Investors around the world need to buckle up because interest rates are headed higher once again. Plus a look at mining stocks.

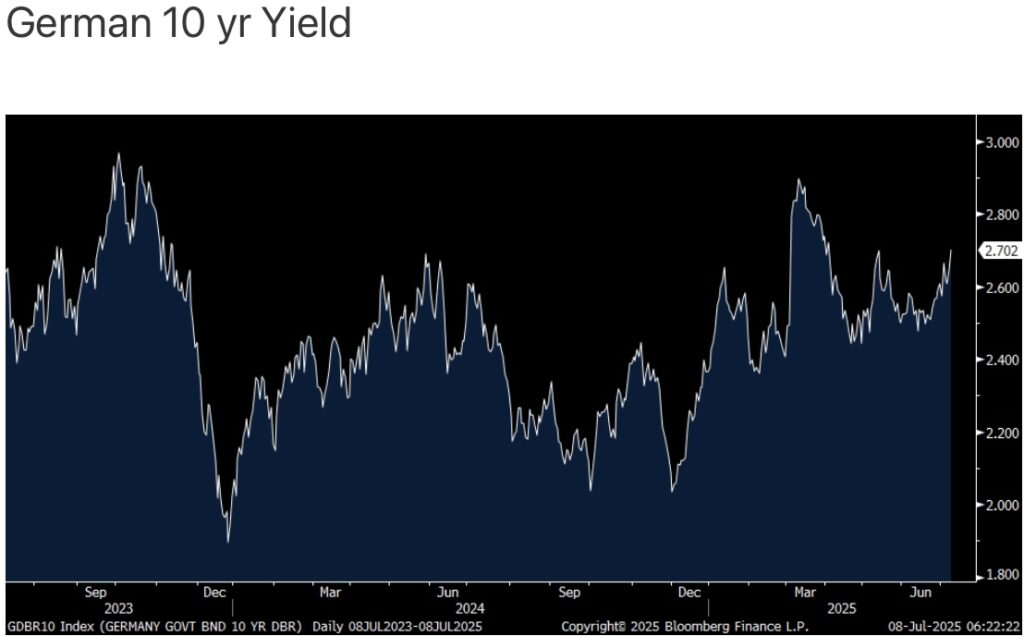

July 8 (King World News) – Peter Boockvar: We still should not stop keeping our eyes off global bond markets as they are on the move again with higher yields. The German 10 year is up by 6 bps to 2.70%, still low but at the highest since April 2nd.

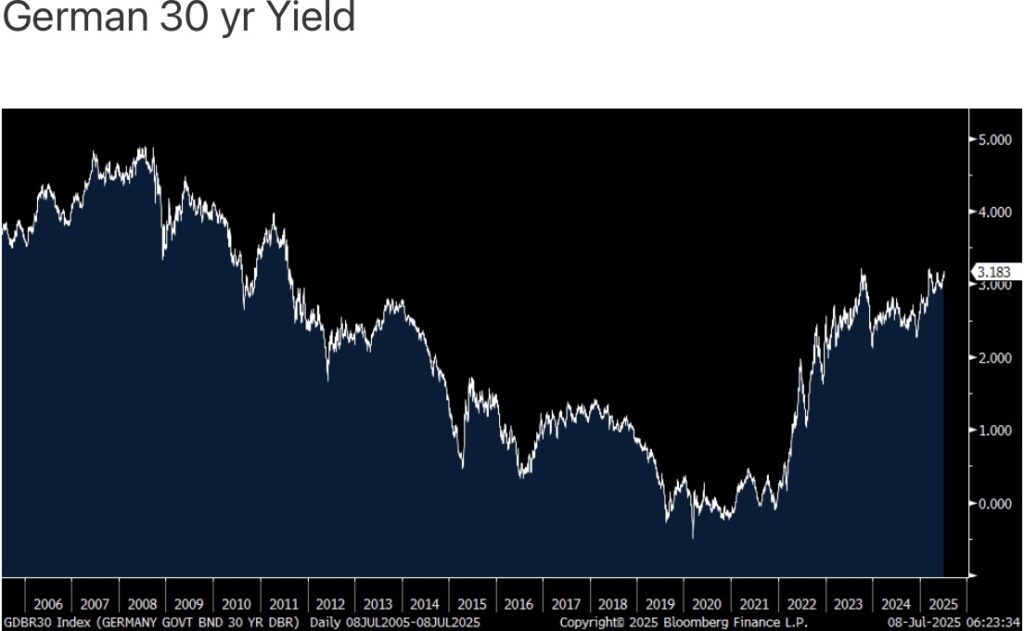

The 30 year bund yield is just a few bps from the highest since 2011.

