An inflation wave is hitting that will terrify already shattered consumers.

Another Inflation Wave Is Hitting

March 25 (King World News) – Peter Boockvar: In last week’s Fed dots, there were two people that wanted just one rate cut this year (also two that wanted none and I’m guessing Michelle Bowman was one of them) and notably one of them is a voting member it seems, the Atlanta president Raphael Bostic. He was also the one who warned us a few weeks ago about the pent up animal spirits that would be unleashed upon rate cuts.

That has certainly been seen in financial markets to state the obvious. When speaking Friday, in getting to a 2% rate of inflation sustainably, he said “I’m definitely less confident than I was in December.” He went on to say, “If we have an economy that is growing above potential, and we have an economy where unemployment is at levels that were deemed to be unimaginable without pricing pressures, and if we have an economy where inflation is moderating…those are good things. That give us space for patience.” How patient? He said “later in the year” will he support the one cut. He does though support the tapering of QT “relatively soon.”

As it didn’t sound like Powell was the other dot in wanting just one cut, and definitely not one of the two that wanted none, as his dovishness sounded more like 3 and consensus group think is his mantra, we’ll see how Bostic and Powell come together in coming months/quarters.

The 2 yr note yield is up 3 bps in response to 4.62%. It was at 4.67-.68% at 1:59pm est last Wednesday.

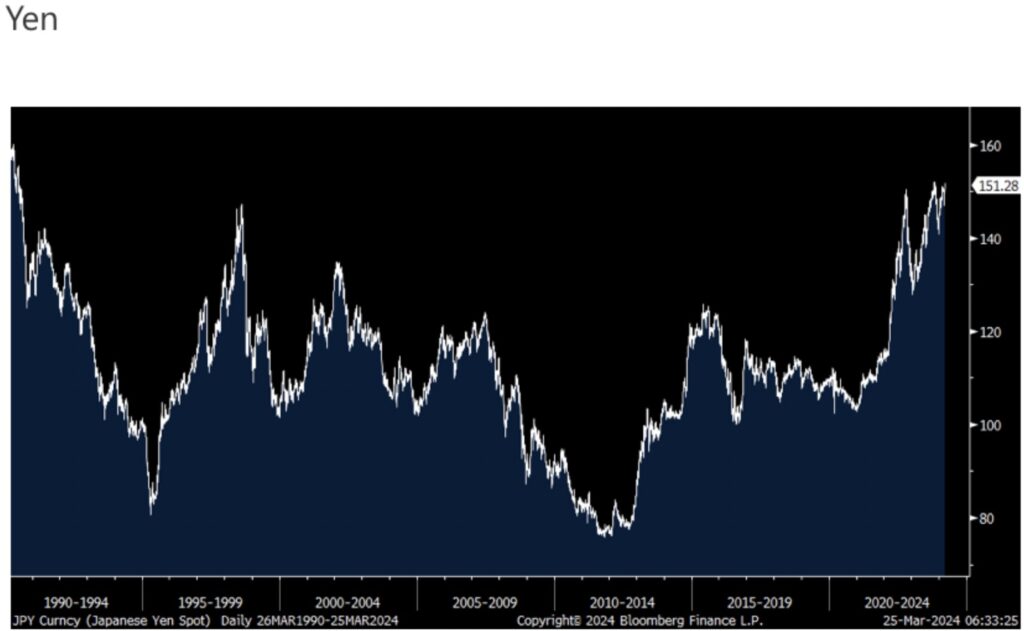

Yen Weakest vs US Dollar In 34 Years

With the yen just off the weakest level vs the US dollar in 34 years, the verbal intervention is back from the finance ministry. Masato Kanda, the vice finance minister said today the recent moves “has not reflected fundamentals and I feel something strange about it…is clearly driven by speculation” and “We will take appropriate action excessive fluctuations…We are always prepared.” With history with intervention as its guide and the fruitless attempts in the past of Japanese FX intervention, the market yawned on the comments. While negative rates don’t exist in Japan anymore thankfully, zero to .10% is only slightly better.

The yuan by the way had a stronger FX fixing today and likely means that last week’s weakness was about all the PBOC will tolerate for now.

A combination of strict lending standards and a lack of demand at current rates, C&I loans outstanding fell another $8.7b in the week ended 3/13 to $2.747 Trillion and that is the lowest amount since September 2022.

