2024 is shaping up to be one of the most important years in human history.

2024 Economic Forecast: Peace or Chaos?

January 2 (King World News) – Dr. Stephen Leeb: The year 2024 is shaping up as potentially one of the most consequential in human history…

To put it simply, the fate of mankind revolves around humanity’s ability to cooperate with one another. Yet, we find ourselves embroiled in conflict and chaos instead of finding peaceful avenues of cooperation and sustainable solutions.

The most existential problem the world currently faces is the shortage of critical resources. All nations should be involved in finding viable ways to properly assess and distribute natural resources for the near and longer term. Additionally, there should be a global coalition dedicated to developing technologies in an effort to deal with inevitable commodity shortages… Instead we find ourselves in an upside-down world where chaos takes the center stage and peace is nowhere to be seen on the horizon.

Quite frankly, the long-term consequences of the lack of global cooperation on this planet include the extinction of our species. If you think that’s a far-fetched concept, it’s not.

The shorter-term consequences of humanity’s lack of cooperation could lead to runaway climate change, continuous wars over resources, or even a nuclear conflict.

Some of the other consequences of limited natural resources and critical commodities- of which we are already witnessing in the United States– is declining living standards. The most salient statistics include rising mortality rates, combined with the sharp decline in living standards due to high inflation. The worsening of these two conditions could lead to massive internal strife in a number of developed countries, including the U.S.

The Fiscal Impact of The Ukraine War

Shortly after the war in Ukraine began, I said that Ukraine would be a point of inflection.

What did I mean by that?

I meant that the Ukraine War would mark the end of business as usual for many countries and indeed for the world as a whole. Specifically, I felt the war would end up forcing the U.S. to either choose to cooperate with the global South and East or find itself in an intolerable economic and geopolitical situation. This assessment was based on my early prediction, that Russia would prevail in the conflict. Unfortunately, both of these predictions turned out to be on the mark.

The Ukraine war has marked the end of U.S. hegemony and the beginning of a new world order. If we are willing to cooperate with other major countries- it will give us a chance to rekindle our mojo– which America has been steadily losing over the past half century. If the United States refuses to cooperate, the consequences in economic terms are either runaway inflation or an economic cataclysm that will make the Great Depression look like balmy times.

Indeed, it does not take a financial wizard to see how times have already changed in the U.S. The current economy is unlike any we have ever seen.

For example, by most traditional measures the economy appears solid. The unemployment rate is merely a few ticks above levels last seen roughly 70 years ago. Unemployment insurance claims have remained at historically low levels for many months. With such excellent employment statistics it should not be surprising to find that year-over-year GDP growth, considered the broadest measure of overall economic performance, is about 30% above its 10-year average.

How The Pandemic Has Cost Us Dearly

It shouldn’t be surprising that in the face of ostensibly strong growth that inflation, though lower than levels seen in the aftermath of the Pandemic, was still above Fed targets. The Fed’s favorite inflation measure – the core personal consumption indicator excluding food and energy – stands at 3.2%. This statistic is above the average when factoring the past 20 years and certainly above the Fed’s target of 2%.

This relatively high inflation figure is one major reason the Fed has decided to take their foot off the proverbial ‘monetary brakes’ as stated at the last meeting of the Open Market Committee. The Fed announced they intend to reverse course and begin quantitative easing.

Though not unexpected, this change in direction in the face of a strong economy and still relatively high inflation is without precedent. Historically, a strong economy and above target inflation are ideal conditions for applying the’ monetary brakes’ not the complete opposite- which is reversing course. But as aforementioned, these are not normal times.

The Pandemic has cost us dearly in many ways… Let’s start with things that are not widely known or discussed.

Students of all ages and income brackets suffered enormously. For example, when schools reopened, testing showed unmatched loss in proficiency in critical subjects. Prior to the Pandemic, according to national testing, about 34% of 8th graders were proficient in math. On the contrary, following the Pandemic, the percentage has dropped to 26%. One of the country’s leading experts on education, Stanford chaired professor, Eric Hanustrek, estimated the lifetime cost to all students will be approximately $30 trillion.

