It appears that the super wealthy still don’t own gold even as miners near blastoff. Astonishing!

Astonishing! The Super Wealthy Still Don’t Own Gold

February 10 (King World News) – Jeroen Blokland: Astonishing!

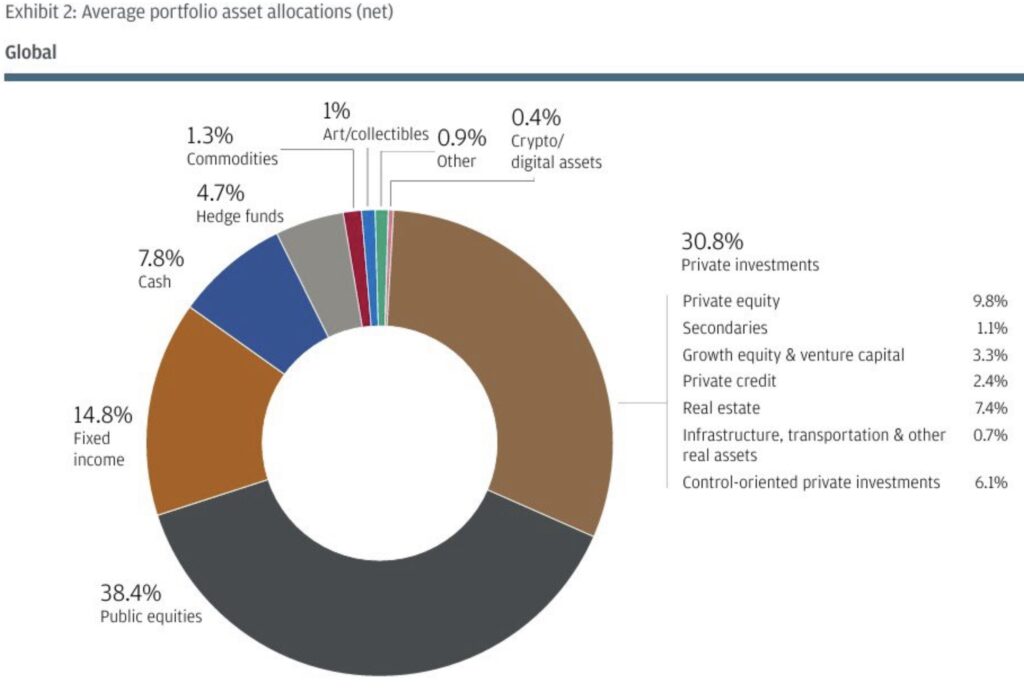

Global family offices have allocated just 0.9% of their portfolios to gold! Instead, they allocate a third to private equity and other illiquid stuff because the marketing machines working for private assets have proven very effective.

KING WORLD NEWS NOTE: Astonishing! The Super Wealthy Still Don’t Own Gold As Holdings Remain Less Than 1%!

GOLD: First Time In Recorded History

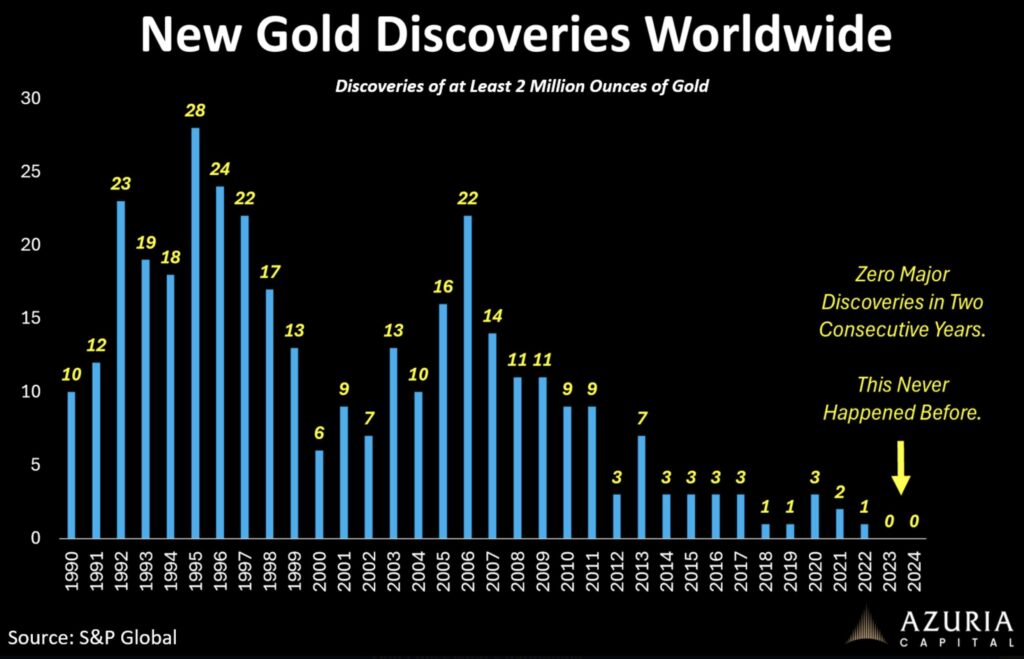

Otavio Costa: For the first time in recorded history, global data show zero gold discoveries in two consecutive years.

