Silver is now consolidating massive gains, but take a look at this…

May 30 (King World News) – Maria Smirnova, Managing Director at Sprott Asset Management: The global energy transition requires many critical materials, including silver, which plays a significant role. Although renewable power generation and battery storage technologies may conjure visions of cobalt, lithium and nickel, we would argue that silver plays an even more fundamental role across several clean energy technologies, which we discuss here.

Silver’s Recent Rally

Following a year of flat performance (silver gained 0.66% in 2023), thus far in 2024, silver has staged a strong rally, climbing 32.93% as of this writing (YTD through 5/27/2024). Silver has been playing catch up to gold’s rally, with both metals buoyed by the prospect of easing monetary policy in the U.S., rising geopolitical turmoil in the Middle East and central bank buying, particularly from China. Silver faced several headwinds in 2023, most notably rising interest rates and slower economic growth in both the U.S. and China. While the physical silver market was robust in 2023, Western investment demand was tepid, with silver bullion ETFs shedding approximately 50 million ounces during the year and representing more than 6% of holdings. Looking ahead, we expect silver prices to continue to improve, driven by lower interest rates, more robust physical investment, ETF purchases and increased industrial demand.

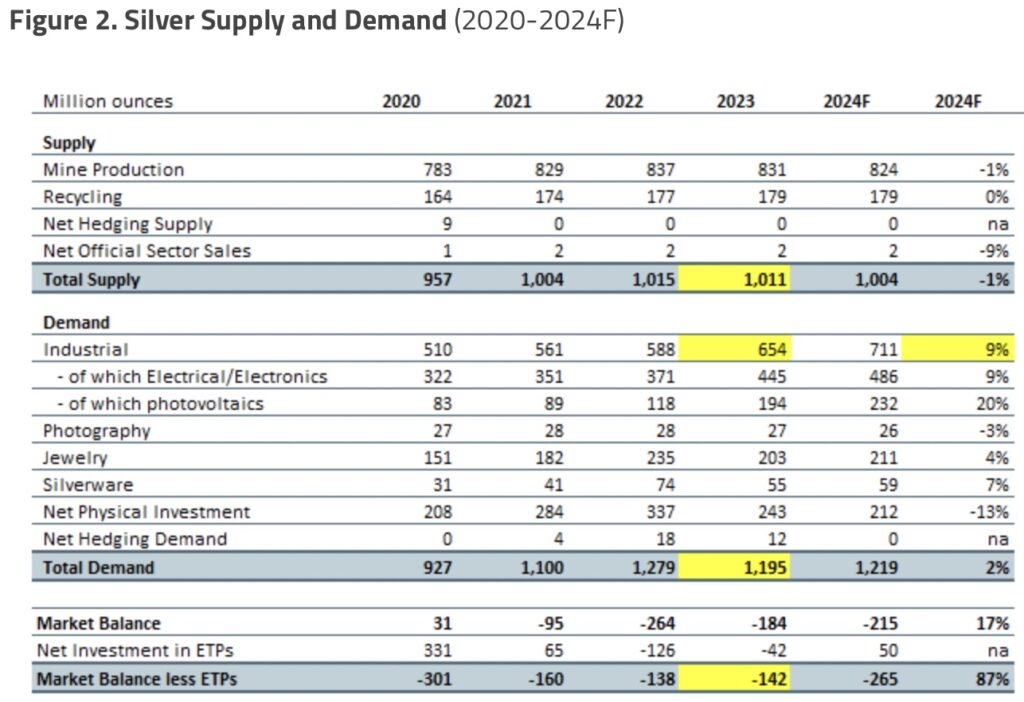

For the third year, silver demand significantly exceeded supply in 2023 as demand for industrial applications continued to increase (see Figure 2). Much of this growth has been driven by photovoltaics, and overall, industrial demand is forecast to rise by 9% this year to a new record high. This dynamic bodes well for silver prices and provides support to silver mining companies.

