Here is the key to when a Fed rate cut is coming, plus a look at real estate.

February 22 (King World News) – Peter Boockvar: I’ll start with this quote from Fed Vice Chair Philip Jefferson that points to a committee that wants to cut rates this year but not anytime soon. “We always need to keep in mind the danger of easing too much in response to improvements in the inflation picture. Excessive easing can lead to a stalling or reversal in progress in restoring price stability.”

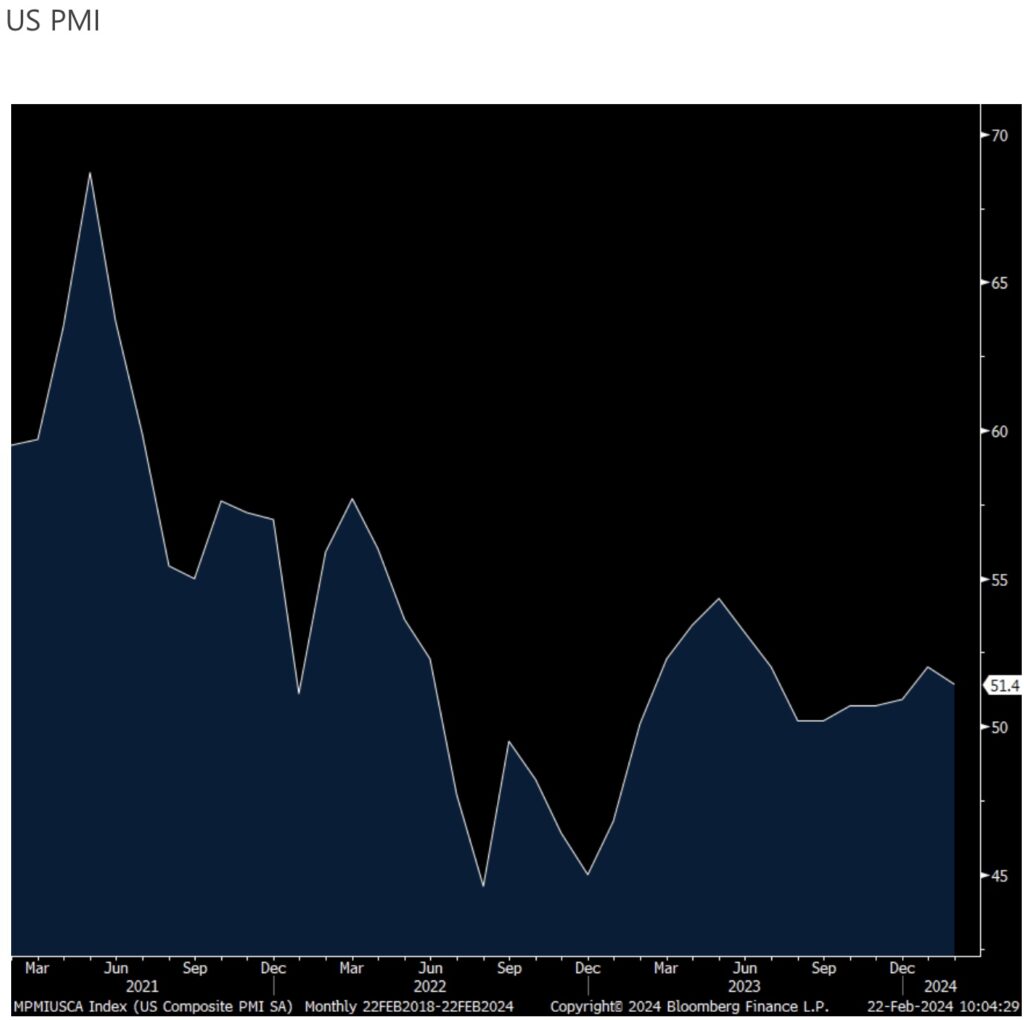

The February S&P Global manufacturing and services PMI fell to 51.4 from 52. Manufacturing actually improved a touch to 51.5 from 50.7 but was offset by a 1.2 pt m/o/m decline in services to 51.3.

With regards to the lift in manufacturing, “Although only modest, the expansion was supported by a return to output growth and quicker increases in new orders and employment. Easing pressure on supply chains led to a renewed improvement in vendor performance during February, with shortened lead times for inputs enabling firms to process incoming new work in a more timely manner.” Thus, no real impact yet from the Red Sea travel diversions that has extended time of delivery but S&P Global is citing better February weather from the rougher January as a reason too for the improvement. Also, and what we’ve been watching closely for, “Optimism in the outlook led firms to build stocks of purchases and finished goods, as both returned to growth in February, with firms indicating the first expansion in pre-production inventories since August 2022.” Selling prices were little changed m/o/m.

In services, new orders fell to a 3 month low and backlogs were down too. The employment component eased as well and “Services firms highlighted caution with regards to hiring due to cost concerns and softer new order growth.” Selling prices were higher.