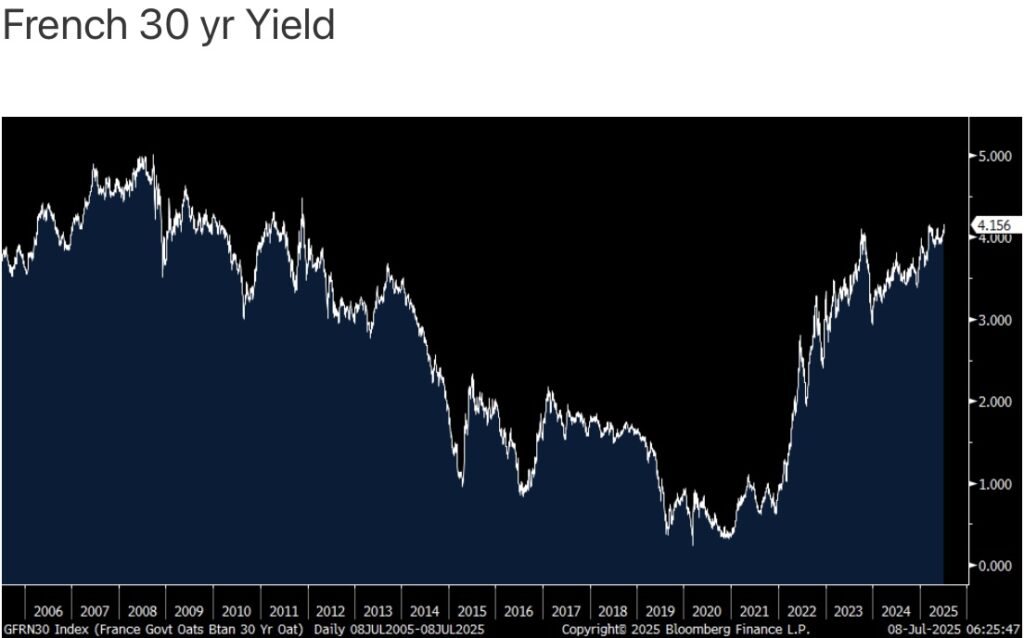

On one hand German has one of the lowest debt to GDP ratios in the developed world but on the other, it’s rising as they ramp up their fiscal spend. The French 30 year oat yield is also up about 6 bps to 4.16%, a level last seen in 2011.

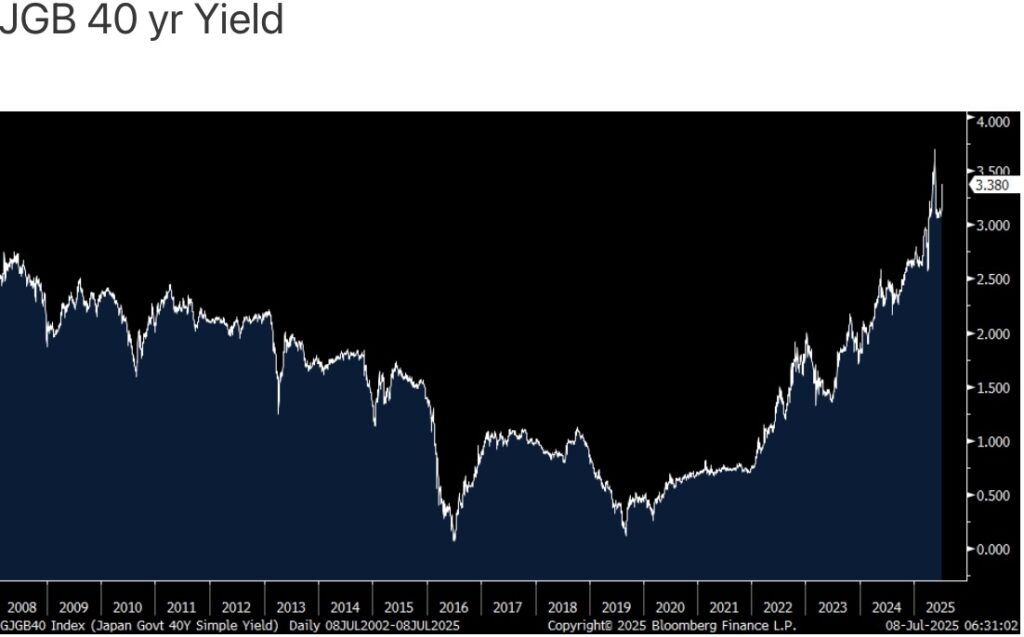

This followed a 9 bps jump in the Japanese JGB 30 year yield and a 15 bp move higher in their 40 year.

