The public is being very cautious with their money, plus a look at the stock market mania and a China surprise.

Public Extremely Bullish On Stock Market

July 22 (King World News) – Peter Boockvar: I feel like we’re headed for some big market moves over the next two weeks as we digest a flood of earnings, and particular from the biggest cap names. I always like to say that valuations don’t matter until they do and all of a sudden they have in both directions. The biggest names are finally being questioned in terms of whether all this AI spend will deliver suitable returns and whether they will be impacted by the broader economic worries at the same time the stocks have little valuation support if they disappoint and the small and mid cap names are finally being discovered for the bargains that many of them are.

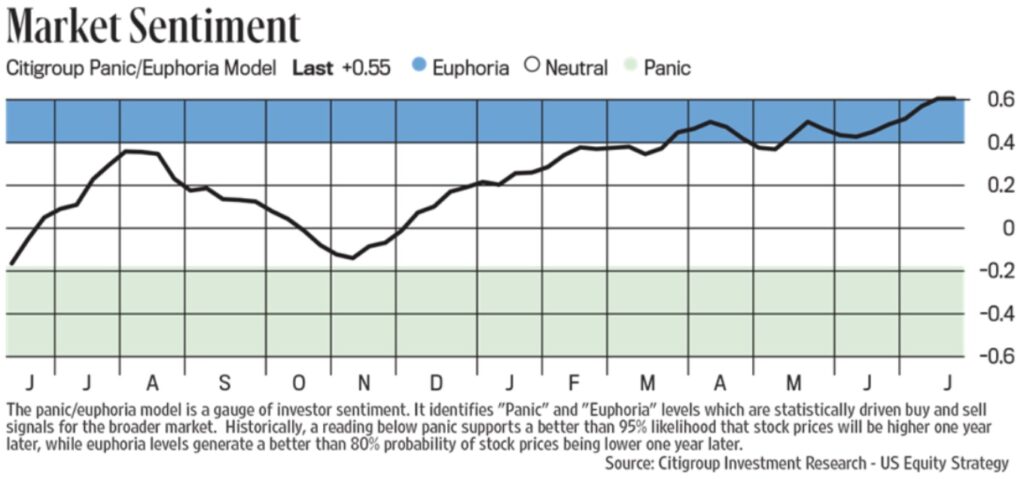

Also, notwithstanding some shaking of the tree in those big names, and a VIX on Friday that closed at the highest level since April, the level of bullishness is dangerously high (from a contrarian standpoint). The updated Citi Panic/Euphoria index, seen over the weekend, rose to a fresh multi year high at .56 from .52 in the week prior. The threshold for Euphoria is .41.

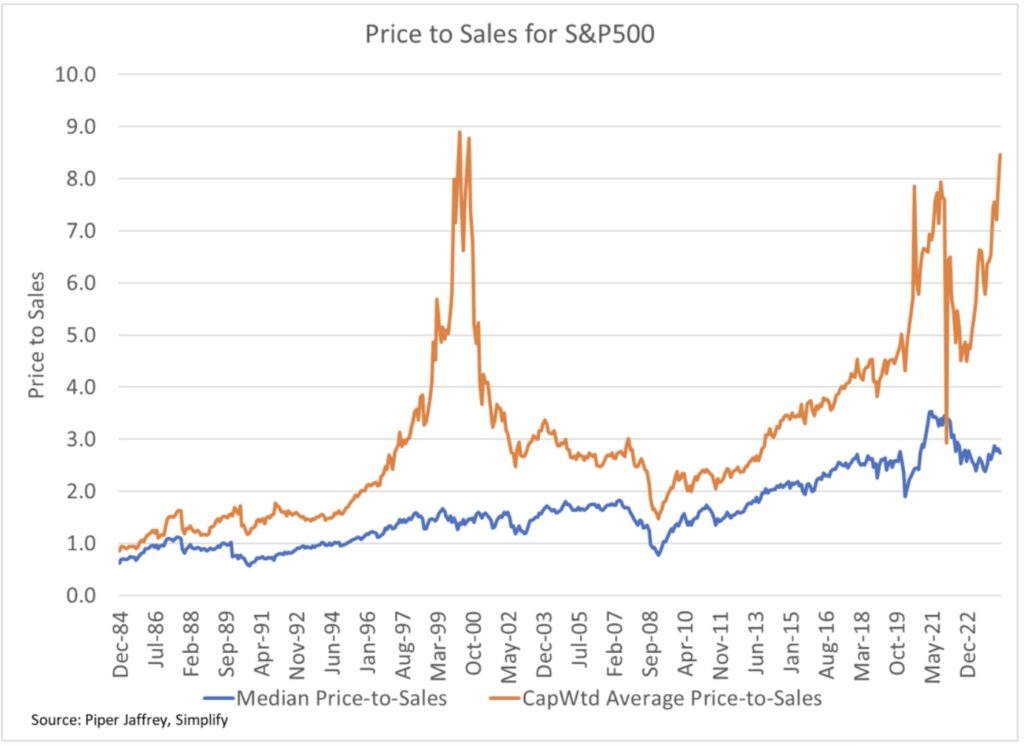

Thanks to my friend Michael Green who showed me this chart on Friday highlighting the valuation divergences in the broad large cap market relative to the biggest names.