This has never occurred before.

KING WORLD NEWS NOTE: Yes, Gold Is Rare!

And this is not unique to gold.

Major discoveries across most metals have fallen into the single digits, with no meaningful projects in the pipeline capable of materially altering the global supply curve.

This is the real barometer of where we are in the mining cycle.

Still early…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

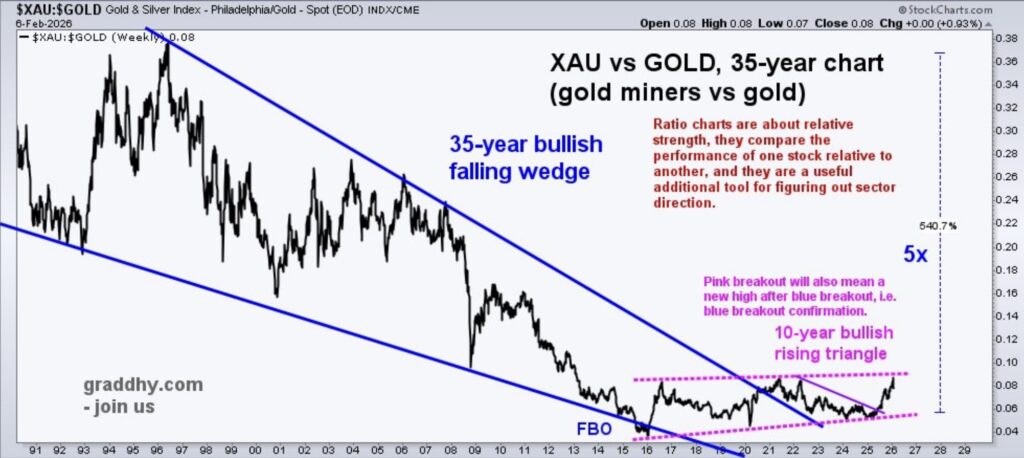

Gold Miners Bottom vs Gold

Graddhy out of Sweden: Been saying a pullback was getting closer and we are now getting it. But, do not lose sight of the very big picture. Gold miners are bottoming very big picture vs gold. Means gold miners will outperform gold long term, and that is when the main part of the bull starts.

That is a pink 10-year base, and we know that “the bigger the base, the higher in space.”

Huge gains last few years, which will continue big picture.

Watch for that pink 10-year base breakout.

KING WORLD NEWS NOTE: As Mining Stocks Break Out Above The Pink Line The Real Bull Market In Mining Stocks Will Begin And Upside Gains Will Dramatically Accelerate!

Crude Oil, Gold, Silver

Ole Hansen, Head of Commodity Strategy at SaxoBank: Crude oil trades steady after a two-day advance, with the Iran-related risk premium continuing to ebb and flow. Brent, however, is struggling to break convincingly above USD 70 amid speculation that the risk of higher oil prices—and the impact of rising fuel costs—could ultimately push President Trump toward a negotiated settlement with Iran. Such an outcome would reduce the risk of conflict and, by extension, the threat of a major supply disruption from the Middle East.

Gold holds above USD 5,000 following a two-day gain, supported in part by reports that Chinese regulators have advised financial institutions to reduce their holdings of US Treasuries. Additional support continues to stem from longer-term themes, including geopolitical risks, fiscal debt concerns, and dollar weakness. Importantly, volatility has started to ease—a prerequisite for more orderly and manageable price action.

Silver volatility has started to ease ahead of next week’s Lunar New Year holiday, during which the Shanghai Futures Exchange will remain closed for more than a week. Monday’s trading range of 7% was elevated but still the narrowest since 28 January, and—together with a softening of the Shanghai premium over London—suggests calmer market conditions following weeks of mayhem.

LISTEN: Gold, Silver, US Dollar, Oil, future inflation and more…

To continue listening to legend Rob Arnott discuss gold, silver, the US dollar, oil, future inflation and much more CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

To listen to Alasdair Macleod discuss the collapse in Open Interest in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

$10,000 Gold And The Vault Behind COMEX CLICK HERE.

Global Banking Elite Orchestrate Shadow Bailout To Survive $5,600 Gold Peak CLICK HERE.

Investing Legend Rob Arnott Says Silver vs Oil Ratio Reached Insane Levels CLICK HERE.

Gold & Silver Open Interest Has Collapsed To Historic Low! CLICK HERE.

UPDATE: Here Is Where The Silver Market Stands After The Crash CLICK HERE.

SILVER: People Start Making Poor Decisions When Volatility Spikes CLICK HERE.

Central Banks Will Move Gold Price Much Higher CLICK HERE.

SILVER: Look At What Is At One Of The Most Undervalued Levels In History CLICK HERE.

Economic Collapse And The Implementation Of The Slave Monetary System CLICK HERE.

Friday’s Historic Takedown In Gold & Silver Caused Some Dealers To Close The Door On Precious Metals Buys CLICK HERE.

This Is The Biggest Breakout In History! CLICK HERE.

Major Gold & Silver Update After Friday’s Crash In The Silver Market CLICK HERE.

Making Sense Of Friday’s Utterly Rigged Nonsense In The Silver Market CLICK HERE.

What To Do After Friday’s Brutal $37 Plunge In Silver CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.