There is also strong evidence that our current labor force also lost skill sets.

Surveys of small businesses after the Pandemic indicated an extraordinary anomaly. These surveys, which have about a 50-year history, assess business optimism on various scales. Typically, feelings about the overall economy are correlated with how hard it is to find competent labor. When it’s tough to find workers, businesses tend to be optimistic about the overall economy because a tight labor force indicates a strong economy.

For more than a year, small businesses’ overall optimism about the economy has been near record lows, while ability to find qualified labor, which has typically been easy with poor economic prospects, is also at a record low.

Not only does this strongly suggest a loss of skills in the labor pool, but also indicates that the strong growth reported is largely confined to big businesses – who can out bid the smaller firms for the shrinking skilled labor pool. That’s a terrible sign for the future, not only because of the widespread loss of skills but because small businesses are the largest source of new employment – and considered the lifeblood of the overall economy.

This huge difference between big and small – so true at the corporate level – is even more apparent at the household level. In 2022 the median (50th percentile) after tax household income for a family of four was a bit shy of $65,000, according to the census bureau.

Most estimates agree that necessary material expenses – food, transportation, and shelter – for a four person household come to about $50,000. Financial expenditures which range from credit card debt to real estate taxes come to $10,000 for that same typical American family.

Now throw in the estimate of about $4,500 for education and our typical American family has to cut their own hair, while greeting cards substitute for presents. You get the point… About half of American families are barely getting by or caught in a downward spiral. Above the 50th percentile, the range stretches from ‘just getting by’ to living like emperors of old.

The dichotomy between big and small – which permeates all parts of our world – have been magnified by America’ extraordinary debt level. In the wake of the Pandemic, enormous amounts of government money (meaning borrowed money) increased the already historically high debt levels in the United States.

Massive funds were necessary to keep a major portion of the country from starvation. Many small businesses had shut their doors and larger companies had no choice but to lay off staff. Moreover, landlords were squeezed by the inability of tenants to meet monthly rent payments, threatening the solvency of landlords while increasing evictions.

Hundreds of billions of dollars were needed to keep the country from disintegrating. At the same time, tens of billions were invested in bolstering the underpinnings of corporate America, which even before the Pandemic had become a shadow of a once great colossus.

America’s Covert Interest In Ukraine

Then came Ukraine – which proved to be the proverbial ‘straw that broke the camel’s back’ in American hegemony.

In other words, the Ukraine war became the final and indisputable sign that the West – America and Europe – will not preside over a unipolar world. It’s become obvious that the United States provoked the Ukraine war with the hope we could destroy Putin and his hold on Russia’s endowment of resources.

Beyond question, Russia’s endowment of natural resources is the broadest and deepest of any country in the world. Destroying Putin would also destroy the strong alliance that has formed between Russia and China. This dynamic duo combines massive resources with world leading overall scientific achievement.

What would a conjoined border between Russia & China look like? It’s not so unrealistic of a scenario to envision Mongolia and Kazakhstan being absolved in the mix.

As a kicker, combine these two giants and you have manufacturing prowess that easily tops that of the entire West. Noteworthy is that Russia is rarely considered as a major manufacturer, assumed to be topped by many European countries from Poland to France to Germany. Yet, estimates show that Russian production of war materials topped that of the entire West by over 5:1, which was a major reason Ukraine is losing the war.

I have written extensively about my strong conviction that America’s support for Ukraine was an attempt -by proxy- to destroy Russia. Still, I‘m sure without utterly credible sources, I would have found it difficult to fight the unceasing propaganda.

Furthermore, it should be mentioned that for whatever reason, if someone wants to argue that Putin is a psychopath, which motivated the West to take every possible step to stop him before he spreads his poison throughout the globe, it doesn’t make any difference. Indeed, even if that were true, it would only mean the outcome of the Ukraine war would be markedly worse.

