Look at the historic setup in the gold and silver markets.

Alasdair Macleod’s audio interview has now been released! But first…

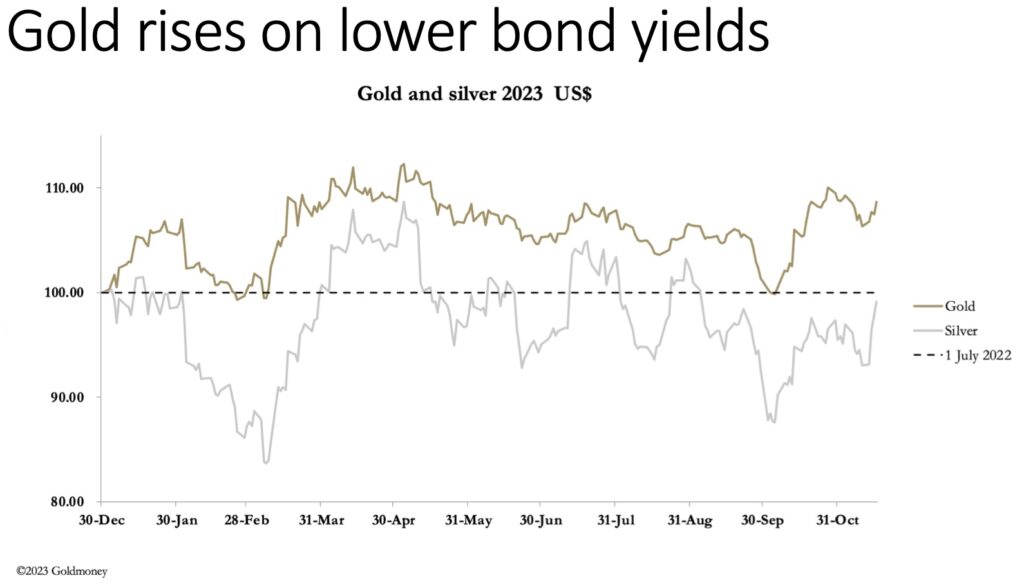

November 18 (King World News) – Alasdair Macleod: Gold and silver rose this week on the back of a growing belief that interest rates will rise no further, and that they could fall sooner than previously expected. In morning European trade today, gold was $1991, up $53 from last Friday’s close, and silver $24, up $1.70.

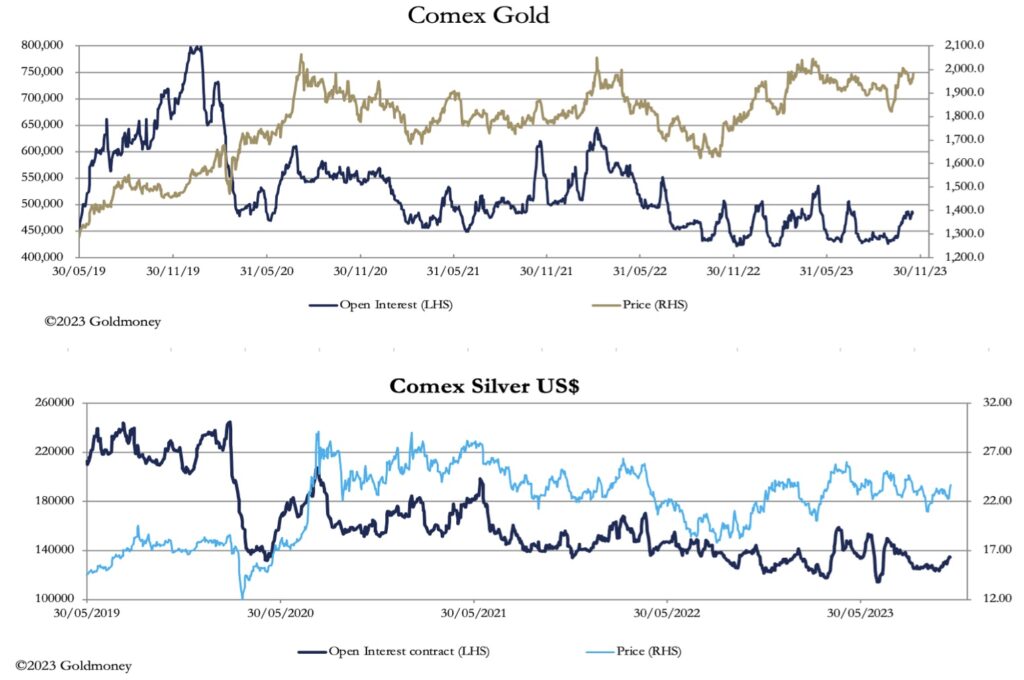

Volume in the Comex silver contract was healthy, indicating significant buying interest against which the shorts were closing positions instead of opening new ones, while in gold turnover was moderate.

