Friday’s trading could be absolutely wild!

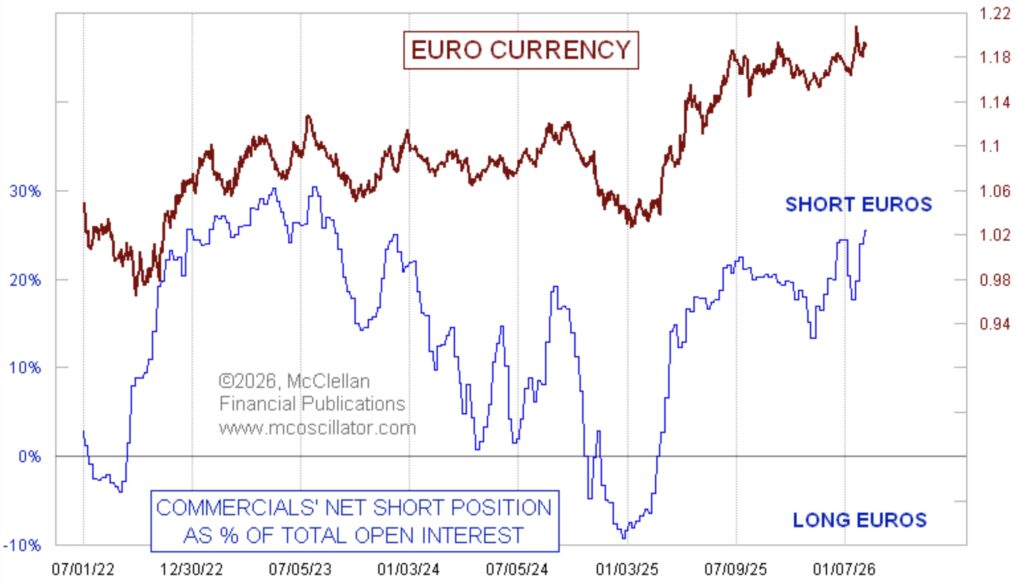

Euro vs US Dollar

February 19 (King World News) – Tom McClellan: We are a week [now anytime] away from SCOTUS potentially issuing a decision on presidential powers over tariffs. This week’s COT Report data show that the big “commercial” traders of euro currency futures are racing to increase their net short position.

KING WORLD NEWS NOTE: Commercial Traders Have Been Adding To Short Positions In The Euro. Their Short Positions Have Been Higher In 2022 & 2023 But Getting To Very High Levels Nonetheless

“Houston, we have a problem.”

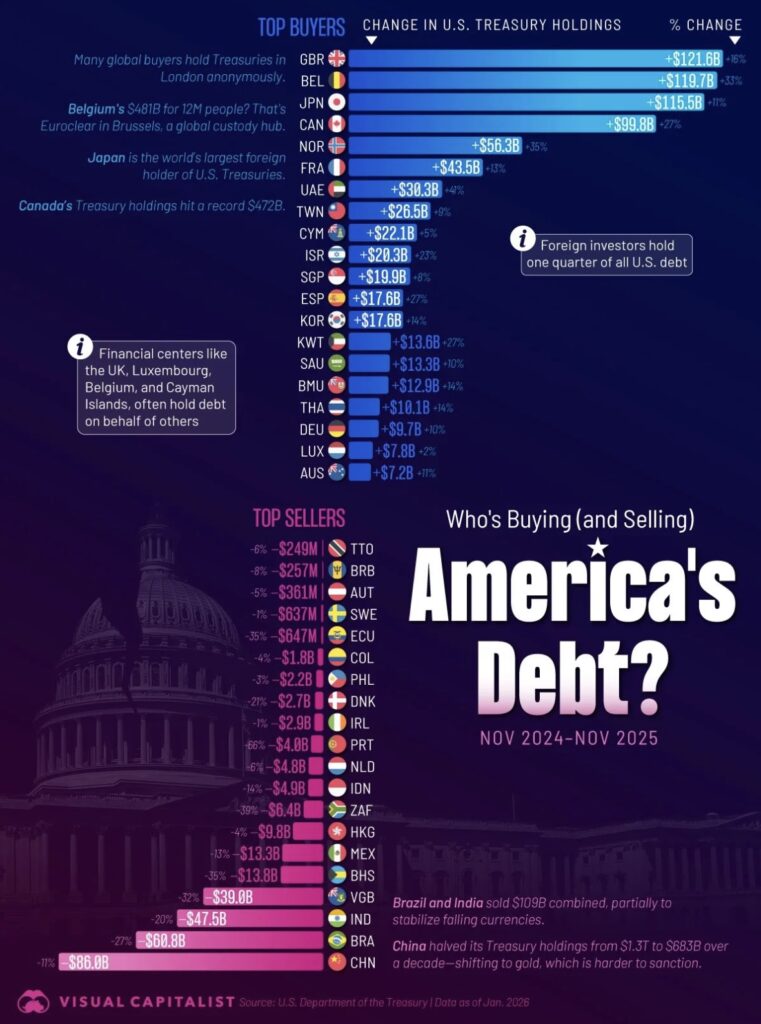

Liz Ann Sonders: Each year, U.S. relies on investors to finance its growing debt ($38.6 trillion as of February 2026); UK, Belgium, and Japan were largest buyers of U.S. debt from November 2024 to November 2025, each increasing holdings by > $115 billion; China reduced U.S. debt holdings by $86 billion over same period, leading all countries in net selling; despite major shifts among individual countries, total foreign holdings of U.S. Treasuries rose to a record $9.4 trillion

This Bull Market Is Headed Higher, Big Time!

