DIRECTIONS ON HOW TO PLAY OR DOWNLOAD AUDIOS: CLICK HERE

Jonathan (Jonny) Haycock: PARTNER of VON GREYERZ

Jonathan (Jonny) Haycock: PARTNER of VON GREYERZ

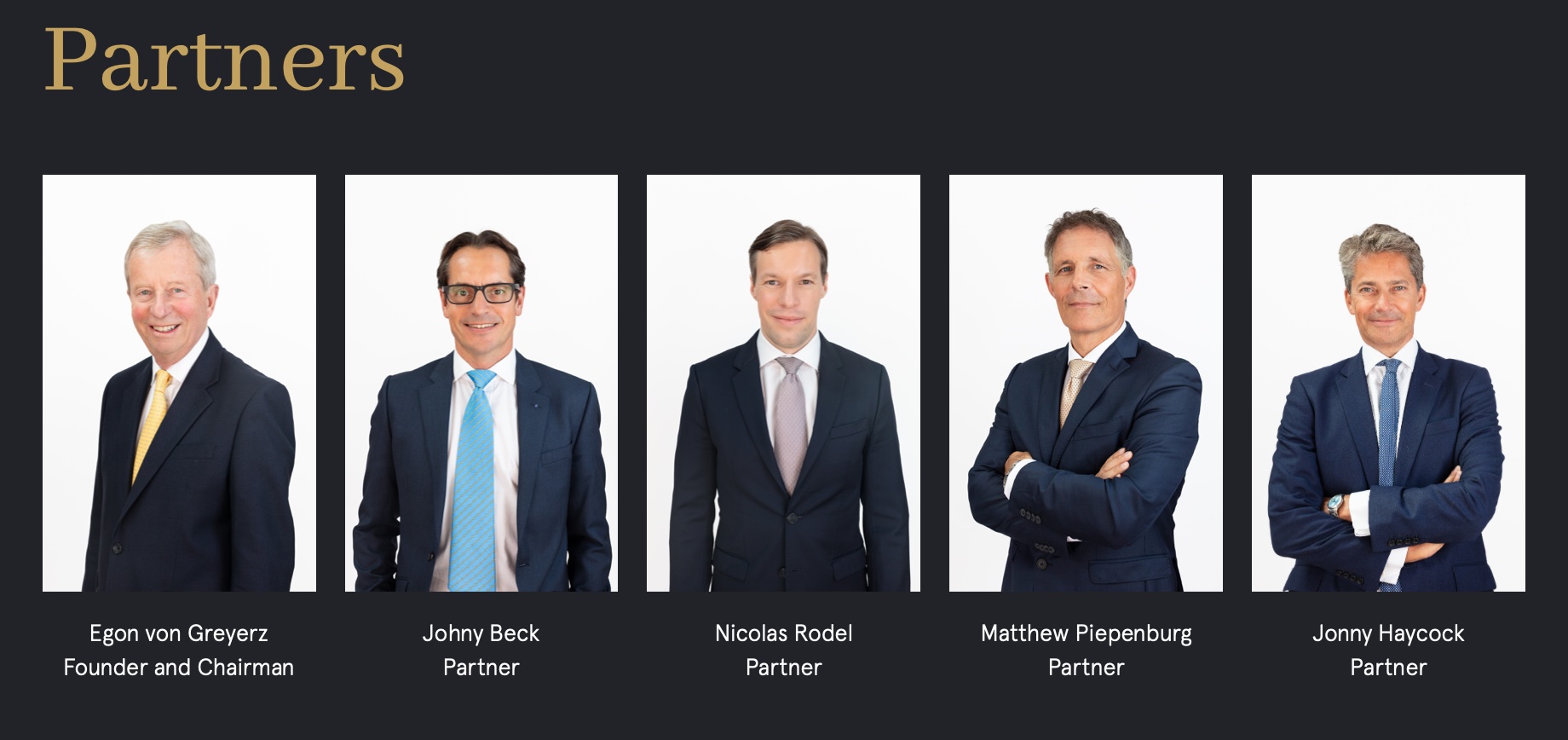

Jonny, who qualified as a barrister in London, enjoyed a 27-year career in the City before joining VON GREYERZ to run their Family Office department. Starting at Salomon Brothers in 1997, Jonny joined Morgan Stanley in 2001, where he spent 23 years advising Hedge Fund and Institutional clients, as well as sitting on their European Equity Underwriting Committee.

