This will ignite the public’s rush into the gold market.

Gold and silver firm on futures’ demand

January 10 (King World News) – Alasdair Macleod: In a shortened trading week, and against a global background of rising bond yields gold and silver have continued to edge higher. This is an important change in investment thinking.

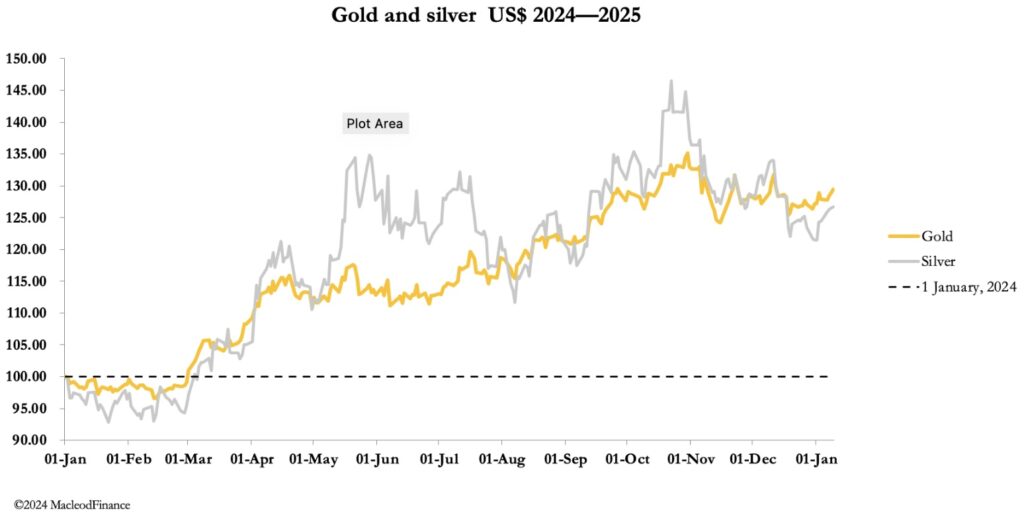

Gold rose by $32 on the week to $2670, while silver rose by 21 cents to $30.12 on futures buying. Gold’s Open Interest rose by about 15,000 contracts while silver’s OI was marginally higher. Gold’s performance is remarkable in that it has been rising while global bond yields have also risen. Clearly, there is a stilI in thinking taking place.

We are at an interesting juncture in credit markets, with a growing realisation that dollar interest rates are unlikely to fall much, if at all, and that they might even rise instead by the end of 2025. This logic comes with an appreciation that inflation under Trump’s avowed policies will continue to rise, or more accurately described, the purchasing power of the dollar will continue to decline.

The interest rate cat has been let out of the bag with dire consequences.

Whether the Fed will accept the need for higher interest rates is a good question. We can be sure that officials understand this problem more than they are generally given credit for. They will be aware that higher interest rates will lead to a bear market in equities, increasing bankruptcies in over-indebted businesses, mortgage difficulties in residential property, and increasing unemployment. This is not a good start to the second Trump presidency. While bond yields continue rising, the Fed is likely to sit on the fence which will underwrite a trend of higher gold prices, much to the displeasure of the new president.

