On the heels of gold futures approaching an all-time high, it appears things are tough all over, plus a look at the wild card.

Things Are Tough All Over

October 1 (King World News) – Peter Boockvar: The September ISM manufacturing index remained in contraction at 47.2, unchanged with August and .3 pts below the estimate. New orders and backlogs remained well below 50 and inventories fell by 6.4 pts to 43.9 after jumping by 5.8 pts in August. Customer inventories were exactly at 50 vs 48.4 in August. Export orders fell by 3.3 pts to 45.3 and is below 50 for a 4th straight month. The employment component was down by 2.1 pts to 43.9, well below 50 and the 2nd lowest read since the summer of 2020.

Supplier deliveries were above 50 for a 3rd month (implying slowing delivery times), ahead of the port strikes. The prices paid index though did dip below 50 at 48.3, down from 54 in August. That’s the lowest since December.

With respect to industry breadth, only 5 industries saw growth, the same number seen in August while 13 were in contraction vs 12 in the month before.

Bottom Line

Bottom line, US manufacturing, along with most of the rest of the world outside of India and a few others, remains in a recession…

This silver explorer did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

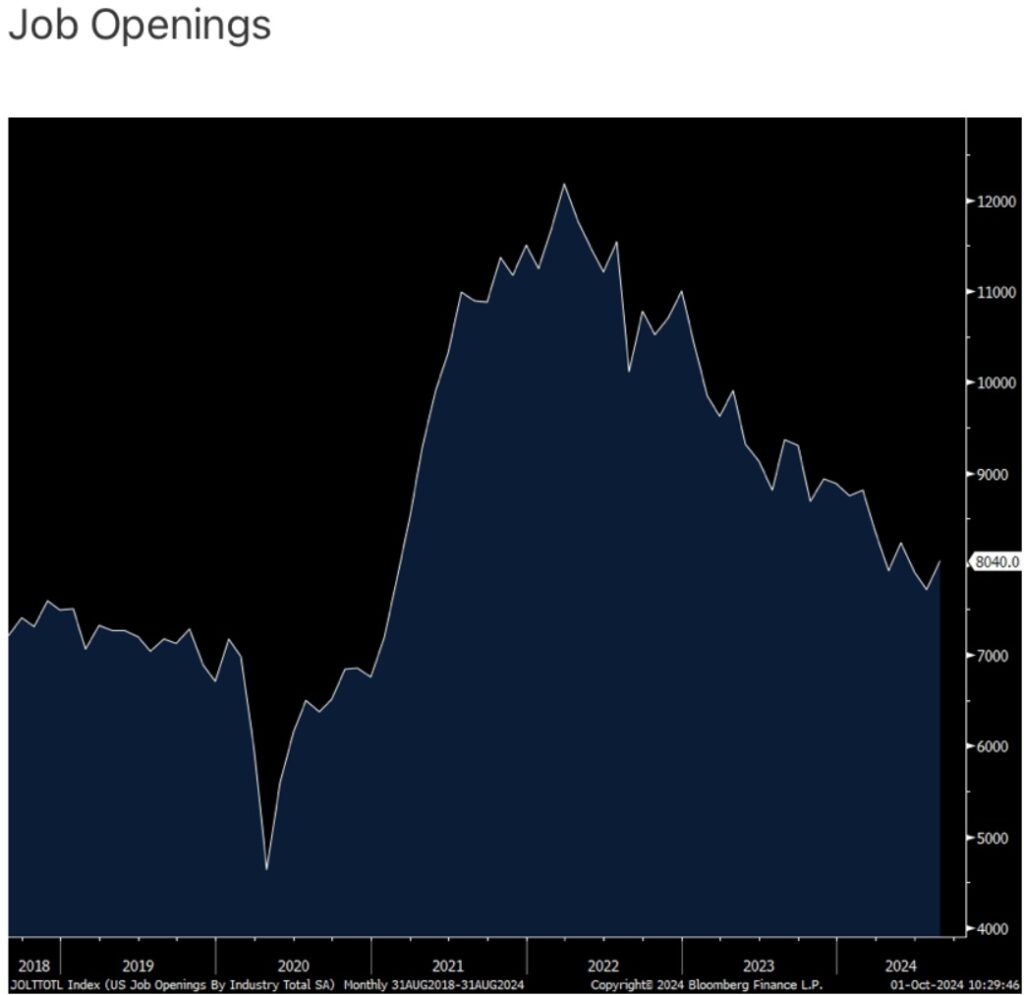

“Job Openings” Remain Weak

Job openings in August bounced back above 8mm at 8.04mm vs 7.71 in July. A bounce in the need for construction workers was the main reason for the lift. The government induced need for them is the likely main reason as it’s not from other areas of commercial real estate.