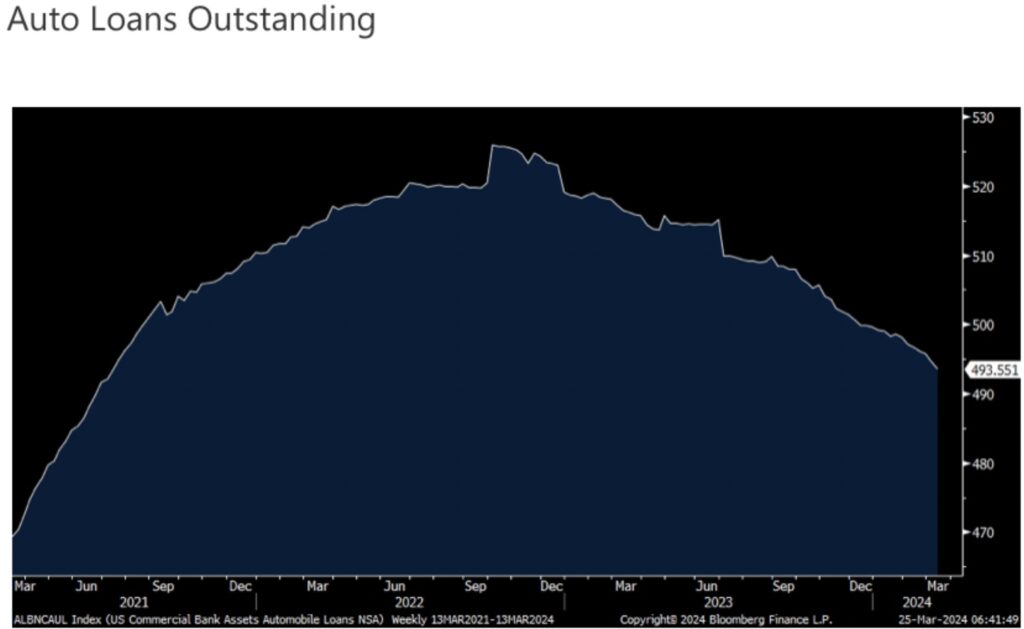

Credit Crunch Worsening

As seen in the chart, the amount peaked right as the bank failures took place one year ago. A credit crunch? Credit scarcity? Slack credit demand? I’d say a bit of all of the above for those small and medium businesses that are solely reliant on bank credit rather than the capital markets.

Also of note, for the week ended 3/13, auto loans outstanding fell to the least amount since July 2021.

The only deal one can find of note today in the auto space is a full EV as supply of them piles up due to a lack of demand.

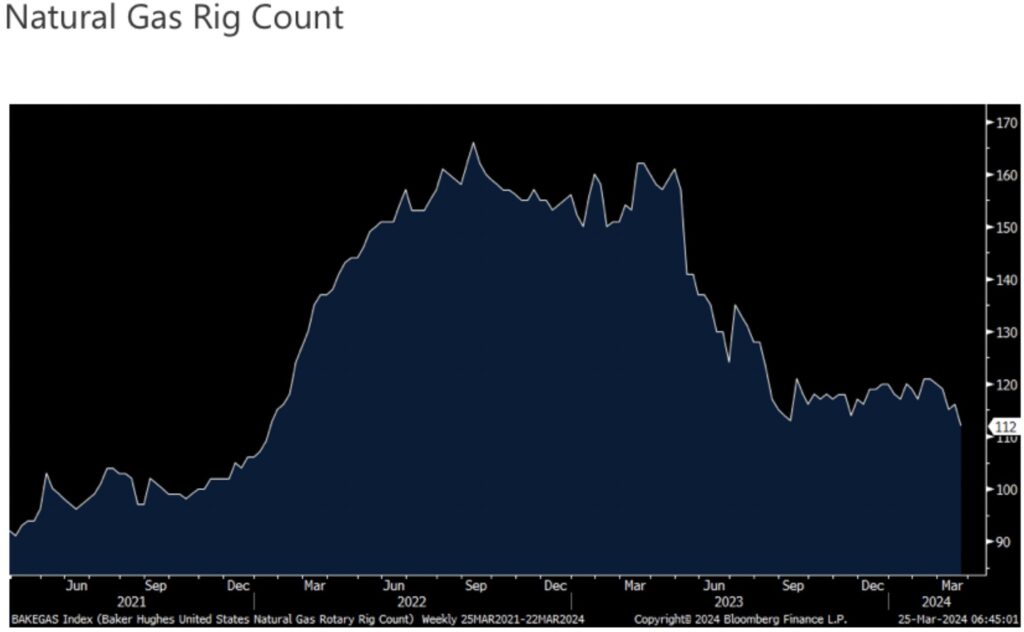

In response to the lowest natural gas price in about 4 years, drillers continue to lay down their rigs. The natural gas rig count as of Friday fell by 4 to 112 and that is the smallest amount since January 2022. Low prices are about to cure low prices.

