As we get ready to head into a new year, there is no question that 2024 will be a year of terror.

A Year Of Terror

December 28 (King World News) – James Turk: “Everything is lining up for 2024 to be a very tumultuous year, Eric.

They say that markets are driven by fear or greed. We have seen the greed in the so-called Magnificent Seven. Even the Dow Jones Industrials has barrelled ahead to a new high.

But there many different things to be fearful about in the year ahead, most of which have been and remain headline news. But number one on my list is the banking system.

We witnessed its fragility earlier this year with the collapse of 3 California banks. The Federal Reserve bailed them out, and also extended a lifeline to some others, but the underlying problems have not been fixed.

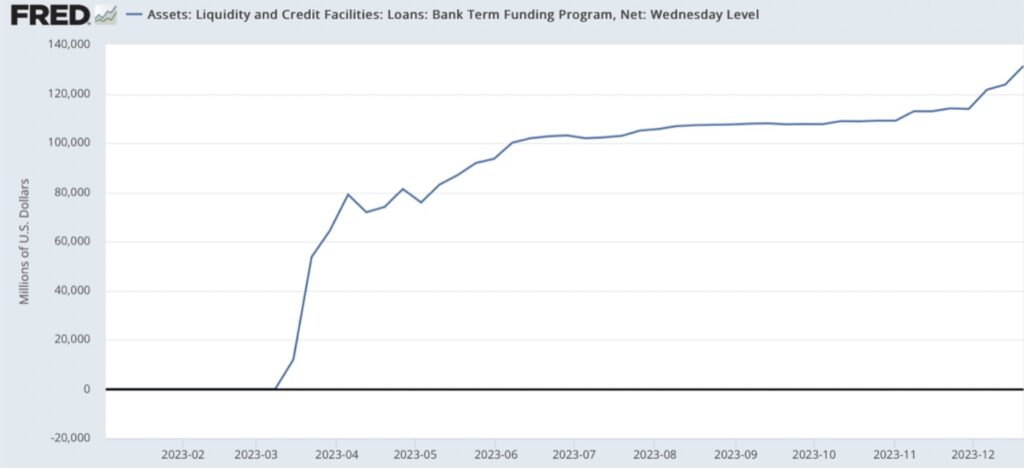

The banks are trying to clean up their balance sheets, but they are starving for liquidity as the Fed tries to fight inflation. The following chart shows what it is taking to bail out the banks.

The bailout is $131 billion so far, and rising. The amount the banks are borrowing is up 15% over the last three weeks.

The Banking Crisis Is Not Over

The banking crisis is not over. And if economic activity slows down – which is beginning to look likely – the pressure on the banking system will only increase, highlighting their fragility and their problems. They have loaned too much money. And with their mountain of derivatives, they have taken on too much risk, now totalling an unfathomable $220 trillion and still growing.

A recession makes repayment of loans more difficult, and some will not be repaid at all. That will erode confidence in the banks even more, not to mention the problems the banks will face when the derivative bubble eventually pops.

As we look to the year ahead, it seems likely that the Fed will soon be easing to help take pressure off the banks, even though the inflation battle has not been won. It’s not interest rates that are going to be “higher for longer”, but the price of gold and silver.

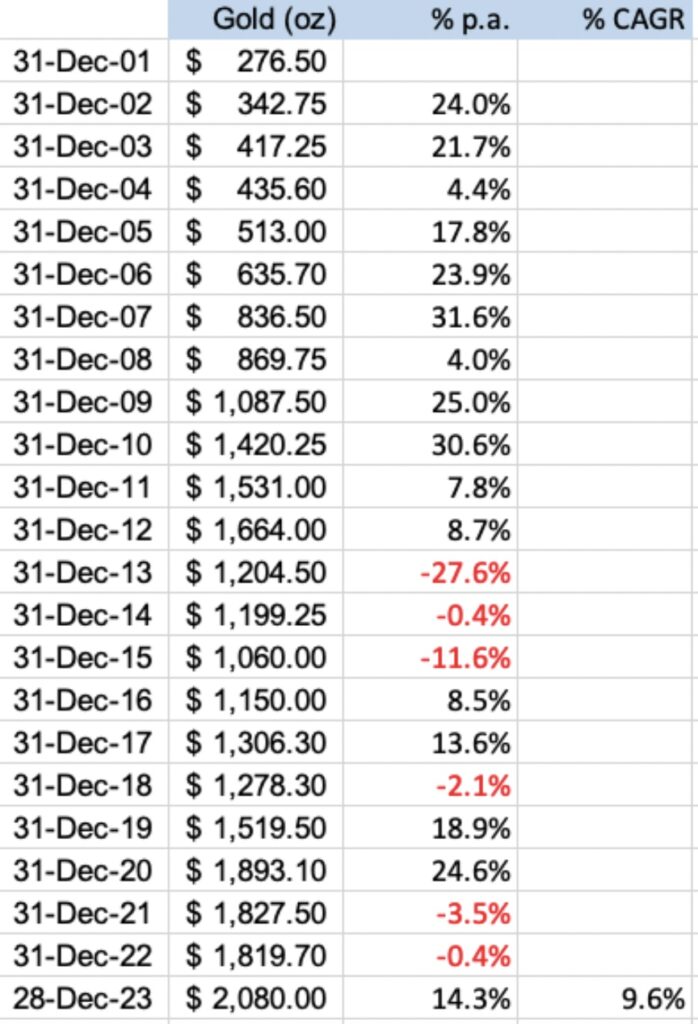

Here’s what gold has done since the turn of the century. Its compound annual growth rate is 9.5%, which of course is simply a tried and true measure of the loss of the dollar’s purchasing power.

If fear becomes a dominant force in 2024, which is what I am anticipating, we can expect gold to repeat what it did as the Great Financial Crisis began unravelling in 2006 (prior to the 2008 collapse). Physical gold is always the safest haven for one’s wealth.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.