Here is an unimaginable price target for silver.

Silver

July 7 (King World News) – Graddhy out of Sweden: Still doubting silver can reach almost unimaginable levels?

Then ponder that silver’s all-time high is not $50, it is $806. In 1998 USD value…And, that is $1,593 today, using Fed’s massaged inflation calculator…And, using ShadowStats, it should be 4x that…

KING WORLD NEWS NOTE: Silver’s All-Time High Is $806-$1,593+

Above $60 Is The True Breakout

Silver had been in decline for 500+ years when it bottomed out around the millennium. The chart shows a 500+ year black expanding falling wedge; my drawing. The false breakout (FBO) is the 20 year bottoming phase of the cup, of the 45 year cup & handle pattern. Note that silver has to hit $60 just to break out of the black expanding falling wedge.

So, could $800 happen briefly again when silver goes ballistic towards the end of the bull?

Absolutely.

Hard To Find A Single Bull

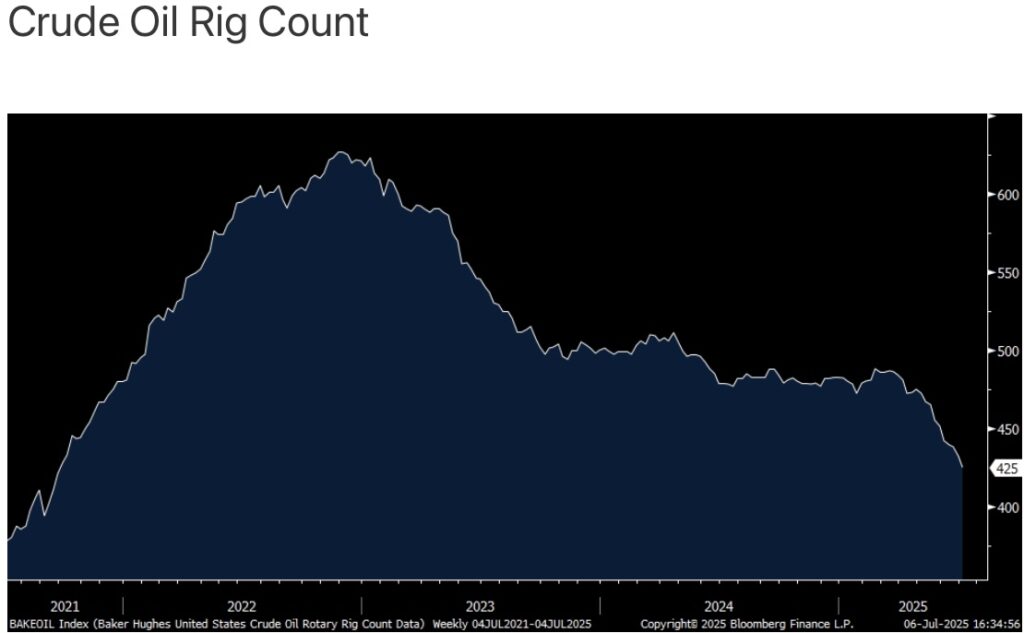

Peter Boockvar: As it is hard to find one bull on the price of oil, outside of myself and only a few others, I’m going to continue to point out the falling US rig count as drillers try to offset the OPEC supply increases, in terms of the global equilibrium. The weekly US crude oil rig count fell for the 10th straight week and by another 7 rigs to just 425. For perspective, we started the year at 483 and now sit at the least since September 2021.

Also out last week was the fresh Dallas Fed Oil & Gas Survey. It said, “Oil and gas production decreased slightly in the second quarter, according to executives at exploration and production firms. The oil production index fell from 5.6 in the first quarter to -8.9 in the second quarter. Meanwhile, the natural gas production index also turned negative, declining from 4.8 to -4.5.”

Here were some of the noteworthy E&P company comments:

“The Liberation Day chaos and tariff antics have harmed the domestic energy industry. Drill, baby, drill will not happen with this level of volatility. Companies will continue to lay down rigs and frack spreads.”

“There is constant noise coming from the administration saying $50-per-barrel oil is the target. Everyone should understand that $50 is not a sustainable price for oil. It needs to be mid $60s.”

“Increased steel costs and other costs for drilling wells are affecting our business. The increased costs change the production economics.”

“The current political uncertainty is causing apprehension and concern about small, independent oil and gas companies’ economic viability.”

“Thank God the previous administration is gone and so are their anti-energy policies!”

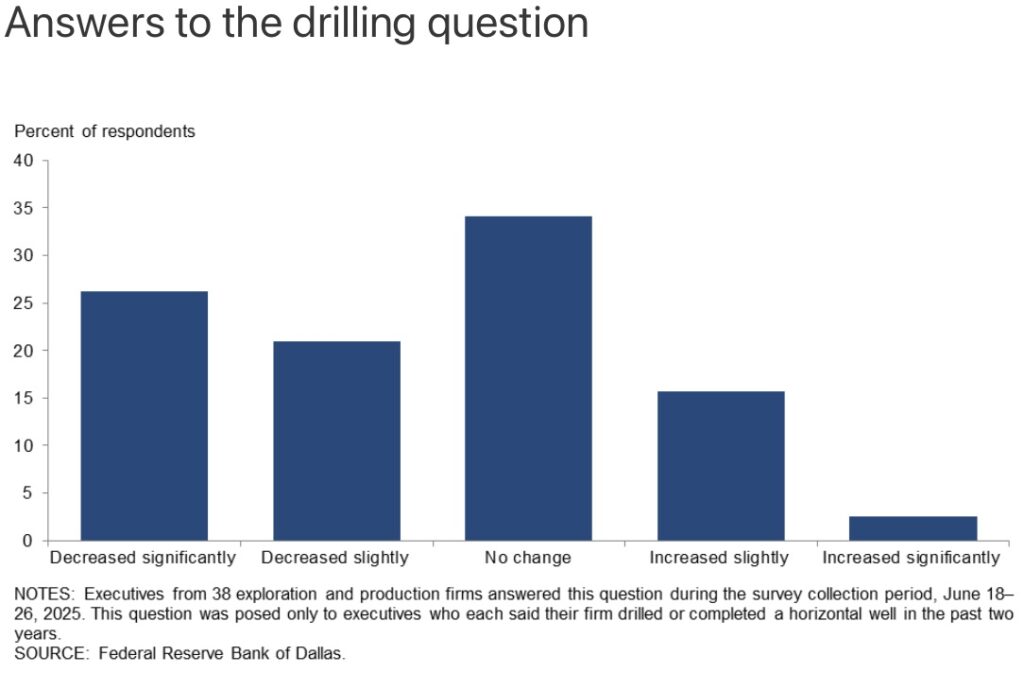

There were also a few special questions and here was one of them, “How has the number of wells your firm expects to drill in 2025 changed since the start of the year?” The answer, “Almost half of executives surveyed expect to drill fewer wells in 2025 than they planned at the start of the year. Twenty-six percent said they expect the number of wells they drill to ‘decrease significantly,’ and 21% said it would ‘decrease slightly.’ Conversely, 16% said drilling expectations ‘increased slightly’ and 3% said they ‘increased significantly.’ The balance saw no change.

JUST RELEASED!

To listen to Alasdair Macleod discuss gold, silver, mining stocks, the wild trading this week and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.