Silver sparkled and gold shined in 2025 but look at what’s ahead in 2026.

Alasdair Macleod’s audio interview has now been released (LINK BELOW). But first…

2025: Silver sparkled and gold shined

January 2 (King World News) – Alasdair Macleod: Precious metal bulls will feel vindicated, but the rise in prices indicates something darker: the dollar’s decline is accelerating, barrelling towards the end of the fiat currency era.

In this our final market report for 2025, we look back on what has been driving gold and silver price in 2025, and their outlook in 2026. Our conclusion is that the dollar is dying and the fiat currency era is drawing to a close. This is the message from gold, silver, and indeed the wider commodity and raw materials world.

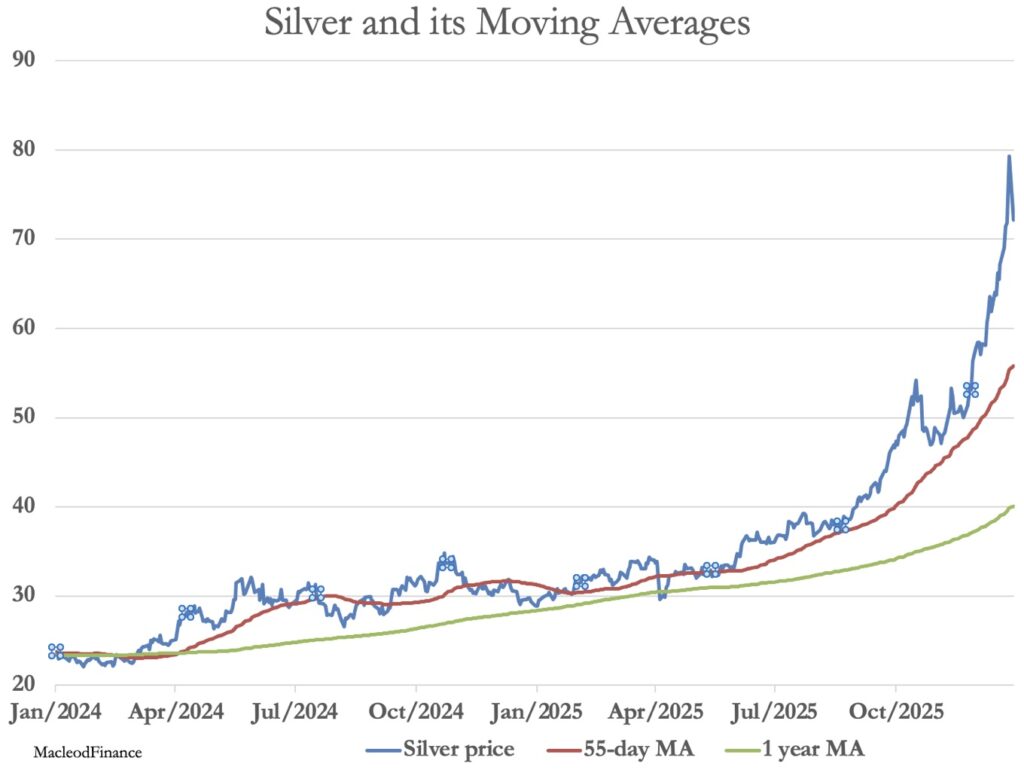

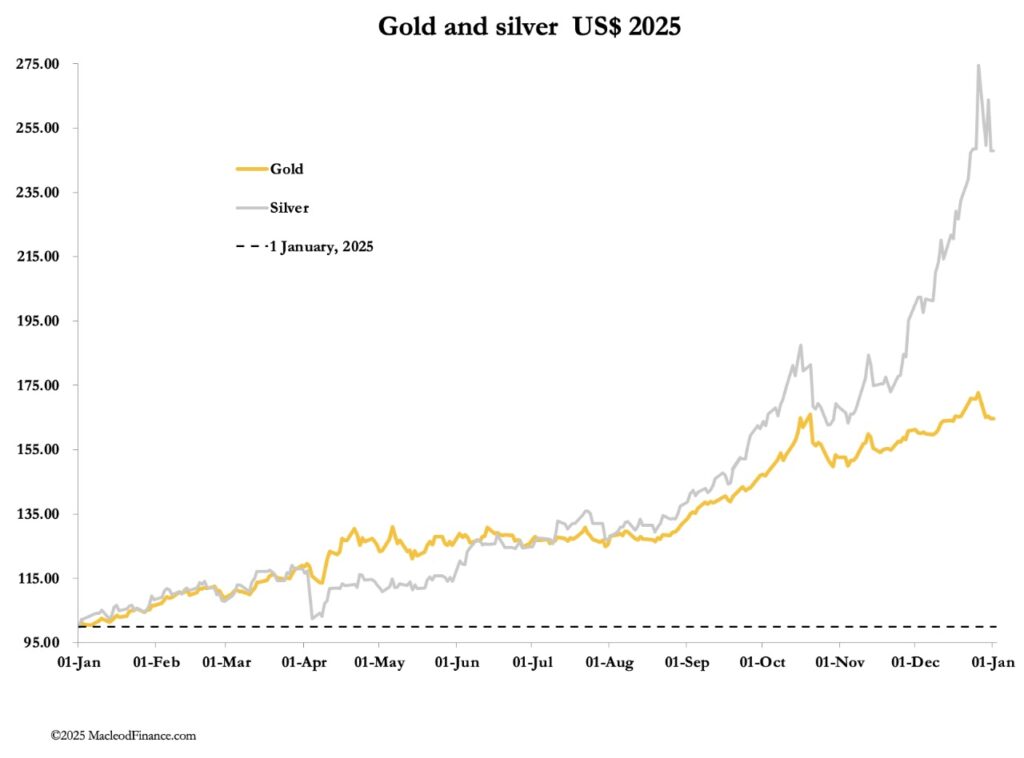

It has been a rewarding year for gold and silver bulls, with gold this morning at $4390, up 65% from 1 January, and silver at $74.50 is up 148% on the same timeframe.

It has been a rewarding year for gold and silver bulls, with gold this morning at $4390, up 65% from 1 January, and silver at $74.50 is up 148% on the same timeframe.

Trading in the final week of 2025 which includes New Year holidays was predictably light and volatile, particularly in silver. London spot silver is down $5 from last Friday’s close, and gold is down $140 on balance.

While perennial gold and silver fans are rejoicing in their good fortune, there is a darker message in their rise. Gold is not so much up as the dollar and the other fiat currencies are down. Gold is almost certainly discounting further declines in the dollar’s purchasing power in 2026, signalling an unexpected and unwelcome increase in consumer prices, probably from the second quarter onwards.

The dollar’s decline has been a death by thousand cuts, with very few of its users actually noticing, attributing rising prices to everything other than the dollar’s decline. But the next chart, which inverts the gold/dollar exchange rate illustrates the dollar’s accelerating deterioration:

