This is what is causing swings in global markets today.

July 9 (King World News) – Peter Boockvar: As he said last week in Sintra, Jay Powell is maintaining his more balanced view on the economic outlook and the two mandates they focus on but with a window towards easing.

“We continue to make decisions meeting by meeting. We know that reducing policy restraint too soon or too much could stall or even reverse the progress we have seen on inflation. At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face. Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

The bold is mine and we know the Fed is now more closely watching the labor market.

And,

“Over the past two years, the economy has made considerable progress toward the Federal Reserve’s 2 percent inflation goal, and labor market conditions have cooled while remaining strong. Reflecting these developments, the risks to achieving our employment and inflation goals are coming into better balance.”

Reflecting the easing bias,

“The Committee has stated that we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent. Incoming data for the first quarter of this year did not support such greater confidence. The most recent inflation readings, however, have shown some modest further progress, and more good data would strengthen our confidence that inflation is moving sustainably toward 2 percent.”

Late Day Update

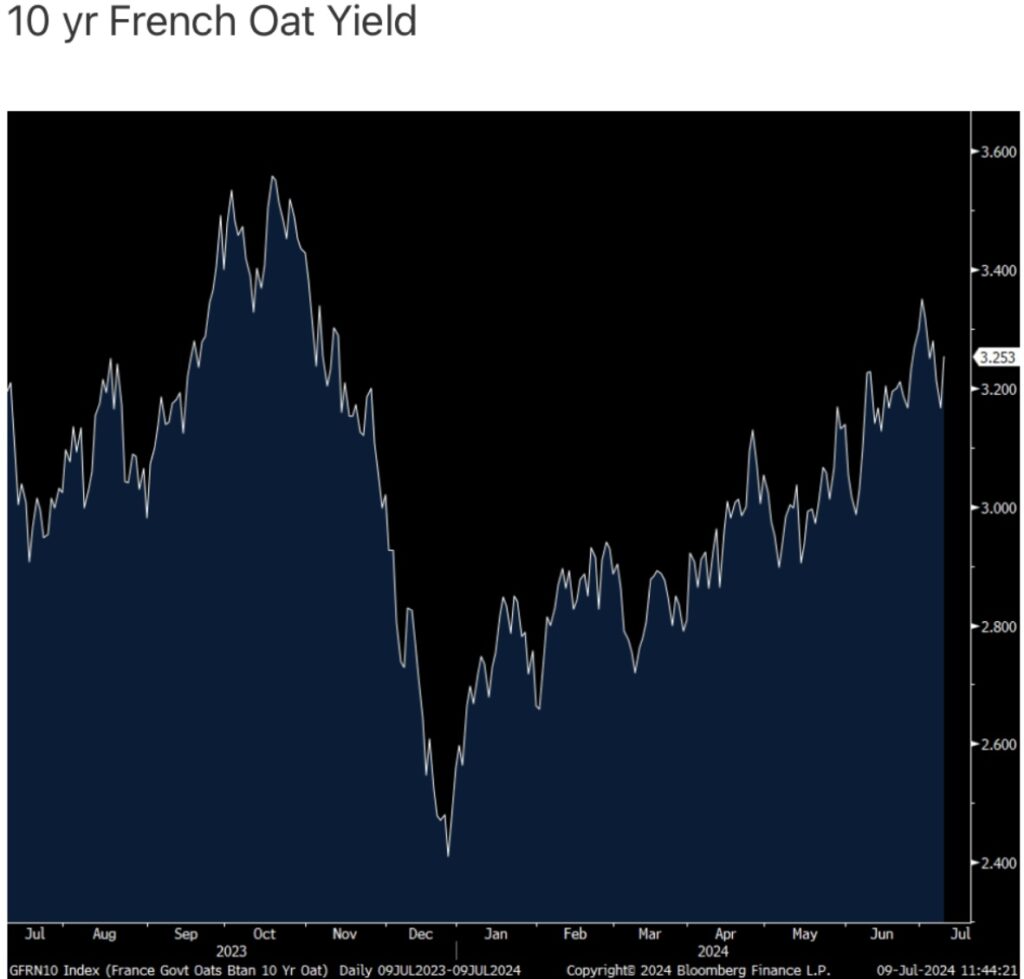

It’s possible that the rise in US yields as Powell speaks is not because of what he is saying, which is nothing really new, but in response to the bond sell off going on in Europe today with French yields up the most.