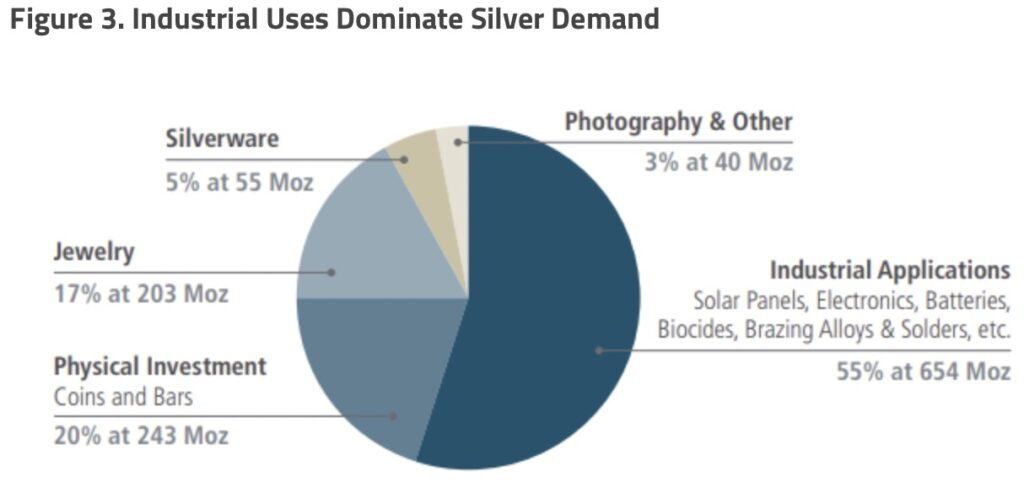

Silver’s Dual Role: Industrial Metal & Precious Metal

Historically, half of the demand for silver has been industrial, and the remaining half has included investment and investment-like categories such as jewelry, silverware, and actual bar and coin investment. In recent years, however, the balance has been shifting in favor of industrial demand, which now represents 55% of the total demand for silver. This category has been growing steadily, and estimates are that it hit a record high of 654 million ounces last year in a 1.2-billion-ounce market. This represents an 11% jump from 2022.

