Look at this little known Fear Index as the global stock market rout continues.

Global Stock Market Rout Continues

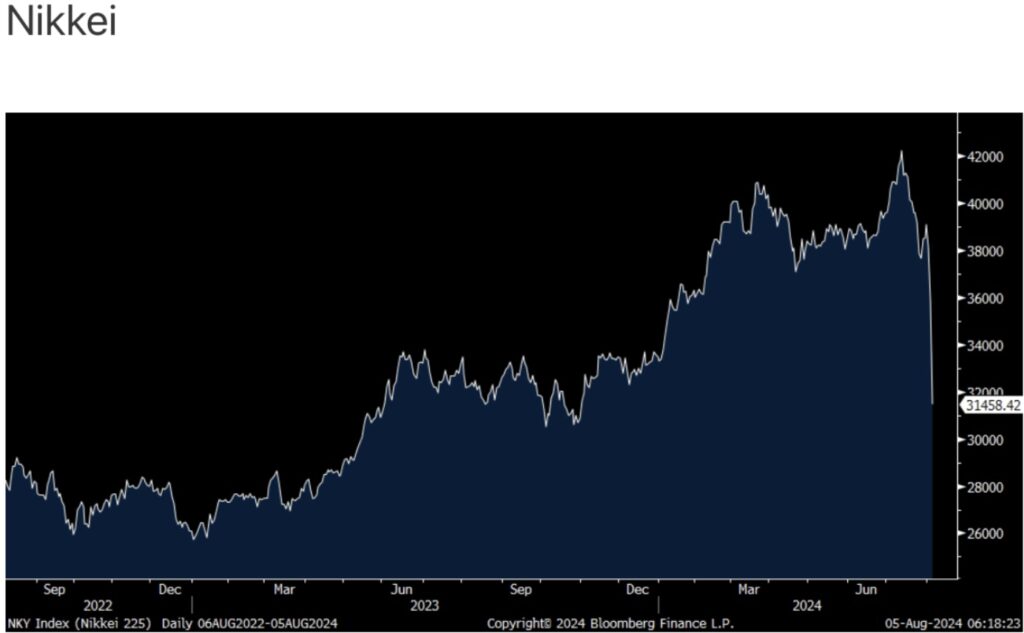

August 5 (King World News) – Peter Boockvar: I’ve talked a lot about the BoJ, JGB’s and the yen this year emphasizing the importance of the shift in policy for not just Japan but global markets. Also I constantly ridiculed the BoJ all year as they redefined the word ‘patience’ when it came to unwinding their excessively easy money in the face of persistent inflation.

That said, never in my wildest market dreams and any analysis I’ve done had any idea to the extent of the epic leverage that was built up in the yen carry trade that is now clearly evident in the unwind. That we have to repeat saying 1987 and market crash in the same sentence is truly stunning as is the global nature of this trade. We have seen just another central bank overdue it with their easing, a massive amount of excess built up as a result and now the nasty unwind.

Corporate Japan though has made some important changes for the better over the years in terms of returns on equity, unwinding share cross holdings, corporate governance, a focus on shareholder value, etc… so Japanese stocks will rebound but again, these moves are quite stunning.

Nikkei Stock Market Crashes!