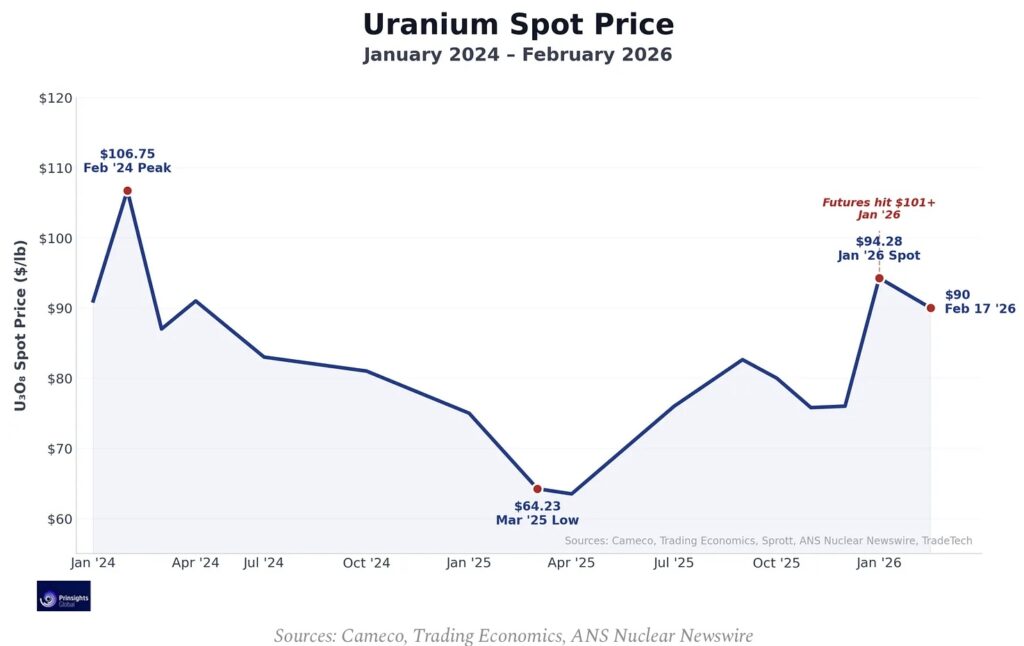

Nomi Prins: Nuclear energy buildout is accelerating on both sides of the Atlantic. In late January, while everyone was watching paper silver prices crash 30% in a single day, uranium spot prices jumped to $94.28, their highest level since February 2024, and futures briefly touched $100 before pulling back to just below $90. The chart below shows that V-shaped recovery from last spring’s lows.

What This Means Going Forward

Nothing in the past month has changed our outlook – and the developments this month has only served to reinforce it. We remain bullish on uranium, enrichment and nuclear technology across the board.

To be clear, pullbacks from spikes like January’s are normal and healthy. For a market in a long-duration uptrend, and for investors building positions in this space, the underlying forces continue to move in the right direction.

The Next Big Bull Market

Otavio Costa: Interesting how oil appears to be “magically” finding support at these levels.

KING WORLD NEWS NOTE: Oil Continues To Find Support On Yellow Breakout As It Coils To Skyrocket

A broader rebound in energy has the potential to become one of the defining themes of the year, in my view.

Among major commodities, energy remains one of the most undervalued segments in today’s market.

ALSO RELEASED!

SPECIAL REPORT: AI Fears Grip Equity Markets CLICK HERE.

Gold Price Rebounds As Oil Price Surges Strongly CLICK HERE.

Look At This Once In A Lifetime Opportunity CLICK HERE.

Are We Seeing The End Of Derivatives In The Gold Market CLICK HERE.

Nomi Prins Says Despite Volatility Silver Price Will Hit $180 By The End Of 2026 CLICK HERE.

Here’s Why Gold & Silver Are Rallying After Thursday’s Takedown CLICK HERE.

Gold: The Anti-Bubble, Plus How Do I Keep My Money? CLICK HERE.

Is Another Gold & Silver Takedown About To Happen? Plus $369 Oil And Booming Commodities CLICK HERE.

Albert Edwards – Is The NASDAQ About To Crash? CLICK HERE.

People Are Being Deceived, The Gold Bull Market Is Not Finished CLICK HERE.

Michael Oliver – Gold Bull Market Nowhere Near Its Final Climax CLICK HERE.

Astonishing! The Super Wealthy Still Don’t Own Gold As Miners Near Blastoff CLICK HERE.

$10,000 Gold And The Vault Behind COMEX CLICK HERE.

Investing Legend Rob Arnott Says Silver vs Oil Ratio Reached Insane Levels CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.