Buckle up because this is about to massively rock global markets!

January 25 (King World News) – Tavi Costa: The US dollar just had another meaningful decline this week. Markets continue to underestimate how consequential this move really is. In my view, a clean break of the dollar’s 15-year support is approaching — and that would mark a major macro turning point. Yes, hard assets are already moving, reinforcing the broader rotation underway. But the dollar remains the central variable. Its direction carries powerful second- and third-order effects across nearly every major macro theme.

The DXY has been sitting on long-term support for more than a year, and consensus still expects another rebound. I see that as increasingly unlikely. What’s unfolding looks less like a pause and more like the early stages of a structural breakdown — one that could simultaneously activate multiple macro narratives. The global positioning simply isn’t prepared for that outcome.

KING WORLD NEWS NOTE: The US Dollar Index Is Now 97.49 (vs 98.491 Show On Chart) So It Has Broken Below The 15-Year Support! This Will Have A Huge Bullish Impact On Global Markets Including Commodities, Oil, Gold, Silver, Mining Stocks And Emerging Markets!

These shifts always seem obvious in hindsight, but the real opportunity belongs to those willing to position ahead of the confirmation, not after it. If this plays out, it marks the beginning of a prolonged downtrend in the US dollar relative to hard assets — and ultimately versus other fiat currencies as well.

That has broad implications: emerging markets, Latin America, miners, commodities, energy, hard-asset-linked businesses, local-currency emerging markets debt, Asian equities, and select developed markets. These are not marginal moves. The advantage accrues to investors who can tune out the daily noise and think in terms of cycles and decades, not headlines and days.

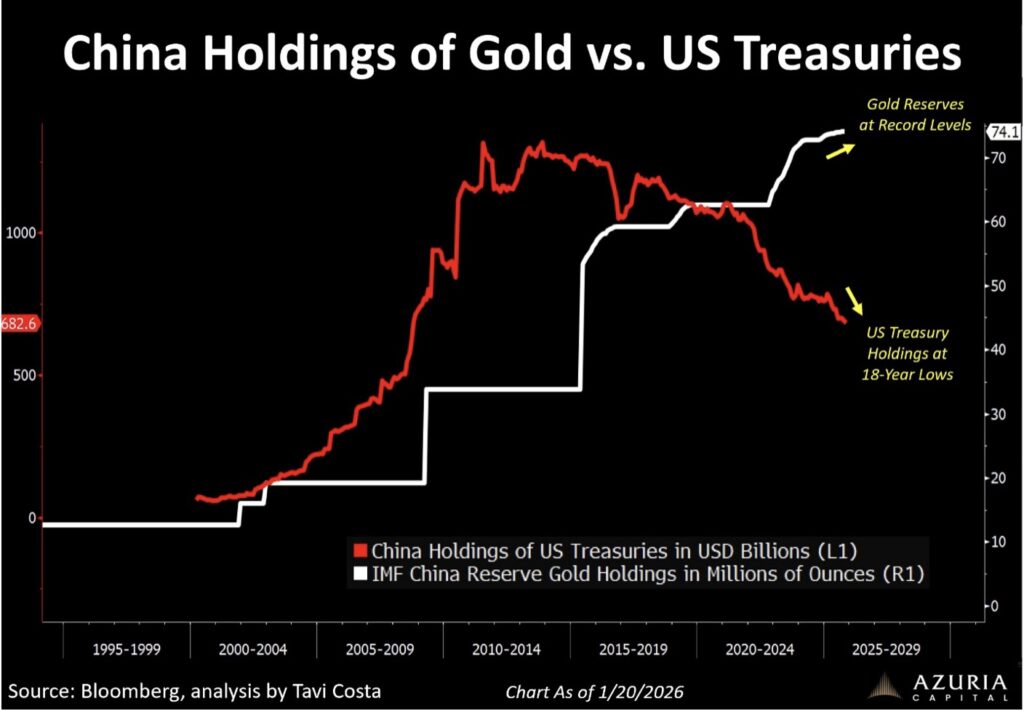

Gold continues to set new highs as a monetary realignment plays out in real time. This chart captures the scale and significance of what’s unfolding—and the strategic repositioning now underway in the global macro landscape.

China’s US Treasury holdings have fallen to 18-year lows, while its gold reserves have climbed to record levels. This represents one of the most substantial reallocations from financial assets into hard assets we’ve seen in decades.

KING WORLD NEWS NOTE: The World Has Had Enough Of The US Dollar. While The Move Out Of The Dollar Has Been Orderly So Far, It Will Now Accelerate!

This Will Mean Another Massive Wave Of Inflation Is Headed For The United States At A Time When The Middle And Lower Classes Simply Cannot Afford It. It Is Going To Get Very Ugly At Some Point.

This does not imply an imminent collapse in Treasuries. The reality is that the US has little choice but to keep interest rates contained — whether through central bank action, fiscal measures, banking system support, or mechanisms not yet fully visible.

What this shift reflects is a growing global recognition that metals are strategically essential — and that inflating our way out of an overwhelming debt burden is no longer a choice, but a necessity.

Silver Will Skyrocket Above $300-$500!

To listen to James Turk’s predictions for the price of silver and gold as well as what to expect from mining stocks CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

James Turk Predicts Silver Will Skyrocket Above Fair Value Of $300-$500 CLICK HERE.

Gold & Silver Record Highs! Look At What Just Hits A Level Not Seen Since 1972 CLICK HERE.

Gold Quote Of The Day! CLICK HERE.

What Could Go Wrong? CLICK HERE.

The US Is Now Headed For Total Collapse CLICK HERE.

GOLD & SILVER SOAR: This Time The Global Financial Crisis Will Be Much Worse CLICK HERE.

RECORD HIGHS! Silver Soars Nearly 8% As Gold Surges $134 CLICK HERE.

Michael Oliver – Gold & Silver Mining Stocks Coiled For Violent 355% Surge CLICK HERE.

Costa – Two Major Catalysts For Gold & Silver In 2026 CLICK HERE.

Nomi Prins Just Predicted A Jaw-Dropping $150-$180 CLICK HERE.

Michael Oliver – Gold & Silver Pause But Look At This Massive Upside Breakout CLICK HERE.

This Kicked Off The Bull Market In Gold CLICK HERE.

What’s Next For Silver? CLICK HERE.

Silver’s Spectacular Rise Has Become Disorderly, But Silver Remains Radically Undervalued CLICK HERE.

GOLD HITS ANOTHER RECORD HIGH: The Global Hyper-Debt Bubble And Gold CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.