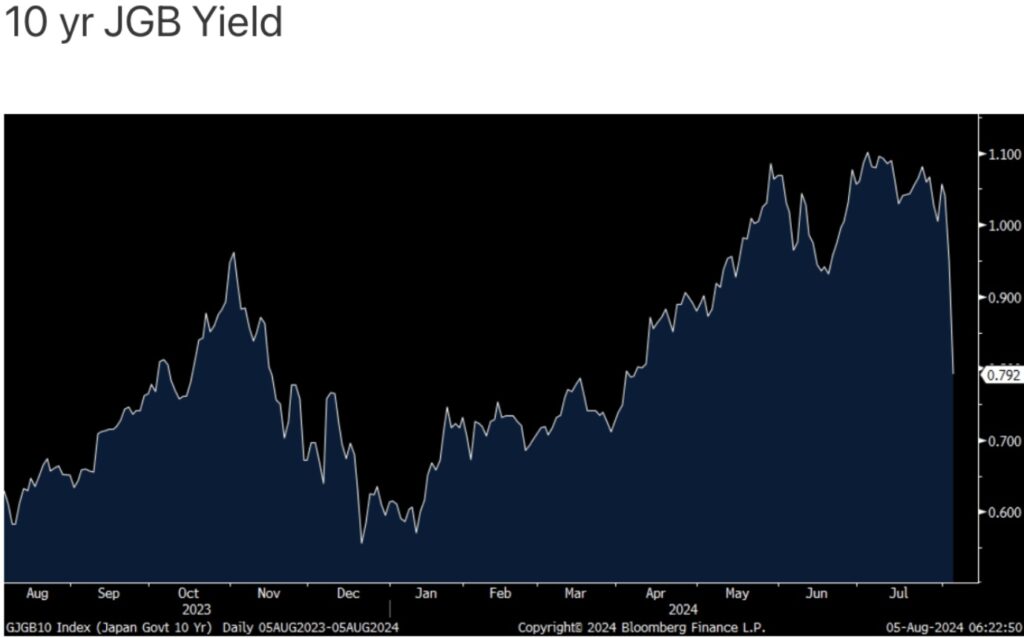

The 10 yr JGB yield fell a very sharp 16 bps to .79%…

Yields Crashing As Well!

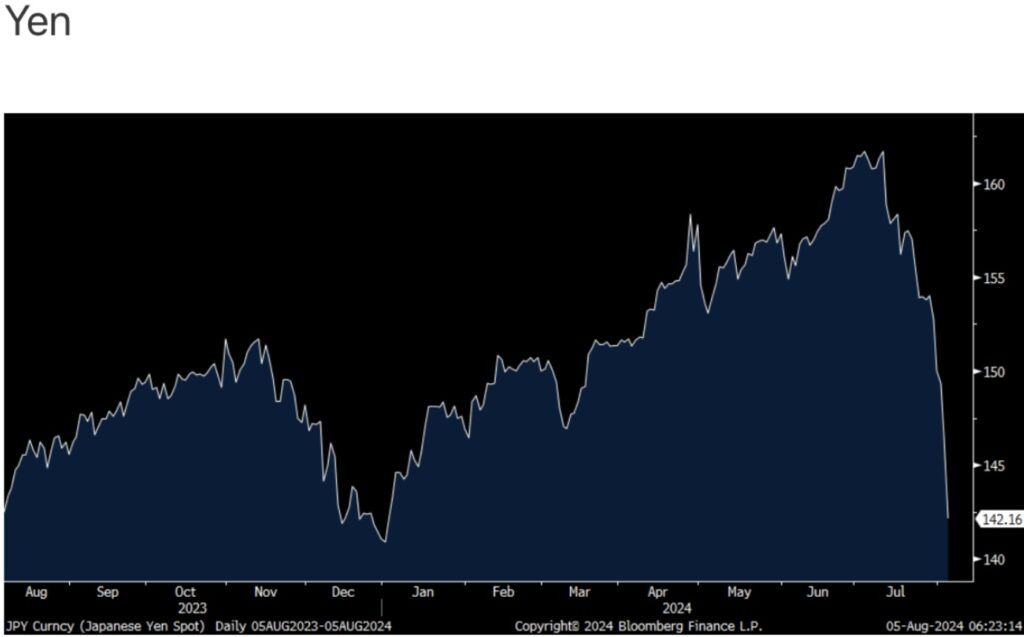

… and the yen continues to rip.

US Dollar Collapsing vs Yen

And by the way, 1987 is not the only reference in global markets. The Taiwanese TAIEX, lower by 8.4% overnight, had its worst day since 1967.

I hear people blaming the Fed for this but Japanese stocks just crashed because of the yen rip not because of the Fed and even at the open, the S&P 500 is still around 5200, still up from 4770 year to date, a gain of 9% not including dividends. I’ve also heard people opining on whether the Fed is now going to have an intra-meeting interest rate cut and I put the odds of that at about zero. It would smack of panic and would actually make the situation worse.