Yesterday’s note from Boockvar regarding the French elections:

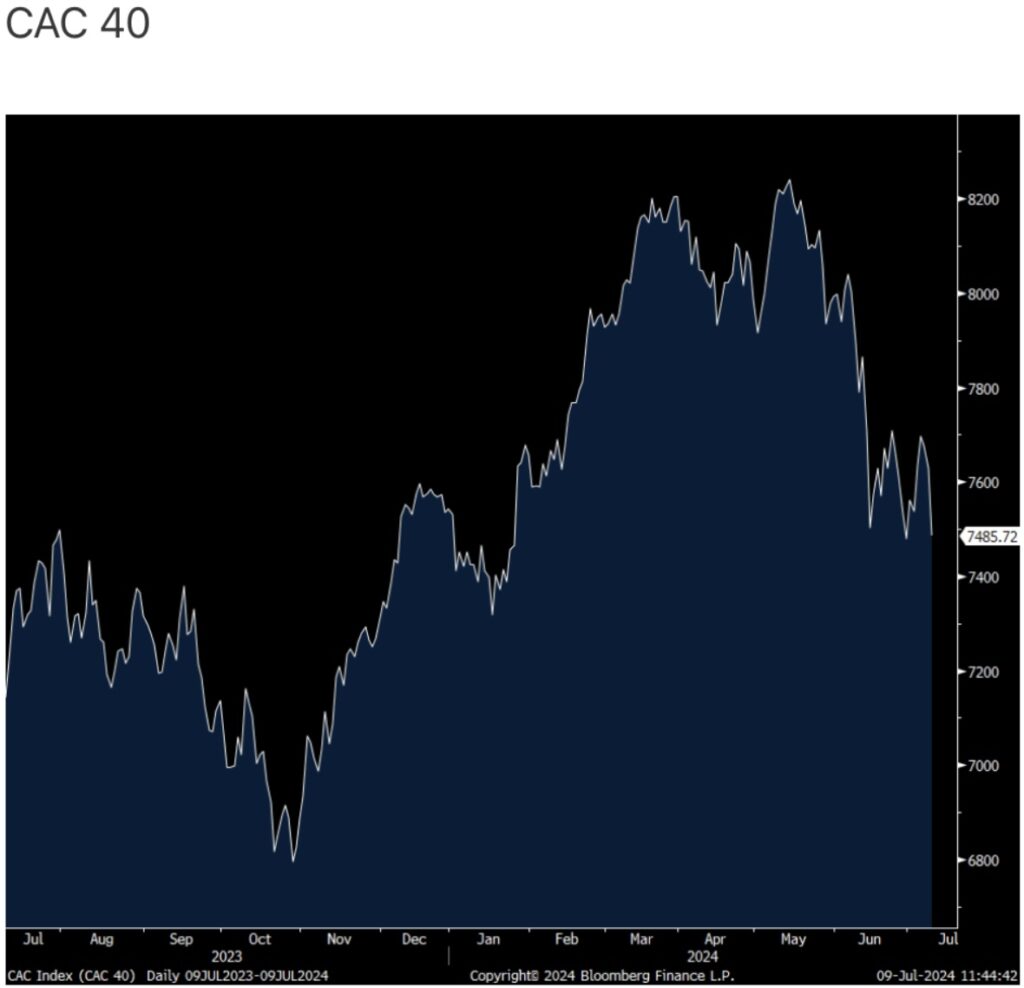

You’ve got to hand it to French politics that the desire of keeping out Marine Le Pen’s ‘far right’ (as referred to by many) party ended up electing more ‘far left.’ Strictly from an economic perspective the latter is worse than the former because of its anti-business belief in socialism (and whose leader is a blatant anti-Semite) but because Macron’s party did better than feared, gridlock and/or political paralysis is being celebrated, albeit barely as the CAC 40 is up about .25% and oat yields are little changed as is the euro.

Today: Reality Is Setting In

The 10 yr French yield is higher by 9 bps after falling by 4.5 bps yesterday in immediate response to the elections.

And the CAC 40 is down by 1.8% taking its year to date performance back to negative, by almost 1%.

The reality of governing is now upon whatever new government gets formed and managing their excessive debts and deficits is what investors are most focused on.

King World News note: As Greyerz noted in his King World News article, as political chaos is unleashed across the globe in 2024, gold and silver will surge far higher than what is being quoted today.

Shocking Parabolic Gold & Silver Moves Are Coming!

To listen to Michael Oliver discuss the shocking moves he predicts for gold and silver CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to James Turk discuss why the gold and silver shorts may be in for a 2010-2011 event that rips their heads off CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.