Gold and silver melt-up continues, but look at this shocker…

Gold & Silver Surge

January 12 (King World News) – Peter Schiff: Gold is up over $80, a record high above $4,590. Silver is up over $4, a record high above $84. Prices are melting up for a reason, and it’s not good. While it’s exciting for those of us who own gold and silver, keep in mind that it foretells economic hardship for most Americans.

Miners Remain Radically Undervalued & Under-Owned

Peter Schiff: GDX and GDXJ are up about 4.5% today, but if investors understood what’s going on, precious metals mining stocks would be up much more. Gold is not in a bubble—it’s the pin that pricked the dollar bubble. That’s why the gold price isn’t going down. It’s going much higher!

The Next Leg Higher

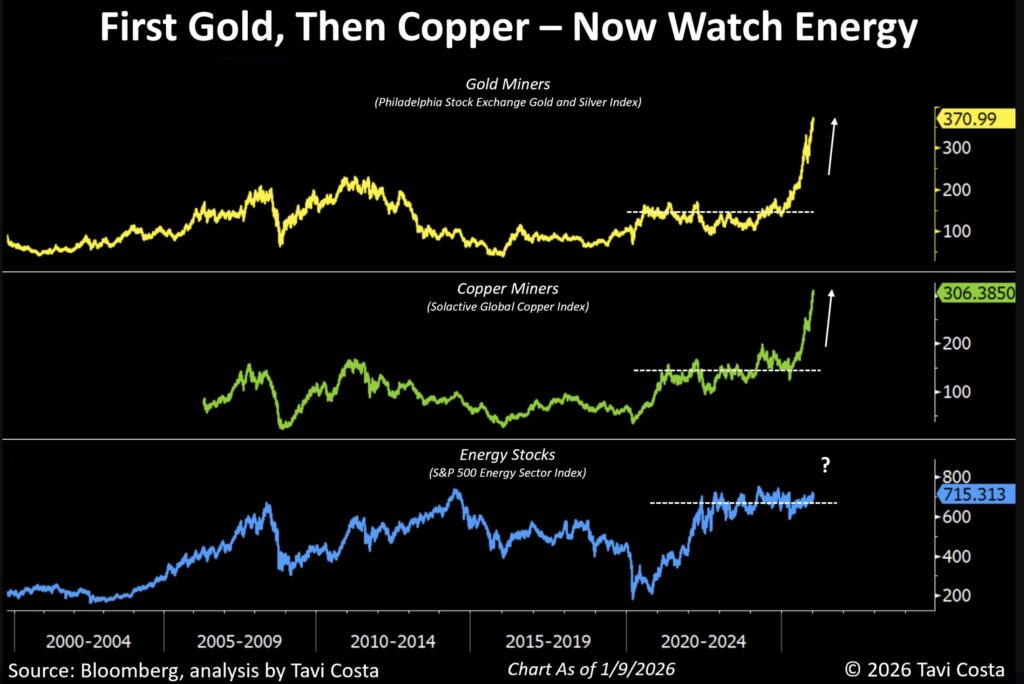