Money Just Can’t Save The Day…

Although I have written repeatedly about the godless West, I still cringe whenever the thoughts come forward. In just half a century, America, the greatest democracy the world has ever seen… A country with a seemingly unshakeable moral foundation… A country which was able to dominate the world in multiple facets of life, ranging from sports to technology to health care to education, has fallen to depths that can be compared morally to the most extreme right-wing government the world has ever witnessed.

America has become a country that believes any problem confronting the nation can be solved with money. And it’s perhaps fitting that the utter failure of money to have any effect on the outcome of the war in Ukraine was the final blow to the chimera of U.S. unlimited power.

To prove this point even further, the financial sanctions imposed on Russia were designed to deprive necessary funds to acquire critical imports for its economy and war efforts. These sanctions didn’t just fail miserably… They blew up and backfired in America’s face when Russia usurped SWIFT and began making international trade agreements in just about every currency aside from USD.

And ditto for China, where sanctions were largely responsible for the country’s unprecedented advances in science and technology. Another survey by Nature of the fastest growing science and technology over the past five years showed 99 out of 100 were Chinese. If Nature wasn’t so highly regarded in the West, I simply would not have believed this statistic. Regardless, it’s probably the most vivid example of how money and one of its by-products- sanctions- have rendered useless.

The geopolitical consequences of America’s missteps should become clear in 2024 and 2025.

The Rise of The Eastern Bloc

BRICS – originally an acronym for Brazil, Russia, India, China, and South America, has morphed into a rapidly growing bloc of nations consisting of the original five, plus other developing countries held together by shared economic goals. The word on the street is that BRICS intends to establish a new exclusive currency.

My speculation… The BRICS monetary system will likely contain a basket of digital currencies, backed by gold. You can read more details of this theory in my latest book, published in 2018, China’s Rise and the New Age of Gold, available on Amazon.

Six countries were added to BRICS at their 2023 summit. Four of the six, Egypt, Iran, Saudi Arabia, and the UAE, are all located in the Middle East. The current BRICS members, though barely topping double digits, has become the most important resource bloc of nations in the world.

Major announcements of BRICS usually come at their summits. The next BRICS summit will occur in Kazan, Russia in October 2024. Not only will new members be proclaimed – which could be any number of the 40 countries that have expressed an interest in joining– plus an announcement regarding the new BRICS currency. In the meantime, evidence of the geopolitical clout of the bloc is already evident.

My final thoughts on BRICS started me thinking – very speculatively – that the beneficiaries of the Israeli conflict could buy the entire Middle East. Clearly one of the top intelligence agencies, Massad, was caught flat-footed by the Israeli invasion. China is one of the few, maybe the only country that could have created conditions that made Massad think there was no threat. My guess- at an admittedly hideous cost- Israel will be mostly successful. Also likely… Netanyahu will lose power. My prediction is that Israel ends up joining BRICS, probably not in 2024 but in 2025.

This raises one question for which I do not have a cogent answer.

Will the U.S. see the writing on the wall and make peace rather than follow its path of etiolation?

My hope is that the United States recognizes what is inevitable and the world will become a cooperative. Quixotic? Hopefully not, for the benefit of the world and also for the U.S, which still has time to recapture a great deal of what they have lost… Before it’s too late.