It was at Morgan Stanley that Jonny became a long-term trusted advisor to their UHNW clients. It is this experience over two decades that he brings to serving Family Office clients seeking wealth preservation advice at VON GREYERZ.

Message Jonny below to schedule a call or connect on LinkedIn.

VON GREYERZ, AG (“VG”) – GoldSwitzerland is THE industry leader in wealth preservation through precious metals for HNW clients in over 90 countries seeking private and unencumbered ownership of their assets outside of a fractured commercial banking system. VG boasts the largest and safest private gold vault in the world (within the Swiss Alps), as well as additional private vaulting options in Zurich and Singapore (ALL fully insured). VG can arrange additional storage options globally and our clients enjoy full logistical/transport services, in-house trading and instant liquidity when required.

VG is the only enterprise in the world offering HNWIs true and direct (fully allocated and segregated) precious metal ownership free of the operational, counterparty and intermediary risks of the commercial banks. This means VG clientele enjoy full legal control and direct access to their assets, as well as to the VG partners and support staff. No other company can make such assertions, and at VG, we can proudly declare: “We have no competition.”

Egon von Greyerz: FOUNDER & CHAIRMAN of VON GREYERZ – BORN WITH DUAL SWISS/SWEDISH CITIZENSHIP, EGON’S EDUCATION WAS MAINLY IN SWEDEN.

Egon began his professional life in Geneva as a banker and thereafter spent 17 years as the Finance Director and Executive Vice-Chairman of Dixons Group Plc. During that time, Dixons expanded from a small photographic retailer to a FTSE 100 company and the largest consumer electronics retailer in the UK.

EVOLUTION TO PRECIOUS METALS

During the 1990s, Egon became actively involved with financial investment activities including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of VON GREYERZ as an asset management company based on wealth preservation principles.

EGON’S LEGACY AND ACTIVITY

VON GREYERZ is now the world’s leading company for direct investor ownership of physical gold and silver outside the banking system. Our vaults include the biggest and safest gold vault in the world, located in the Swiss Alps. Clients include High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds and Trusts in over 90 countries.

Egon makes regular media appearances and speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.

ownership.

THE BEGINNING

Risk-Management Origins

By the end of the 90s, Egon von Greyerz, who had always held an intuitive respect for managing risk in his personal as well as professional settings, determined that global risk was growing increasingly apparent as debt and derivative levels rapidly rose.

He recognized physical gold as a timely, as well as timeless, protection-asset against accelerating risks in the financial system. He thus founded VON GREYERZ (originally operating as Matterhorn Asset Management) in the late 90s as a private investment company for precious metal ownership outside of a highly-fractured global banking system. He chose the highest quality refinery and vaulting partners for acquiring and storing the same.

From Personal Conviction to Global Enterprise

VON GREYERZ was initially set up for Egon’s own family funds and those of a few key investors and business partners.

In early 2002, Egon made major investments for his group of investors into physical gold when the price was $300 per ounce.

Due to growing demand from other investors around the world, VON GREYERZ became a Swiss regulated company in 2005. Since then, VON GREYERZ (originally operating as Matterhorn Asset Management, AG) has grown from a private solution for personal wealth preservation into a global enterprise for clients from over 90 countries.

FROM FOUNDER’S VISION TO GLOBAL MARKET LEADER

Having earned decades of trust from sophisticated investors across 90 countries, the VON GREYERZ multi-lingual team of financial professionals has set the global standard in becoming the world’s leading precious metal advisory service.

THE TEAM: EXCEPTIONAL CREDENTIALS, UNIQUE BACKGROUNDS, SINGULAR VISION

Each member of the VON GREYERZ team approaches the ownership of precious metals within the greater, holistic context of risk management principles, critical to all manner of investing.

Although versed in risk assets and traditional portfolio construction, our singular focus is precious metal ownership as a critical component of risk management and hence wealth preservation.

Meet our key executives and advisors below. We are here to answer any questions and concerns.

