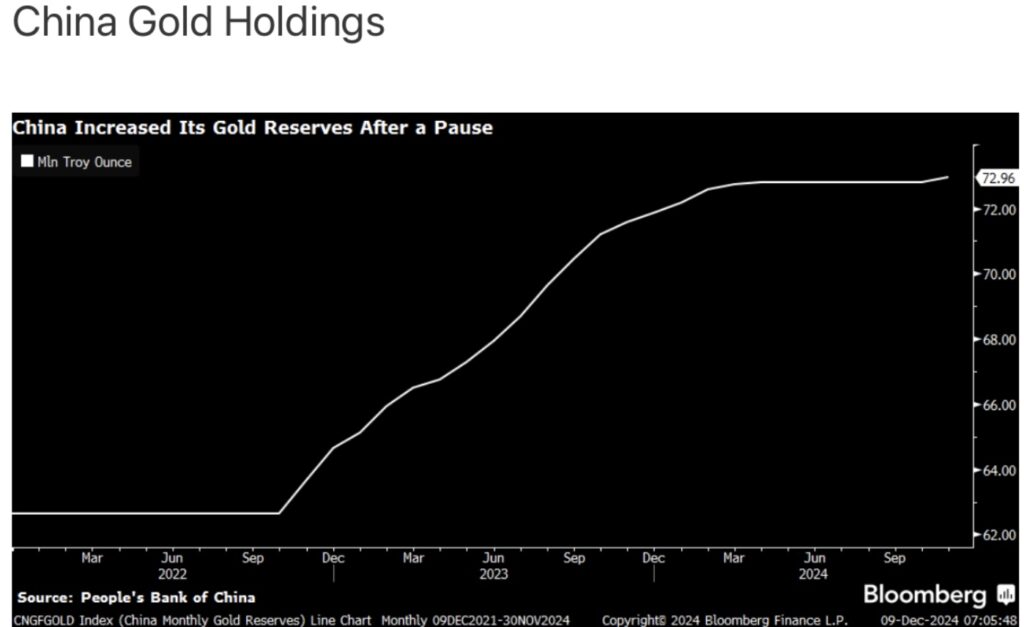

China stepped back into the gold market to add to their country’s growing reserves. This sent the price of gold futures surging to $2,700, but take a look at this…

Madness Of The Crowds

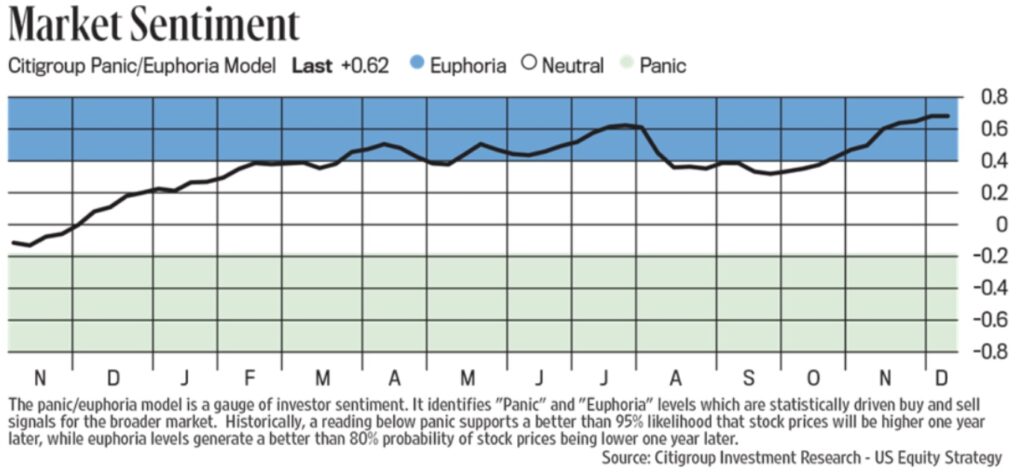

December 9 (King World News) – Peter Boockvar: It doesn’t matter until it does but something we should continue to acknowledge and be aware of from a short term trading and contrarian perspective. That is the ever rising bullish sentiment that continues to get more extreme. The updated Citi Panic/Euphoria index rose to .62 w/o/w from .58 in the week before. It’s now about 50% above the Euphoria threshold and above the previous July peak. Again, Citi claims that above .41 is statistically significant in terms of the one year performance from here.