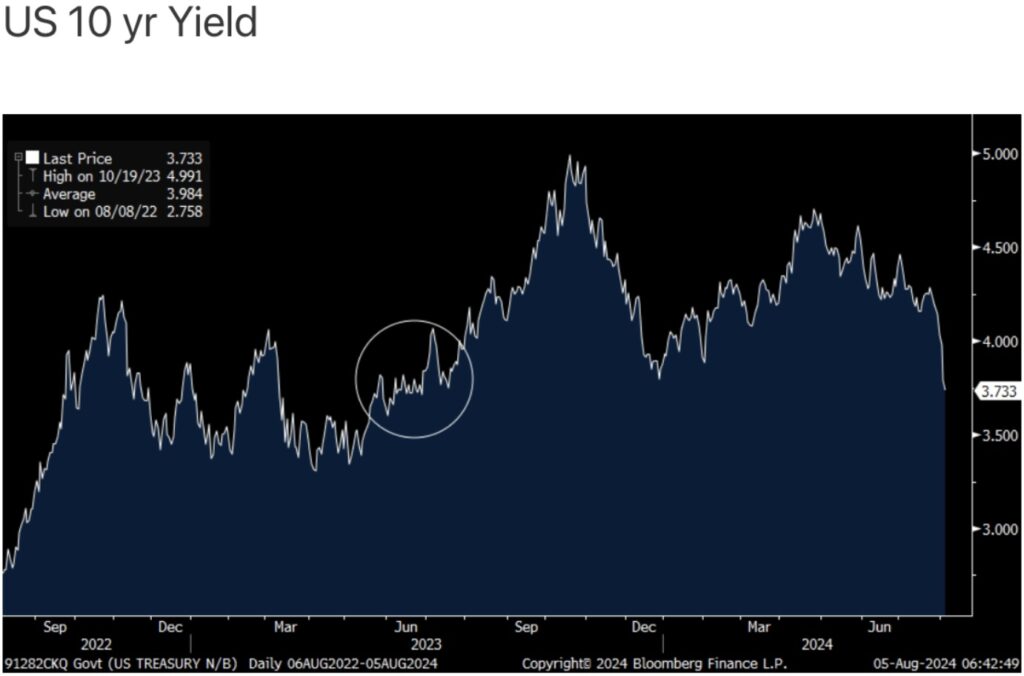

With respect to the US 10 yr yield, this is a key spot of around 3.75% as this was the level from which we ran to 5% last summer in response to the BoJ widening yield curve control. I’ve circled that time frame.

James Turk’s Global Fear Index

James Turk: There are a lot of opinions about gold, but little objective analysis. I’ve been using my Fear Index for 40 years to cut through the clutter to obtain an objective view on gold’s value.

At times, assets can be undervalued, fairly valued or overvalued. The key of course is to recognize when assets are undervalued and to accumulate them. They should then be held until they are overvalued, at which time they should be sold. Valuations are regularly applied to shares and other assets, but gold’s valuation can also be measured. To do this, the Fear Index is essential.

READY FOR THE NEXT CRISIS?

Global Fear Index Is Waking Up

One cannot use the dollar price of gold to determine whether gold is good value. First, the purchasing power of the dollar is ever-changing. So, it is not a good measuring stick. Second, sentiment needs to be considered. In fact, gold may be undervalued or the dollar overvalued for long periods of time because of sentiment. In other words, for emotional reasons like the force of habit or people’s unwillingness to consider alternative moneys, confidence in the dollar may remain unreasonably strong.

Gold presently is undervalued, which is indispensable information given gold’s exceptional appreciation. It might seem expensive at recent record highs above $2400 per ounce but appearances are deceiving. When viewed in terms of US dollars, gold remains relatively cheap. This conclusion is illustrated in the following chart.

With my Fear Index at only 2.89%, gold is being valued in dollar terms by the market near historic lows, just like it was before other major economic, banking, and financial crises over the past hundred years. Given the fragility of today’s monetary system, I anticipate that rising fear will once again send gold and the Fear Index soaring, as it has done many times throughout monetary history.

We are constantly being deceived by the dollar. It fails in the basic criteria required of all money. Its purchasing power shrinks over time making it an unreliable measuring stick for use in economic calculation. Therefore, ignore the dollar price of gold and focus instead on its relative value. Gold is a safe-haven that protects your purchasing power, and is presently an undervalued one, which makes it even more attractive.

Gold remains relatively cheap. We should therefore continue to accumulate it.

Nomi Prins Says Gold Price Will Continue To Soar

***To listen to Nomi Prins discuss where the price of gold is headed, the wild trading that is unfolding in global markets as well as what to expect next CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss the wild week of trading in global markets, gold, silver and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.