MATTHEW PIEPENBURG – PARTNER

MATT BEGAN HIS FINANCE CAREER AS A TRANSACTIONAL ATTORNEY BEFORE LAUNCHING HIS FIRST HEDGE FUND DURING THE NASDAQ BUBBLE OF 1999-2001.

Thereafter, he began investing his own and other HNW family funds into alternative investment vehicles while operating as a General Counsel, CIO and later Managing Director of a single and, later, multi-family office. Matthew worked closely as well with Morgan Stanley’s hedge fund platform in building a multi-strat/multi-manager fund to better manage risk in a market backdrop of extreme central bank intervention/support. The conviction that precious metals provides the most reliable and longer-term protection against potential systemic risk led Matt to join VON GREYERZ.

The author of the Amazon No#1 Release, Rigged to Fail, as well as co-author of Gold Matters with Egon von Greyerz, Matthew is fluent in French, German and English; he is a graduate of Brown (BA), Harvard (MA) and the University of Michigan (JD). His widely respected reports, interviews and conference appearances on macro conditions, the changing behaviour of risk assets and the role of precious metals complement the long-standing insights of his colleague, Egon von Greyerz.

JOHNY BECK – PARTNER

JOHNY BECK – PARTNER

JOHNY STARTED HIS FINANCE CAREER IN THE TRADING DEPARTMENT AT BARCLAYS CAPITAL IN LONDON.

He has more than 20 years’ experience in trading/markets and brokerage. During his time in London, Johny served as a senior broker at ICAP Plc, the world’s leading inter-dealer broker. Johny has been an advisor to VON GREYERZ since its foundation in 1999 and joined as a Partner in 2012. His main role at VON GREYERZ is covering the sales, marketing and trading side of the business.

NICOLAS RODEL – PARTNER

NICOLAS RODEL – PARTNER

IN ADDITION TO FINANCE & CONTROL, NICOLAS IS RESPONSIBLE FOR COMPLIANCE AND I.T.

Nicolas previously worked in different senior roles in Finance & Control at Nestlé and holds a master’s degree in Banking and Finance (MBF) and a double bachelor’s degree from the University of St.Gallen (HSG), Switzerland. Nicolas is also a Certified Internal Auditor (CIA) certificate holder and has passed all three levels of the Chartered Financial Analyst (CFA) program.

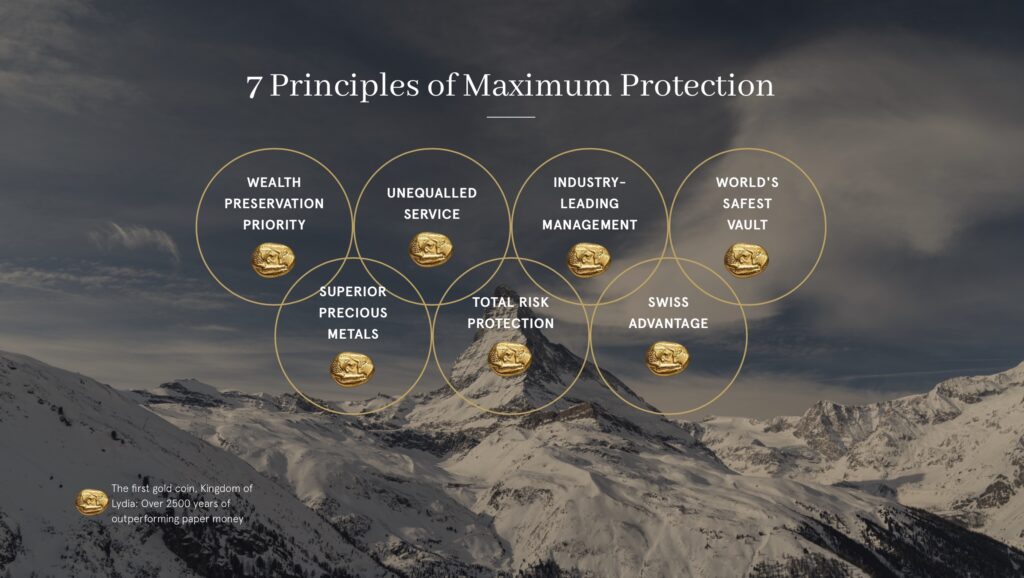

The Values: Shared Convictions, Guiding Principles

Although proud of our individual credentials and collective market experience, the VON GREYERZ team shares a deep conviction of prioritising wealth preservation through precious metals.