Used Car Prices Surging Again

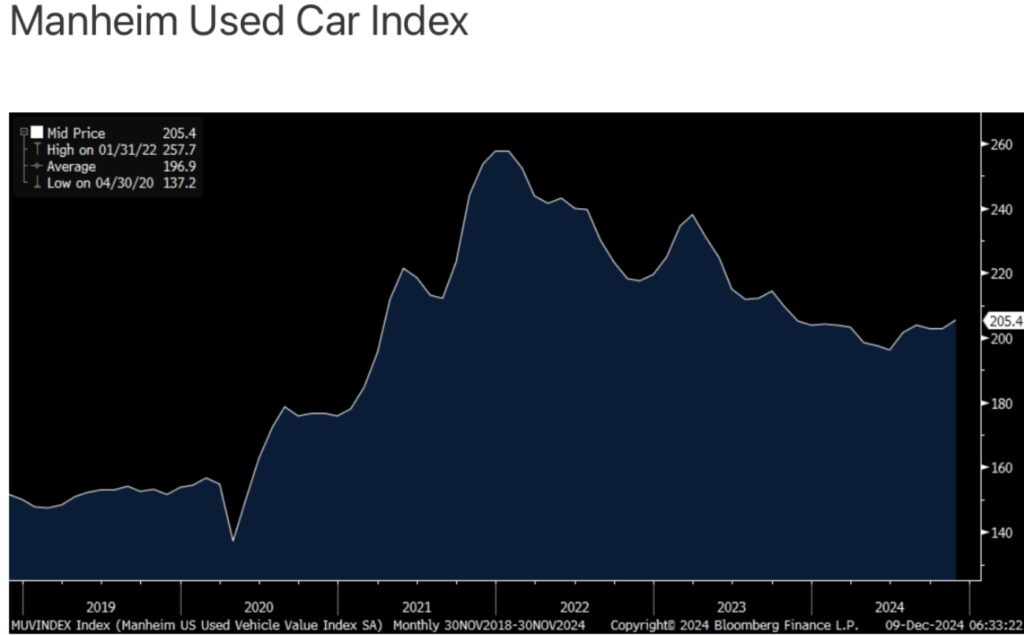

Ahead of the inflation stats this week, on Friday the Manheim used vehicle index measuring wholesale prices for November rose to the highest level since October 2023, up by 2.6% sequentially but flattish y/o/y.

Manheim said “Wholesale values gave back a little bit of the strength we saw earlier in the month but depreciated less than what we normally see in November…tight supply in wholesale and retail markets will support healthy dealer demand through the final month of the year.” Something to watch after the disinflation in goods prices we’ve seen. You’ve heard me say many times that with still below pre Covid trends in the sale of new cars means less used cars eventually in terms of supply…

ALERT:

Look at which company has positioned itself to become the next K92 high-grade gold powerhouse! CLICK HERE OR ON THE IMAGE BELOW.

Shipping Costs Surging Again

As we get closer to the holidays, air cargo rates continue higher. World ACD on Friday said “Worldwide air cargo rates rose to a 2024 high in November of US$ 2.76 per kilo, despite a slight (-2%) drop in flown tonnages compared with October.” Average worldwide rates rose 6% m/o/m and are up 11% y/o/y. That combines both spot and contracted rates. As for spot rates, they are up 21% y/o/y and contract rates are higher by 10% y/o/y.

More “Transitory” Inflation On The Way

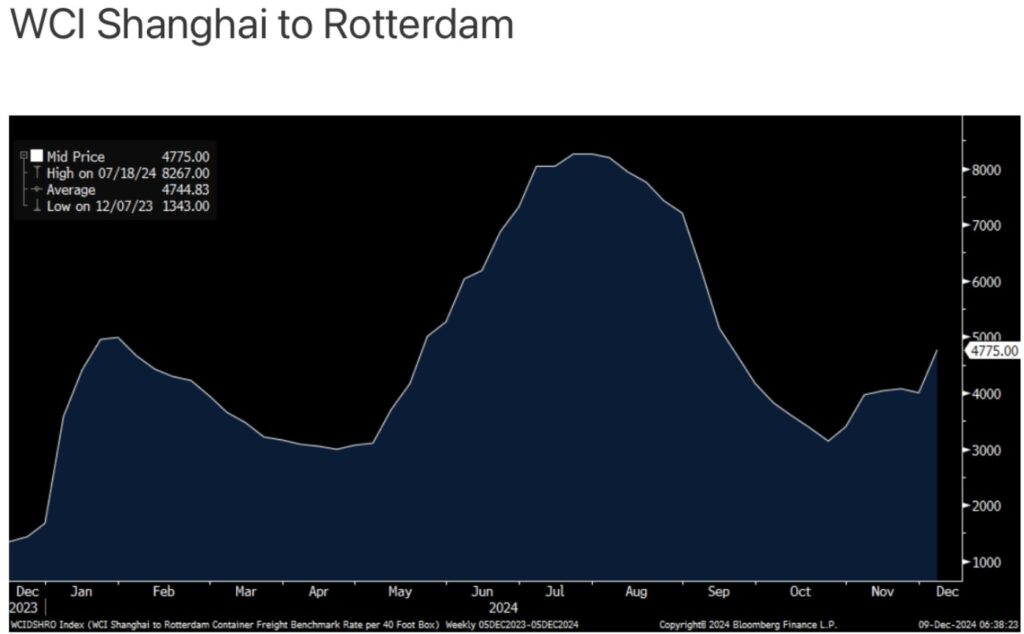

An update too on container shipping costs, the Shanghai to Rotterdam route saw a 20% w/o/w jump as of 12/5 to $4,775.

