Look at what China is doing in the gold market.

The money rate can, indeed, be kept artificially low only continuous new injections of currency or bank credit in place of real savings. This can create the illusion of more capital just as the addition of water can create the illusion of more milk. But it is a policy of continuous inflation. It is obviously a process involving cumulative danger.” ~ Henry Hazlitt

The Real Reason China Is Buying Gold

June 24 (King World News) – Bryan Lutz: If you’re invested in gold, then tracking the People’s Bank of China(PBOC), Turkey, and India’s gold purchases is important.

It implies that central banks are interested in stabilizing their currencies.

They want out of the US Dollar, and a stable currency for themselves.

Especially, China.

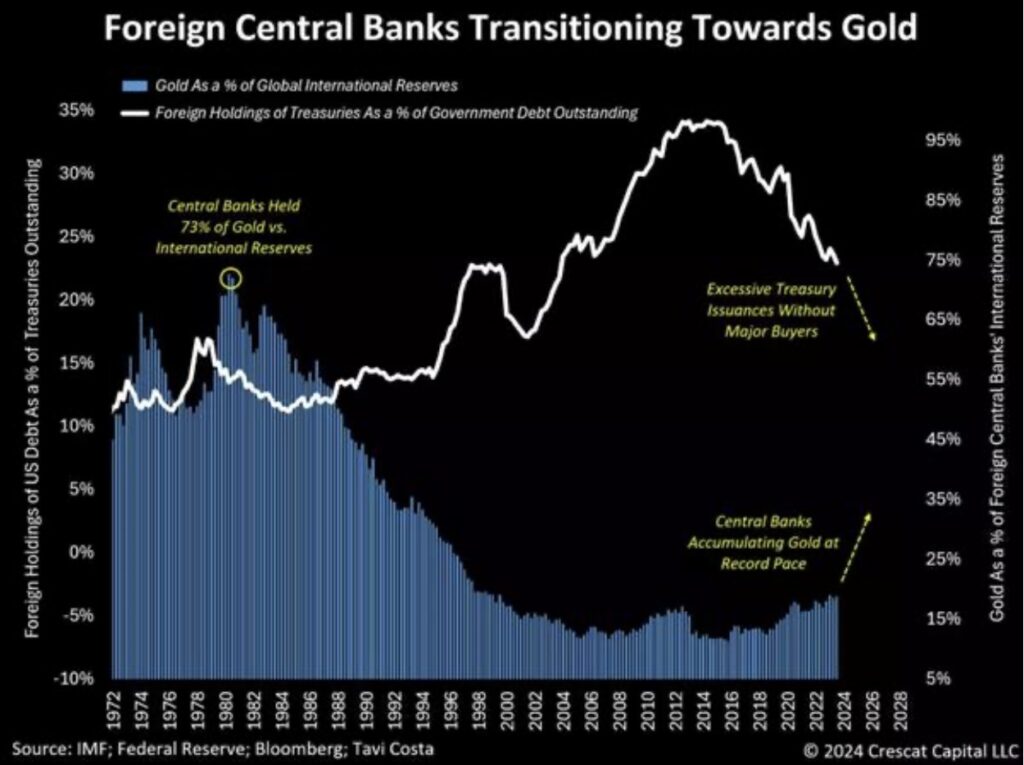

They’re buying the most gold, and they’re selling US debt at the fastest rate ever.

But as far as direct investments, China still has a long way to go.