Comex Open Interest in the gold contract has increased towards the 500,000-contract level in recent weeks, but it is only just beginning to increase for silver. These are our next charts.

Arguably, this takes gold out of oversold territory, while silver has some way to go. But the rally this week has been so sharp that the Commitment of Traders numbers even for last Tuesday due to be released later today will not be much of a technical guide.

Suffice to say that it appears that a bear squeeze is in progress, fuelled by falling bond yields and growing expectations that the Fed is done and interest rates will fall sooner than expected. The yield on the 10-year US Treasury illustrates the point.

The yield has fallen back to the 55-day moving average but given that the 200-day MA is only at 3.97%, a pull back to 4.25% and even 4% is possible. Presumably, the squeeze on the swaps will increase as more speculators jump onto the falling interest rate bandwagon. And there has been a growing problem for the Swaps.

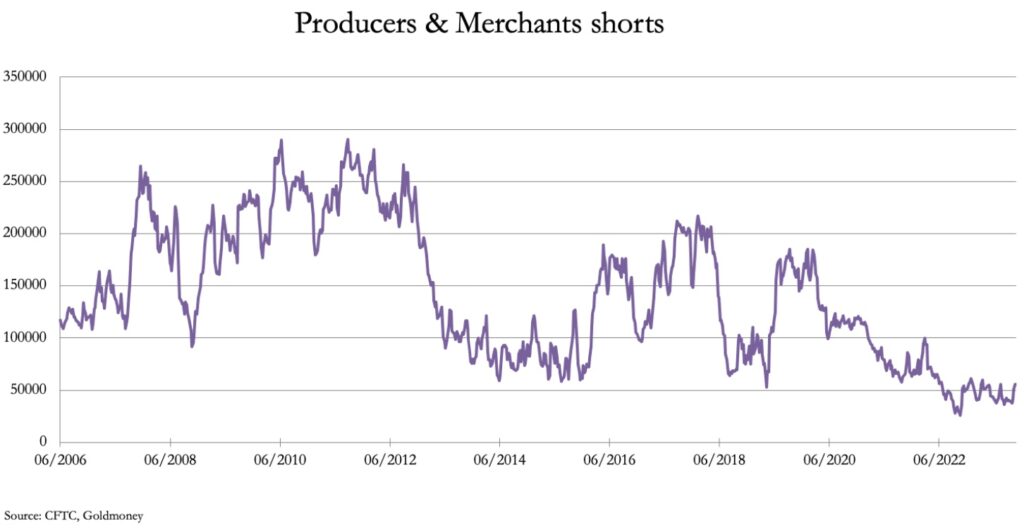

There are two categories in the COT figures deemed to be non-speculators, the Swaps comprised mostly of bullion bank trading desks, and Producers and Merchants. The problem for the Swaps is that the Producers and Merchants are taking less of the short side, so the Swaps are increasingly exposed to bear squeezes. The next chart shows how the Producers and Merchants have reduced their hedging positions over the years to illustrate the point.

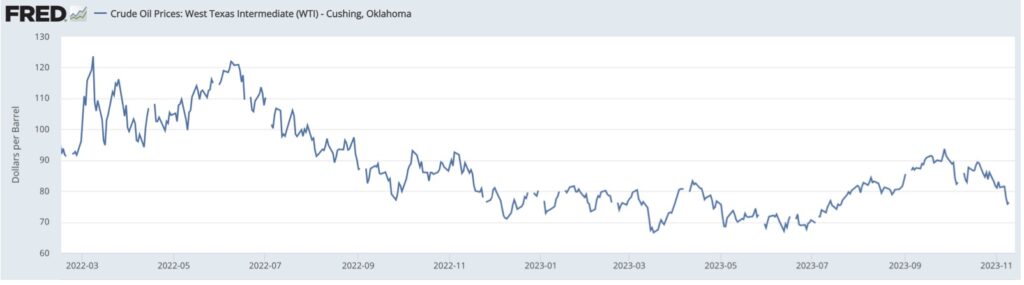

With the gold contract more prone bear squeezes, there are therefore good reasons to expect gold to break out above the $2000 level and silver above $25. Additionally, hopes for lower interest rates have been bolstered by falling oil prices, with WTI spot declining to $73. This is next.

Weaker energy prices raise hopes that the inflation problem is dying out. And while hopes that lower interest rates will propel gold and silver higher are dominating thinking again, the real reasons for holding gold have nothing to do with interest rates. They are a hedge against currency and credit destabilisation, the risks of which appear to be diminishing with a lower interest rate outlook.

Nevertheless, gold is the canary in the coal mine, and the geopolitical and banking problems are still there, likely to flare up at any moment. While we can expect some profit taking to impact prices later today, this highly technical squeeze looks like it has further to go.

To listen to Alasdair Macleod discuss available physical gold disappearing off the market, and the coming storm that is already beginning to ignite the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.