While that is well off its summer high, it is up from $1,667 to start the year.

In contrast, the Shanghai to LA route saw prices fell for a 5th straight week to $3,719 but compares with $2,100 at the beginning of the year.

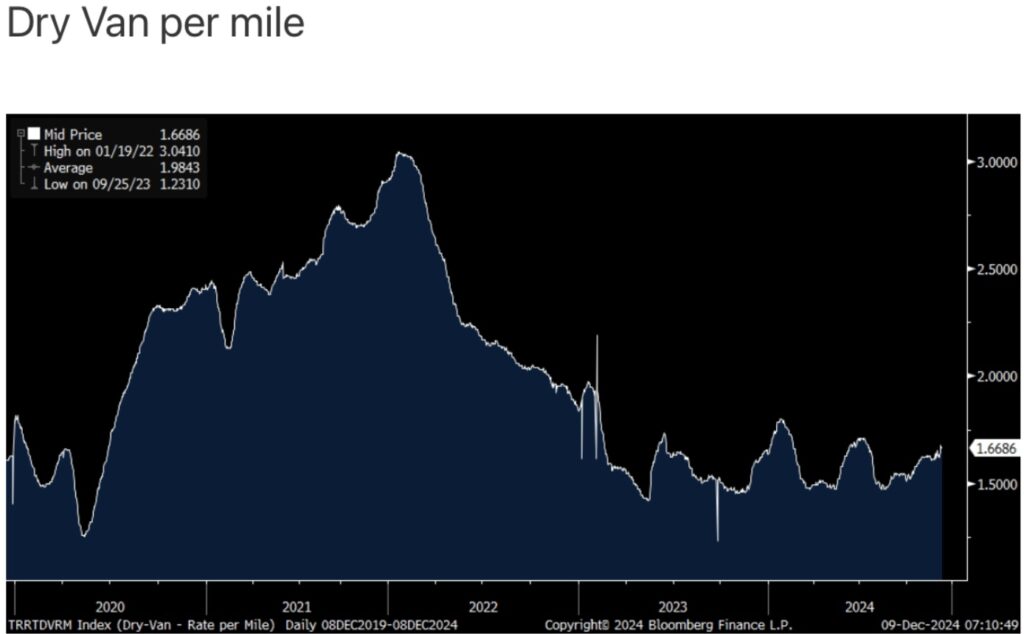

I’ll finish on transportation costs by looking at the updated Dry Van per mile rate as of yesterday and that stands just below the highest level since July at $1.67. That is up 3.7% y/o/y.

Bottom line, the path to a sustainable, and I emphasize ‘sustainable’, path to 2% inflation will not be easy. Yes, slower rents should keep a lid on services inflation in 2025 but on the other hand the CPI/PCE calculations never fully captured the spike in rents. We then watch, in part due to the things mentioned above, whether goods prices are bottoming.

