The Fed will cut interest rates tomorrow, but look at this…

Michael Oliver’s audio interview has now been released! (Link below) discussing gold futures breaking above $3,700 this week and silver surging to $43 along with strong advances in the mining stocks! For now…

Fed To Cut Rates Tomorrow

September 16 (King World News) – Peter Boockvar: So, do we now assume that new Fed Governor Stephen Miran will vote for a 50 bps cut tomorrow and Lisa Cook will vote for none? Does Waller vote for 50 bps too because he really, really wants the Fed Chair job? I wish we didn’t have to wait so long to get the actual, real minutes (not the laundered ones in three weeks) from this meeting as it will be something.

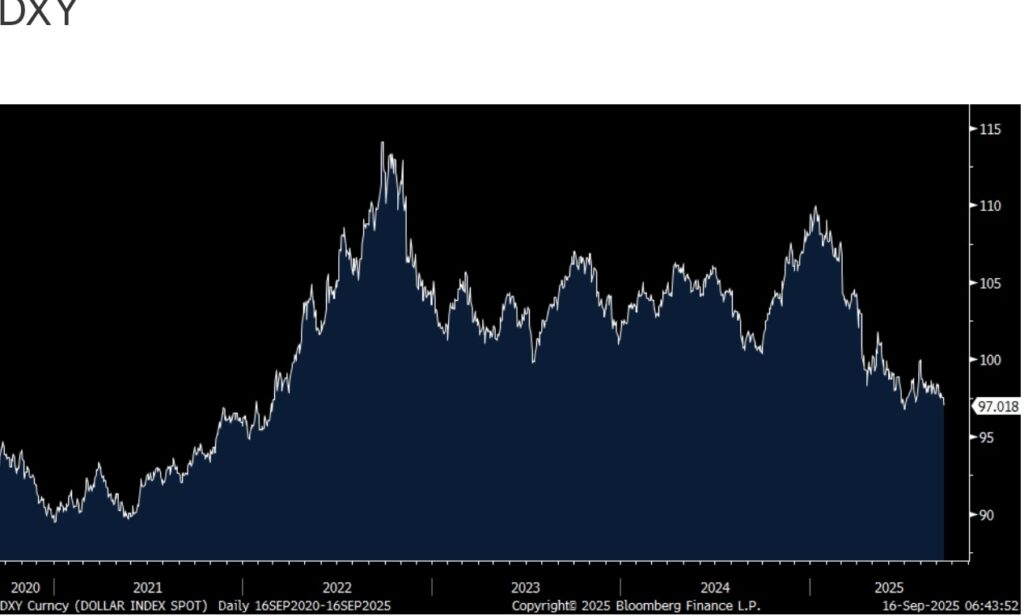

Ahead of the meeting with stocks at the highs and after a rally in Treasuries, the euro/yen heavy US dollar index is just .25 from a 3 ½ yr low and which makes imports even more expensive on top of tariffs that many pay on those imports. About 40% of US imports by the way are raw and intermediate term goods that end up in finished products. Gold in turn is at another record high.

KING WORLD NEWS NOTE: US Dollar Index Trading Near Lowest Level In 3.5 Years

If there is any hint by Jay Powell tomorrow that while he’s on board for rate cuts but not by the 100 bps thru the rest of his term that the market is currently pricing in because we’re still stuck at 3% inflation instead of 2%, we could get a reversal in the prices of just about everything that has melted up, as so many investors have been trained to just get long when the Fed cuts rates without regard to why they are doing so. Right now, the fed funds futures are pricing in a 100% chance of two cuts this year and a 62% chance of a third.

Also, market participants tend to view interest rate changes very simplistically. Higher rates bad, lower rates good. But, there is so much nuance to that. There is about $7 trillion of money sitting in money market funds that are going to produce less interest income for savers. Pile another $7 trillion of other fixed income that will do the same. Upper income spending has been a main driver of consumer spending and this cohort is about to make less money. On the other hand, anyone borrowing SOFR plus will certainly get relief and we’ll soon see how long term Treasuries trade AFTER the fact to see the extent to which home buyers get help too.

