Today Alasdair Macleod said something shocking is happening in the gold market.

KWN Michael Oliver audio interview has now been released!

The Big Surprise In The Gold Market

April 24 (King World News) – Alasdair Macleod: Gold rose on the week, but silver was barely changed. From last Friday’s close, gold rose $47 to $1728 in early European trade this morning, while silver rose five cents to $15.23 on the same timescale. While silver still has a lot of catching up to do, in percentage terms it has outperformed gold since the mid-March sell-off. However, on the year that still leaves silver down 14% on the year so far, while gold is up 14%.

The big surprise is the lack of progress bullion banks have made in closing their short positions. The most recent Commitment of Traders report for 14 April showed the swaps (bullion bank trading desks) still short, slightly more so at a net 172,157 contracts, an increase of over 6,000 contracts on the previous week. Our next chart shows this very oversold position.

The problem is evident in the positions of the large four traders, which has deteriorated substantially in recent months, shown in the screenshot below.

From 14 January, when the gold price was $1583, the net short position of the largest four traders increased by 90,442 contracts while the gold price rose to $1729. The additional losses suffered by them came to $1.32bn, while the whole position deteriorated by $2.65bn. At the same time, the next four large traders reduced their net short position by 47,384 contracts, contracting them by 40%.

Huge Losses On Gold Short Positions

It seems unlikely that the individual positions of the four largest traders would have all increased, while those of the next four largest had fallen by 40%. This opens the possibility that one of the four largest has an extended short position and is in trouble.

We cannot know the extent of it, but if the other three largest had reduced their average position on a similar scale to the next four largest, then one very large bank is on the hook for about 140,000 contracts. This would be a loss-making position of $24bn. Ouch!

Of course, it may be that the loss is not confined to one of the very large traders. That point being made, we should note that attempts to alleviate the position have so far only made it worse, with all eight finding their short positions have increased since the end of March. It is small wonder that prices for the active June contract on Comex consistently trade at a significant premium to London spot. We look forward with great interest to tonight’s updated COT release…

To learn about one of the most exciting silver plays in

the world click here or on the image below

Gold, Silver, And Economic Destruction

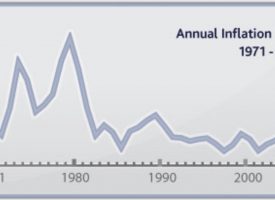

The sheer scale of economic destruction wrought by lockdowns is only beginning to be understood, and it is apparent that all major central banks are being forced to limitlessly increase money in circulation to rescue everyone and everything from economic catastrophe. Furthermore, bank counterparty risk is increasing, which is bound to limit trading in London’s forward market, which lacks the intermediation of a regulated exchange. Certainly, it is not a time to be caught short so badly on Comex, and therefore it is hard to see why precious metal prices should ease.

KWN Michael Oliver audio interview has now been released!

To hear Michael Oliver’s latest remarkable prediction click here or on the image below.

Look Who Just Called For $2,500 Gold

***Also Released: Look At Who Just Said The Price Of Gold Will Spike To $2,500 CLICK HERE.

© 2020 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.