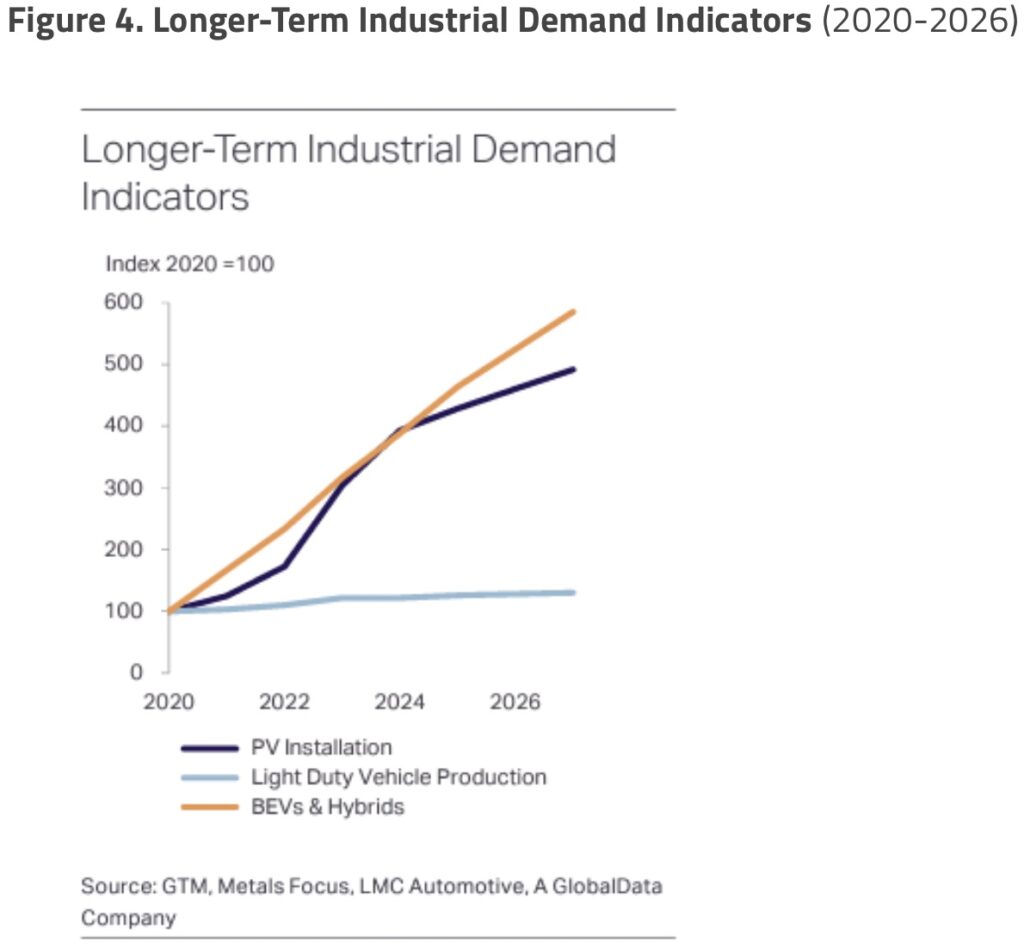

As global efforts to decarbonize and electrify gather steam, we expect the following three areas to contribute significantly to silver consumption:

The Solar Energy Industry/Photovoltaics

- A silver paste is used to capture electrons produced from sunlight striking cells—its high conductivity makes silver highly effective.

- The average solar cell uses ~111 milligrams of silver.

The Automotive Sector and Electric Vehicles (EV), and Associated Infrastructure

- Silver’s high conductivity and ductility make EVs more efficient by establishing lightweight but strong electrical connections between batteries and other car components.

- Battery electric vehicles use between ~25-50 grams of silver per vehicle.

Artificial Intelligence (AI)

- AI is likely to increase demand for silver, with end uses including transportation, nanotechnology, biotechnology, healthcare, consumer wearables, computing and energy storage in data centers.

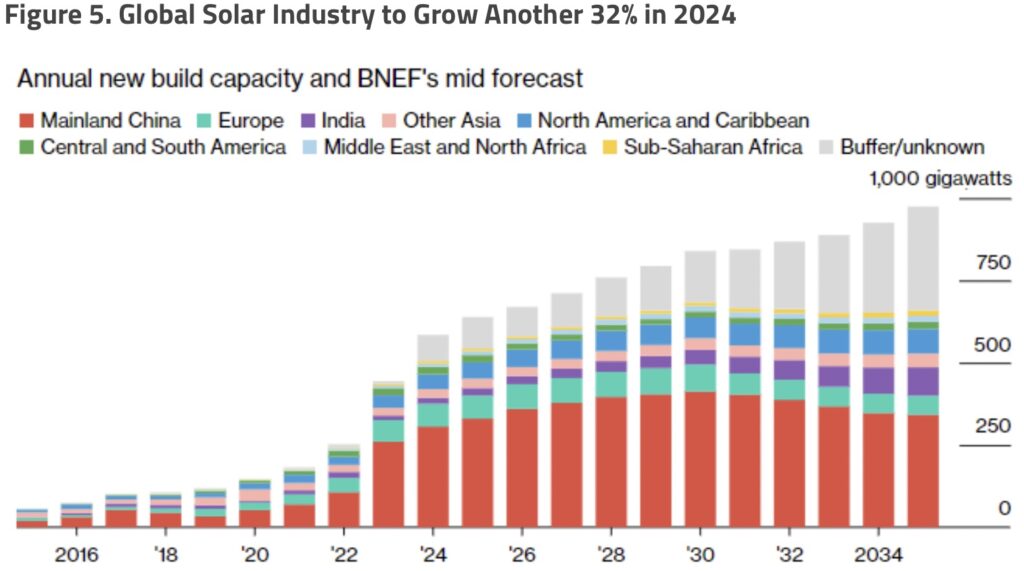

Solar Panel Development on the Rise

Silver is crucial to solar photovoltaic panels because of its high electrical conductivity, thermal efficiency and optical reflectivity. Investment in this sector now accounts for approximately 40 percent of global investment in energy transition manufacturing, reaching $80 billion in 2023. Demand for silver is expected to continue to increase, possibly by 170% by 2030.

The Biden administration’s plans to combat climate change include the creation of millions of clean energy jobs. To encourage this effort, the administration is building incentives to promote the installation of millions of solar panels. In 2023, photovoltaics consumed 142 million ounces of silver, or 13.8% of total silver usage worldwide, up from nearly 5% in 2014.