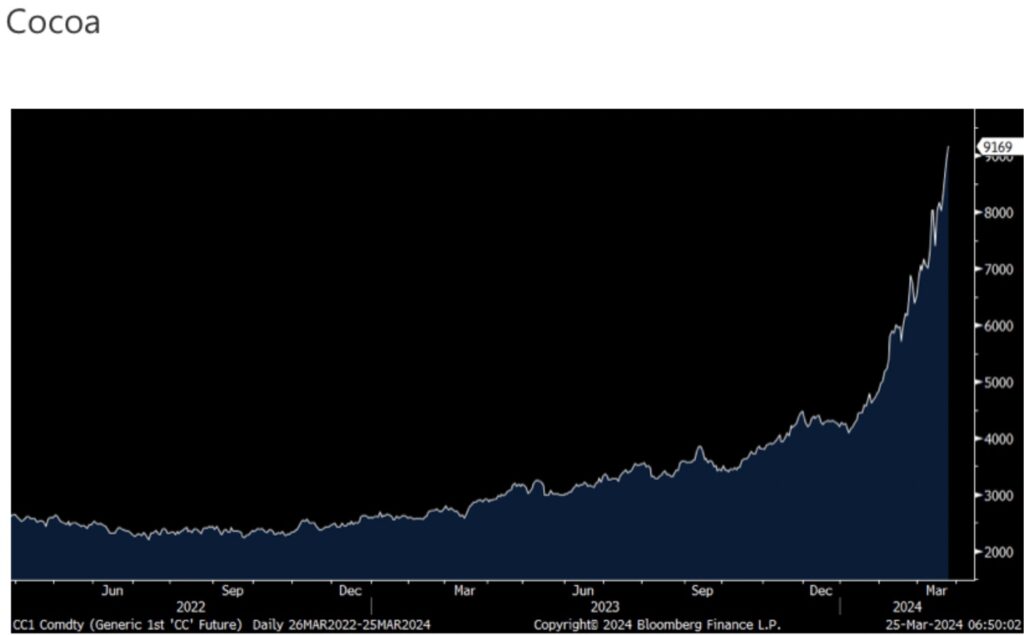

Is This Parabolic Chart Nvidia Or Cocoa?

With Cocoa going parabolic (now looks like the Nvidia stock chart)…

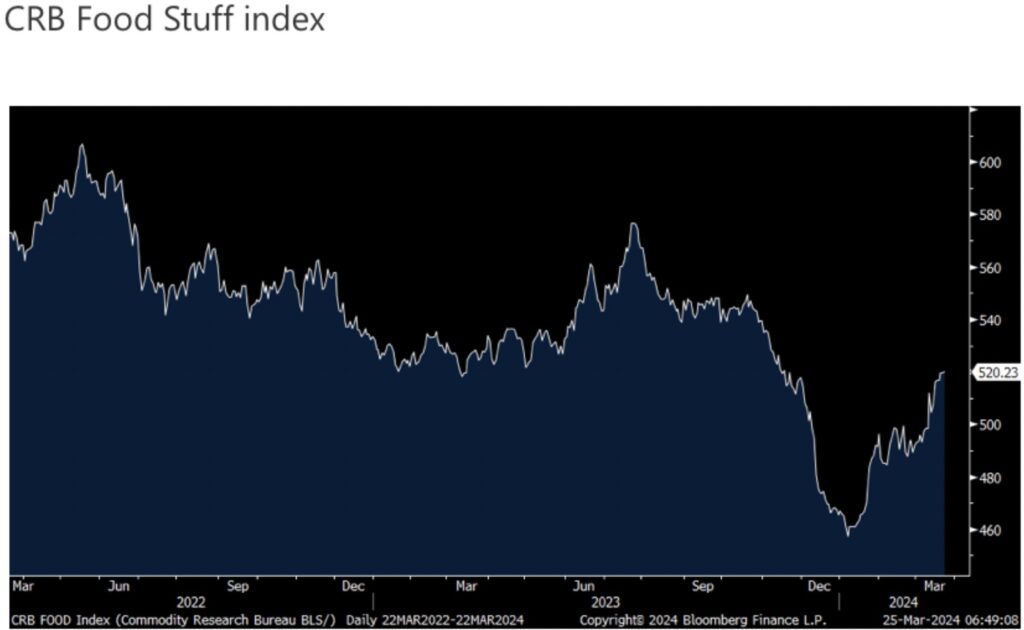

A Little More Parabolic “Transitory” Inflation

… wheat at 3 week highs and corn and soybeans getting off the mat (those being one of my contrarian picks this year and we own fertilizer stocks), the CRB Food Stuff index closed Friday at the highest point since November 2023. Jay Powell has no easy job from here.

Get Ready For Higher Food Costs

To listen to Alasdair Macleod discuss China losing control over the price of silver and what this will mean for the silver market in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.