On the heels of the crash in the silver market it appears that Open Interest in gold and silver have both hit historic lows!

Alasdair Macleod’s audio interview discussing the collapse in Open Interest in the Gold and Silver markets was just released (LINK AT BOTTOM). But first…

February 6 (King World News) – Alasdair Macleod: The disconnection between physical reality and derivative volatility became obvious in gold and silver pricing this week. No silver? No matter. Futures carry on regardless.

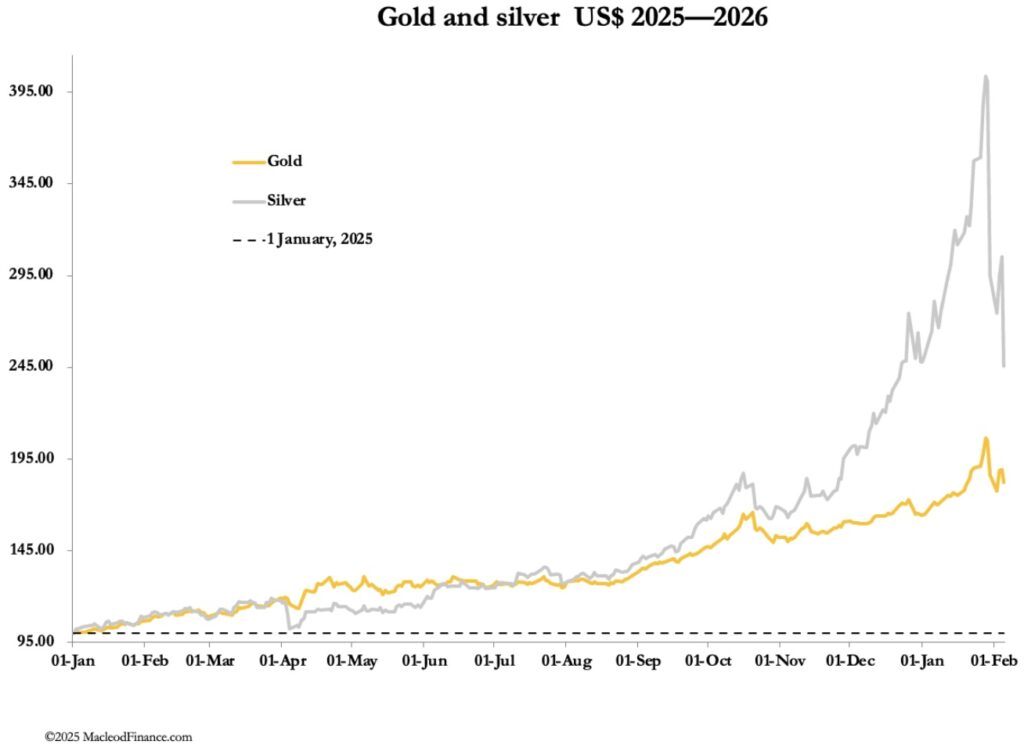

This week has seen price instability in gold and particularly silver. This morning in European trade gold was $4875, up $210 from last Friday’s close and silver at $73.80 is down $11.60 having been as high as $92 on Wednesday.

