Here is a look at gold, crude oil and interest rates.

But first, another email from a King World News reader…

Gold And Fiat Money

October 28 (King World News) – Email from King World News reader Ian Caseley from the United Kingdom:

Hello Eric & team

Thank you for your great website. 15yrs + of daily reading for me.

I’m referencing the email you published from a gentleman in Portishead, UK. It commented on the £ and it’s convertibility. I’ve just listened to Alasdair Macleod commenting that the pound was convertible to a sovereign.

I’d like to ask if my understanding of the £ historical benchmark is correct. I understood the UK £ note was first issued to save traders from having to carry a physical pound (in weight) of silver. And this also gave rise to the pound being quoted as Sterling. My measure of the £ debasement is viewed at the fort currency price of silver because of this and I didn’t know of its relationship to a sovereign. Is it possible for this to be clarified?

Regardless, keep up the great work. I used to have my business in Portishead, UK with my farm being about 15 miles away. Small world.

Best wishes

Ian Caseley

Alasdair Macleod’s Response

Alasdair Macleod: The reason the pound is referred to as sterling is because originally a money pound was one pound weight in silver. No coin was ever struck with this weight, but a pound was divided into 240 coins, called pence (the equivalent of Roman denari). Twelve pence were called a shilling (equivalent to the Roman solidus) and 20 shillings weighed a pound.

While the units remained until decimalisation, their weights in silver had disappeared through progressive debasement some time before. Edward I coined 243 pennies out of a pound, Edward III coined 266 pennies, Henry VIII 360, and Elizabeth coined 744 pennies. This debasement process was not unique to England, with France’s livres (French for a pound) and Italy’s lira (Italian for a pound) suffering even greater debasements through those times.

England’s Great Recoinage was in 1816, when it was decided to adopt gold as the coin standard thereafter, replacing silver. And the sovereign, as one monetary pound in gold was coined to be equal to 20 shillings in silver at the then market value of gold and silver at that time, and the first gold sovereigns were issued the following year. The gold standard effectively commenced at that time, with it formally adopted in 1821.

Bank notes were certainly more convenient than using coins for all but small transactions. Additionally, being dealers in credit banks issued notes in excess of their holdings of gold, retaining enough cover for all practical purposes. Private banks in London ceased issuing banknotes in the 1790s, though they weren’t forbidden from doing so until the 1844 Bank Charter Act. Banks in Scotland still issue their own notes, fully backed by reserves at the Bank of England.

Kind regards

Alasdair

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Crude Oil And Bond Yields

Peter Boockvar: After this drop in crude oil prices after the weekend’s Israeli attack on highly specific military installations in Iran I can’t imagine it leaves much geopolitical risk left in the price. We are remaining long oil and gas stocks. Either way though and notwithstanding the disinflation that comes from lower oil prices, Treasury bond yields continue higher with the 2 yr now at 4.11%, the highest since early August and the 10 yr back at 4.26%, last seen in late July. I’ve mentioned that 4.30% is the key technical level for the 10 yr with it being the 50% retracement off last year’s 5% high and the 3.60% low made within days of the Fed’s aggressive rate cut.