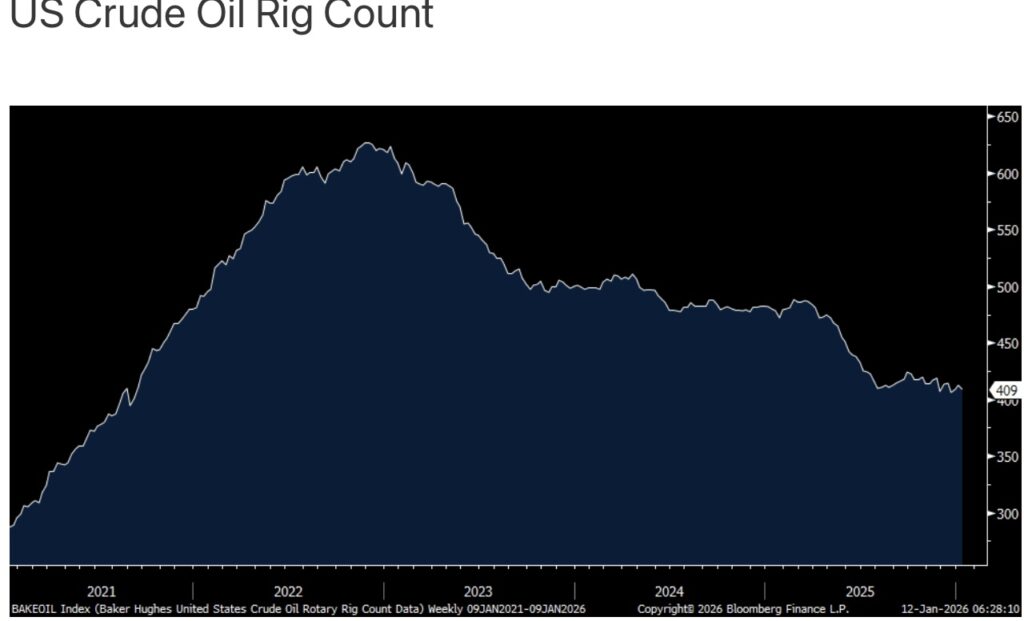

Otavio Costa: The next leg higher in energy stocks could be explosive.

This chart speaks for itself, yet investors continue to treat commodity moves as isolated events.

That’s not my view.

These dynamics are deeply interconnected, and energy appears next in line.

Gold, Silver & Oil

Peter Boockvar: I’ll let the price of gold (up $96), silver (up $4.5), platinum (up $78), the value of the US dollar (DXY down .4%) and US Treasuries (10 yr yield up 3 bps) speak to the criminal targeting of Jay Powell, at least today.

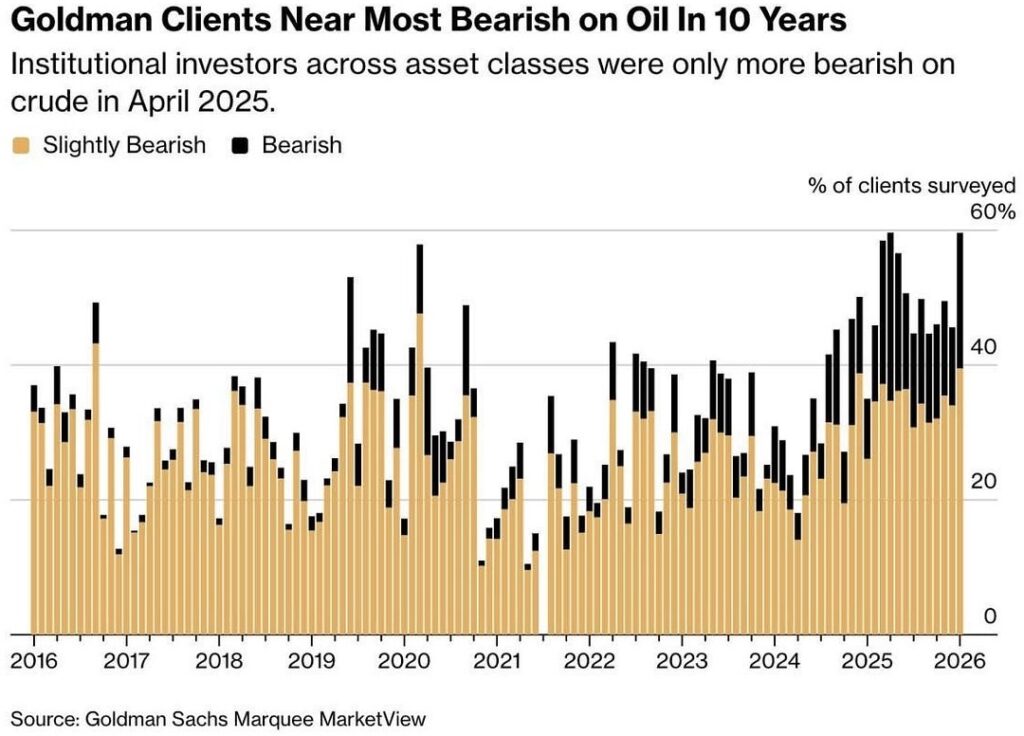

As a bull on oil and gas stocks, from a sentiment perspective I was encouraged from a contrarian standpoint to see this chart from Goldman Sachs a few days ago highlighting the high level of bearishness.

