Today gold futures have surged $54 to a new record high at $2,546, but look at this…

Within hours the remarkable audio interview with Egon von Greyerz will be released! Until then…

August 16 (King World News) – Alasdair Macleod: Despite trying everything to shake out the bulls, establishment traders on the short tack have failed. And as the canary in the mine, silver catches a bid…

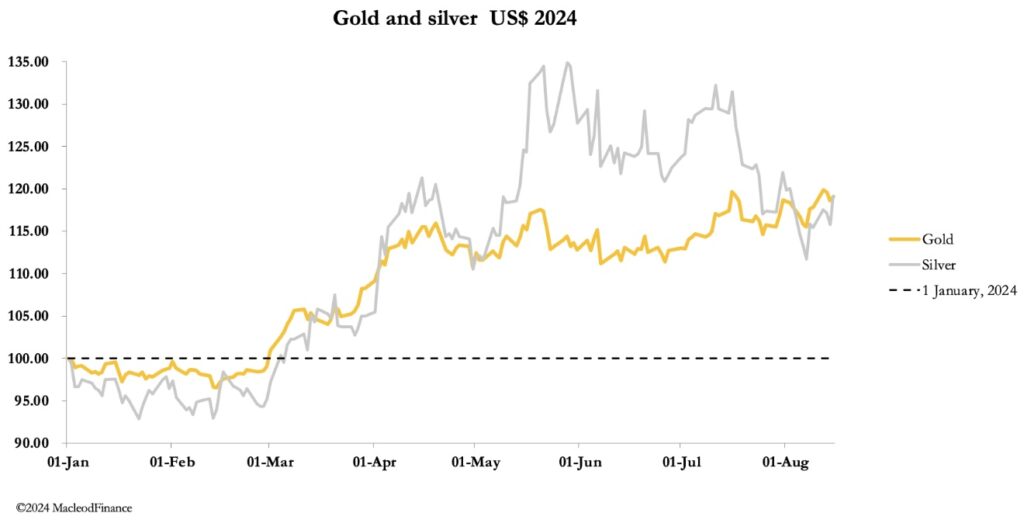

This week, gold continued to consolidate close to its all-time highs, while silver began to recover out of its recent downtrend. In European trade this morning, gold was $2042, up $31 from last Friday’s close, while silver at $28.25 was up 75 cents. Elliott wave fans will note silver’s classic A-B-C correction from late May, signalling the start of a new bullish leg potentially taking it to $40+.

Our focus must be gold. Every day this week, gold has been firm-to-better during or in the wake of Asian trading, only to decline during Comex hours. The declines were particularly sharp on Wednesday and Thursday in the wake of statistical releases. Anyone looking at the statistics concerned objectively would dismiss them as meaningless, except for the bullion bank traders desperately trying to close their shorts…

ALERT:

To learn which gold & silver royalty company is one of the greatest opportunities in the world CLICK HERE OR ON THE IMAGE BELOW.

Their problem is that every time they try to do so, those pesky Chinese wade into the market for both physical and also sometimes to pick up futures on Globex and the Shanghai Futures Exchange. The result is that despite their efforts, spot gold this morning is less than $20 from its all-time high on 14 Aug. That’s only 0.6% below a breakout. The technical chart is up next.

