Gold shingles again hitting another new all-time high as homebuilders continue to struggle.

Gold Shines Again

July 17 (King World News) – Naveen Nair, Citi Analylst: Gold prices have broken above prior highs, and the picture remains very bullish:

Gold’s Big Picture Remains Very Bullish

We are now coming close to strong resistance at $2500-2523 (psychological level and inverted head and shoulders indicated target). Beyond that, look for resistance at $2600-2613 (psychological level and short term double bottom indicated target).

Building blocks:

- Medium-term picture has remained bullish for a while, and in our past notes, we had highlighted the long-term inverted head and shoulders at play, with a formation indicated target ~2523.

- The cross higher in weekly slow stochastics also adds to the bullish picture

- Short term, we also see a double bottom formation at play with neckline at 2450 – yet another bullish indicator.

- Initial resistance is likely at $2500-2523, followed by $2600-2613. Support is likely at 2352 (55d MA), followed by 2277 (May low).

- Our CETS CTA tracker also sees gold at ‘max long’ positioning.

- Citi Commodities strategy forecasts gold at ~2500 in Q3.

Anybody Left To Buy At These Prices?

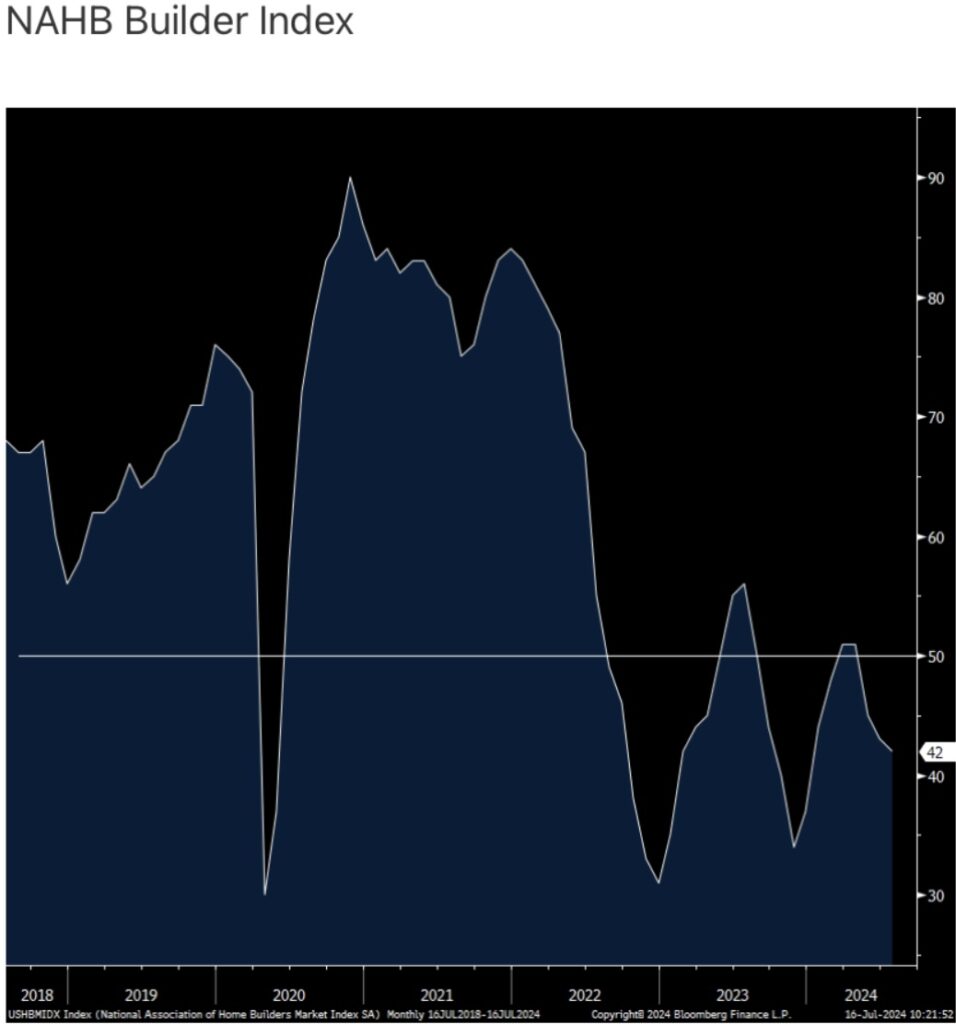

Peter Boockvar: The July NAHB home builder sentiment index fell 1 pt m/o/m to 42, the lowest since December and well below the breakeven of 50. The Present Situation and Expectations components were little changed at 47 and 48 respectively.