Today’s Mania Is Beginning To Mirror Year 2000 Stock Market Madness

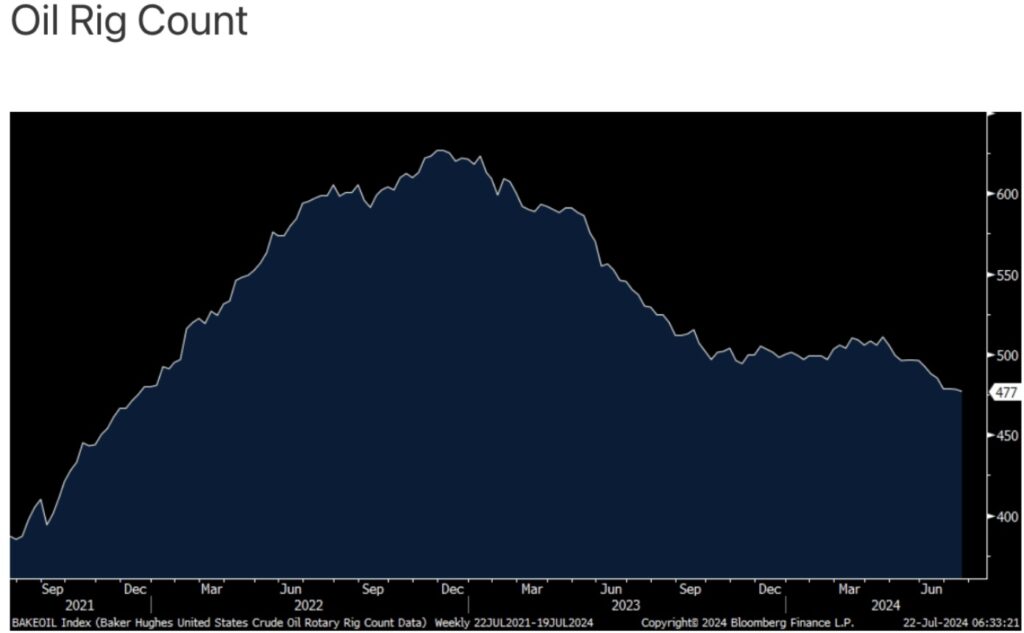

I’ll reiterate our positive and long stance on oil and gas stocks as the crude oil rig count keeps on dropping. Though down just 1 rig w/o/w, at 477 it is the least since December 2021.

The natural gas rig count has rebounded this month by 6 rigs but at 103 it’s down from 160 early last year.

China’s Surprise Rate Cut

China surprised markets with a 10 bp rate cut for its 7 day repo rate, which impacts short term rates and the 1 yr and 5 yr loan prime rate that influences bank lending rates. The new rates are 1.7%, 3.85% and 3.35% respectively. While 10 bps are really meaningless, China is trying to quicken the trip through the residential real estate downturn. I think the best policy rolled out so far in terms of absorbing the excess supply is turning many of the unused buildings into rentals. Time though is what is most needed for the housing market but there is little doubt that the dropping home prices is negatively impacting the wealth psychology of the Chinese, many of which have most of their net worth in property.

The market response was mixed as the Shanghai comp fell .6% but the H share index in Hong Kong rallied as did the Hang Seng. The yuan is a touch lower for a 3rd day vs the US dollar.

Ryanair Customer Base Cautious Regarding Flight Prices

Shifting to earnings, Ryanair is trading down by 14% in Dublin after they disappointed. The CFO said this on their earnings call,

“Consumers are just a little bit more frugal. People want to get out there, but they’re just a bit more cautious in how they’re spending their money.”

They also expect lower ticket prices this summer but based on what we’ve heard from other airlines, capacity is coming out of the industry quickly.

From American Express:

Said Friday but similar to the Ryanair comments:

“We did see some slower growth in certain T&E categories vs the prior quarter, such as in airline and lodging.”

But also this,

“At the same time, growth in our largest T&E category, restaurants, remained strong and goods and services strengthened a bit vs the prior quarter when excluding the impact of the Leap year.”

“Obviously, organic spending, we’d like to see a little bit higher, but it is a slower growth economic environment.”

On the corporate side,

“Spending growth from our US small and medium enterprise customers increased a bit sequentially vs last quarter but remained modest.”

They are seeing faster business spend from their international customers.

Overall,

“while we are not in a high growth spend environment, particularly in the US, our spending volumes are tracking in-line with our expectations and support our revenue expectations for the year.”

Just Released!

Gerald Celente’s King World News audio interview has just been released discussing the gold market and much more and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

Released!

To listen to Alasdair Macleod discuss the wild trading in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.