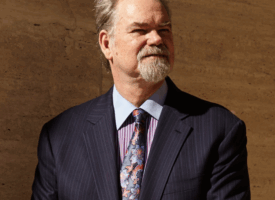

Company veteran Chuck Robbins, 49, will take over as CEO while 65-year-old Chambers, one of the longest-serving leaders of a Silicon Valley company, will become executive chairman and continue to be chairman, the company said on Monday. Wall Street analysts said a change was expected and could signal a refocusing of Cisco, which acquired dozens of companies under Chambers but has failed to make great headway outside its core networking

New orders for U.S. factory goods recorded their biggest increase in eight months in March, boosted by demand for transportation equipment, but the underlying trend remained weak against the backdrop of a strong dollar. The report on Monday from the Commerce Department was the latest indication that while economic growth is regaining some momentum after abruptly slowing down in the first quarter, the rebound would not be as strong as

Recent ETF data makes one investing trend very clear: Stock investors are looking beyond US borders and flooding into overseas equities.

The collapse of oil prices in 2014 has prompted expectations that supply growth in higher-cost crude producers such as the United States will slow. On Friday, oil services firm Baker Hughes Inc. said the number of U.S. active rigs had fallen for a record 21 weeks in a row. Brent crude (LCOc1) slipped 15 cents to $66.31 (£43.83) a barrel by 1431 London time, after hitting a 2015 peak of

The latest gauge of China’s manufacturing activity showed the country’s vast factory sector remained in contraction for the month of April.

Berkshire Hathaway Inc shareholders on Saturday celebrated Warren Buffett’s 50th anniversary running the conglomerate, as the billionaire fielded questions about the company and its future, and explained some business practices. Berkshire owns more than 80 companies including the Burlington Northern railroad, Geico car insurance, Benjamin Moore paint, Dairy Queen ice cream, Fruit of the Loom underwear, and See’s candies, and owns more than $115 billion of stocks. Berkshire’s annual meeting

The U.S. stock market has struggled for direction of late, but next week’s payroll report could confirm whether the recent weakness in data and stock prices is waning as the weather warms, or the start of a longer-term trend. U.S. data, including on economic growth, have been weak, but are seen as making the Federal Reserve less likely to raise interest rates soon, a view that has lifted market sentiment.

Warren Buffett’s Berkshire Hathaway Inc on Friday said first-quarter profit rose 10 percent, and operating results easily beat forecasts, boosted by its railroad and insurance businesses and gains from …

Berkshire Hathaway’s BNSF railroad is “forever better” after a capital program last year boosted capacity following complaints about congestion, BNSF chief executive told Reuters on Saturday. We think we’ve got opportunities going forward,” said Carl Ice, BNSF’s president and chief executive officer, speaking on the sidelines at Berkshire Hathaway’s annual meeting. Profits at the railroad rose 44 percent from a year earlier, when bad weather and congestion led to what

U.S. factory activity failed to gain steam in April after slowing for five straight months and demand for automobiles softened, suggesting the economy was struggling to find momentum after growth almost stalled in the first quarter. Other data on Friday showed construction spending hit a six-month low in March, also indicating that the anticipated acceleration in growth in the second quarter could disappoint. The economy expanded at a 0.2 percent