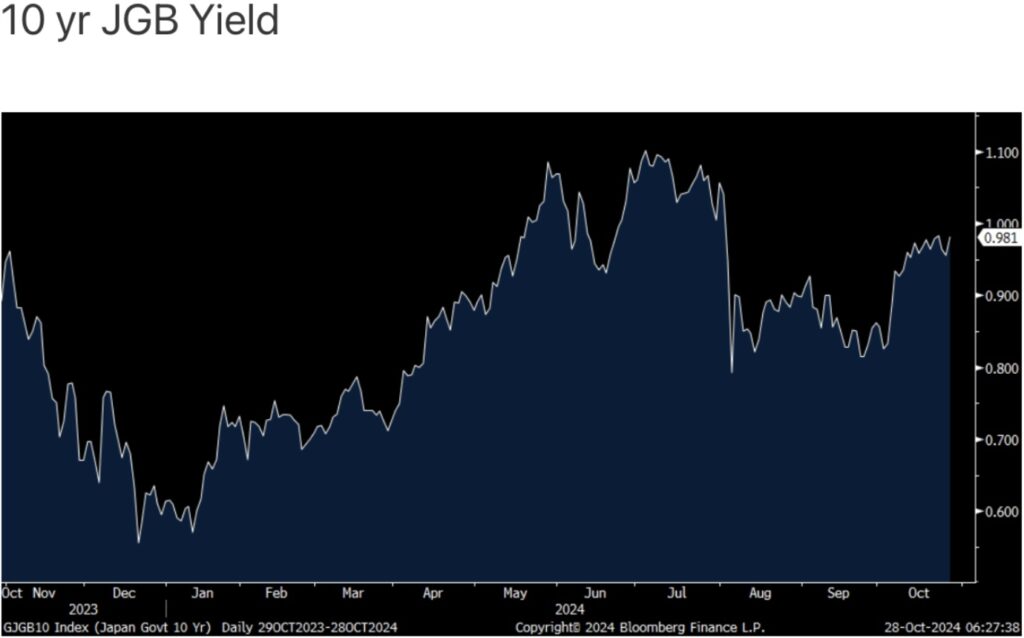

Maybe this move up again today in yields is following the selling seen in JGB yields after the election results in Japan over the weekend where the Liberal Democratic Party (LDP) didn’t receive the needed seats to have a majority in the lower house and now needs to politic for some coalition partners.

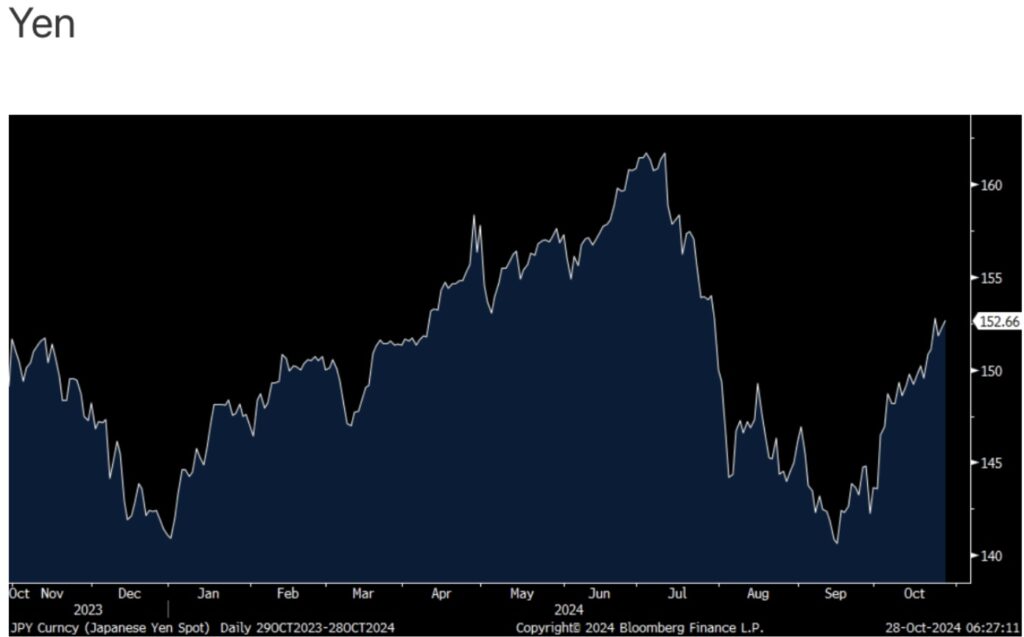

The yen is down but off its lows and sits at the weakest since late July vs the US dollar.

That slightly weaker yen did help Japanese stocks withstand the political noise with a 1.8% rally. We remain bullish and long Japanese stocks.

Just Released!

To listen to James Turk discuss how fortunes will be made in this gold bull market CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod’s KWN audio interview that was just released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.