Crude oil may attack all-time high as eurozone inflation hits 37.2%! Plus can you believe it, car sales and more…

All-Time High For Crude Oil?

June 2 (King World News) – Top Citi analyst Tom Fitzpatrick: Crude oil is back above horizontal resistance at $116.64 (Mar 24th high). A close above $116.64 this week, if seen, would complete a double bottom formation and could suggest a target of $140.35, with intermediate resistance at $130.35 (2022 high). A close above all mentioned levels, if seen, could suggest a test of $147.27 (all-time high).

Crude Oil May Attack All-Time High Of $147.27

Can You Believe It?

Peter Boockvar: I have to highlight again what is going on in European bonds as yields continue to rise. When we look back over the last 10 yrs and search for excess, negative interest rate policy was the epitome of it as it was the ultimate hot potato, and the air continues to come out of that epic bubble in response to high inflation and ECB rates that are still negative and QE is still ongoing for another week. The markets of course don’t wait around and they continue to do the central banks work. As for that negative rate pile of debt, it totals $2.46 Trillion as of yesterday’s close after peaking at $18.38 Trillion in December 2020.

Can You Believe There Is Still

Negative Interest Rate Debt?

Interest Rate Markets Are Moving In Europe

The German 2 yr bund yield is at the highest level since October 2011. For perspective, Mario Draghi said ‘whatever it takes’ in July 2012 when attacking the spike in European bond yields and he went down the negative rate path in June 2014. The 10 yr yield at 1.21%, up another 2 bps today, is at a level last seen in August 2014. The French 10 yr yield at 1.73%, up 3 bps, has now gotten back all of the yield decline after June 2014. All eyes though on Italy as this is where the biggest amount of sovereign debt lies on a country basis. The Italian 10 yr yield is up 200 bps this year to 3.25%, up 5 bps today. It was at 3.00% right before ECB deposit rates were taken below zero. The Italian 10 yr BTP yield spread to the German 10 yr bund yield is at 204 bps, the widest since May 2020. Its peak wide was 552 bps in November 2011, 7 months before Draghi said what he said in July 2012 and was 327 bps in late 2018 when budget worries were at its loudest.

Italian vs German Yield Spread Highest Since 2020

Switzerland, the home of the deepest negative rate central bank policy at -.75%, saw its May CPI rise 2.7% y/o/y vs 2.3% in the month prior. That’s the fastest rate of change since September 2008 and the 2 yr Swiss yield is up 5 bps at .12%.

Swiss 2 Year Yield Fastest Change Since 2008

It’s of course barely above zero but it’s the highest in 11 years, thus getting back all that was lost when the SNB went negative with rates. Their 10 yr yield is up for the 6th straight day and by 26 bps in this time period. The SNB will likely follow the ECB in raising rates.

Yields also rose in Asia, with the Australian 10 yr yield in particular rising by 8 bps to 3.50%. The Japanese 10 yr yield closed at .241%. The 40 yr JGB yield is less than 1 bp from a 6 yr high.

Japanese 40 Year Closing In On 6 Year High!

I’ll say for the umpteenth time, analyze US inflation and growth stats all you want in trying to predict where long term rates go but if you’re not taking into account the influence of movements in overseas bonds, you’re not looking at the full picture. We’re all in this bond move together.

ALERT:

Billionaire and mining legend Ross Beaty, Chairman of Pan American Silver, just spoke about what he expects to see in the gold and silver markets and also shared one of his top stock picks in the mining sector CLICK HERE OR ON THE IMAGE BELOW TO HEAR BEATY’S INTERVIEW.

US Vehicle Sales

US vehicle sales in May totaled 12.68mm, a full 1mm below expectations and compares with 17mm in May 2021 and vs 14.3mm last month. Keep in mind, this is a recession level amount of car sales. It was 12.21 in May 2020.

US Auto Sales At Recession Level

Normal should be 17-18mm but we know much of the shortfall is because there aren’t enough new cars but I have to believe some now is due to the rising cost of financing a record high average price of a car and truck.

Sentiment

The bounce in the stock market lifted sentiment over the past week. Investors Intelligence yesterday said Bulls jumped to 35.2 from 28.2 while Bears fell 2.8 pts w/o/w to 38. AAII today said Bulls rose 12.2 pts to 32 and that is the highest since late March. Bears fell 16.4 pts to 37.1 and that is the least since late March. Bottom line, Bears still dominate but there is nothing like a rally to soften that sour mood and it was that very downbeat view that was the contrarian set up for the bounce. Where do we go from here? I expect more Bulls to hop on board and less Bears to show up before the next leg lower in this bear market that still needs to run its course with QT the next catalyst. It gets to that $95b per month in September.

Eurozone Inflation

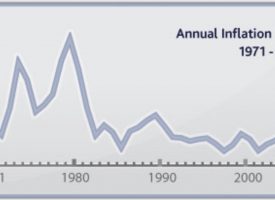

A few days after reporting the 8.1% y/o/y increase in CPI for the Eurozone in May, today we saw April PPI and it was up 1.2% m/o/m and 37.2% year over year.

Eurozone Inflation Hits 37.2%!

That though was a bit under expectations but who cares with these robust rates of change. Either this is tinder for much more consumer price inflation or European companies are on the cusp of a huge profit margin contraction. It will likely be a combination.

JUST RELEASED: Get Ready For A Collapsing Global Economy And The Crack-Up Boom CLICK HERE.

JUST RELEASED: Mind Blowing Charts And Comments On Inflation, Stocks The Economy, Rent Interest Rates, Gold & Silver CLICK HERE.

JUST RELEASED: The Flight Continues CLICK HERE.

JUST RELEASED: CAUTION: This May Not Be A Bear Market Rally After All CLICK HERE.

JUST RELEASED: BUCKLE UP: This Monster Is Going To Be Highly Disruptive For Global Markets CLICK HERE.

JUST RELEASED: Greyerz – We Are Witnessing The Bursting Of A $3 Quadrillion Global Bubble CLICK HERE.

JUST RELEASED: Most People Don’t Have A Clue How Bad Things Are CLICK HERE.

© 2022 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.