I’m going to add this to my list of bullish factors I incorporate into my analysis and here are the rest:

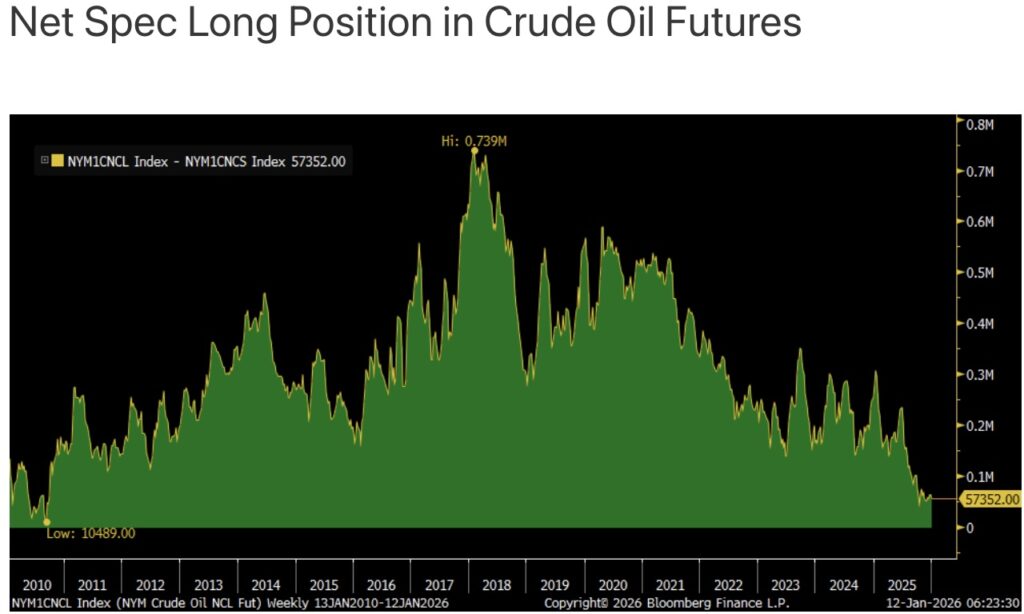

1) More on sentiment, the net speculative long positions in crude oil according to Friday’s CFTC data for the week ended last Tuesday is just off 15 year lows, an historically good contrarian take.

