With the Dow closing above 18,000 and the price of silver surging along with crude oil, today one of the greats in the business sent King World News a fantastic piece that covers everything from the gold and silver markets to concerns about deflation and a global depression.

By Bill Fleckenstein President Of Fleckenstein Capital

February 13 (King World News) – Overnight markets were largely uneventful, but to the upside. It is worth pointing out that yields on JGBs have up-ticked to 41 basis points, which is still a rounding error, but a long way from the 19 bps of a couple of weeks ago. Whether this is the start of anything meaningful, it is too early to say. One day a bond market somewhere is going to revolt against the madness of the central banks.

Deflation Worries Now a Dime a Dozen

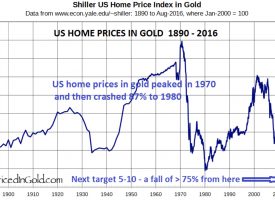

Meanwhile, the hysteria of deflation hits new levels every day, as illustrated by the lead story in today's Financial Times headlined, "Central Banks Take Extreme Action to Stave Off Deflation." The article demonstrates no understanding of financial history, however, as falling prices thanks to productivity (i.e., technology) are never a bad thing, nor are lower prices generically.

Nobody wants a weak economy, let alone a depression, but the misplaced fears of deflation are really fears of a depression. Not that we are close to one, but if markets were ever allowed to clear, one could easily happen. However, as long as central bankers can resort to their printing presses, markets will never clear to where they "ought" to.

Gold Bear Propaganda Is Nonsense

Lastly, the apparent intense focus by the gold bears on the possibility that the Fed may raise rates seems rather nonsensical to me because, even if that occurs, it will only be a small amount while the rest of the world is racing in the other direction. Do gold bears really think that a 25-basis-point hike (should it occur) trumps the lunacy taking place elsewhere?

With that rant out of the way, the U.S. stock market was modestly higher through midday, with nothing of any particular consequence driving the action. Nonetheless, todays modest advance was enough to punch the S&P to a new all-time high (at least with half an hour to go, when I had to leave). Away from stocks, green paper was flat, fixed income was weaker, oil rallied 3%, and the metals were higher, led by silver, which gained 2.5% to gold's 0.5%. *** To subscribe to Bill Fleckenstein's fascinating Daily Thoughts CLICK HERE. KWN will be releasing more written interviews today with David Stockman and others. ***ALSO JUST RELEASED: David Stockman – World Central Banks Are On The Edge Of Desperation And Carnage Is Coming Soon CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the blog page is permitted and encouraged.

The audio interviews with David Stockman, Eric Sprott, Felix Zulauf, Andrew Maguire, John Mauldin, Egon von Greyerz, Dr. Paul Craig Roberts, Gerald Celente, Lord Christopher Monckton, Michael Pento, Bill Fleckenstein, Dr. Philippa Malmgren, Stephen Leeb, John Embry, Rick Rule, Rick Santell and Marc Faber are available now. Other recent KWN interviews include Jim Grant — to listen CLICK HERE.