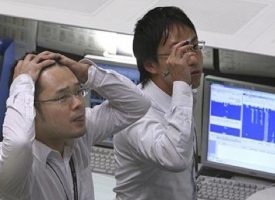

In the wake of the stunning Brexit outcome in Britain there is trouble at the Comex as the price of gold surges and the global financial system is now on the brink. This is why emergency central bank intervention is taking place.

Victor Sperandeo has been in the business 45 years, and has worked with famous individuals such as Leon Cooperman and George Soros. Below is what Sperandeo had to say in the aftermath of the Brexit shocker.

Victor Sperandeo: “Right now I would be a buyer of the FTSE and a buyer of the British pound. I would also stay long gold at this point. I have 85 percent of my pension fund long gold and I would be a buyer on any dips.

What’s more important is that there is virtually no gold at the Comex. If the longs ask for delivery and they can’t deliver, then there will be a force majeure. Meaning, they will settle for cash and that will send the price of gold much, much higher.

And now we will see more European countries doing their own version of Brexit and the real problem is that the central banks of the world are out of ammunition. This is the beginning of the end of the EU. This puts the world financial system in a precarious position to say the least and it’s the reason why central banks are desperately intervening in global markets.” ***Due to the enormous volatility in the aftermath of the Brexit vote, KWN will be releasing updates and interviews all day today.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.