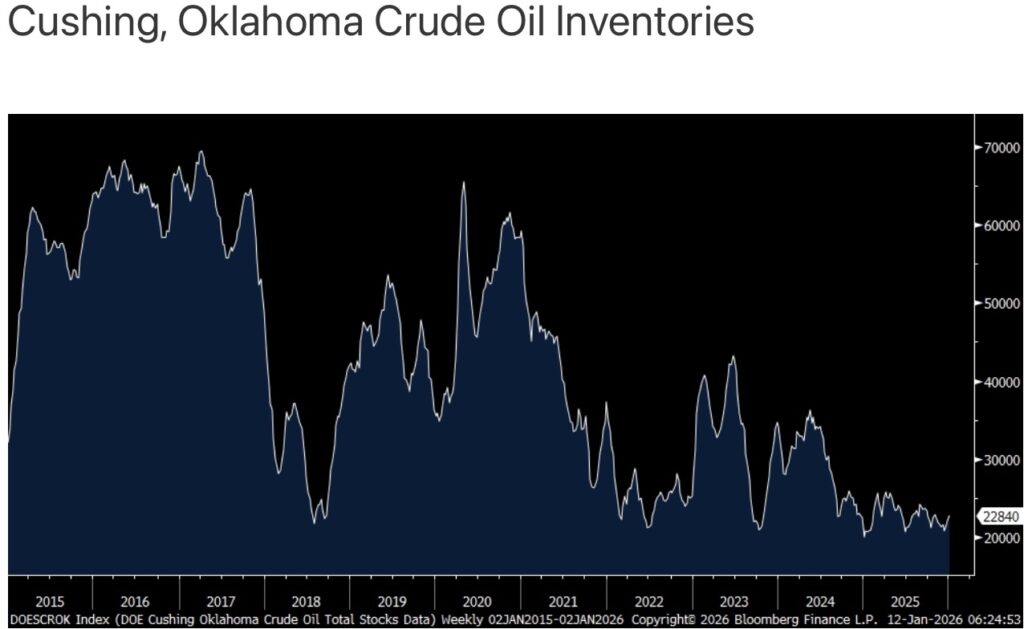

2) While there is all the talk about a glut of oil inventories, it seems to be mostly on the water. Inventories in Cushing are at 10 yr lows.

3) At least over the next year plus, the futures curve is flat as a pancake, not a sign of any short term gluts.

4) While there will be an increase in Venezuelan supply in the coming years, however slow it will take, however much it will cost, all to get back to where they were more than a decade ago, eventually, along with incoming supplies from Guyana and Brazil, there seems to be little talk about the plateau in US shale oil production. US shale accounted for about 85% of non-OPEC+ oil supply over the past 15 years and this production, at least geologically for now, is in the process of rolling over. My friend Tracy Shuchart in a piece over the weekend said “The Permian Basin, which carries the entire US production story, requires 400,000 barrels per day of new production additions annually just to offset base declines from existing wells. You’re not growing production in this environment. You’re running in place, and increasingly you’re falling behind.”

5) The US oil rig count is at a 4 ½ yr low. More than half of US shale basins lose money around $50 a barrel.

6) A lot of talk about reduced China demand for oil due to the ever growing EV presence, which is true, but did you know that of the 1.4 billion people in China that only about 400,000 have been on a plane? Demand for jet fuel and other petro products, especially for petrochemicals, will continue for years. And, the demand from India, the Middle East, Africa and other emerging areas will only continue higher keeping oil demand steady at 1-1.5mm barrels per day, easily absorbing new Venezuelan oil supply in coming years.

7) Even the IEA is now admitting that oil demand won’t peak until at least 2050 up from tomorrow, I say sarcastically because they’ve been mostly wrong in their belief that the world was on the cusp of using less fossil fuels.

8) EV’s are losing the VHS/Betamax battle with hybrids and ICE vehicles, thus pushing further out the demand for fossil fuels.

9) I don’t think Saudi Arabia wants oil prices any lower and that’s reflected in OPEC+’s desire to hold quota’s unchanged in Q1. And the quota increases seen so far over the past year have not been matched by coincident increases in oil production, evidence that there isn’t much spare capacity left, seemingly just in Saudi Arabia and the UAE.

10) Free Iran, a big question with what comes next of course.

Gold, Silver & Oil Boom

King World News note: As Schiff warned, boom times for gold, silver and oil will mean suffering and economic hardship for others. If you are well positioned for what is now unfolding be thankful to God because it’s going to get very bad at some point in the near future. There is also a positive benefit to countries which are commodity based such as emerging markets, so not everyone will be suffering.

JUST RELEASED!

To listen to Gerald Celente discuss the shocking new trends he predicts will unfold in 2026 including gold and silver CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to James Turk discuss the wild trading in the gold, silver and mining share markets and much more CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

Celente’s Shocking Top Trends Predictions For 2026 CLICK HERE.

Look At Who Just Became One Of The Largest Holders Of Gold In The World CLICK HERE.

NEXT BIG BULL MARKET: Look At Who Just Predicted $369 Oil CLICK HERE.

Is It Possible Silver Will Hit This Jaw-Dropping Price? CLICK HERE.

This Shows Silver Would Have To Skyrocket To $917 To = 1980 Peak CLICK HERE.

Is This About To Send Silver Above $100? Plus China Continues To Increase Its Gold Holdings CLICK HERE.

China’s “Silver Gate,” Gold & War As We Continue Kicking Off 2026 CLICK HERE.

$80 SILVER & $4,500 GOLD: Here’s The Shocker In The Silver Market Today CLICK HERE.

Silver Futures Surge Above $80, Plus This Major Bull Market Is About To Kickoff CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.