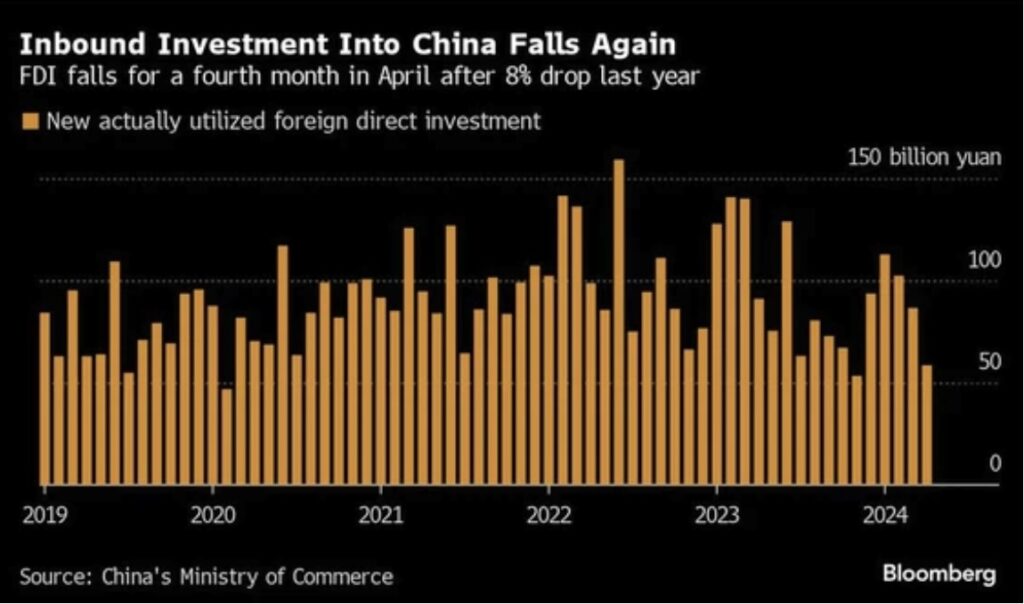

In fact, they’ve been losing the battle on foreign direct investments(FDI) into the country since 2022.

You can see the declining trend…

Since the United States started raising interest rates in 2022, the US has been receiving much of the world’s foreign investment.

The dollar’s just been too strong, and the US economy too attractive.

Bloomberg reports: How the US Mopped Up a Third of Global Capital Flows Since Covid

“For all the angst over the dollar’s dominance, a run-up in US interest rates to the highest levels in decades proved a major draw for overseas investors. The US has also pulled in a fresh wave of foreign direct investment (FDI) thanks to billions of dollars worth of incentives under President Joe Biden’s initiatives to spur renewable energy and semiconductor production.”

I don’t know how much the increase in Foreign Direct Investment is a result of government incentives and stimulus, as much as it is media bias praising Bidenomics.

Rather, it’s a result of something different.

China’s economy appears weak.

Nikkei Asia reports:

“Foreign direct investment in China plummeted 56% on the year in the first quarter of this year, according to the official data released Friday, underscoring global businesses’ reluctance to pour money into an economy grappling with weak internal demand…

…Foreign direct investment has fallen sharply since the second quarter 2022, when the economy was severely disrupted by Shanghai’s COVID lockdown. The July-September period last year had the first net quarterly outflow of foreign direct investments on record.

Domestic demand is lacking, undercutting growth expectations.”

Declining recovery from businesses in China after pandemic lockdowns combined with a US dollar dominating the currency market is what’s driving China’s turn to gold.

China desperately wants a trusted currency. They want to maintain a strong economy.

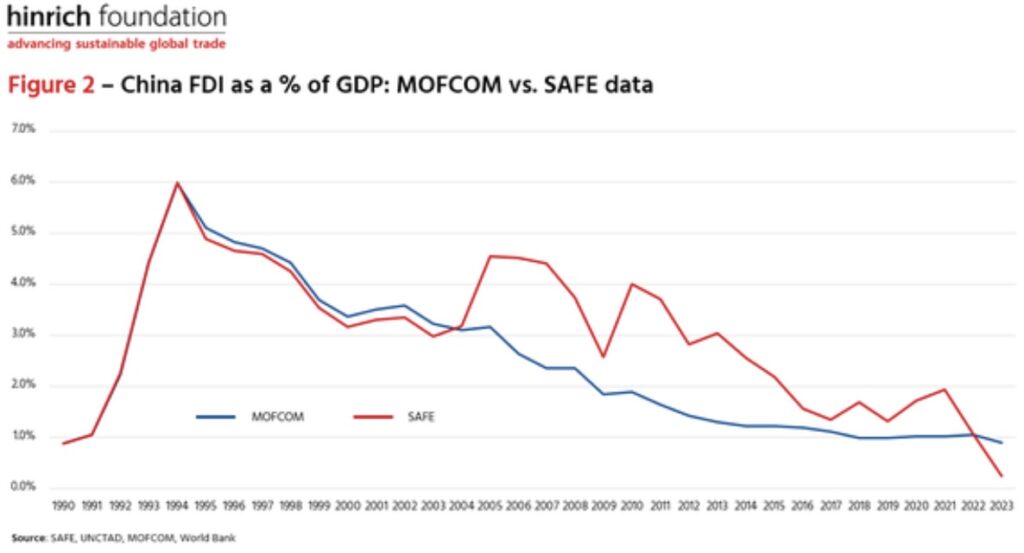

Unfortunately, FDI has been declining for decades in China, while the US Dollar has been dominating foreign investments for some time.