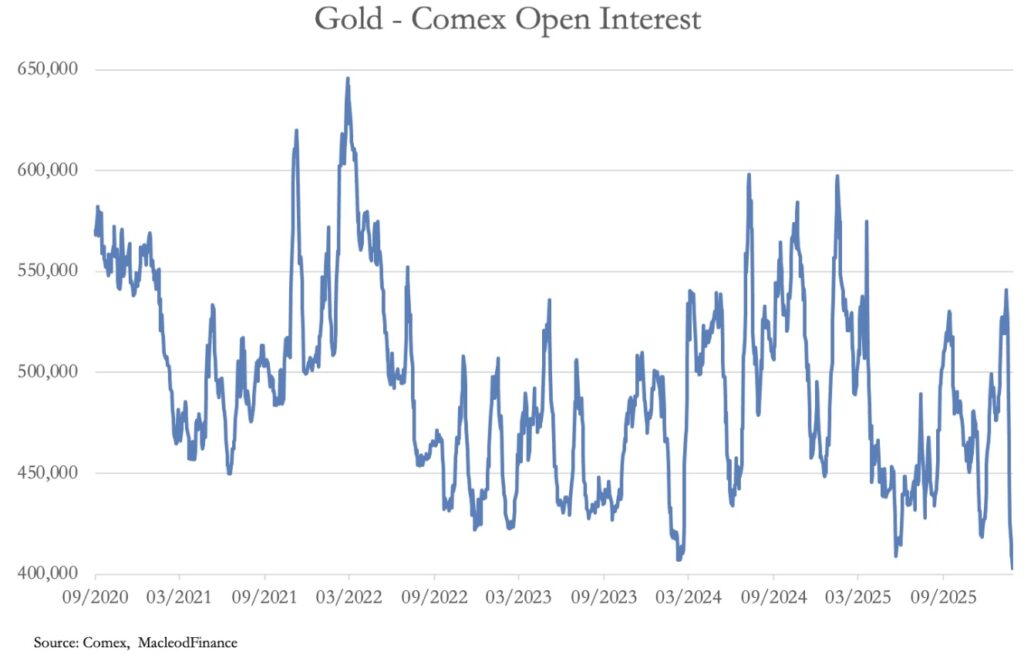

Contrary to most commentary, speculative interest in both metals Comex contracts is very low, in gold’s case the lowest it has been this decade:

KING WORLD NEWS NOTE: Gold Open Interest Has Collapsed To The Lowest Level In A Decade!

So, what is happening?

The fundamental reasons for stacking gold still apply. Furthermore, most of the big US banks are forecasting higher gold prices over 2026 with their investment funds seriously underweight. And reliable anecdotal evidence is that larger investors are taking the opportunity to buy more physical gold (and silver if they can get it) and are not put off by current developments. This is important, because it isolates the cause of price volatility as a function purely of derivatives.

In the absence of speculative buying interest from hedge funds, we can’t rule out speculative shorting. This is not reflected in Comex open interest, because it allows the swaps (market makers and bullion bank traders who normally take the short side) to close their shorts rather than create new contracts.

We await tonight’s Commitment of Traders report to assess the extent of these shifts. But if so, then the swaps have got a temporary get-out-of-jail card. But hedge funds are likely to be squeezed badly as well when the current hiatus subsides. This squeeze generated by physical demand on derivatives was first noticed in London’s silver forward market in early-October but could now be shifting to Comex.