A PV solar power system catches sunlight that hits the solar cells, turning it into electrons for energy to use now or store for later. Silver pastes within the cells ensure the electrons move into storage or toward consumption, depending on the need.

Solar panel manufacturers have worked to reduce costs, and the technology has evolved so that less silver is needed per panel. In 2009, each solar cell required 521 milligrams of silver; currently, a solar cell uses approximately 111 milligrams of silver. Despite this, efforts to dramatically increase the number of solar panels in use will likely offset any reduction in the amount of silver required in each cell.

Several regions outside the U.S. have renewable energy targets, including China, Europe, India, the Middle East and South America. Also, technological innovations in the solar industry may reverse thrifting due to new types of panels requiring higher levels of silver loading. The continued growth of electricity demand, renewable energy aspirations and falling costs all point to rising solar power penetration in the foreseeable future. According to BloombergNEF, the global solar industry is expected to grow 32% in 2024. At the same time, manufacturers of polysilicon, wafers, cells and modules are facing challenging economics due to acute overcapacity across the value chain and falling prices.

Boosting Electric Vehicles with Silver Loadings

As with other critical minerals like lithium and copper, the electric vehicle (EV) market is a large driver for silver demand. After breaking through the one million mark in the U.S. in 2023, an increase of 52% from the previous year, EV sales are expected to power through 2024.3 Global EV sales are expected to crack 17 million units sold, and the IEA predicts that by 2035, every other car sold globally will be electric.

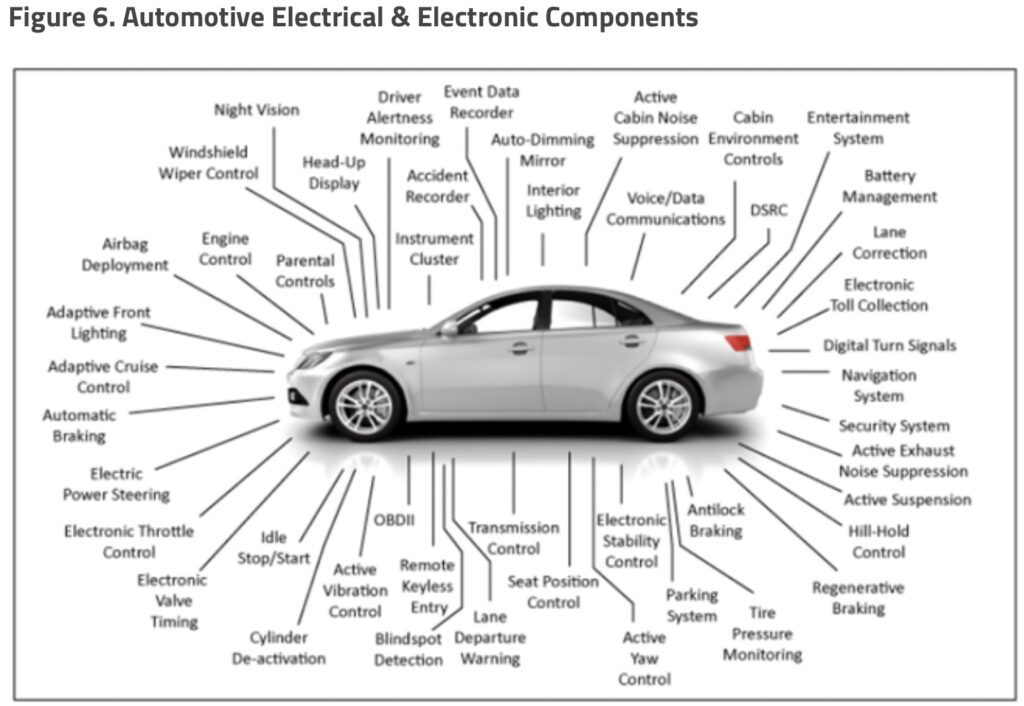

Silver’s superior electrical properties make it hard to replace across a wide and growing range of automotive applications, many of which are critical to safety and to meet increased environmental standards. Silver is found in many car components throughout vehicles’ electronic systems (see Figure 6). These components include, but are not limited to, conductive pastes in automotive glass, circuit-breakers and fuses, switches and relays used to activate varying electronic devices.

