Silver’s Open Interest has collapsed, but look at what’s happening with gold…

Alasdair Macleod’s powerful audio interview has just been released (link below)!

Paper Demand Driving Gold Higher

August 30 (King World News) – Alasdair Macleod: Gold’s story has been all about insatiable Asian demand. But there are now signs that driven by a falling dollar, paper gold traders are joining the bullish camp.

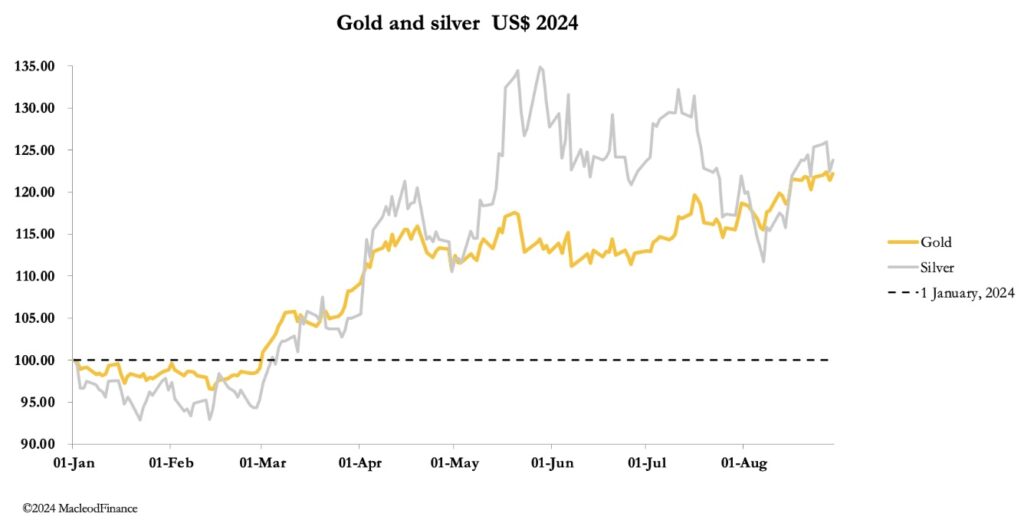

Gold and silver were in a holding pattern this week, with gold consolidating at all-time highs and silver consolidating a rally after a previous decline from early-July. In Europe this morning spot gold was $2524, up $13 on balance from last Friday’s close and silver at $29.50, was down 30 cents on the week. On Comex, gold volumes were low, while they were healthier in silver.

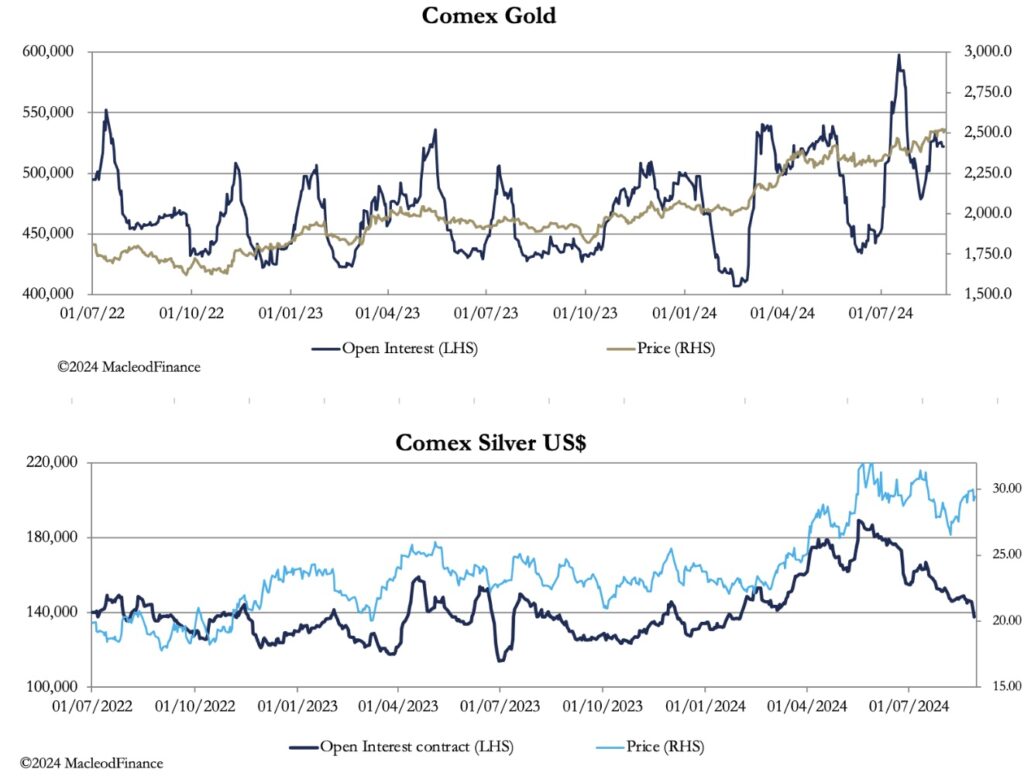

My next two charts contrast Comex Open Interest and the relationship with gold and silver prices:

Silver’s Open Interest Has Collapsed While Gold’s Remains Elevated

With gold’s Open Interest having declined from an overbought 592,000 contracts in mid-July, the recovery in buying interest has begun, putting a squeeze on the short side. Yesterday was notable because Open Interest jumped on provisional figures by 13,651 contracts when gold rallied $25 to challenge the intraday all-time highs seen on 20 August, before declining $8 towards the close. Technically, this is healthy, indicating that strong underlying support at $2500 is limiting the downside — enough to encourage buyers to take low-risk positions. Subdued levels of turnover confirm that selling pressure is minimal.