Weakest In 11 Years

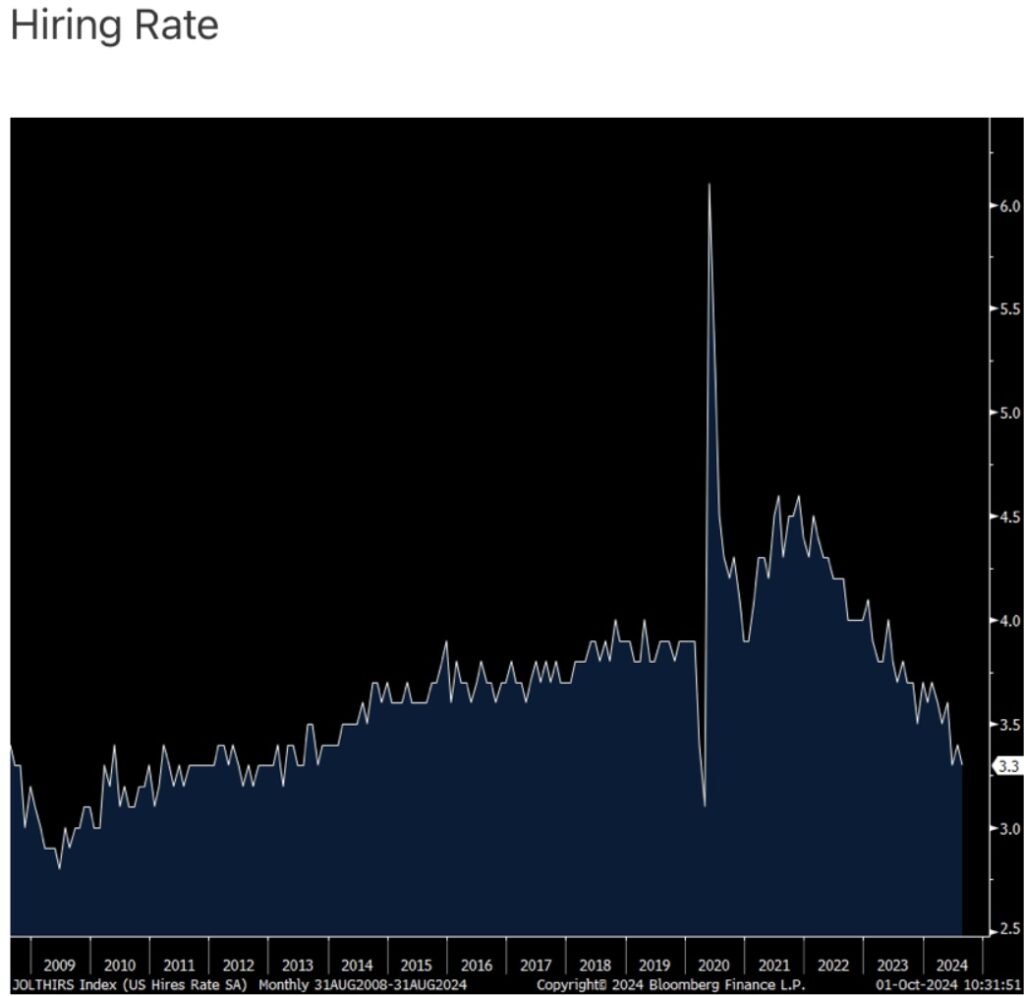

Of particular note though, the hiring rate fell back to 3.3% and that matches the lowest since October 2013 not including Covid.

Hiring Rate Tumbles To Lowest Level Since 2013!