Importantly, silver is used in a wide range of vital safety features, such as airbag deployment systems, automatic braking, and security and driver alertness systems. In addition to higher environmental standards, safety standards worldwide continue to improve and increase the demand for silver loadings (which refers to the amount of silver used in a vehicle). As the auto industry embraces new technologies, silver remains of pivotal importance.

The automotive industry uses approximately 80 million ounces of silver annually, which is expected to increase to 90 million by 2025. Silver loadings are between 15 and 28 grams per internal combustion engine (ICE) light vehicle (depending on the model and market). Silver loadings have been rising over the past few decades and are expected to increase even more in the future. In hybrid vehicles, silver use is higher at around 18 to 34 grams per light vehicle, while battery electric vehicles (BEVs) are believed to consume in the range of 25 to 50 grams of silver per vehicle. The move to autonomous driving should dramatically escalate vehicle complexity, requiring even more silver consumption.

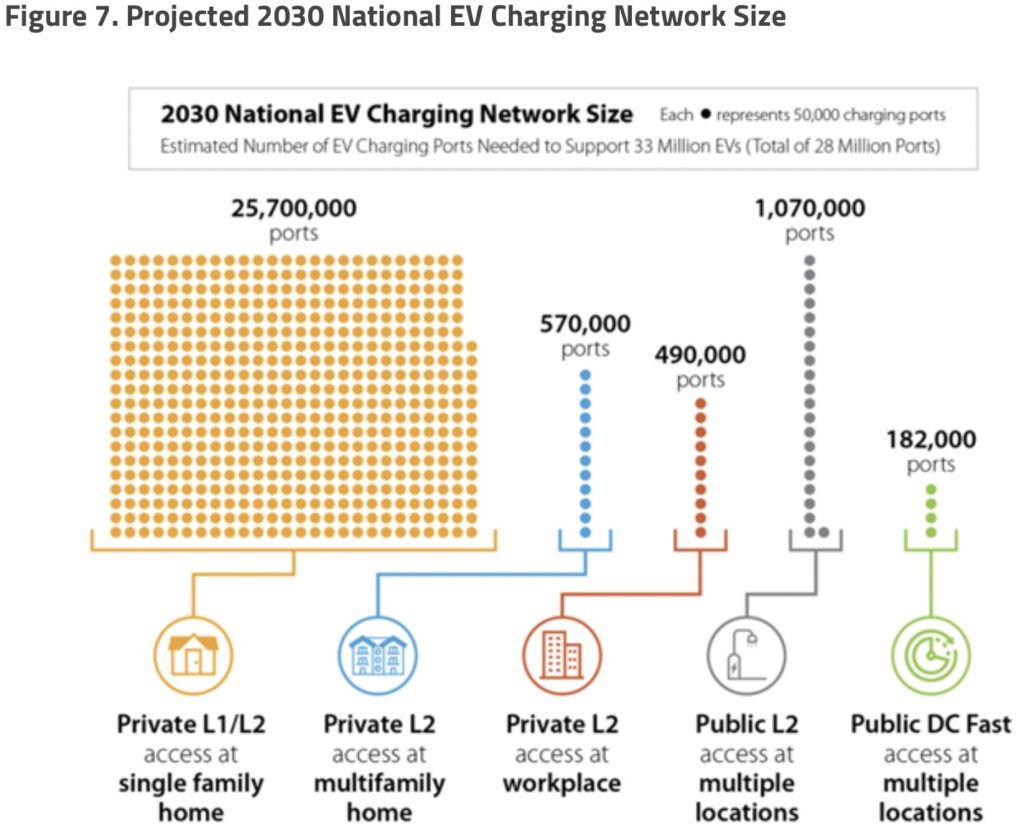

Higher loadings are the primary reason silver demand is likely to increase significantly as the global EV market expands. Another reason for the growing silver demand for EVs vis-a-vis ICEs is their use in charging stations, additional electric power generation and other supporting infrastructure. The National Renewable Energy Laboratory estimates that by 2030, 28 million EV charging ports will be needed to support the fleet of EVs in the U.S.

