It’s time to buy gold as the Open Interest in gold has collapsed and hedge funds are now net-short silver!

Alasdair Macleod’s audio interview has just been released discussing the remarkably bullish setup for the gold, silver, and mining share markets as well as the collapse in Open Interest in the gold market. The link is at the bottom of this article…

Banking Crisis Looms

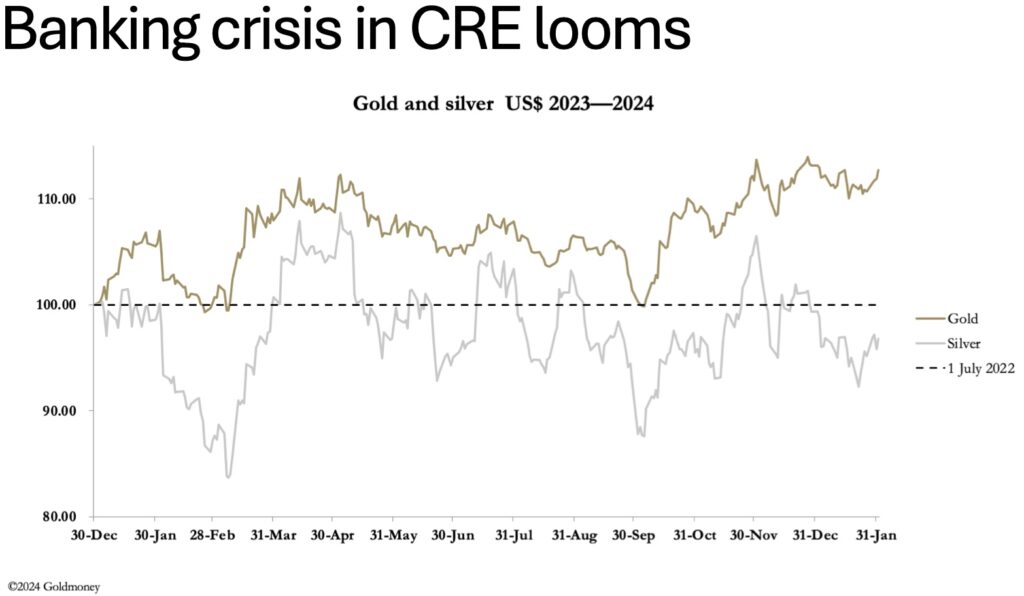

February 2 (King World News) – Alasdair Macleod: Precious metals prices were subdued this week, though there was a firmer underlying tendency. In European trading this morning, gold was $2055, up $38 from last Friday’s close, and silver $23.20, up 43 cents.

The weakness typical at Comex contract expiry was absent, but Comex deliveries featured, with 15,979 gold contracts delivered since last Friday (1,597,900 ounces or 49.69 tonnes). Silver deliveries were 822 contracts (4,110,000 ounces or 127.8 tonnes. These are substantial numbers and with some of the February contracts still open, there’s more to come.

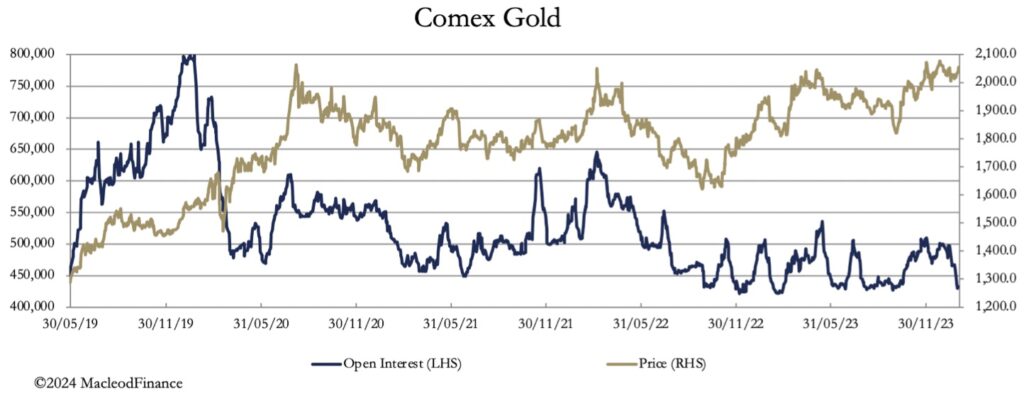

Traders have yet to be convinced that the rally in the dollar’s trade weighted index is over, putting the sell-dollar/buy-gold trade on hold. But gold’s persistent price firmness above the psychological $2000 level in the face of general market apathy is impressive. And this week saw a dramatic decline in Comex Open Interest. This is our next chart.