SWIFT Sliding Down A Slippery Slope

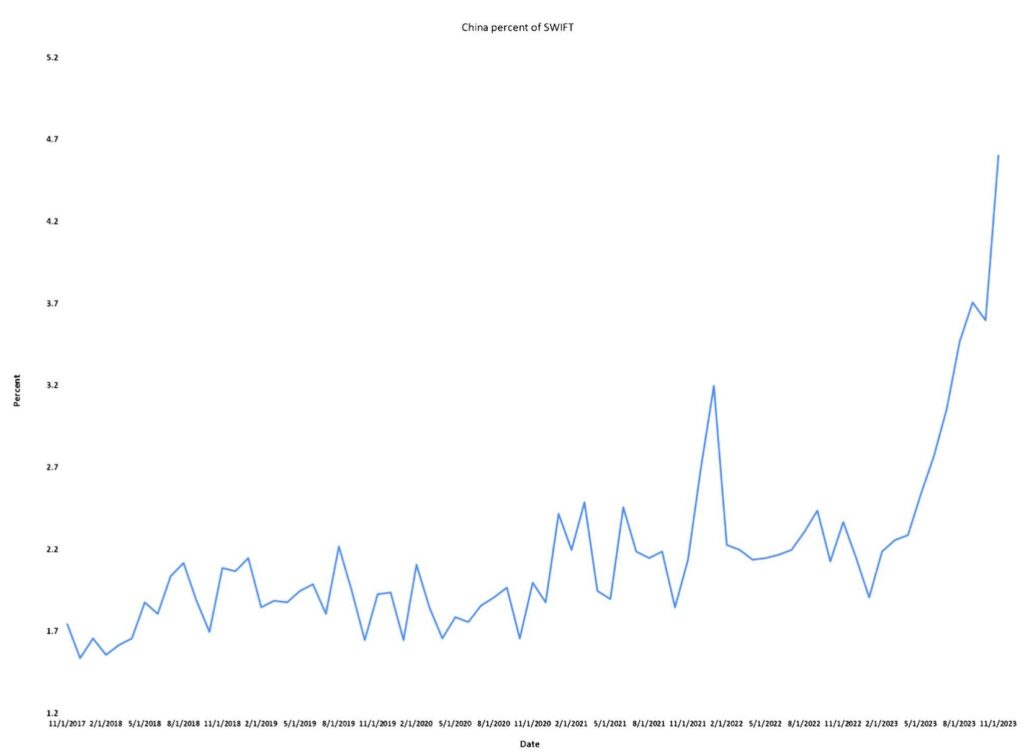

Here is a chart, which could convince America that its most powerful lever for controlling worldwide trade is rapidly losing its clout. The U.S. controlled SWIFT system is used to facilitate trade among countries. The ability of a country to use SWIFT depends on how many of the 11,000 financial members are willing to accept the country’s currency as a form of international currency.

The chart speaks for itself. About a year after the Ukraine War started and it became clear that not only was Ukraine losing but that the sanctions were boomeranging, the rapid, near exponential ascent of the Chinese yuan’s use in SWIFT began.

America, in other words, was losing control of its last vestige of power – the power over the flow of money. The chart also makes clear that Ukraine was indeed the point of inflection.

My strongest hope is that America elects to cooperate with BRICS- in a best scenario– join the organization. It’s utterly apparent that if America choses cooperation, the entire world economy would be better off. The chances of achieving a sustainable economy would be sharply enhanced and the U.S. would be given another chance to prove to the world what a critical role it could still play.

Final Thoughts…

Whatever decision America makes, its catastrophically high dollar debt guarantees a lot of inflation. By not joining with BRICS, America could come to resemble the Weimar Republic in the wake of WWI. Hyperinflation would become a serious possibility. By joining, the piper would still be paid off but with much milder consequences. Albeit, there’s no way the United States magically averts record inflation.

One piece of critical advice is to own gold. Gold, I believe, is destined for fantasy-like heights. First because it will need to be reevaluated in the wake of its role in the new BRICS currency. Second, because it’s the only hedge against runaway or very high inflation. In wake of the worst hyperinflation ever recorded, no asset better protected citizens of the Weimar Republic than gold.

And there’s a reason that gold is so special – it’s the most beautiful material on the planet. This unmatched beauty has been recognized for as long as humans have walked the earth. Beauty has long been viewed by philosophers, poets, and even scientists as inseparable from the divine and spiritual. Long-lived civilizations arguably survived because they recognized the specialness of gold. Gold is the only material that can bridge the gap between the spiritual, which defines each of us uniquely and the material, which defines our shared world. Because of its uniqueness… Gold has a timeless role as a store of value and is essential in any monetary system, essential as the only adjunct that can tame the evil that comes from worshiping money.

To listen to Alasdair discuss how 2024 will kickoff for gold, silver, and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.