After the RBA didn’t raise rates as many expected, Australian yields popped too. The RBA said “The Board judged that it could wait for a little more information to confirm that inflation remains on track to reach 2.5% on a sustainable basis.”

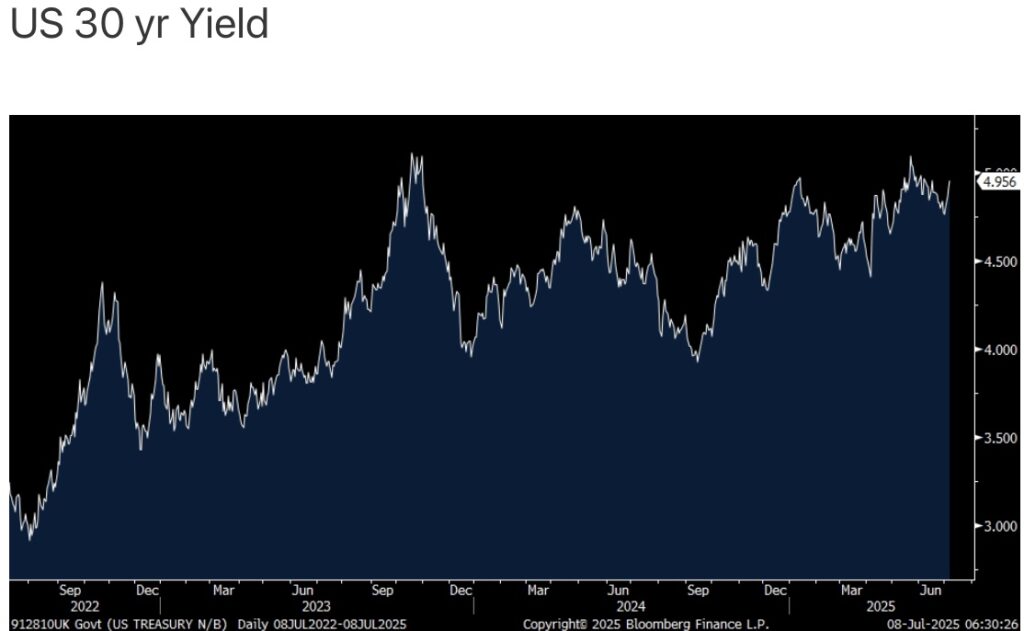

And in response, the US 30 year yield today is approaching 5% again at 4.96%, up 10 bps over the past two trading days.

Bottom Line

Bottom line, there is a global aversion still to too much bond duration with the 30 year maturities (and out to 40 years in Japan) the most vulnerable. This long end global bond bear market I believe is still alive.

As we are all market participants, in many varying ways, and with so many global cross currents, Oasis sang to us over the weekend in their first concert since 2009, “And all the roads we have to walk are winding. And all the lights that lead us there are blinding. There are many things that I would like to say to you but I don’t know how.”

A Huge Opportunity While No One Believes

Graddhy out of Sweden: Bias is a strong emotion. Many said and continue to say tech will continue to outperform precious metal miners. That is how we work – the mind makes you think things will go on as they have forever. But, charts do not lie.

The ratio chart below shows that gold miners reversed the big picture trend vs the leading tech sector already 17 months ago. The chart talks about global capital flows changing from there on, a historical sector rotation is now in the making.

KING WORLD NEWS NOTE: HUI Gold Mining Index Set To Outperform Tech SOXX By A Jaw-Dropping 5,000%

Catching huge trend reversals, major lows and sector rotations early, is one piece of the puzzle to making the really big gains. The largest percentage gains are always from the very lows. Profit is made when you buy.

JUST RELEASED!

To listen to Alasdair Macleod discuss gold, silver, mining stocks, the wild trading this week and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.