Here is a chart from two of China’s internal data sources:

It shows more than a decade of a shrinking economy.

And now, with Xi’s government tightening security laws…

The Hinrich Foundation writes:China is running out of FDI ideas

“The pandemic highlighted the vulnerabilities that excessive concentration of supply can bring. China’s falling growth rate has additionally tarnished the appeal of investing there, based purely on future expected returns. And there is a perception that the business environment in China has become trickier to manage in the light of new security-related laws.”

The real reason China and Russia, and the rest of the BRICS nations are buying gold is because the fight against the USD is unsustainable.

Foreign investors would rather place their money safely in the United States…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

While at the same time, the United States is overwhelming themselves with debt, devaluing and destabilizing their own currency.

Centrals Banks and governments see the impossible scenario.

So they’re moving out of US Treasuries and into gold.

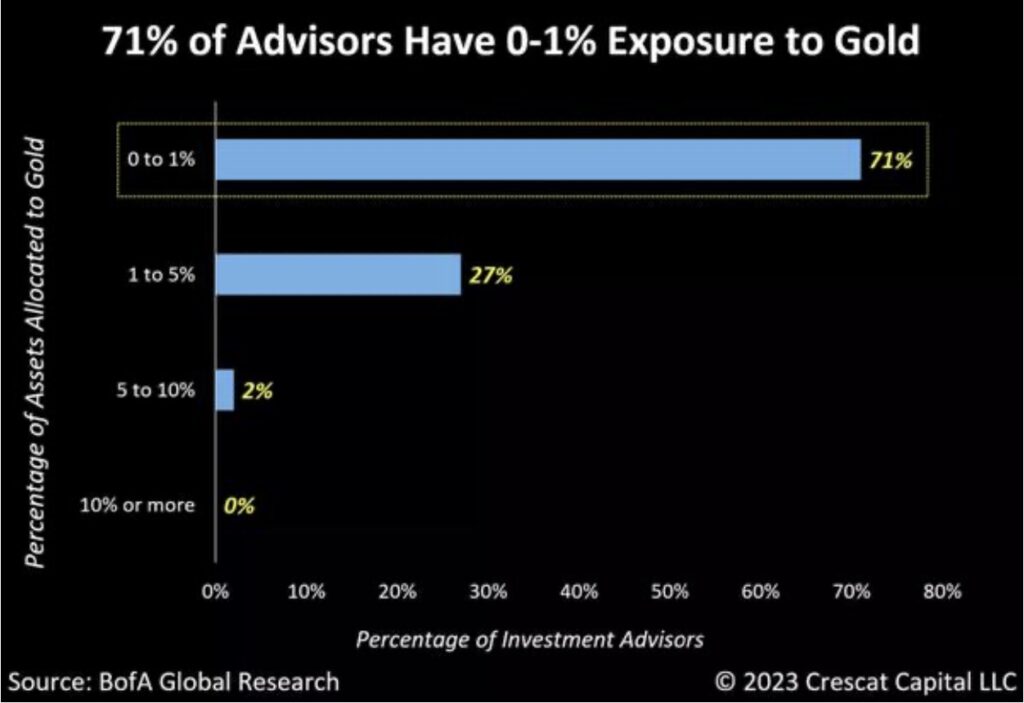

Direct investors, family offices, advisors don’t see it.

They’re choosing the United States to place their money.

They’re also not thinking about gold…

Central Banks are thinking about gold though…

China, Russia, and India all see it.

Gold is the answer in the era of a collapsing US dollar.

Wild Trading In Gold & Silver!

To listen to Alasdair Macleod discuss the wild trading in the gold and silver markets this week and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.