The United States is facing a catastrophic situation, plus are they going to eliminate private property rights in the US?

“Houston, we have a problem.”

April 25 (King World News) – Alasdair Macleod: Now that short-term funding through Treasury bills must be nearly exhausted, how will the US Treasury fund the budget deficit, running at well over $3 trillion this year?

According to the US Treasury, the two largest buyers of US Treasuries have been Japan and China. Japan is now the largest holder, but this reflects the interests of mainly pension funds, insurance companies, and a carry trade. Most of the $775 billion recorded as Chinese is the Chinese government itself, making it by far and away the single largest holder. This is because China exercises exchange controls, thereby limiting foreign investment by domestic institutions. And in the past the Peoples Bank has accumulated dollars and US Treasuries (and gold) as a consequence of trade surpluses…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Britain and others are also listed as major holders. But as in Japan’s case, these are not holdings of government agencies and cannot be influenced by the US Treasury directly. This is why the US Treasury is liaising with the Peoples Bank and China’s treasury officials, trying to persuade them not to sell but to buy more US Treasuries. Being in a debt trap, the Americans will be desperate to secure funding without interest costs rising making a deteriorating government debt position even worse.

So far this fiscal year, the Treasury has been funding its deficit through Treasury bills, short-term discounted instruments for which it currently pays the equivalent of over 5%. But there comes a point where excess liquidity in money funds and bank balance sheets runs out, and the Treasury must contemplate term funding along the yield curve. Banks will be reluctant to take on duration risk, and anyway will want to reduce their balance sheet leverage in a struggling economy. As the largest single holder of US Treasuries this is why China matters.

China’s authorities now have an important decision to make. Do they bail out the Americans, or do they cut their losses on $775 billion?

A Very Big Decision

King World News note: The decision by the Chinese, who have serious problems with their own economy, is going to have a massive impact on the interest rate market in the United States. It will also impact the US dollar and gold. Regardless, there is nothing that will stop the secular bull market in gold. As Richard Russell used to say, “No government or central bank on earth can stop the bull market in gold from fully expressing itself.”

Real Estate

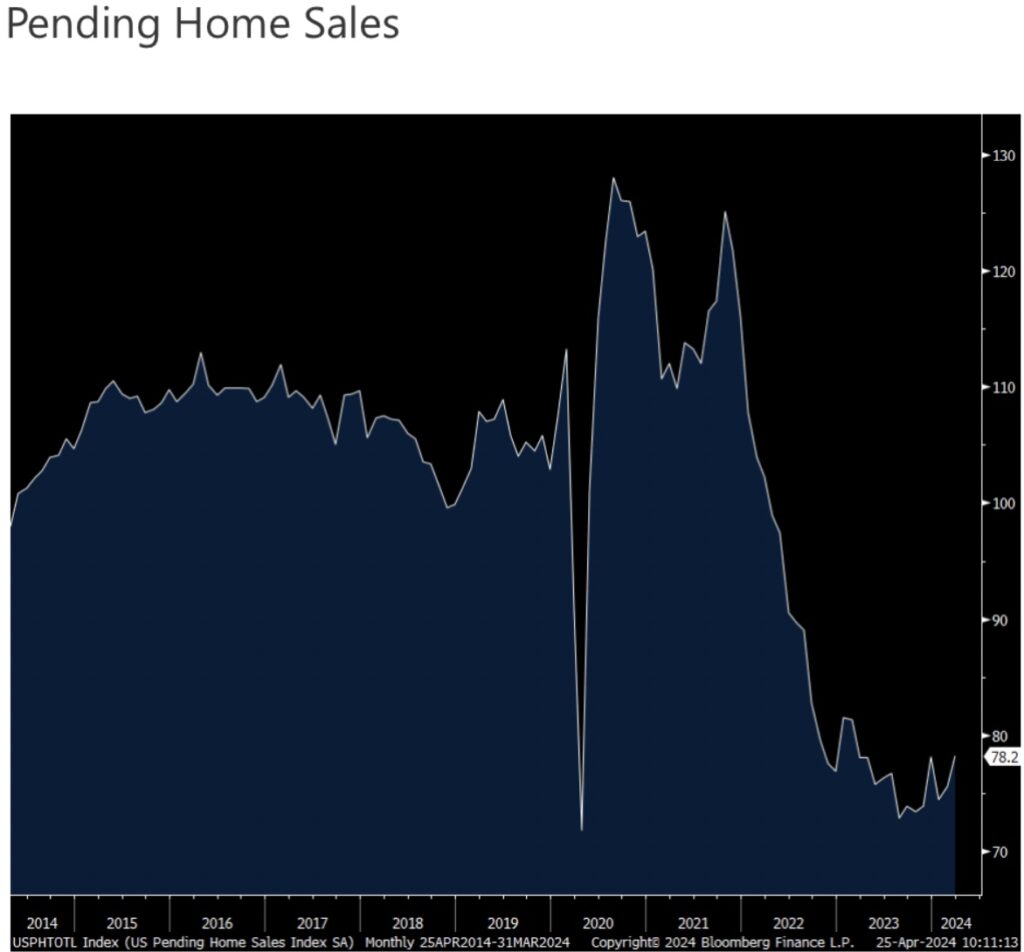

Peter Boockvar: Pending home sales in March rose by 3.4% m/o/m, above the forecast of up .4%. Three out of the 4 national regions saw a rise but as seen in the chart, we’re sort of bouncing along the bottom both due to limited inventory of existing homes and high prices along with a 7%+ mortgage rate which makes it tough for many first time buyers.

The NAR said the index level of 78.2 is the highest since February 2023 but “still remains in a fairly narrow range over the last 12 months without a measurable breakout. Meaningful gains will only occur with declining mortgage rates and rising inventory.”

This Is What Mainstream Media Is Celebrating Today?

Bottom line, we’re well aware of the bizarre housing market with a near 30 year low in the pace of existing home transactions but with a better situation for new homes that are needed to fill the inventory vacuum.

Elimination Of Private Property Rights In The US?

King World News note: Many people believe there is a move being made in the United States, over time, to eliminate private property rights. The first step in that direction is to make housing unaffordable to the masses through a combination of high pricing, high insurance costs, high property taxes, and the entrance of participants who in the past were not traditional buyers of single family housing and condos.

The entrance of AirBnB into the housing market along with Wall Street has propelled housing and condo prices to all-time record highs. We will now have to see if the housing market is allowed to have a brutal correction or if the forces mentioned above continue to artificially prop up prices, reduce the amount of private property held by individuals, and increase the amount of property held by corporations.

If the latter scenario unfolds, and the masses can no longer to afford to own private property, the masses could be more easily persuaded to eliminate private property rights under the guise of making housing available to everyone as a right. In other words, the state would supply the housing after confiscating it from private property owners. To make this a reality they must radically bring down the percentage of people that own property. That is what some people fear will unfold in coming years.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.