Silver is a very interesting but technically different story. While turnover has been relatively healthy for some time, Open Interest at 134,676 contracts is less than 24,000 more than the all-time low. Yet, if you look at the chart carefully, you will see that while Open Interest has continued to decline, the price has rallied strongly since 8 August, gaining about 12%. This is an extraordinary performance. Despite the heathy turnover in the contract, the underlying condition is of a significant and developing bear squeeze. It will probably not take much to drive silver significantly higher.

Comex was never intended to be a delivery market, yet that is what it has become. As this month closes out, there has not been one day when there have been no stand-for-deliveries in gold, and only one day in silver. Gold’s total from 31 July was 69.6 tonnes, and silver’s 161 tonnes. It cannot be emphasised enough that this changes the character and function of the futures market from a hedging mechanism to a source of bullion.

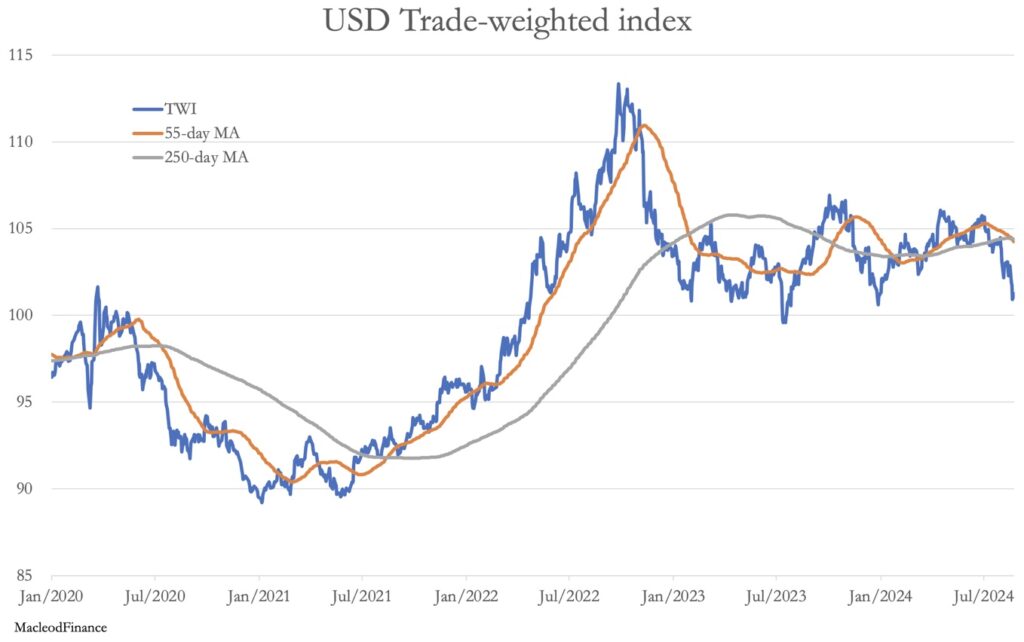

However, the gold future contract remains one leg of a pairs trade for hedge funds. We can be sure that they are not interested in anything other than timing the swings in and out of dollars, which is why the dollar’s trade weighted index is so important. This is next:

Having just established a death cross (where the price is under the moving averages, with both of them turning down and the 55-day crossing the 250-day — an extremely bearish development) we can be sure that any rally in the dollar’s TWI will be sold, and gold contracts bought. This condition foresaw Powell’s Jackson Hole speech, when he pivoted from interest rate policies for suppressing inflation to supporting the economy. There can hardly be a clearer signal that the Fed now tolerates a lower dollar.

So far, my market analyses have emphasised continuing demand for bullion from China and central banks, which are an early recognition by foreigners of the dollar’s decline. The story is now evolving, with futures (and no doubt London forward contracts as well) beginning to reflect growing demand for paper gold in western capital markets to hedge the falling dollar. That seems certain to drive gold and silver values higher, particularly given the lack of physical liquidity.

To summarise, there are now signs that driven by a falling dollar paper gold traders are joining the bullish camp. This is an extremely important development. Surely, it cannot be long before the entire investment management cohort wakes up to the consequences of being seriously underweight in gold, silver, and their proxies.

Just Released!

***To listen to Alasdair Macleod discuss the wild trading he expects to see in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.