In addition, our partners share the guiding principles of modesty, straight-talk, high-conviction and a genuine interest in both protecting and honouring the trust granted to us by our clients.

ALIGNED VALUES & INTERESTS

Wealth preservation is not only about currencies and metals, but family values/ideals, goals and the protection of wealth that has been carefully earned and nurtured for years, and often, generations.

Our objective has never been to dazzle, scare or impress, but to candidly share what we have learned and deduced after decades of combined experience in the global markets.

Thus, we treat each investor with the same degree of honesty, clarity and transparent counsel we would expect for ourselves and our own families.

WHY OWN GOLD?

First, The Problem: An Undeniable Currency/Wealth Crisis & Transformation

Fiat currencies are openly entering the last chapters of their once illusory but now steadily declining purchasing power and global credibility.

La plus ça change…

This slow and steady spiral of fiat currency strength and the consequent risk of wealth destruction is nothing new.

In fact, all debt-soaked systems throughout history have ended with a debased and then broken fiat currency. This is true without exception—from Ancient Rome to the Modern West.

Today’s global currencies are empirically following the same familiar pattern.

In a global setting of unprecedented (and rising) debt levels which have risen from $258 trillion in 2020 to well over $330 trillion by 2022

PROVIDING A NEEDED SERVICE IN TIMES OF INCREASED UNCERTAINTY

- Client assets held at VON GREYERZ represent the culmination and protection of years of wealth creation; we do not ignore the immense trust our clients have placed in selecting VON GREYERZ to guide them in acquiring, protecting and securing that wealth.

- We earn such trust with decades of transparency, confirming not only our conviction in precious metals as a timeless asset class in everything we advise, author and transact, but our equal conviction that our clients deserve our total attention to the unique service we provide.

- Our concerns as to past, current and future conditions within the global economy stem from years of careful yet blunt analysis of objective market risk.

- Such risk is far too often ignored or downplayed by conventional wealth advisory services and sell-side optimism.

- We are participants, not just advisors, in the service and counsel we offer. VON GREYERZ was founded to protect the family wealth of its founder and business partners. Our interests, as well as assets, are thus entirely aligned with those of the clients we serve.

Gold: The Art of Wealth Preservation

Our exclusive focus is the preservation of wealth through the private ownership of physical gold and silver stored outside of a fractured banking system. Such a singular vision ensures personalised client attention and enhanced protection from openly deteriorating global financial conditions.

Investment Minimums: CHF 400,000 for Zurich and Singapore Vaults; CHF 5M for Swiss Mountain Vault Contact Us

TO LEARN MORE ABOUT THE FAMILY OFFICES, KEEP READING BELOW:

FAMILY OFFICES PREFER THE PERSONAL TOUCH OF FAMILY BUSINESSES

As a family business ourselves, VON GREYERZ understands the challenges facing many Family Offices today. Whether the goal is to enhance or protect the wealth of future generations or avoiding escalating inflationary or geopolitical risks, every decision ultimately hinges on the trust and values we are committed to preserving.

For the past 25 years, we have been dedicated to helping families worldwide, many with billions in assets, safeguard their wealth against current and future challenges by storing their gold in the world’s most secure vaults.

With the great power of inherited wealth comes an equally great responsibility. Through our personal approach, commitment to customer needs, and market expertise, we have eased the burden of wealth preservation, enabling our clients to focus on what truly matters.

We are passionate about analysing risk and advising capital stewards to take advantage of their ability to genuinely invest for the long term. We use gold as an essential diversifying, as well as strategic, reserve asset allocation within a traditional portfolio comprising equities, bonds or real estate and private equity.

The power of our business is rooted in its simplicity and differentiated offering.

Understanding the Geopolitical and Inflationary Risks Facing Family Offices Today

The dramatic shifts we are sadly witnessing in geopolitics, combined with unprecedented debt levels globally, are occurring at a time when inequality between the wealthy and the less fortunate has never been greater. While it is impossible to predict precisely when the debt burden will become critical or when the asset market corrections will occur, preemptive protection is crucial.

