With fear gripping world markets after the recent plunge in stocks, here is where things stand today.

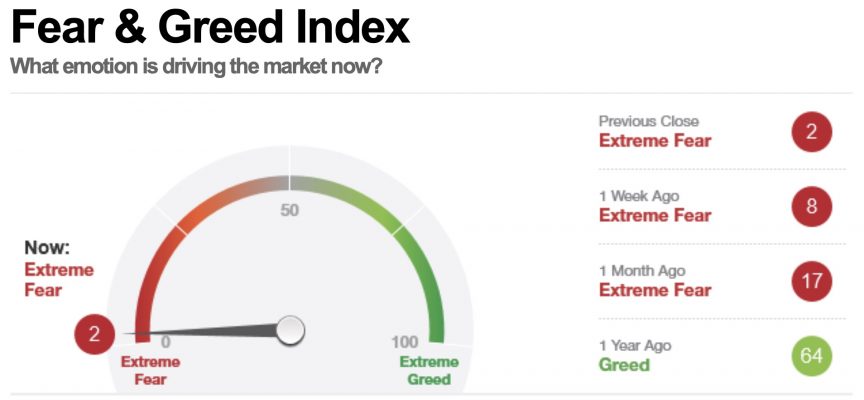

Gold and silver continue to surge as extreme fear grips world markets. Gold is up $8 in early trading and silver has surged 31 cents to break above the $15 level. This is the highest level for gold in six months. Meanwhile, the Fear & Greed Index just registered a reading near zero (see below).

Fear & Greed Index Hits One Of The Most Extreme Readings Ever!

Regarding the collapse in the stock market…

December 26 (King World News) – Here is a portion of what Top Citi analyst Tom Fitzpatrick had to say about the collapse in the S&P: “The S&P has continued to fall and break pretty much all the important supports but one…

BONUS INTERVIEW:

To listen to Doug Casey’s just-released KWN interview discussing his prediction of financial and economic chaos and a panic into gold CLICK HERE OR BELOW:

Fitzpatrick continues: “The 200 week moving average stands at 2,348 and was the most aggressive of targets once we saw the weekly close below the 55 week moving average (see chart below).

S&P Update: No Christmas Cheer

… A move here has been the most aggressive correction that we envisaged. Only a weekly close below, if seen, would cause a reassessment of that view.”

King World News note: The gold market continues to the primary beneficiary of the plunge in global stock markets. This is exactly how gold was expected to trade during the unwind of one of the most historic bubbles in history. Expect the gold market to continue to trade inverse to the stock market.

***KWN has released one of the most important interviews of 2018 CLICK HERE OR ON THE IMAGE BELOW.

ALSO RELEASED: STOCK MARKET COLLAPSE CONTINUES: Meanwhile, The Gold/Oil Ratio Is Skyrocketing! CLICK HERE TO READ.

***KWN has now released the remarkable audio interview with legend Pierre Lassonde and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2018 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.