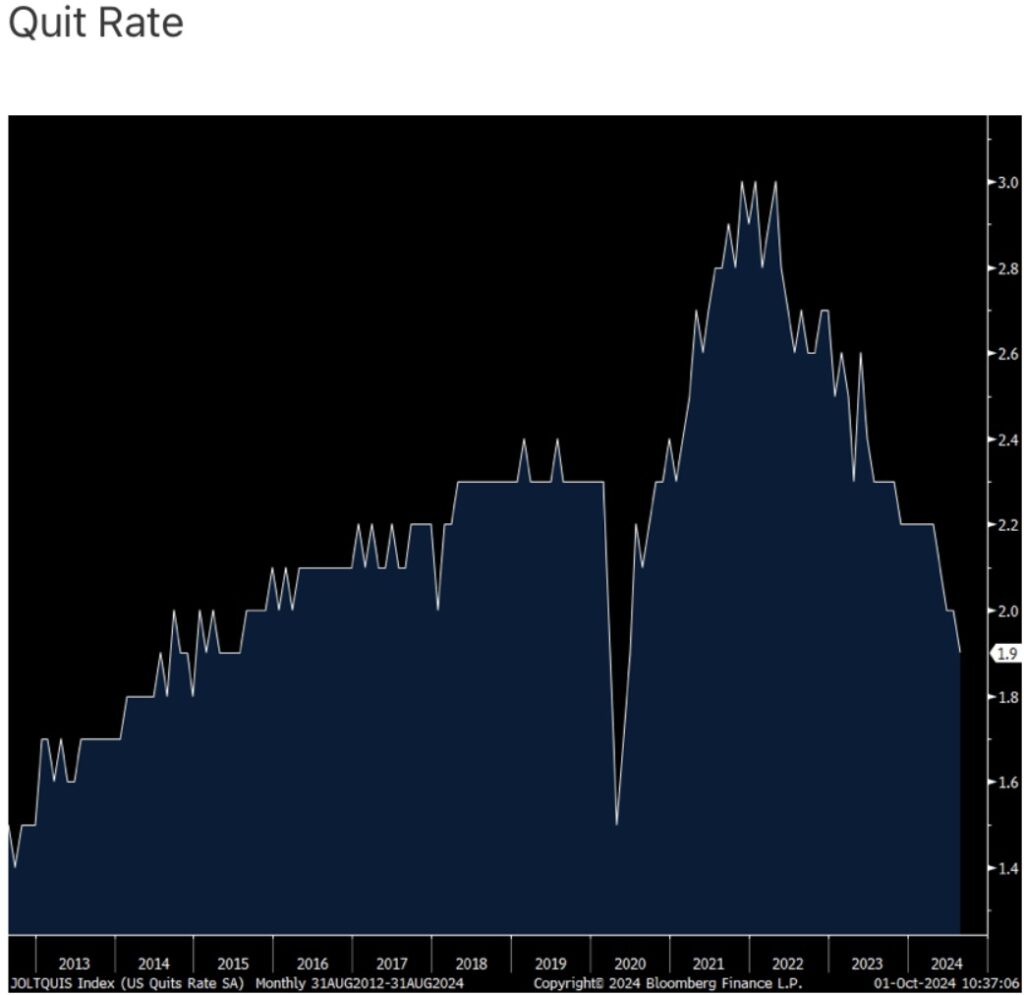

People No Longer Want To Quit Their Jobs

The quit rate dropped to 1.9% from 2% in the two prior months. That is the lowest since 2015 not including Covid.

The Wild Card

With about a $3.8-$4.5b daily cost of the strike according to a JP Morgan estimate I’ve seen, the big question is how much of this is lost forever in terms of lost sales of the stuff coming in and out of the 14 ports on strike or can it be recaptured, however much delayed. Of course right before the holidays, every lost day can move closer to being a lost or heavily discounted sale. Lori Ann LaRocco at CNBC in a piece yesterday had a good stat that “On average, it takes one week to clear out one day of a port closure.” And, “As much as 43% to 49% of total containerized goods entering the US are processed through ports on the East Coast and Gulf Coast.” https://www.nbcnews.com/business/business-news/ports-strike-imminent-east-coast-gulf-truckers-rails-are-scrambling-rcna173233

GOLD & SILVER: Just Released!

***To listen to Alasdair Macleod discuss the stunning things taking place behind the scenes in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.