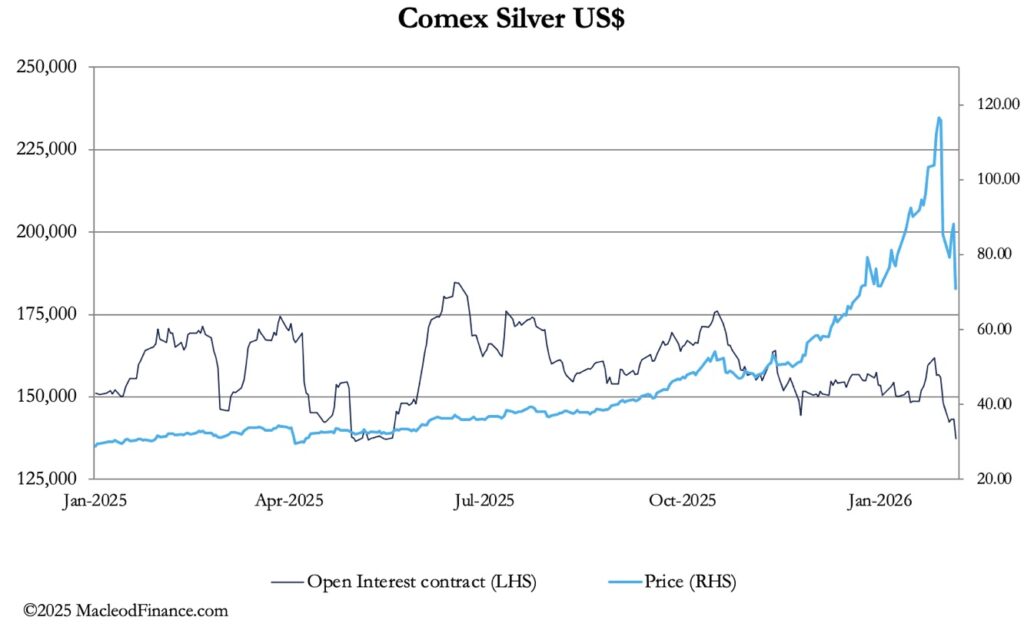

This morning, the March silver contract stands at 80,479 on preliminary estimates, which compares with only 20,706 contracts equivalent registered in Comex vaults for delivery. In a normal market, we would expect this contract to be either closed or rolled into May which is the next active contract. But speculative interest which is what normally gets rolled or closed is extremely low, reflected in our next chart:

KING WORLD NEWS NOTE: Silver Open Interest Has Also Collapsed!

It’s about as low as it gets. But if it’s not speculative interest, then a good portion of those 80,479 contracts will stand for delivery, in which case there’s a significant possibility of contract failure. This might not happen because large bullion banks such as JPMorgan will probably find some silver from somewhere to augment registered stocks. But that is borrowing from Peter to pay Paul, adding to all the other leased and swapped obligations to be unwound. It is extremely unlikely that silver prices will remain this low with this deferred buying of physical overhanging the market.

Therefore, the squeeze on London and Comex continues, and is probably made significantly worse by a near-halving of the silver price entirely due to derivative instability.

Meanwhile, gold which has suffered similarly from derivative shenanigans has held up better than silver and as its chart plotted logarithmically illustrates it is not too far from trend:

Its price consolidation comes ahead of Japan’s snap general election on Sunday. Prime Minister Sanae Takaichi is strong favourite to win a clear mandate and will go ahead with her reflationary plans. She promises to use the funds to suppress price inflation, the idea being to take pressure off the Bank of Japan to raise rates. But printing money to curb inflation only leads to higher inflation, higher bond yields, and ultimately higher interest rates.

As the world’s principal supplier of capital, Japanese insurance companies and pension funds will be less receptive to buying US, EU, and UK debt as their bond yields resume their rise post-election. Therefore, it could become a different financial environment from next week onwards, including a deteriorating outlook for US debt financing.

Macro-economic figures released this week suggest a stalling US economy, which shows sign of destabilising the tech bubble and more particularly the associated super bubble which is bitcoin. Neo-Keynesian investment and hedge-fund managers take it all as a signal that the Fed can reduce interest rates earlier, reflected in US treasury bond yields easing slightly.

That is a mistake born out of a misunderstanding that bond yields ease in a recession. Instead, dollar bond yields are set to rise reflecting increasing supply of debt without the tax income to fund it.

We’ll see what the foreign holders of $44 trillion and underlying financial assets make of that, in the context of the US dollar debt trap being slammed firmly shut! To listen to Alasdair Macleod discuss the collapse in Open Interest in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

UPDATE: Here Is Where The Silver Market Stands After The Crash CLICK HERE.

SILVER: People Start Making Poor Decisions When Volatility Spikes CLICK HERE.

Central Banks Will Move Gold Price Much Higher CLICK HERE.

SILVER: Look At What Is At One Of The Most Undervalued Levels In History CLICK HERE.

Economic Collapse And The Implementation Of The Slave Monetary System CLICK HERE.

Friday’s Historic Takedown In Gold & Silver Caused Some Dealers To Close The Door On Precious Metals Buys CLICK HERE.

This Is The Biggest Breakout In History! CLICK HERE.

Major Gold & Silver Update After Friday’s Crash In The Silver Market CLICK HERE.

Making Sense Of Friday’s Utterly Rigged Nonsense In The Silver Market CLICK HERE.

What To Do After Friday’s Brutal $37 Plunge In Silver CLICK HERE.

Historic Gold & Silver Plunge As Banks Cover Short Positions CLICK HERE.

Graddhy – We Just Saw A Short-Term Top In Gold, But There Is Good News CLICK HERE.

Billionaire Pierre Lassonde Just Predicted Gold Price Will Hit $25,000 CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.