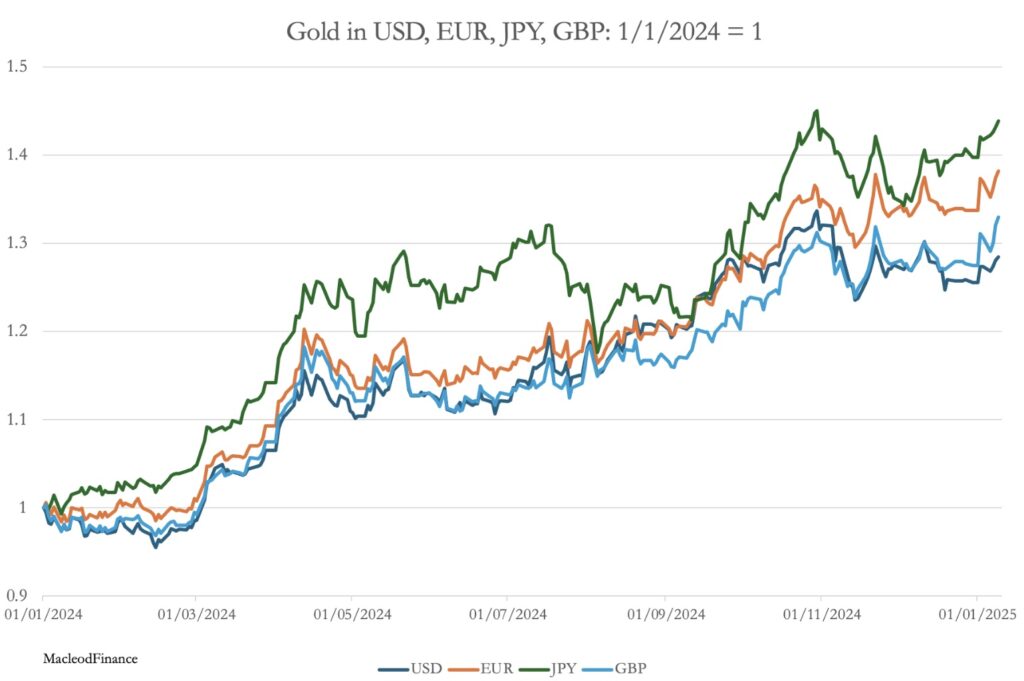

However, markets are now likely to begin discounting higher rather than lower rates after Trump’s inauguration. As well as the obvious difficulties faced by the Fed, this change in expectations is killing the other major currencies. To illustrate the point, the chart below shows how gold priced in these currencies is rising, despite everyone thinking that it is still consolidating — which it is in dollars, having so far failed to challenge the late-October high.

While gold has risen by 28% since 1 January 2024, in sterling it has risen 33%, euros by 38%, and in yen by 44%. And currently, it is at new highs in euros and pounds, and not far off it in yen.

Remarkably, the investing public is simply not buying it!

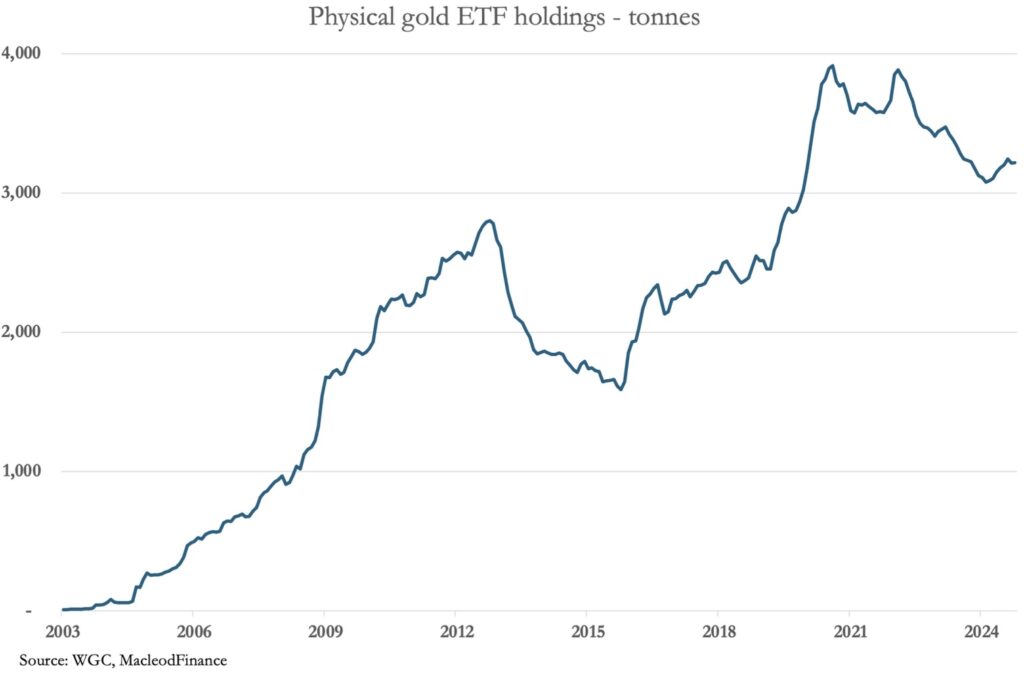

The next chart is of global gold ETF holdings, reported by the World Gold Council in December to total 3,219 tonnes, nearly 700 tonnes below the October 2020 high point when gold was $650 lower.

The pickup since the low point last May has been only 131 tonnes, of which 77 tonnes has been North American demand. Asians have increased their holdings by 44.26 tonnes, and Australia and South Africa by 6.41 tonnes. Europe has increased its holdings by a paltry 2.8 tonnes to 1,288 representing 40% of the total. But the euro and sterling are particularly vulnerable, with potentially much further to fall against the dollar. Surely, it is a matter of not much time before Europeans realise that they should be buying gold.

It is important in the context of credit flows likely to move away from conventional and tech stocks due to the developing reassessment of interest rates. Led by some of the more prescient US investors who are already beginning to buy ETFs (reflected in the numbers above), there is nowhere else for investors to go other than cash on deposit, gold, or the mining stocks.

This Will Ignite The Public’s Rush Into Gold

Keep in mind that out of total global bond and equity investments, somewhere between only 1/2%—3/4% is hedged into gold, telling us that when equities start declining the switch into gold for protection should be substantial in a market of extremely limited supply.

A further bullish development is China’s policy of easing rates, presumably due to an increase in savings at the expense of consumption. This makes gold even more acractive for Chinese household savers, faced by a weakening yuan.

Prins Warns Gold Price May Double To $5,400

To listen to Nomi Prins discuss why the price of gold may double to $5,400+, what to expect from for the silver market, mining stocks, uranium market, currency markets, CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.