Note that even with the Y-axis logarithmic, the dollar’s trend measured against real legal money is accelerating downwards, having already lost 93.6% of its value since January 2000.

Silver is telling us something else. The distortions of continuingly declining fiat dollar values have suppressed the market price of silver for decades, leading to substantial and accumulating supply deficits relative to demand. Now that China which has been suppressing the price is no longer doing so, silver has substantial catching up to do. This is reflected in the dollar price of silver, our next chart:

Global industries which have benefited from and become accustomed to China’s price suppression are now faced with the deferred cost and are scrambling to obtain inventory. China realises that if no physical silver leaves China, priced in yuan its photovoltaic and electric vehicle industries would struggle, which is why it is introducing a new export licencing system from this month. Rather than stopping silver exports entirely, China now seeks to moderate the rise in prices.

However, the backlog in terms of price suppression is enormous, and could easily see silver doubling or tripling, even priced in gold despite China’s efforts. The effect on dollar prices will be further enhanced by the dollar’s accelerating decline, illustrated in our second chart above.

Shorter-term, commodity markets are struggling to absorb this new reality for silver, as physical liquidity is now drained from London’s vaults. Lease rates have soared as bullion banks and their customers are being forced by desperate manufacturers to encash derivative obligations for physical metal. But if in order to deliver physical silver, you lease it from elsewhere, you still have a duty to return it to the original owner, building up delivery commitments which still have to be honoured. It has the making of a serious crisis in financial markets which has just started and cannot be resolved by higher prices, because there is no silver available.