Bottom line, S&P Global equates the figures above to an annualized GDP growth rate of 2%. Treasury yields fell to 4.30% after the slight miss but has since bounced back to 4.32%, about where it was right before the release. Maybe the Jefferson comments was a factor too in the lift…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Real Estate

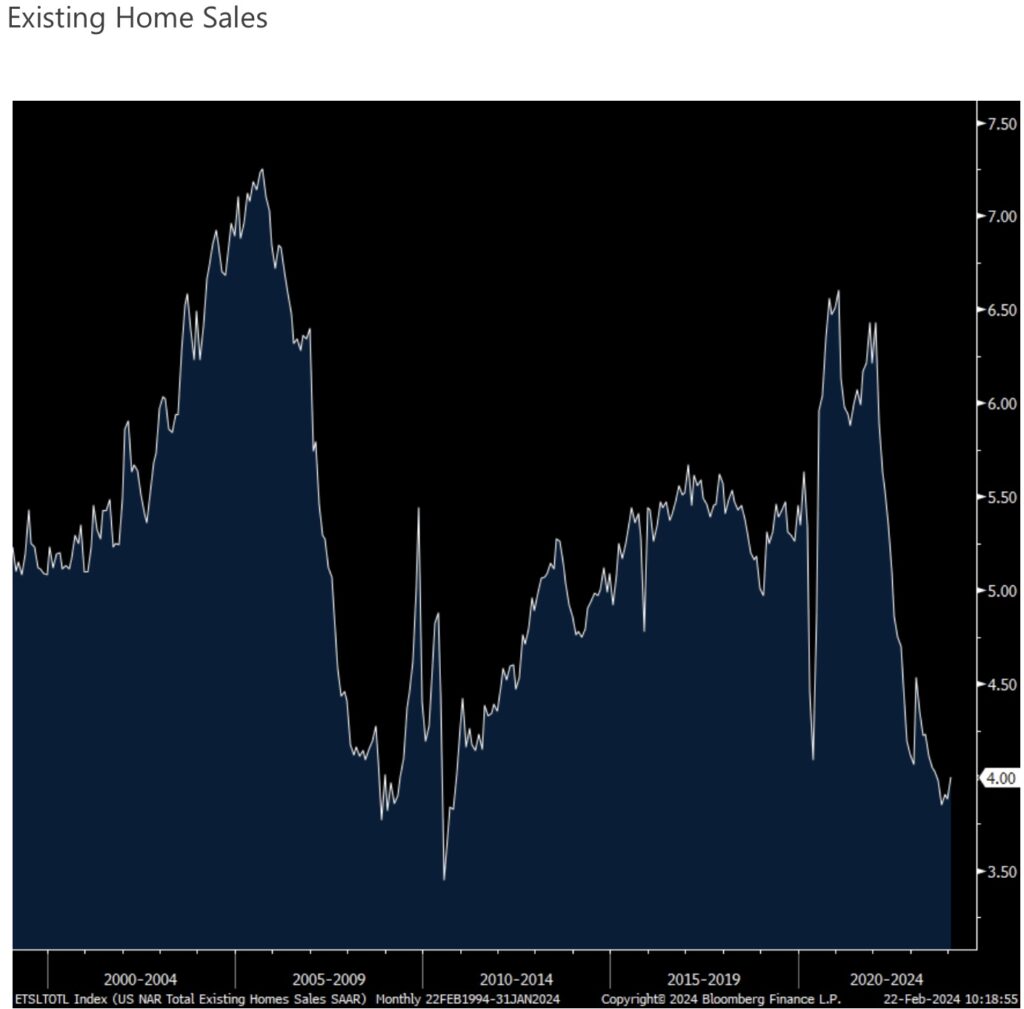

Existing home sales in January, thus likely capturing most contracts signed in the September, October, November timeframe, totaled exactly 4mm which is about in line with expectations and about the same as the final 2023 number and up from December’s print of 3.88mm (revised up by 100k).

Seasonally, the number of homes for sale is muted this time of year before picking up in the spring and months’ supply fell to 3 from 3.1 in December and compares with 2.9 in January 2023 and 3.1 in January 2020. The median home price rose 5.1% y/o/y and continues to put a squeeze on the first time home buyer who made up just 28% of purchases, getting boxed out by all cash buyers who totaled 32% of purchases from 29% last month.

Bottom line, assuming many contracts in this figure were signed in late Q3 into Q4, it was during this period that mortgage rates rose above 8%. But when closings occurred in January, that rate got back below 7% and now in the 3rd week of February it stands at 7.28% according to Bankrate. It’s tough to know however who had rate locks and who didn’t and when. Either way, overall, we’re talking about the pace of existing home sales that are hovering the lowest levels in 2009-2010 as affordability challenges for first time homebuyers is acute.

To listen to Alasdair Macleod discuss what is happening behind the scenes in the war in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.