Owning Physical Gold In a Secure, Non-bank Location Is Vital Insurance Against Uncertainties

We recognise that each Family Office is unique. However, the exposure to inflationary pressures and weakening FIAT currencies is universal. In fact, since 1971, these FIAT currencies have lost 98% of their value relative to gold due to the relentless debasement of money. So, whilst we appreciate various strategies by which our clients generate multi-generational wealth, our commitment is to advise Family Offices to safeguard and preserve a part of their wealth in physical gold.

PRESERVING GENERATIONAL WEALTH

Learn Why Gold is a Vital Asset for Family Offices

The world is changing rapidly, and the risks to wealth preservation are increasing. Download our complimentary guide to learn why gold remains the ultimate hedge against financial uncertainties and a critical asset for today’s Family Offices.

With The Great Power Of Inherited Wealth Comes An Equally Great Responsibility

Through our personal approach, commitment to customer needs, and market expertise, we have eased the burden of wealth preservation, enabling our clients to focus on what truly matters.

We are passionate about analysing risk and advising capital stewards to take advantage of their ability to invest for the long term. We use gold as an essential diversifying and strategic reserve asset allocation within a traditional portfolio comprising equities, bonds, real estate, and private equity.

The power of our business is rooted in its simplicity and differentiated offering.

The Ripple Effect of Weakening Currencies on Family Offices

In 1920, gold traded at $20 per ounce. At that time, 250 ounces of gold worth $5,000 could buy you an average family home in America. Today, of course, a $5,000 cheque probably wouldn’t be enough even for a house deposit.

If, however, you had held on to those 250 ounces of gold at current valuations, it would still buy you an average home in the US. This is a simple way to illustrate how gold acts as a reliable store of value over time, in contrast to ever-weakening FIAT currencies.

Expertise for Generations

Family offices face significant challenges in securing, growing, and preserving generational wealth. Having served as both a Managing Director and CIO of a family office, I appreciate the tactical and strategic responsibilities involved in diversifying asset exposures, overcoming inflationary pressures, and optimising tax efficiencies – all while striving to maximise returns and minimise risks. These are indeed challenges.

Gold complements these efforts by providing essential, yet often overlooked, protection against the increasingly misunderstood risks to purchasing power posed by FIAT currencies. Additionally, gold serves as a buffer against short-term portfolio volatility while ensuring long-term wealth preservation. For families planning decades into the future rather than focusing on quarterly returns, gold remains a crucial allocation for safeguarding wealth worldwide.

Matthew Piepenburg, Partner at VON GREYERZ

Alternatives for Gold Asset Allocation

All our clients understand that once they have decided to allocate part of their wealth to gold, it makes little sense to store it in a bank inside a leveraged financial system. Choosing the solution outside that framework offers you zero counterparty risk and the best protection.

At VON GREYERZ, we fully understand that wealthy Families will have a large percentage of their wealth inextricably embedded in the financial system. Therefore, it is crucial that the insurance allocation to gold within their portfolio is held outside this system, eliminating the counterparty risk.

We also advise against owning gold in the form of ETFs. Not only is it debatable whether these ETFs are backed by physical gold, but also because these ETFs are held within the financial system, increasing counterparty risks for a multi-asset portfolio.

The Golden Opportunity

We estimate that only 0.5% of global financial assets are invested in gold today, compared to circa 5% in the 1960s. Given the rising risk of debt, inflation and geopolitical instability, it is reasonable to assume that gold reverts to its long-term mean of 2% of global financial assets. But that would require a quadrupling of demand, which could only be satisfied by materially higher gold prices.

Understandably, some clients are concerned about buying gold at or near recent high prices. Of course, in absolute terms, evaluating gold can be complex. If, however, you adjust and measure the gold price versus the money supply over the last 90 years, gold is almost as cheap today as it was in 1970 and 2000. That is why we believe the bull market in gold has only just begun.

GOLD’S CRITICAL ROLE WITHIN FAMILY OFFICE ALLOCATIONS

Essential Insights for Strategic Wealth Preservation

Dive into our comprehensive slide deck to understand why gold should be a cornerstone of any Family Office wealth pyramid. This complimentary resource provides valuable data to help enhance your investment approach.