No Shocker Here

This story I first saw last week can be very isolated or the beginning of something more. I don’t know but wanted to bring it up because now the WSJ editorial page got a hold of it and it’s worth watching if it ends up being the latter instead of the former. I’m referring to the company Tricolor, a subprime auto lender that filed for Chapter 7 last week. According to the WSJ, “it is liquidating after 18 years in business. The Texas-based firm specialized in lending to car buyers with no credit history or social security number, including undocumented migrants in the Southwest.” Fifth Third Bancorp was one of the warehouse lenders to Tricolor and they announced last week they were a “one off” victim of fraud. Tricolor is being accused of fraud by pledging collateral twice to their lenders. If fraud, then this will be a ‘one-off’, but if a reflection of broader stress in subprime auto lending, then not. The article of that WSJ piece titled “Tricolor and the Subprime Debt Canary…Is the auto lender’s surprise bankruptcy an outlier or a harbinger.”

Meanwhile In Germany The Current Situation Is Bleak

The September German ZEW investor confidence index in their economy did rise to 37.3 from 34.7, about 12 pts above expectations. However, the Current Situation weakened to -76.4 from -68.6. ZEW said “There are still considerable risks, as uncertainty about the US tariff policy and Germany’s ‘autumn of reforms’ continues. The outlook has improved in particular for export-oriented sectors, which had recently suffered a strong decline. Among the industries that benefit most are the automotive sector, the chemical and pharmaceutical industry and the metal sector. Nevertheless, the three indicators for these industries continue to be in the negative range.” Nothing market moving here though.

Bank of England Will Leave Rates Unchanged

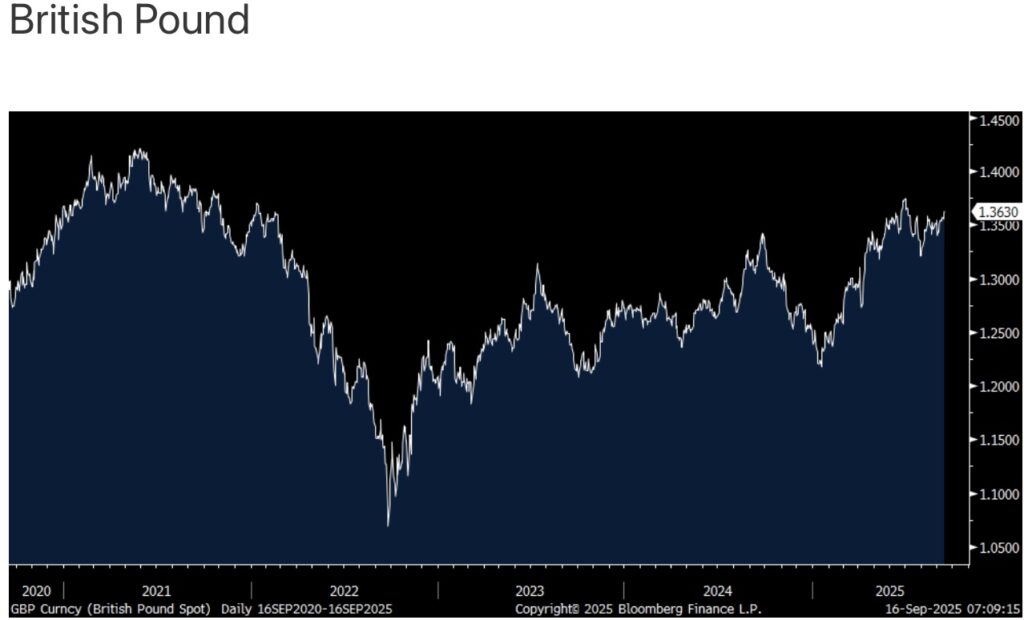

Ahead of the Bank of England meeting on Thursday, payrolls in August fell by 8k but that was 4k less than expected and through July, their unemployment rate held at 4.7% and employment in the three months through July was a bit above expectations. Wage growth continues to run above inflation, higher by 4.8% ex bonuses on a weekly basis, though down from 5% in the month before.

Market expectations for the BoE is that they will leave its base rate unchanged at 4% on Thursday and the pound is trading at its highest level since early July vs the US dollar after the jobs data.

Michael Oliver Warns This Is Going To Shock Gold & Silver Investors

To listen to Michael Oliver discuss gold futures surging above $3,700 this week, silver futures hitting $42.98 and mining stocks surging CLICK HERE OR ON THE IMAGE BELOW.

Also Just Released!

To listen to Alasdair Macleod discuss the wild trading in the gold, silver, and mining shares this week CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.