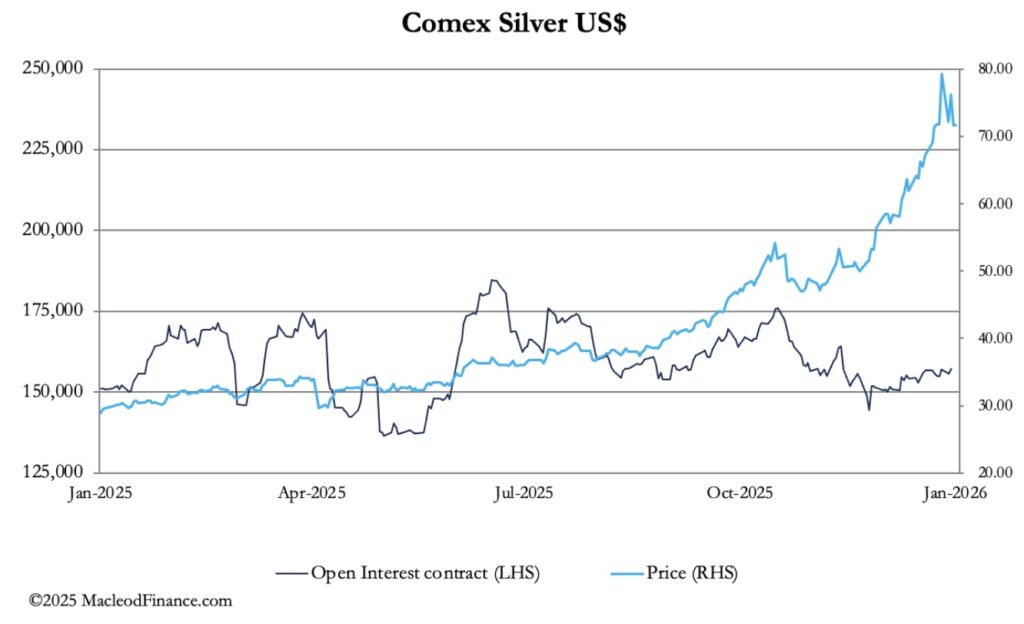

The scramble for silver is also evident on Comex, where unknown parties stood for delivery of 15,536 tonnes in 2025. That is 60% of global mine output. We cannot allege that all of this silver is the result of industrial users sourcing it from Comex futures, but it is bound to be a significant element of physical demand. It is also evident in the relationship between the price and open interest, shown next:

From late-June onwards, open interest has declined from 183,300 contracts to the current 157,000, while the price doubled from $36. This inverse relationship is particularly noticeable from mid-October when silver lease rates in London spiked at over 30% and spot traded well above Comex futures. It is the absence of trend-chasing managed-money which is particularly noticeable, confirming it is a delivery crisis and not a conventional bull market.

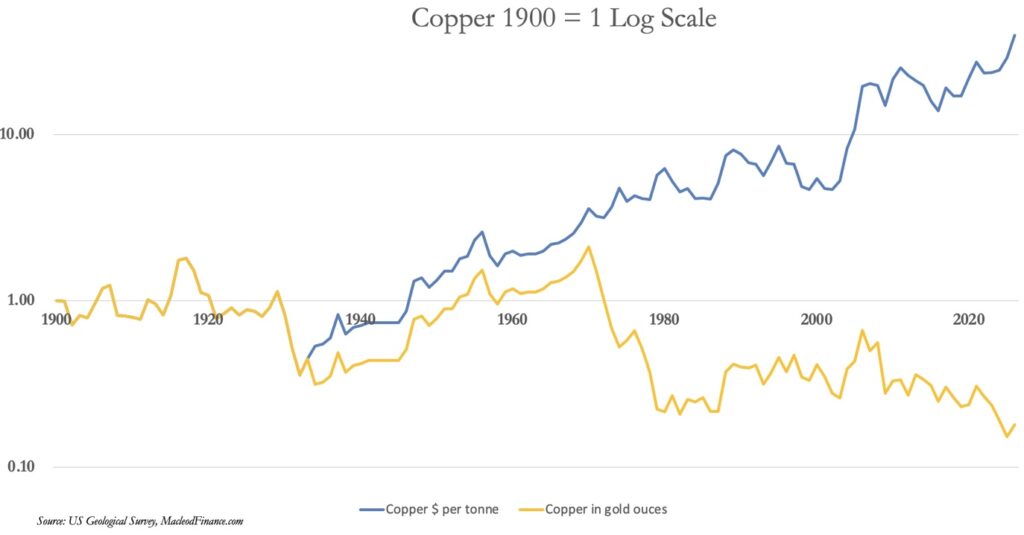

Silver’s delivery crisis is far from over, and we can expect significantly higher prices in 2026 as a result. All analytical evidence points this way. But that is not all. The entire base metal complex has become underpriced in real money terms, though they are rising in declining dollars. Our next chart is of copper, universally taken as the most important base metal indicator. This time, it is less due to increasing industrial demand relative to supply, and more to do with a collapsing dollar:

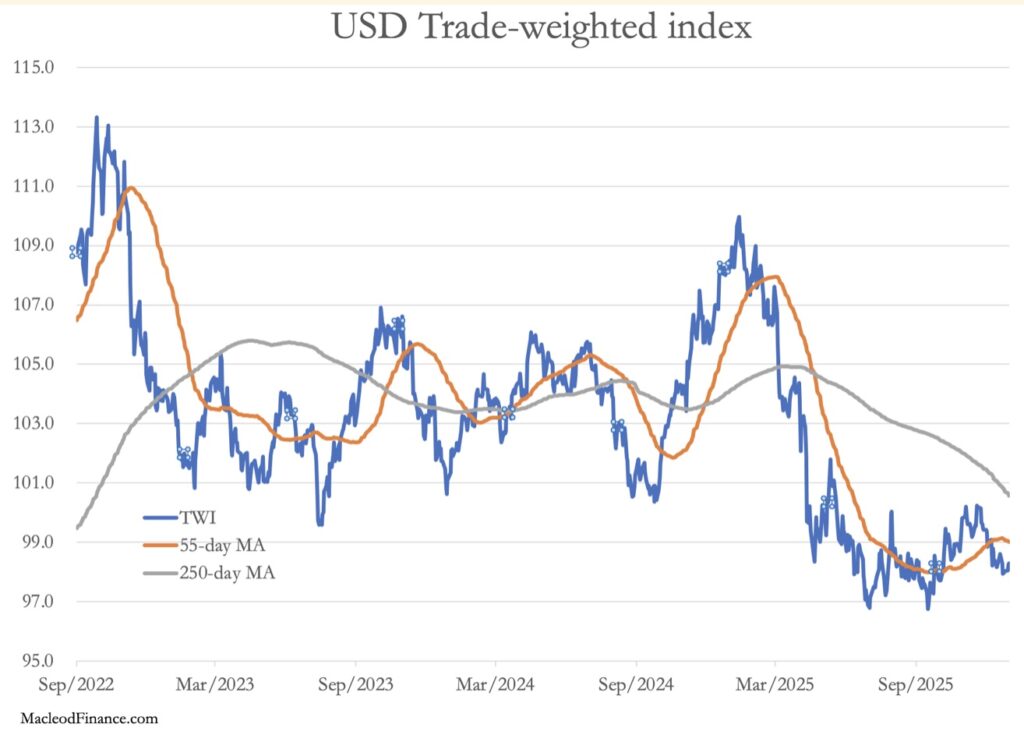

Entire commodity and raw material categories appear to be heading higher priced both in gold and dollar terms. Some of this is due to gold discounting the dollar’s decline in future months, putting it ahead of the game even relative to commodity values. If it wasn’t for the dollar’s debt crisis and attendant credit bubble, a significant pause in gold’s rise would make sense. But the dollar’s outlook is deteriorating rapidly, even measured against other currencies as the trade weighted index and its moving averages illustrate:

The debt-cum-credit crisis is most acute in dollars, and it is even in a technical bear market against other similarly inflicted G7 fiat currencies. Meanwhile, gold is merely consolidating its gains of the last six months, having peaked in mid-October:

It is now finding support at the $4300—$4500 levels, but it looks unlikely to hang around current levels for long, given the rapidly deteriorating outlook for the dollar. To listen to Alasdair Macleod discuss what to expect for gold, silver and the miners in 2026 CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

Silver, And What Stood Out To Me The Past Two Weeks CLICK HERE.

Here Is The Remarkable Big Picture Setup For Gold As We Head Into 2026 CLICK HERE.

CNBC Antics About The Silver Market CLICK HERE.

Turnaround Tuesday As Silver & Gold Soar, But Take A Look At This… CLICK HERE.

Black Monday For Gold, Silver & Platinum Markets. Here Is Where Things Stand CLICK HERE.

Costa – Here Is The Big Picture After Silver & Gold Prices Tumble CLICK HERE.

Tavi Costa – What A Week As Silver Explodes To The Upside! CLICK HERE.

Historic Silver Short Squeeze Sends Price Soaring Over 7% On Friday! CLICK HERE.

An Astonishing Christmas Prediction From Legend Richard Russell CLICK HERE.

EXPECT WAR: Early Days For Gold & Silver Bull, Especially The Miners CLICK HERE.

Hansen – This Is What Is Really Happening With Gold Market CLICK HERE.

$15,000 TARGET: Volatile Gold & Silver Trading But Look At What Is Coiled To Skyrocket CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.