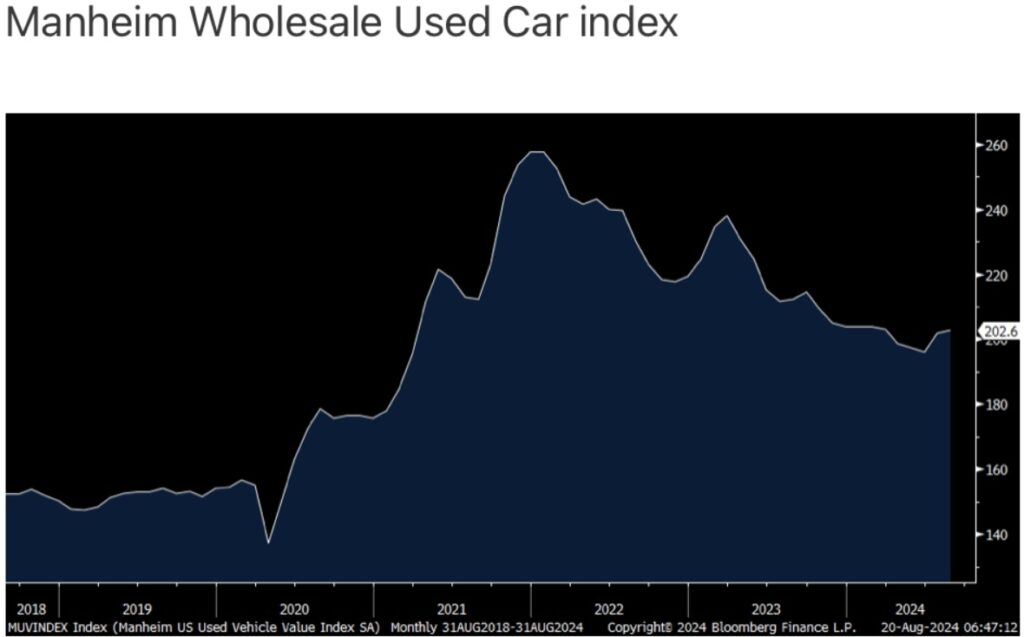

Disinflationary Source

The main disinflationary source in the goods portion of the CPI and PCE figures has been the decline in used car prices after the dramatic spike it saw prior. Manheim said that wholesale used car prices rose .5% seasonally adjusted from July, though are still down 4.5% y/o/y. They said the rise “is in line with longer-term trends” and that “The industry clearly experienced strength in wholesale values for the full month of July, and that trend has continued so far into August.

The three year old segment is the largest at Manheim, and wholesale values for those units have increased for five weeks in a row. Recently, we have seen the strength broaden out, as values for some of the older segments have also seen small gains w/o/w.”

King World News note: The US Dollar Index has been breaking down on a short-term basis. This is helping to fuel gold’s rise. If the dollar continues its breakdown that will send the price of gold significantly higher than what is being quoted today.

Egon von Greyerz

To listen to the powerful audio interview with Egon von Greyerz where he issues a dire warning for people in the US and around the world as well as discussing what people need to do to avoid having their money trapped and possibly confiscated and much more CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss his prediction for where the price of silver is headed,$3,000 gold and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.