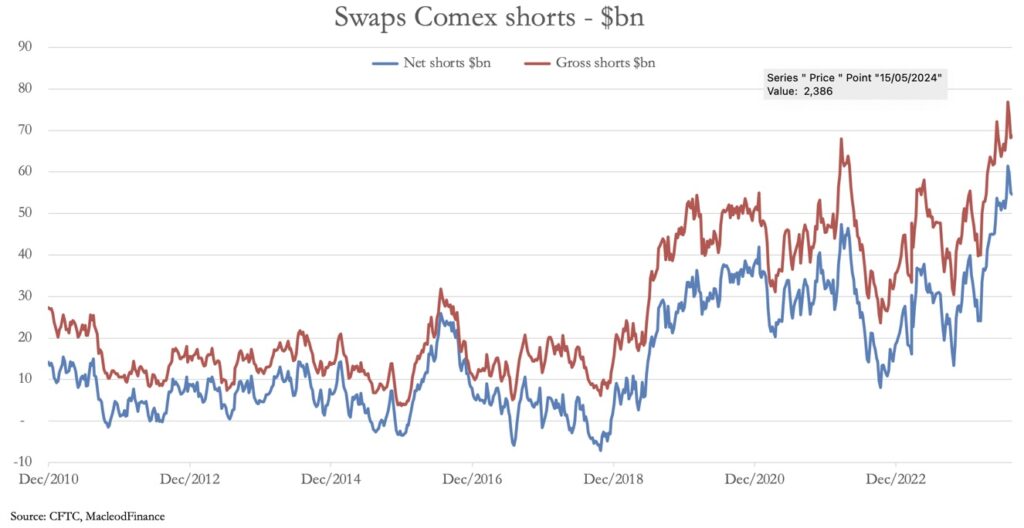

With the price having found support at the 55-day moving average, this upward sloping flag indicates that the underlying momentum is strongly bullish, allowing us to pencil in a target of $3,000+ on a three-to-four-month view. No wonder the Comex Swaps are desperate to close their shorts, the total value of which is our next chart.

A breakout to $3000 could be a life-threatening experience for some bullion banks, requiring a behind-the-scenes rescue operation to ensure the integrity of the contract.

It is beyond extraordinary that these plain signals evoke no interest in western capital markets. Other than a small minority of traders who pairs-trade gold with the dollar, public interest is as close to zero as it can get.

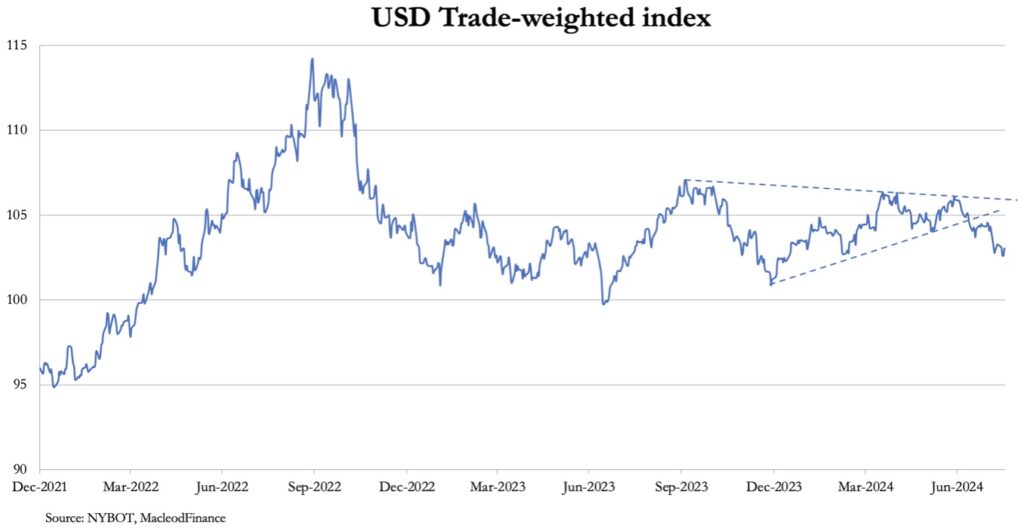

The dollar’s trade weighted index is now breaking lower, confirming these developments. This is up next.

It confirms that weakness in the dollar is likely to drive gold higher and that the pairs traders will put the squeeze on the Swaps in addition to Asian (Chinese) demand.

There is a growing realisation that with the US budget deficit already at 8% of GDP, the signs of an imminent recession (Sahm rule etc.) is very bad news. Tax receipts will fall, and welfare costs rise. Furthermore, with both presidential candidates being spendthrifts the deficit will not only get out of control, but with foreigners being net sellers of US Treasury debt there is a looming funding crisis which can only be resolved by the Fed monetising it.

When this becomes apparent to complacent investors in western capital markets who so far have ignored gold, will the dollar-gold exchange rate stop rising at $3,000? To listen to Alasdair Macleod discuss his prediction for where the price of silver is headed,$3,000 gold and much more CLICK HERE OR ON THE IMAGE BELOW.

Within hours the remarkable audio interview with Egon von Greyerz will be released!

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.