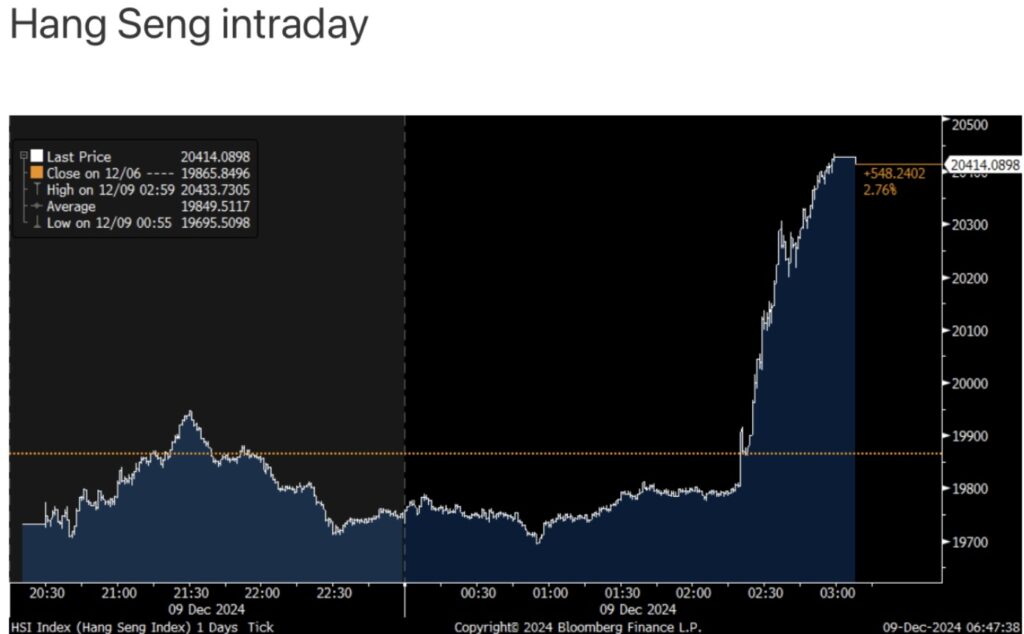

More China Stimulus Announced

China stocks saw a late day rally after the printout of the Politburo meeting today came out and this was said on monetary policy, “A more proactive fiscal policy and an appropriately loose monetary policy should be implemented, enhancing the refining the policy toolkit, strengthening the extraordinary counter-cyclical adjustments.” ‘Appropriately loose’ is what the markets are hanging their hat on as that is a change in tone as usually they say they will pursue ‘prudent’ monetary policy instead.

China also reported its inflation stats. Price stability for consumer prices is what they continue to see with prices up .2% y/o/y. Taking out both energy and food saw prices up .3%. While some cry ‘deflation’ as a problem here, stable prices is good for a still hesitant Chinese consumer. If you polled the US consumer and asked them whether they would choose a .2% rise y/o/y in their cost of living or 2%, the Fed’s target, I’d bet 100% would say .2%.

PPI, more reflecting commodity prices and industrial pricing, saw prices drop by 2.5% y/o/y but which is less negative than expectations of 2.8% and vs -2.9% in October.

China Buying Gold Again

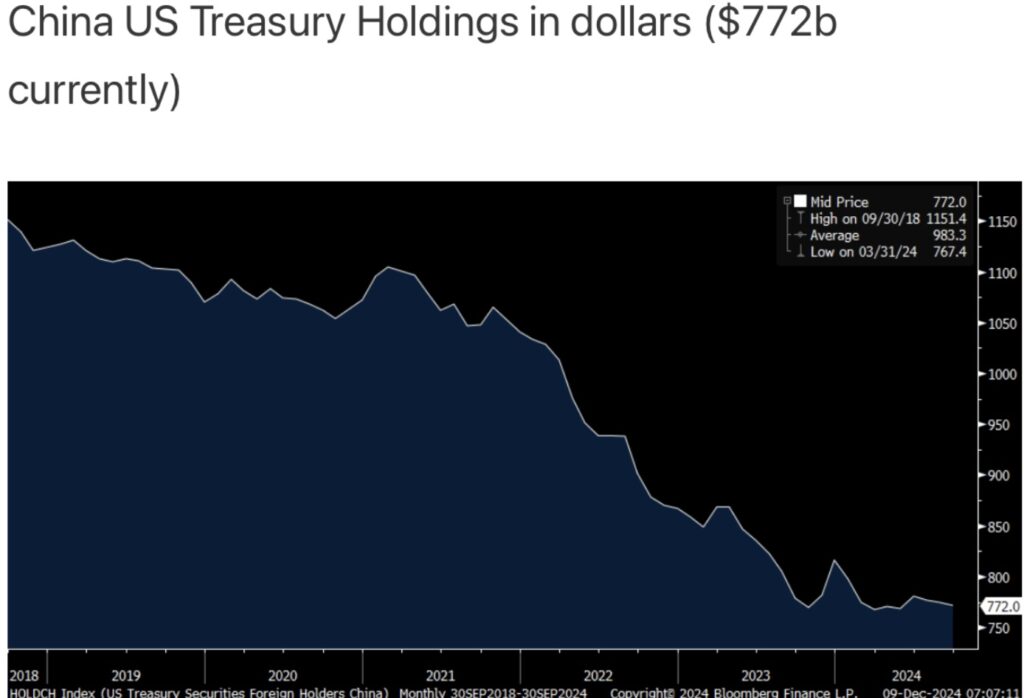

China too said they were back in the market in November buying gold, the first time since April according to the PBOC. Understand that the buying of gold has risen just as China’s holdings of US Treasuries have fallen.

Gold is higher by $18 in response to the news.

Billionaire Pierre Lassonde Says 2025 Gold & Silver Headed Higher!

To listen to legend Pierre Lassonde discuss how you can become rich investing in 2025, what he is buying right now with his own money, what people should be buying with their money, what to expect from gold, silver, miners and crypto in 2025 and beyond CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.