Gold’s Open Interest has collapsed to the lowest level in 5+ years! Here is a look at what is happening behind the scenes in the war in the gold and silver markets.

Alasdair Macleod’s latest audio interview has just been released (link below)!!

Massive Bear Squeeze Likely In Gold

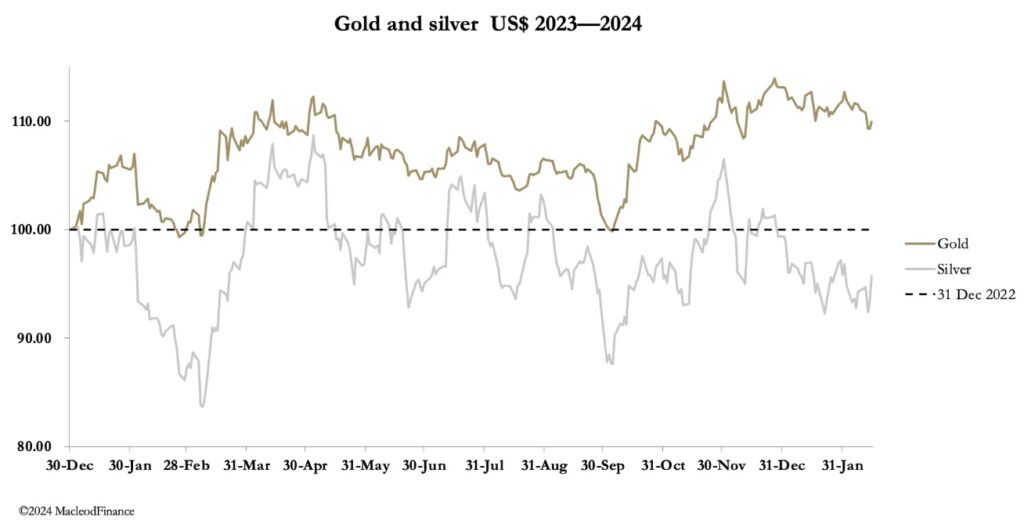

February 17 (King World News) – Alasdair Macleod: This week, gold dipped below the $2000 level before rallying, and silver reflected a traditional bear squeeze. In European trade this morning gold was $2005, after testing the $1985 level, down $19 net from last Friday’s close. And silver was $22.98, up 38 cents after testing $21.95.

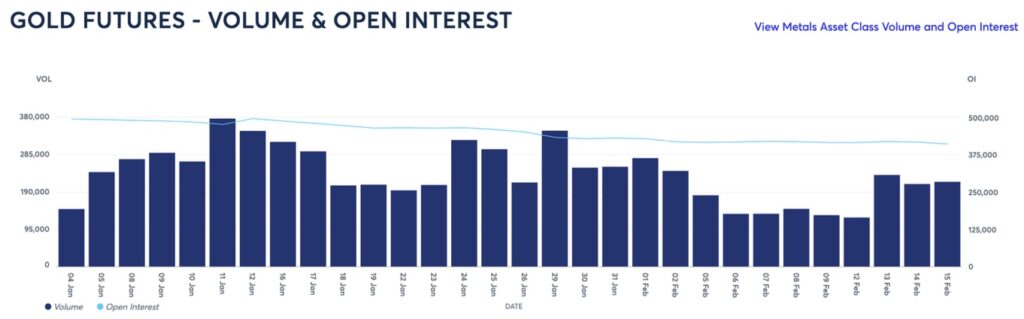

On Comex, gold’s volume was moderate, but good in silver, as the chart below shows:

The last Commitment of Traders Report (6 Feb) showed Comex Managed Money (hedge funds) net short of 4,599 silver contracts (22,995,000 ounces), while the Swaps (mainly bullion bank traders) were short of only 820 contracts net. They may have even got level on Tuesday when the price dipped under $22 — we will see in tonight’s COT release. But the Swap’s desire not to be caught short is surely behind silver’s 4.6% rally since Tuesday.

Comex silver Open Interest at 150,000+ contracts is about the long term average, which coupled with a healthy 66,000 volume is in sharp contract with the position in gold, which is up next.

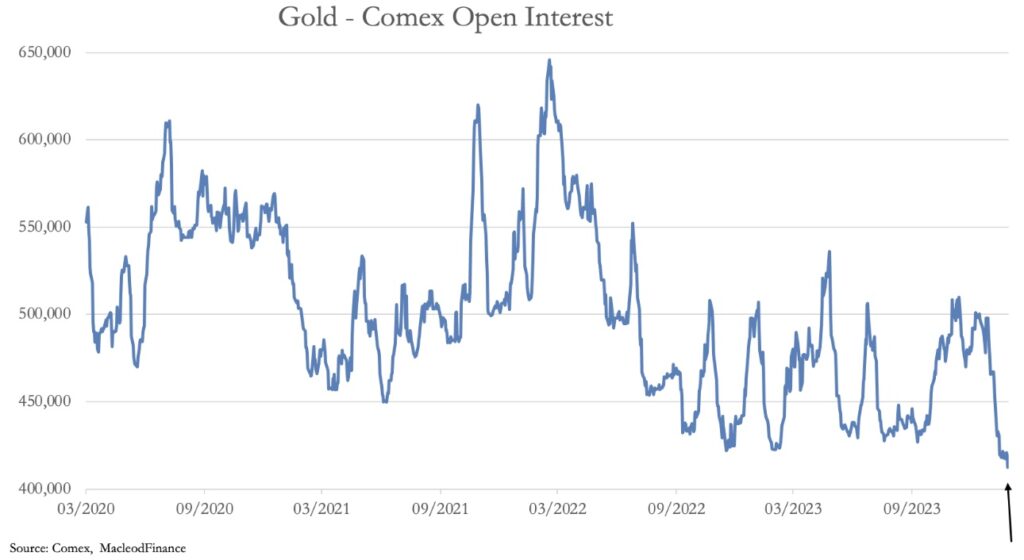

Now look more closely at Open Interest:

King World News note: Gold’s Open Interest Has Collapsed To Lowest Level In 5+ Years!