Open Interest In Gold Has Collapsed!

What it tells us is that declining interest in the paper market fails to suppress the gold price. Commitment of Traders figures confirm that hedge funds (Managed Money category) have reduced their position to net longs of 61,033. That was on 23 January. With the collapse in Open Interest, I suspect that today the figure is closer to 40,000.

Meanwhile, Other Reporteds net longs have increased to 108,441 on 23 January. It is this category which I believe stands for delivery, taking out 1,646,300 ounces (51.21 tonnes) this year so far.

Comex’s influence on the gold price is visibly declining, a point poorly understood. And the investing public is disinterested as well. According to the World Gold Council, ETF holdings declined by 244 tonnes last year, 10 tonnes of which was in December. The gold price holding levels close to all time highs with public interest virtually zero is a powerfully bullish combination. Demand is being led by central banks, adding more than 1,000 tonnes for the second year in a row. And one guesses that off-balance sheet government buying in sovereign wealth funds is also a factor…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

This week saw the Fed’s FOMC hold interest rates, but the tone of its statement was perhaps softening slightly. The Bank of England’s Monetary Policy Committee even had one member voting for a cut in rates. But more importantly, commercial real estate (CRE) exposure crashed shares in New York Community Bank, rippling into other US regional banks.

Aozora Bank (Japan) was forced to write down the value of its exposure to the US CRE market. And the Hong Kong court’s decision not to sanction Evergrande’s reconstruction implies a potential property crisis in Hong Kong, to which two British banks, HSBC and Standard Chartered have collateral exposure.

There is a growing risk that global CRE market woes will destabilise the banking system. Under these circumstances a flight out of credit generally makes sense. Perhaps this will be the background to the gold price in the coming months.

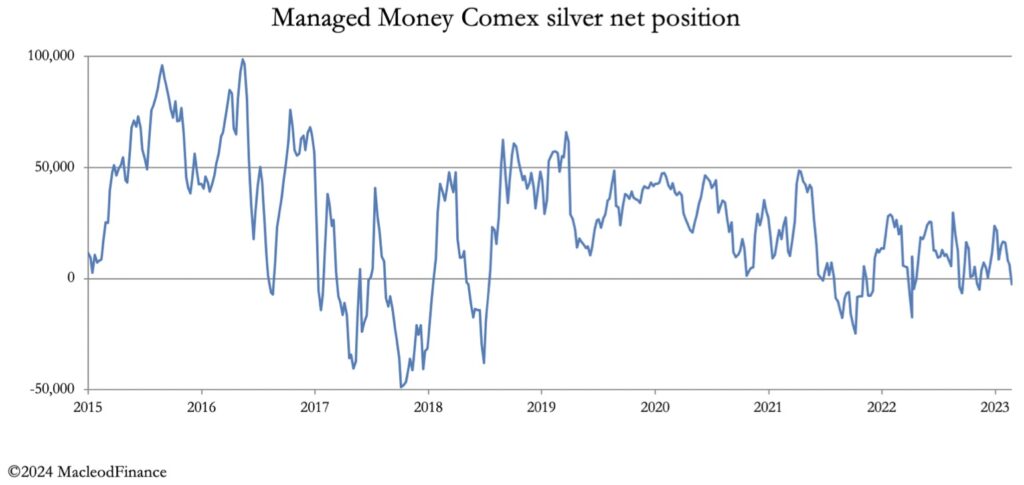

In silver, the last COT numbers indicated that hedge funds are net short, which while not unheard of is unusual and very bullish. This is my last chart.

Hedge Funds Now Net Short Silver!

Alasdair Macleod’s audio interview has just been released click here!

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.