An increasing number of governments are introducing incentives and supportive policies and the automotive industry is transitioning from combustion engine powertrains to electric powertrains. The reasons for the government’s push into EVs are decarbonization goals, tightening emissions regulation and the need for more sustainable mobility.

Additionally, carmakers have scaled up their electrification plans, increasing the number of available EV models by 15% year-on-year, now totaling almost 600…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Silver and AI

New AI capabilities are continuously being developed, and these functionalities will require increased data center capacity. AI and data centers will consume massive amounts of electricity in the coming years. In 2022, data centers (mostly non-AI focused) accounted for 1.2% of global electricity demand (see Figure 2), with annual consumption of approximately 340 TWh. According to various sources, by 2026, data center demand will have doubled to over 700 TWh, or 2.2% of the global electricity supply. By 2030, data center power requirements could quadruple to over 1,400 TWh, or 4.1% of the global electricity supply.

Silver has the lowest electrical resistance among all metals at standard temperatures and is crucial in many electronic applications, including electrical contacts in switches, transformers, relays and capacitors. Additionally, silver will be needed in many forms in the transportation industry, such as semiconductors, harnesses, controls, fuses, switches, electronic control units, infrared radars, laser radar (LIDAR), motion sensors and displays. Healthcare will also play a role, with silver being necessary for wearable devices.

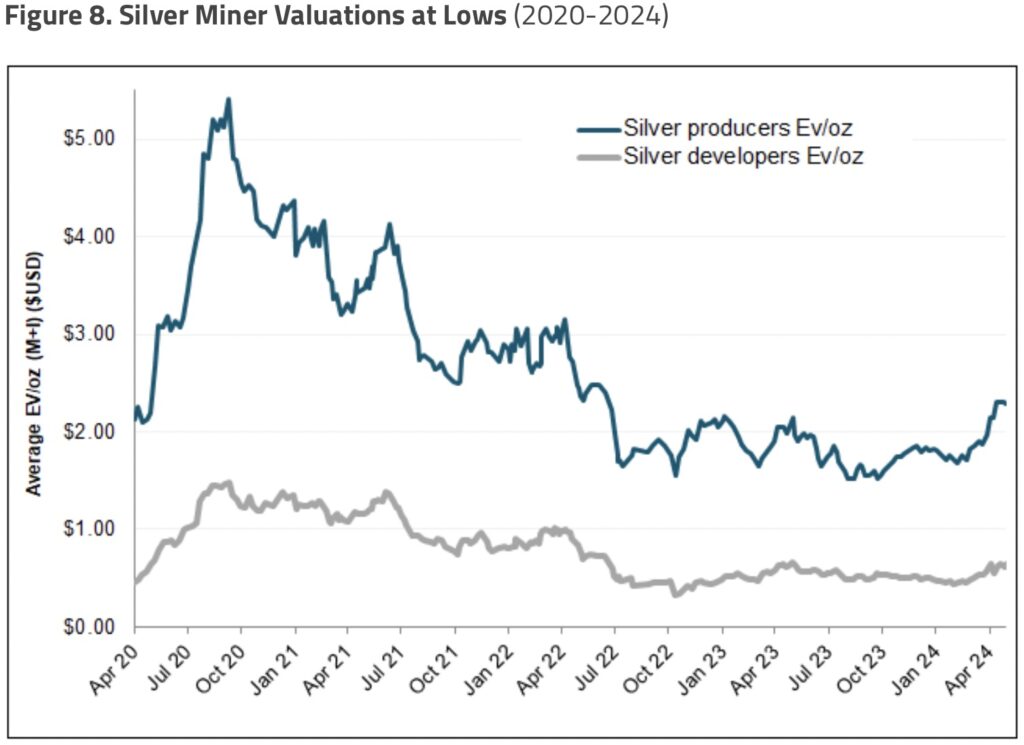

Silver Supply Continues to Stagnate

Silver mine supply has been essentially flat over the last 10 years and declined 1% in 2023. Going forward, mining production is expected to decline another 1% in 2024 to 823 million ounces, the lowest level since 2020 when the Pandemic shut down mines. Recycling or scrap supply is also expected to remain flat this year, leading to a 1% decline in total supply.