Preliminary figures for yesterday are 412,506 contracts, the lowest in four years. In fact, it is the lowest since December 2018 when gold was sold down to under $1200. The level of disinterest today is similar to then, which preceded a 20-month bull phase taking the price to $2074.

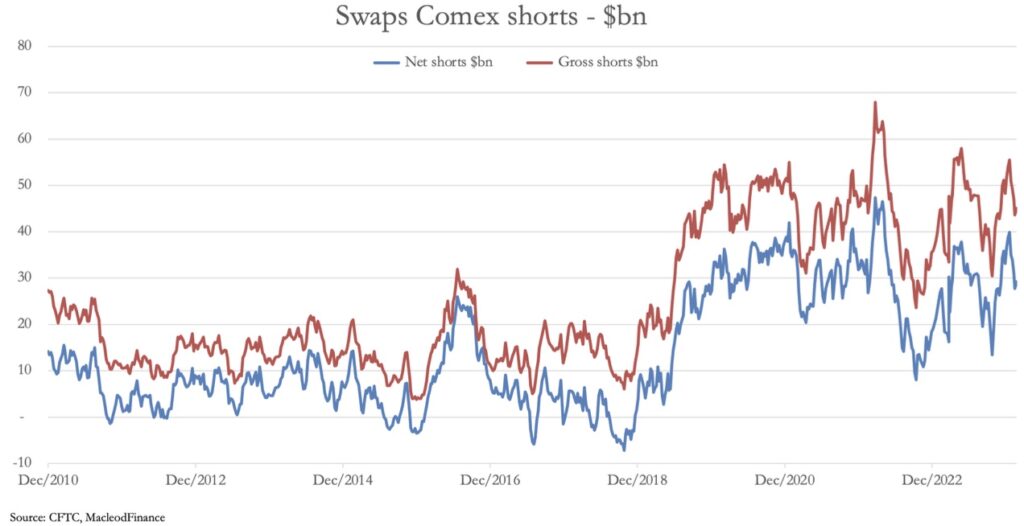

Two months before, in August 2018 Managed Money had gone record net short (109,454 contracts. It is not so extreme today, with MM net long 68,069 contracts on 6 February. This gives the Swaps category bullion banks a problem: in August 2018 they were net long 60,000 contracts, so were the right side of the massive bear squeeze that followed. Ten days ago, they were net short 143,623 contracts (14.36 million ounces, 446.7 tonnes) worth $29.23 billion. See the next chart of the gross and net short values:

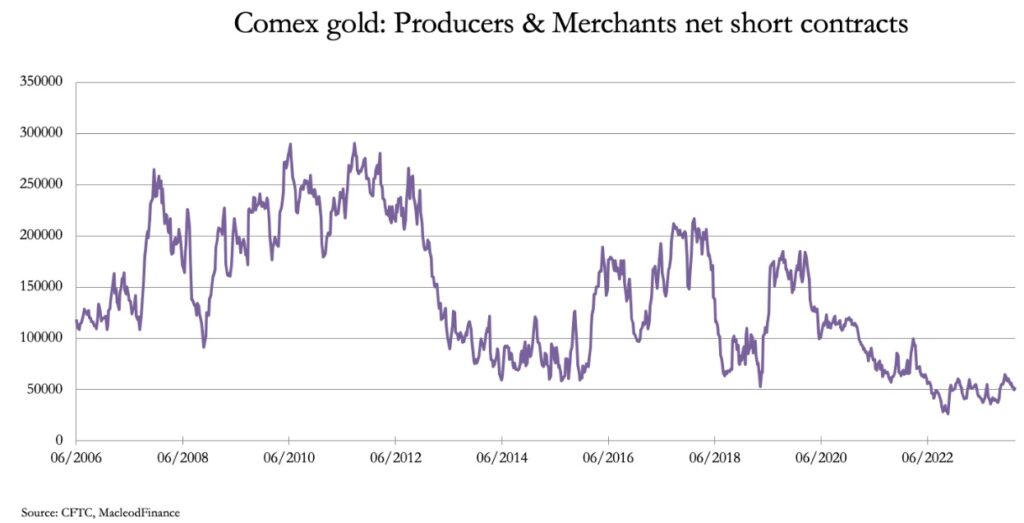

The Swaps’ problem is that the other category normally taking the short side, Producers and Merchants, have reduced their hedging to a minimal level. This is next.

Admittedly, in late-2018 producer hedging was at similar levels to today, but this you would expect in a sell-off such as occurred at that time. Today is different. With the gold price close to all-time highs, you would expect a far higher level of producer hedging.

Taking these technicalities into account, we can only conclude that the situation in the Comex gold contract could become systemically threatening for the bullion banks. It is becoming apparent to the major players (central banks etc.) that the fundamentals behind the US dollar are becoming dangerous to it, threatening its very survival. Yet the bullion banks are unable to close their short gold positions.

Will the dip testing the water at under $2000 be the last chance to buy gold before it roars ahead on a bear squeeze, potentially taking out some bullion banks? It is a possibility which should not be lightly dismissed.

Furthermore, this month so far, nearly 45 tonnes of gold have been stood for delivery. And that was never meant to happen! To listen to Alasdair Macleod discuss what is happening behind the scenes in the war in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.