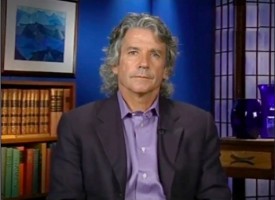

Ben Davies: Co-Founder & CEO of Hinde Capital – Ben is recognized as one of the top fund managers in the gold, silver and commodities arena. His interviews are considered a must hear for all KWN listeners. Ben is a regular on CNBC, Bloomberg, Sky Business News and also occasional speaker at the London Gold Conference. Ben ran trading for RBS Greenwich Capital in London where he managed a macro portfolio. Ben Davies and Mark Mahaffey a former colleague from RBS Greenwich Capital, established Hinde Capital in early 2007, primarily to focus on the precious metals and the commodity sector.

BEN DAVIES

CO-FOUNDER AND CEO

Ben has over 17 years experience within financial and commodity markets, starting his career in 1994 trading credit fixed-income at Credit Lyonnais. He then moved to Aubrey G Langston & Co (IBJI) in 1997 where he was a US fixed-income trader. In 1999 Ben moved to Greenwich Capital in London where he traded multi-asset classes. He left Greenwich in 2001 following the merger with RBS and took a position as a portfolio manager for Blue Sky Capital Australia, a Japanese equity hedge fund.

In 2002 he returned to Greenwich Capital in London to take up the position as head of fixed income and macro-proprietary trading. Ben is considered a leading expert in the precious metals sector, and his views on global economic issues and markets are widely cited by the financial media. He is a frequent commentator on financial markets on numerous broadcast networks, including Sky Business News, CNBC, Bloomberg and King World News, and is widely cited in the mainstream media. He is also a partner of the growing independent macro-research company Variant Perception. Ben co-founded Hinde Capital in 2007.

HINDE GOLD FUND

Hinde Capital is a London based Investment Manager. The Firm’s flagship fund, Hinde Gold Fund, specializes in the precious metals sector. Hinde Capital Ltd (authorised and registered by the FSA) is the investment manager to Hinde Gold Fund, a managed fund for all types of investors from global high-net-worth individuals

to institutional firms. The minimum investment is US$100,000 or the EUR or GBP equivalent.

Hinde Gold Fund is a managed gold fund that maintains a long bias. The Fund offers investors the opportunity to seek the preservation of capital against the potential erosion of the purchasing power of fiat ‘paper’ money. The core of the Fund’s assets are held in allocated physical gold bars stored in secure vaults in Bank Julius Baer (BJB) a private bank in Zurich, Switzerland.

The Fund provides exposure to the upside appreciation in the precious metals sector while smoothing out the downside volatility. we reduce and increase allocations to the sector so as to provide an on average constant investment to the gold price. The Fund also has a small allocation to companies engaged in mining, exploration and production in the precious metals sector. The Fund targets a significant return in excess of its designated benchmark, the USD spot gold bullion price.

-

A long bias gold bullion fund, which

smooths downside volatility - A solid return targeted above the USD spot gold price

- An investment in small-cap gold mining holdings; average is 15%

- A secure method of owning physical allocated gold

- A managed investment in three share classes EUR, GBP or USD

- A liquid investment, no subscription or redemption fees, and same month dealing

-

A tax-efficient gold investment – SIPP & US IRA monies accepted

Hinde Gold Feeder Fund Ltd and Hinde Gold Fund LP will purchase Hinde Gold Fund (Master) shares. All investment assets will be held in the name of Hinde Gold Fund.

Investments are made via:HINDE GOLD FEEDER FUND LTD (CAYMAN)

• Listed on Cayman Stock Exchange

• Distribution statusHINDE GOLD FEEDER FUND LP (DELAWARE)

• A Delaware Limited Partnership for US taxable monies

COMPANY PROFILE

Hinde Capital is a London based Investment Manager, specialising in developing world-class investment solutions for institutions, family offices, trustees, as well as high net worth private clients and their advisers. Hinde Capital offers investors a range of disciplined investment strategies that draw on the founders’ real-world trading and risk management experience attained from previous senior trading and money managing roles at some of the largest global financial institutions.

Our principle aims are to help investors achieve real adjusted returns and provide long-term wealth protection. We offer funds and strategies that both grow capital and accrue income.

Established in 2007, Hinde Capital launched its first fund the same year specialising in the precious metals sector, Hinde Gold Fund, BVI Ltd. Hinde Gold Fund’s primary aim is to provide our investors with exposure to the precious metals market through a highly liquid, actively managed fund with low leverage and security of assets.

Hinde Dividend Products were introduced in 2014 to provide a series of equity income strategies run by both strategy and geography, based on our proprietary valuation models the Hinde Dividend Value Matrix™. The SG Hinde UK Dynamic Equity ETN (50% Hedge) was the first of a series of equity traded products. We are currently developing our European, US and MSCI Asian versions.

The strategies range from long only, 50% hedged to market neutral, enabling investors to switch between more or less exposure to stock markets but without negating the reinvestment of their dividends in the stocks held.

Products are available within Exchange Traded Products (ETPs) and Managed accounts, where we can tailor solutions and add absolute return profiles.