As we continue to kickoff trading in 2025, a 1970s-style financial crisis is about to be unleashed.

February 19 (King World News) – Gregory Mannarino, writing for the Trends Journal: While everyone is as usual being directed to “look over here, do not look over there,” via the mainstream media outlets and the geo-political goings on, an inflationary tsunami—(LITERALLY on an unprecedented scale), is rapidly approaching.

The causes of inflation are multifactorial however, one specific dynamic arguably stands out…

That dynamic is: When global debt expansion outpaces economic growth, (and ever since the “financial crisis” the world has suffered VAST debt expansion), inflation hits…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Putting a timeline on WHEN the effect of, in this case, vast debt expansion outpacing economic growth will cause inflation is admittedly difficult.

However, there is ONE metric which can allow us to consider the “Inflation Lag Effect.”

Once debt expansion begins, and this is a direct effect of central bank monetary policy—specifically, artificially suppressed rates and therefore currency devaluation, there is always an inherent lag effect of varying lengths. The length of the “lag effect” as to WHEN inflation will hit is grossly dependent on Money Velocity.

Money velocity is a measure as to how fast cash is moving through an economy.

Look at the chart below.

The chart above demonstrates the Money Velocity since 1960. The MV peaked just prior to the Dot-Com Bubble bursting and has been in a downward trajectory ever since. Note the black arrow to the right, this is where we are today. This “blip” higher in the MV is not due to an increase in economic output/activity, this the direct result of what now is, the effect of unneeded currency/debt now just starting to chase the same amount of goods—and this is inflation.

Being that the MV is near historic lows, it has taken YEARS for the effect of vast debt expansion to make its way through the economy—A HUGE LAG EFFECT. (The lower the MV, the longer the lag effect). But now that this door has been opened, so to speak, the effect will worsen rapidly. (UNLESS DIRECT AND IMMEDIATE ACTION IS TAKEN TO STOP IT).

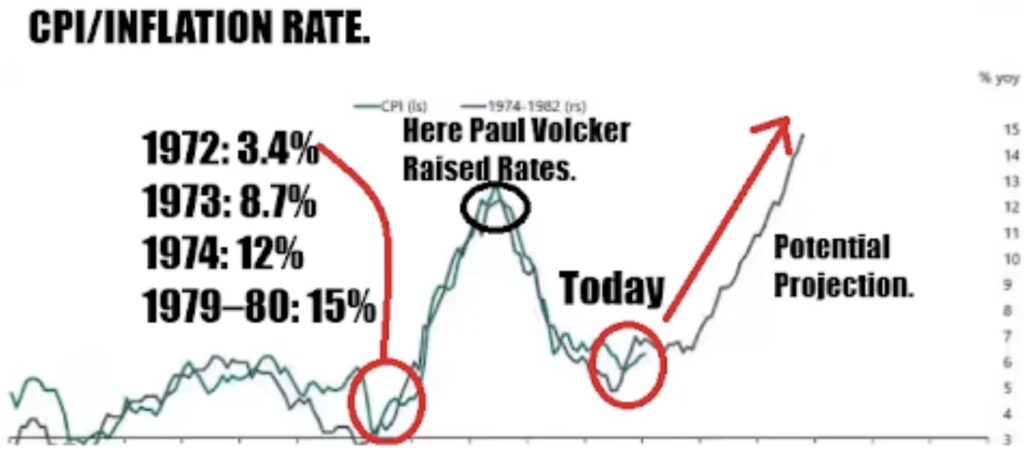

Now, look at this chart below

This is the relationship between the CPI, (consumer price index), and the inflation rate. The red circle on the left is the last time we had a crossover which led to an inflation surge in the 1970’s. What reversed this inflation surge, was in 1979, then Federal Reserve Chairman Paul Volcker introduced a new monetary policy of high interest rates. In fact VASTLY higher.

If you do follow my work, then you are aware I have been screaming from rooftops for quite a while now that THE LAST THING WE NEED is lower rates, like Sen. Elizabeth Warren and President Trump are now calling for.

WE NEED MUCH HIGHER RATES! BECAUSE IF ACTION IS NOT TAKEN IMMEDIATELY, what is about to happen here in the U.S. regarding inflation, will make what happened last time in the 1970’s look like a walk in the park…

Immediate action is needed now due to the LAG EFFECT. Even when Volcker raised rates in 1979, the effect of higher rates took time to take effect… We will have the same situation here.

MAJOR GOLD PRICE PREDICTION 2025!

To listen to one of Gerald Celente’s best interviews ever discussing his shocking predictions for 2025 CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED! Gold Hits New Record High This Week!

To listen to Alasdair Macleod discuss gold hitting a new record high this week as well as some surprises happening in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.