Home Builder Confidence Remains Collapsed

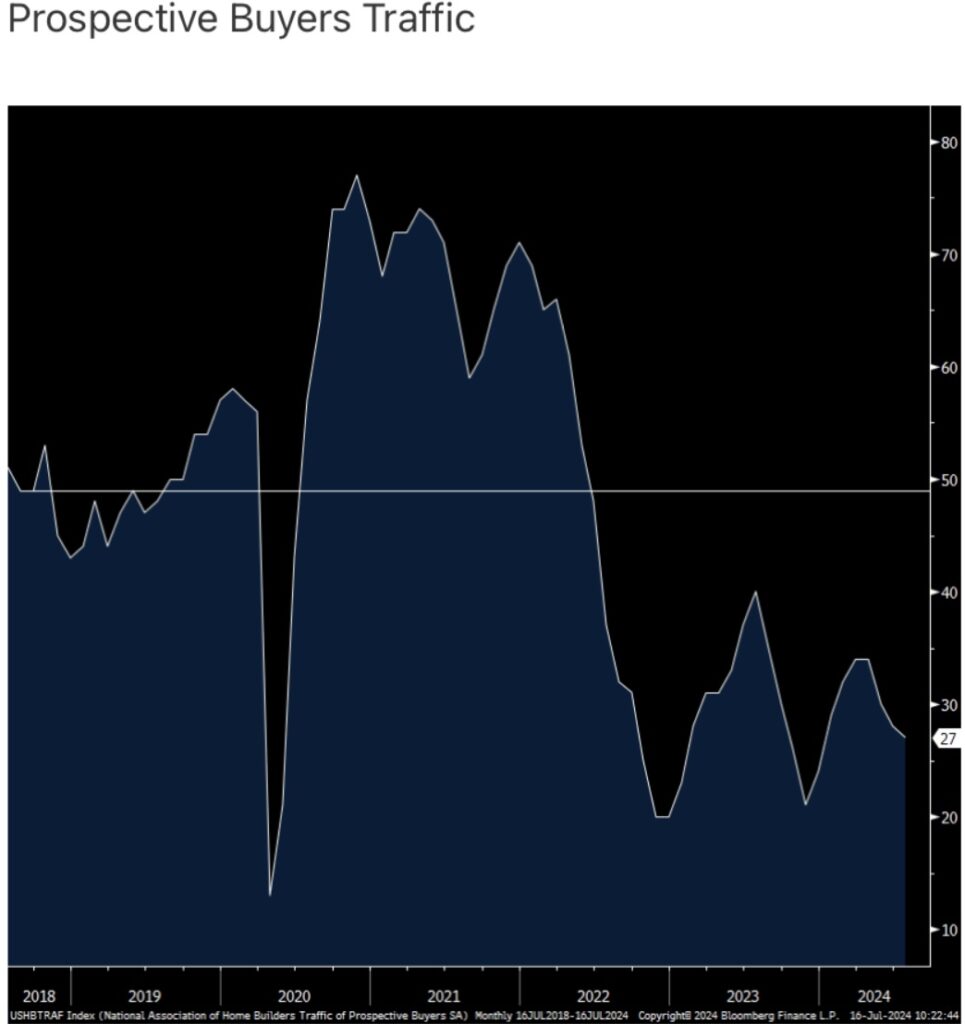

The real problem for the industry is while there is a need for more housing supply, at current prices and mortgage rates, the demand is somewhat muted. Evidence of this, Prospective Buyers Traffic came in at just 27, also the weakest since December.

Very Few Buyers Interested At These Price Levels

Of note, the NAHB said “that 31% of builders cut home prices to bolster sales in July, above the June rate of 29%. However, the average price reduction in July held steady at 6% for the 13th straight month. Meanwhile, the use of sales incentives held steady at 61% in July, the same reading as June.”

The bottom line, it remains clear to us all that buying a home right now is very expensive relative to one’s income for many, especially for first time home buyers. I will add to this builder sentiment weakness commentary with what Zillow said today in a press release on existing homes.

“Home listings are piling up as buyers step back from the peak of home shopping season faster than normal” said Zillow. Their chief economist said, “A growing segment of homes that aren’t competitively priced or well marketed are lingering on the market. Sellers are increasingly cutting prices to entice buyers struggling with affordability.”

That said, “Attractive listings are selling relatively quickly. But buyers still in the market are enjoying a few more days to weigh their choices than they had last summer.”

https://zillow.mediaroom.com/2024-07-16-Nearly-1-in-4-sellers-cut-home-prices-as-inventory-grows

I’ll add, the big builders of course have the ability to discount, as we’ve seen, and which has been effective but now existing home sellers realize they need to do the same in order to sell a house.

Manic Phase

King World News note: The opportunity in mining stocks as we work our way toward the eventual manic phase of this gold bull market will be one for the history books.

***To listen to Alasdair Macleod discuss how to make a fortune in this gold bull market CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.