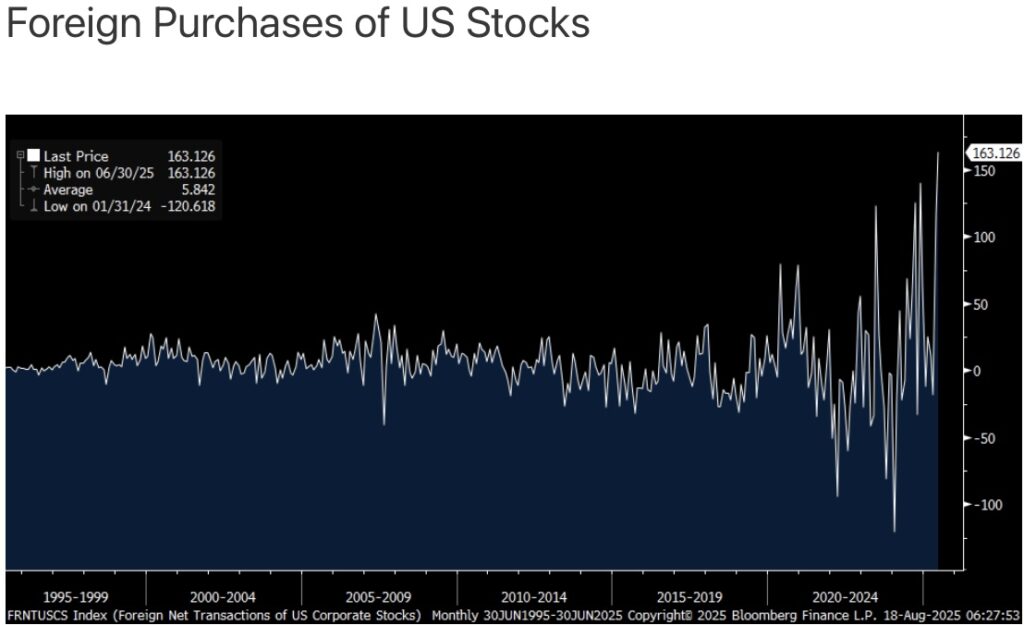

It appears that foreigners have just bought an all-time record amount of US stocks.

August 18 (King World News) – Peter Boockvar: I argue again that the best path Jay Powell can take in his speech Friday, and something I recommend too to his colleagues, is to focus on the September meeting only (basically telling us you’ll cut as the market expects) and not prognosticate about what you’ll do after that because the economic landscape is clear as mud. Non voting member taking Raphael Bostic is taking that same tact, especially after a three day trip visiting households and businesses in meetings in Alabama and Mississippi, regions he covers. “Today, I think my strategic approach would be ‘move and wait.’ It might be that it will take some time for the economy to evolve after a move that we do, in ways that make clear sort of what the next step would need to be” he said late last week.

According to the Bloomberg News story that covered this trip, it also said “Tariff costs are actually real costs,” he said. While many firms have absorbed some of the shock to shield consumers, “they don’t think they can do that forever,” said Bostic. “And time is getting short.”

I agree with the theoretical economic concept that a tax (tariff in this case) is a one time price reset but I’ll also argue that it is much more nuanced than that as if supply chains get shifted and tossed around in response to tariffs, the price impact can be multi year.

Here’s a great example I read about in the Weekend WSJ on an article about tariffs and inflation. “Barry Roth, who imports used cars from Canada for US dealers, says he imported around 1,000 cars a month on average last year through November. In January, that surged to almost 1,500 as car dealers tried to get ahead of tariffs. Now, as many cars from Canada face 25% levies, he says he is lucky to import 400 vehicles a month.”

“But as dealers sell down their expanded inventories, they will either have to pay the tariffs or be left with fewer cars to sell. Either way, he says, prices are likely to rise. ‘It’s not going to happen tomorrow, it’s not going to happen next week, but it will ratchet up,’ Roth said.”

Foreigners On US Stock Market Buying Binge

Seen Friday was the June TIC data reflecting foreign purchases of US assets and vice versa. While foreigners sold on net US Treasuries by $5b after a large rebound in May, they gobbled up US equities. In fact, with US stocks, they’ve never bought this much in any one month, purchasing $163b worth on net. Let’s hope they are not a contrarian indicator because they bought a record amount, at the time, in February 2000 and did so again in May 2007. On the other hand, they used pullbacks in 2020 and 2022 to add.

KING WORLD NEWS NOTE: Foreigners Just Bought All-Time Record Amount Of US Stocks!

It’s quiet otherwise ahead of big retail earnings this week and Mr. Powell on Friday.

Nomi Prins Just Predicted $9,000-$12,000 Gold

To listen to Nomi Prins discuss her latest predictions for where the prices of gold and silver are headed along with the mining stocks and the uranium sector CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the calm before the storm and what to expect from gold, silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.