Silver mine production is prone to disruptions and unforeseen events, which have culminated in the current supply shortage. Additionally, most silver mines are focused on other metals, with silver as a by-product. Only 28.3% of mines that produce silver are primary silver mines.

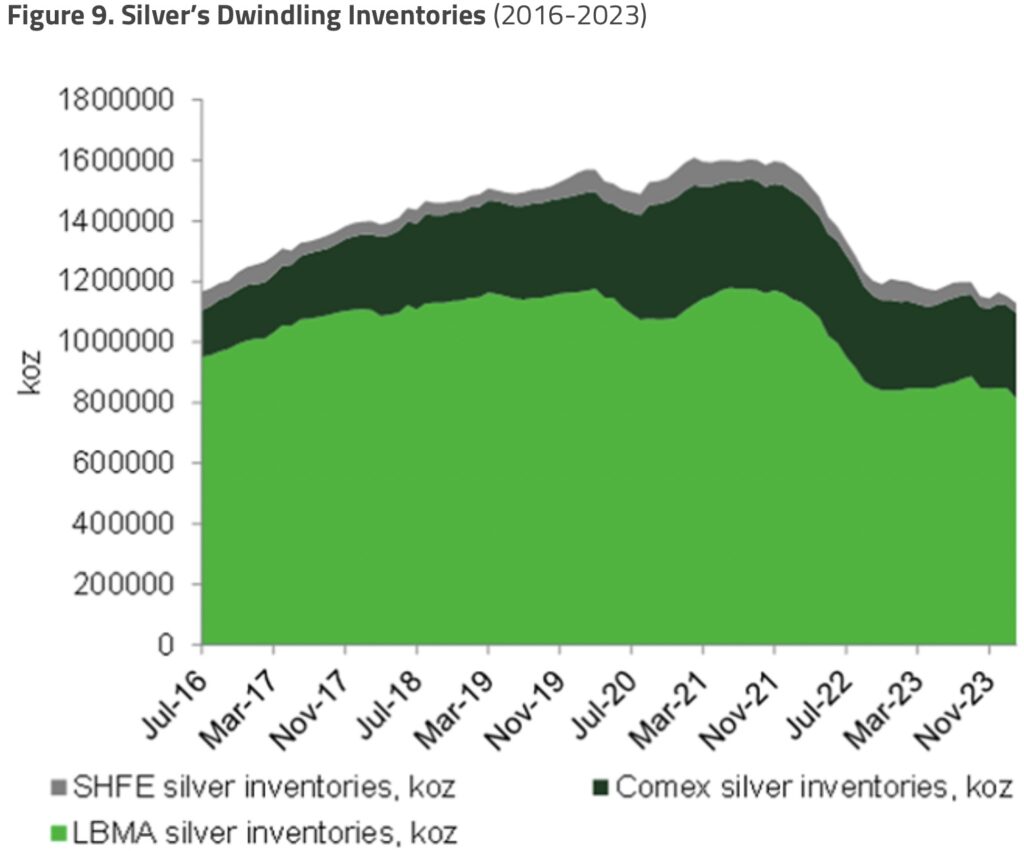

Implications for Supply/Demand

Silver’s market deficit is expected to grow by 17% in 2024 as supply stagnates and industrial demand posts another record. Industrial demand is expected to grow 9% in 2024. Deficits should also continue, depleting currently ample inventories. We have already seen a decline of ~480 million ounces of silver held on the major exchanges since February 2021 (see chart below). One can only postulate the amount of time it will take to deplete the remaining ounces, given the metal’s precarious supply/demand situation.

We believe the global energy transition will be highly positive for silver, leading to much higher prices for silver bullion and equities.

Ultra-Wealthy Moving Into Physical Gold

To listen to Egon von Greyerz discuss the ultra-wealthy moving into gold and how that will impact the gold market CLICK HERE OR ON THE IMAGE BELOW.

Silver Shorts Are Desperate And Trapped

To listen to Alasdair Macleod discuss the silver shorts being trapped and what to expect from gold and silver in the coming weeks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.